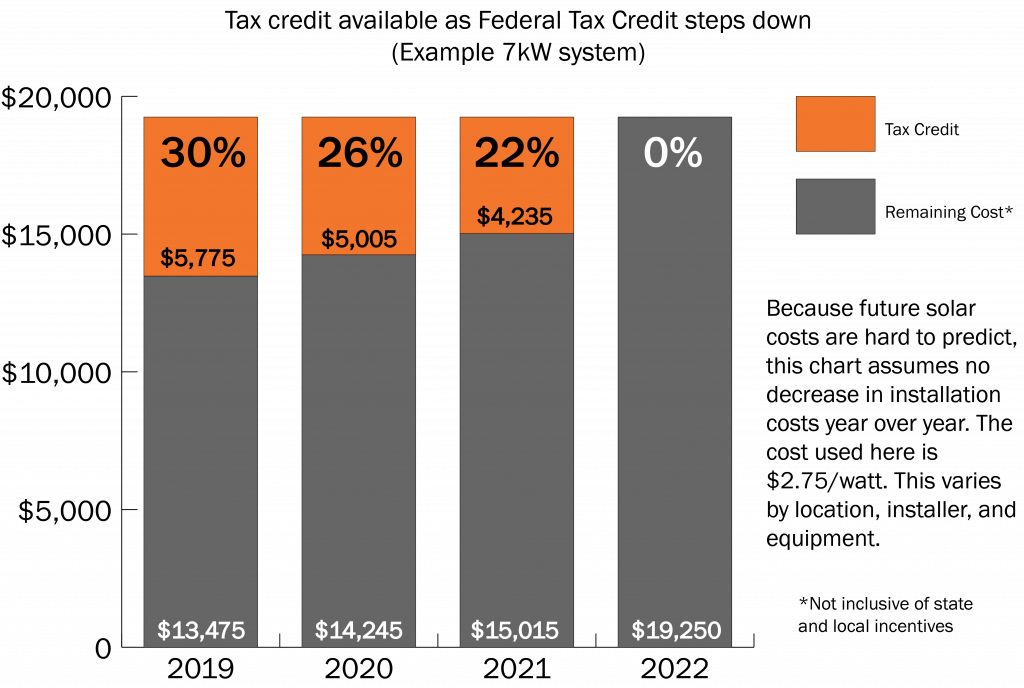

Federal Tax Rebate For Solar Installation Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation

Federal Tax Rebate For Solar Installation

Federal Tax Rebate For Solar Installation

https://i.pinimg.com/originals/6b/59/a6/6b59a602a0fb3214fc79a205d863ad41.jpg

Here s How To Claim The Federal 30 Tax Credit For Installing Solar

http://www.solarpowerrocks.com/wp-content/uploads/2015/01/5695-Line-11.jpg

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

https://www.solarunitedneighbors.org/wp-content/uploads/2018/12/Solar-tax-credit-graph-without-header-1024x688.png

