First Child Tax Credit The United States federal child tax credit CTC is a partially refundable tax credit for parents with dependent children It provides 2 000 in tax relief per qualifying child with up to 1 600 of that refundable subject to a refundability threshold phase in and phase out In 2021 following the passage of the American Rescue Plan Act of 2021 it was temporarily raised to 3 600 per child under the age of 6 and 3 000 per child between the ages of 6 and 17 it was also made fully re

The first child tax credit was enacted in 1997 as part of the Taxpayer Relief Act of 1997 P L 105 34 but it was conceived years earlier and included in several different bills That legislation increased the Child Tax Credit to 3 600 for children under the age of 6 and to 3 000 for children over the age of 6 expanded the credit to 17 year olds who

First Child Tax Credit

First Child Tax Credit

https://www.flanews.com/wp-content/uploads/2021/07/child-tax-credit00000005.jpg

Shakopee MN Tax Preparer Shows How To Write Off Johnny s Soccer Camp

https://mendenaccounting.com/wp-content/uploads/2012/06/child-tax-credit-1-scaled.jpg

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

Complete Schedule 8812 Form 1040 Credits for Qualifying Children and Other Dependents The Instructions for Schedule 8812 explain the qualifications for CTC ACTC Learn how the Child Tax Credit works if you qualify how to claim it and what additional credits you may be able to claim If you are not eligible for the Child Tax Credit you

What Is the Child Tax Credit The Child Tax Credit is a tax benefit granted to American taxpayers with children under the age of 17 as of the end of the year For the 2023 Tens of millions of families have been sent the first payment of the expanded child tax credit the Internal Revenue Service and the Treasury Department said Wednesday night

Download First Child Tax Credit

More picture related to First Child Tax Credit

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

https://www.the-sun.com/wp-content/uploads/sites/6/2021/11/KB_COMP_child-tax-credit-ctc-2.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

New Child Tax Rebate Available Applications Being Accepted Now

https://www.cthousegop.com/mccarty/wp-content/uploads/sites/44/2022/05/Baz-child-tax-credit.png

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

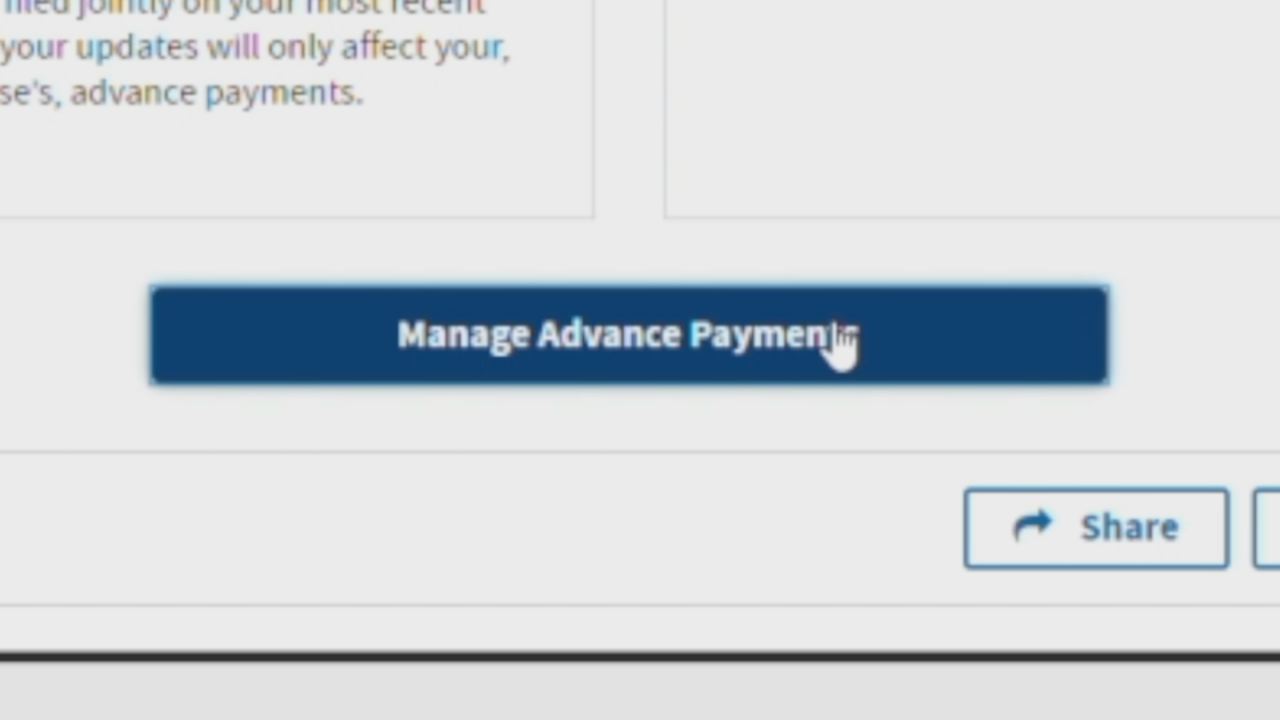

Child Tax Credits if you re responsible for one child or more how much you get eligibility claim tax credits Roughly 15 billion has been sent to 35 2 million families in the first of six advance child tax credit payments according to the U S Treasury Department and IRS The average

For 2021 the maximum credit is 3 600 for children younger than age 6 and 3 000 for those between 6 and 17 Half of the credit will be distributed as an advance on 2021 taxes Learn about the seven key requirements including age relationship and family income to see if you qualify What if the credit exceeds my tax liability What is the Other

3rd Round Of Child Tax Credit Payments Go Out This Week The Daily World

https://www.thedailyworld.com/wp-content/uploads/2021/09/26463542_web1_ChildTaxCredit-ADW-210914-TreasuryCheck_1.jpg

Child Tax Credit

https://hansonattorney.com/wp-content/uploads/2023/04/taxes-file-contains-taxation-reports-and-documents-SBI-300168771.jpg

https://en.wikipedia.org › wiki › Child_tax_credit_(United_States)

The United States federal child tax credit CTC is a partially refundable tax credit for parents with dependent children It provides 2 000 in tax relief per qualifying child with up to 1 600 of that refundable subject to a refundability threshold phase in and phase out In 2021 following the passage of the American Rescue Plan Act of 2021 it was temporarily raised to 3 600 per child under the age of 6 and 3 000 per child between the ages of 6 and 17 it was also made fully re

https://crsreports.congress.gov › product › pdf

The first child tax credit was enacted in 1997 as part of the Taxpayer Relief Act of 1997 P L 105 34 but it was conceived years earlier and included in several different bills

Expanding The Child Tax Credit Budgetary Distributional And

3rd Round Of Child Tax Credit Payments Go Out This Week The Daily World

The Child Tax Credit Is Coming Here s What To Expect From The IRS

Taxes Archives Www steadfastbookkeeping

New Child Tax Credit Opens The Door For Old Scams

RI Child Tax Credit Checks Are On Their Way

RI Child Tax Credit Checks Are On Their Way

The Child Tax Credit Proved Unrestricted Cash Keeps Families Out Of

The Expanded Child Tax Credit The Life Financial Group Inc

You May Be Able To Get More Money From Federal Child Tax Credits By

First Child Tax Credit - The child tax credit is a tax break for families based on their income level and the number of dependent children they have The American Rescue Plan Act of 2021 temporarily