First Home Buyer Tax Exemption If you qualify for the first time home buyers exemption the amount of property transfer tax you pay depends on The fair market value of the property The percentage of the property transfer eligible for the exemption The size of the property Whether there are any non residential improvements on the property

Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct home ownership expenses However taxpayers can t take the standard deduction if they itemize The FHSA is a registered account that could allow you to save for your first home with tax advantages Contributions are generally tax deductible and withdrawals for the purpose of buying or building a qualifying home are tax free

First Home Buyer Tax Exemption

First Home Buyer Tax Exemption

https://i0.wp.com/facelesscompliance.com/wp-content/uploads/2022/10/HUF-cannot-be-denied-the-benefits-of-Section-54-exemption-just-because-it-purchased-a-property-in-the-members-name.jpg?fit=1280%2C839&ssl=1

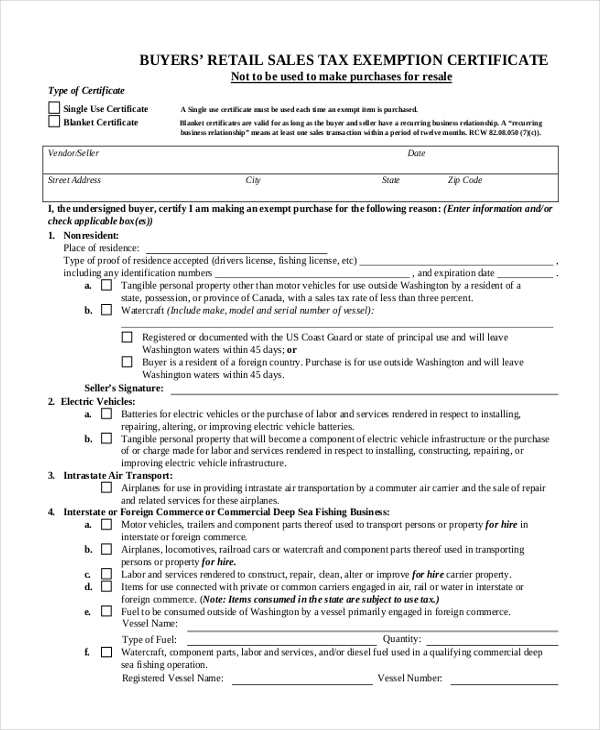

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/virginia-sales-tax-exemption-form-st-11-fill-out-and-sign-printable-6.png

Do I Have To Pay Back First Time Homebuyer Tax Credit Tax Credits

https://i.pinimg.com/originals/8b/1b/2d/8b1b2d20225636720288f936a349e25f.gif

Overview If you re a first time buyer you may be able to buy a home for 30 to 50 less than its market value The home must be your only or main residence This offer is called the First First time home buyers program If you re purchasing your first home you may qualify to reduce or eliminate the amount of property transfer tax you pay Purpose built rental exemption

B C s First Time Home Buyers Program exempts people who are buying their first home from paying property transfer tax provided the property is purchased for 500 000 or less But many GST New Housing Rebate For newly built homes first time home buyers are able to apply for a GST credit from the government and or the developer The GST in BC is equal to 5 and as a home buyer you may be eligible for a rebate of 36 of the 5 GST

Download First Home Buyer Tax Exemption

More picture related to First Home Buyer Tax Exemption

Delaware First Time Home Buyer State Transfer Tax Exemption Get FHA

https://delawaremortgageloans.net/wp-content/uploads/Delaware-First-Time-Home-Buyer-State-Transfer-Tax-Exemption-Image.png

The First Time Home Buyer Tax Credit NerdWallet

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2017/06/what-happened-first-time-home-buyer-tax-credit-story-e1583353367710-1920x1152.jpg

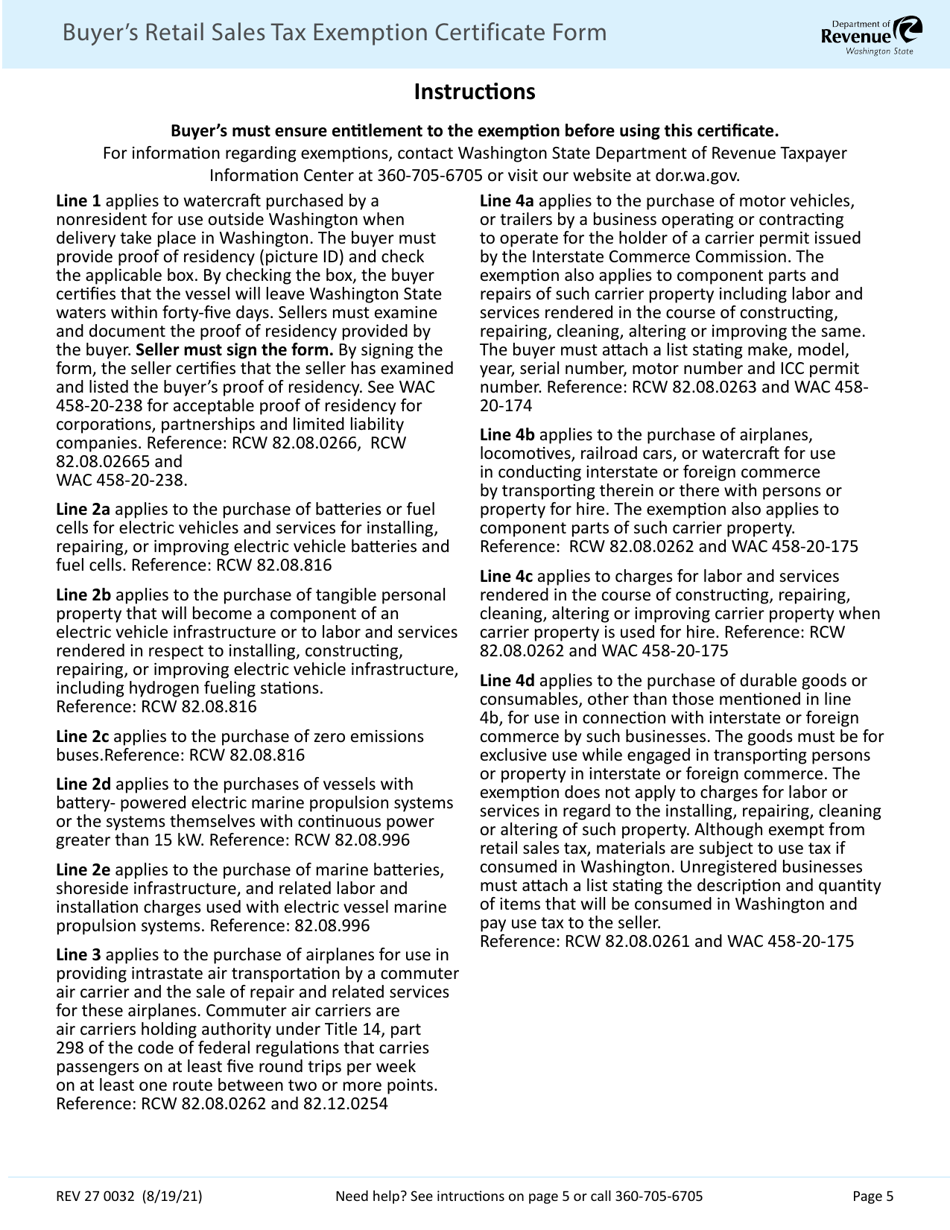

Form REV27 0032 Download Fillable PDF Or Fill Online Buyer s Retail

https://data.templateroller.com/pdf_docs_html/2213/22133/2213398/page_5_thumb_950.png

From 1 July 2023 a full exemption from transfer duty will be available if you are buying a new or existing home valued up to 800 000 while homes valued over 800 000 and less than 1 000 000 may qualify for a concessional rate First home buyers in NSW may be eligible for a duty exemption concession or grant Are you eligible for home buying assistance House hunters can now use the Home Buyer Assistance Finder on nsw gov au to easily check their eligibility for the three main programs provided by the NSW Government

[desc-10] [desc-11]

First Time Home Buyers Tax Credit HBTC Loans Canada

https://loanscanada.ca/wp-content/uploads/2021/02/First-Time-Home-Buyers-Tax-Credit.png

NSW Government Plans To Extend First home Buyers Stamp Duty Exemption

https://content.api.news/v3/images/bin/e9238a6a316724f0f8e855652d3d900f

https://www2.gov.bc.ca/.../first-time-home-buyers/current-amount

If you qualify for the first time home buyers exemption the amount of property transfer tax you pay depends on The fair market value of the property The percentage of the property transfer eligible for the exemption The size of the property Whether there are any non residential improvements on the property

https://www.irs.gov/newsroom/know-whats-deductible-after-buying...

Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct home ownership expenses However taxpayers can t take the standard deduction if they itemize

Fillable Online First Time Home Buyer Affidavit Of Exemption From

First Time Home Buyers Tax Credit HBTC Loans Canada

First Time Home Buyers Tax Credit Explained Tax Credits First Home

First Time Home Buyers Tax Credit Explained Tax Credits First Time

Tax Tips For First Time Homebuyers MintLife Blog

How The Proposed 15 000 First Time Home Buyer Tax Credit Works PMR Loans

How The Proposed 15 000 First Time Home Buyer Tax Credit Works PMR Loans

Filing Exempt On Taxes For 6 Months How To Do This

Irs Form 8718 Fillable Printable Forms Free Online

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

First Home Buyer Tax Exemption - GST New Housing Rebate For newly built homes first time home buyers are able to apply for a GST credit from the government and or the developer The GST in BC is equal to 5 and as a home buyer you may be eligible for a rebate of 36 of the 5 GST