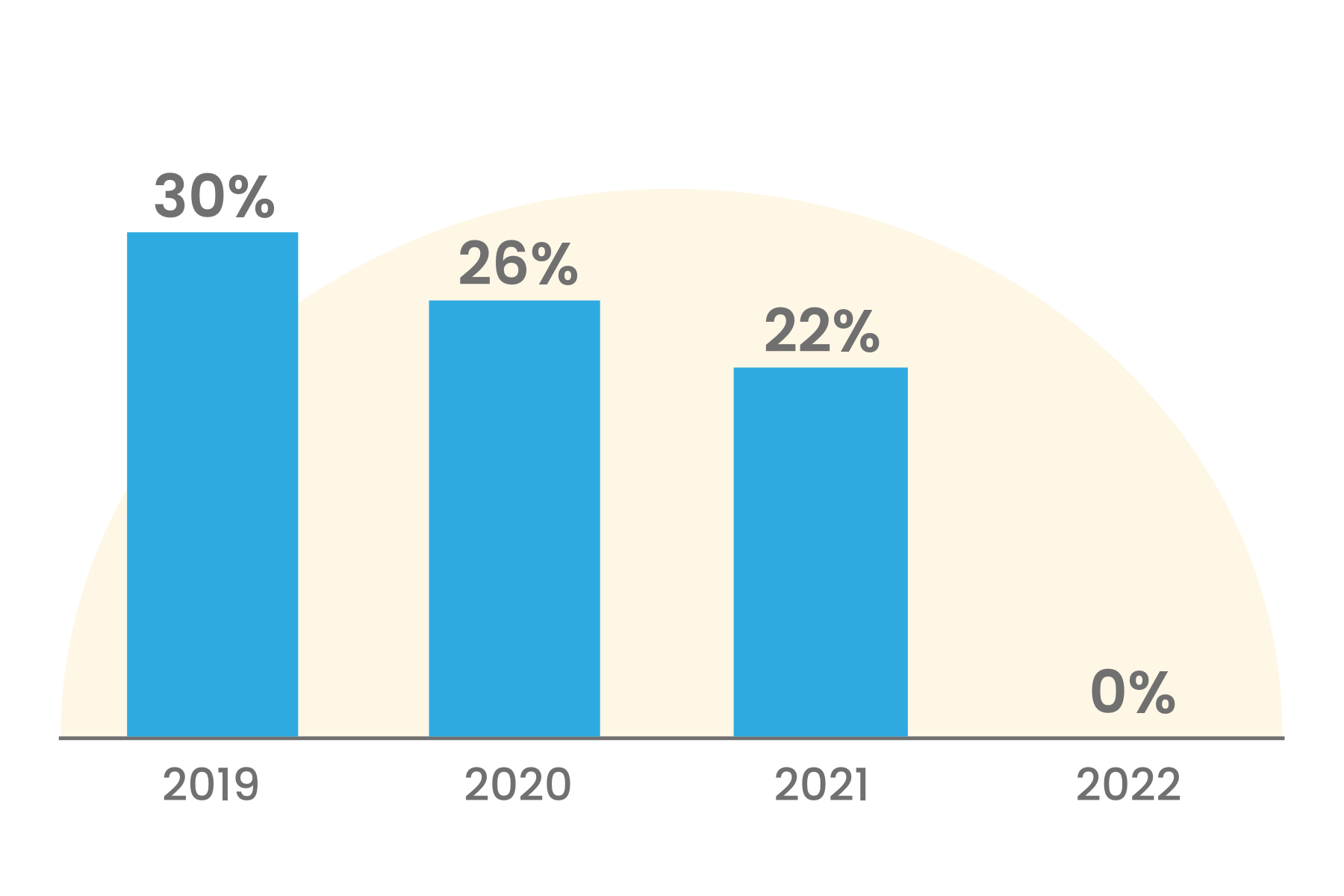

Web 8 sept 2022 nbsp 0183 32 The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Download Federal Tax Rebate For Solar Installation

More picture related to Federal Tax Rebate For Solar Installation

The Future Of Solar Energy Rebates Solaris

https://cdn10.bigcommerce.com/s-3yc5xwvk/product_images/uploaded_images/federal-rebate-for-solar.png?t=1460888427

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

https://www.ysgsolar.com/sites/default/files/styles/panopoly_image_original/public/form_1040_rec.png?itok=pf_SEkRq

Frequently Asked Questions About The Federal Solar Tax Credit In 2020

https://www.solarpowerrocks.com/wp-content/uploads/2015/12/seiapng.png

Web 7 ao 251 t 2023 nbsp 0183 32 Installing solar panels earns you a federal tax credit That means you ll get a credit for your income taxes that actually lowers your tax bill The federal government Web 16 ao 251 t 2022 nbsp 0183 32 Installed and claimed in 2021 taxes at the 26 level your credit would be 7 020 Installed and claimed in 2022 taxes at the full 30 level your credit would be 8 100 That s a savings difference of 1 080

Web 21 avr 2023 nbsp 0183 32 A 20 000 solar system would receive a tax credit of 6 000 to what you owe in federal income taxes Solar systems installed in 2033 will receive a 26 tax credit Web 1 ao 251 t 2023 nbsp 0183 32 The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2019/01/tax-credit-change-.jpg

Congress Gets Renewable Tax Credit Extension Right Institute For

https://ilsr.org/wp-content/uploads/2016/01/federal-solar-tax-credit-phase-out-ILSR-2015-1024x768.jpeg

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave

https://www.energy.gov/sites/default/files/2023-03/Homeown…

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

Upcoming Changes To The Solar Tax Credit And How They Affect You

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

How To Claim The STC Solar Rebate VIC NSW QLD WA SA

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

Alternate Energy Hawaii

How To Claim The Federal Solar Tax Credit SAVKAT Inc

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Federal State Local Rebates Are Available Now Home Solar Rebate

2020 South Carolina Solar Incentives Rebates And Tax Credits Tax

Solar Tax Credits Rebates Missouri Arkansas

Federal Tax Rebate For Solar Installation - Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC