First Time Buyer Stamp Duty Uk 2023 Changes reflect the increase to nil rate band from 125 000 to 250 000 increase to First Time Buyers Relief nil rate threshold from 300 000 to 425 000

For example if you were paying 500 000 for your first home you would have a 3 750 stamp duty tax bill That is 5 of the 75 000 above the An increase in the NRB for first time buyers from 300 000 to 425 000 An increase in the maximum amount first time buyers can buy a house for and still be

First Time Buyer Stamp Duty Uk 2023

First Time Buyer Stamp Duty Uk 2023

https://www.nerdwallet.com/uk/wp-content/uploads/sites/4/2023/03/Property-chains-Purchase-agreement-for-new-house-getty-images-e1679925000307-770x320.jpeg

Do First Time Buyers Pay Stamp Duty GCM Management Ltd

https://www.greencm.co.uk/wp-content/uploads/2021/10/first_time_buyer_stamp_duty_holiday_pandemic-970x545-HxLpMI.jpeg

Complete Guide To Stamp Duty Relief Period

https://onlineconveyancingsolicitors.co.uk/wp-content/uploads/2020/11/stamp-duty-scaled.jpg

2023 update Stamp Duty Land Tax SDLT Everything you need to know Plain English Guide Keep reading to discover The latest SDLT rates The latest rules for 2nd home First time buyers will pay no Stamp duty land tax on properties worth up to 425 000 On any property purchase price of up to 625 000 you will pay no Stamp Duty on the first

First time buyers can spend 425 000 roughly an average flat in London before paying stamp duty Spend 625 000 perhaps a detached home somewhere like Colingham in Leeds and you ll The minimum cost of a property on which homebuyers pay stamp duty in England and Northern Ireland has been raised from 125 000 to 250 000 For first

Download First Time Buyer Stamp Duty Uk 2023

More picture related to First Time Buyer Stamp Duty Uk 2023

Stamp Duty Rate Calculator UK Property Land Tax IP Global

https://www.ipglobal-ltd.com/wp-content/uploads/2021/06/stampduty-table-1280x475-1.png

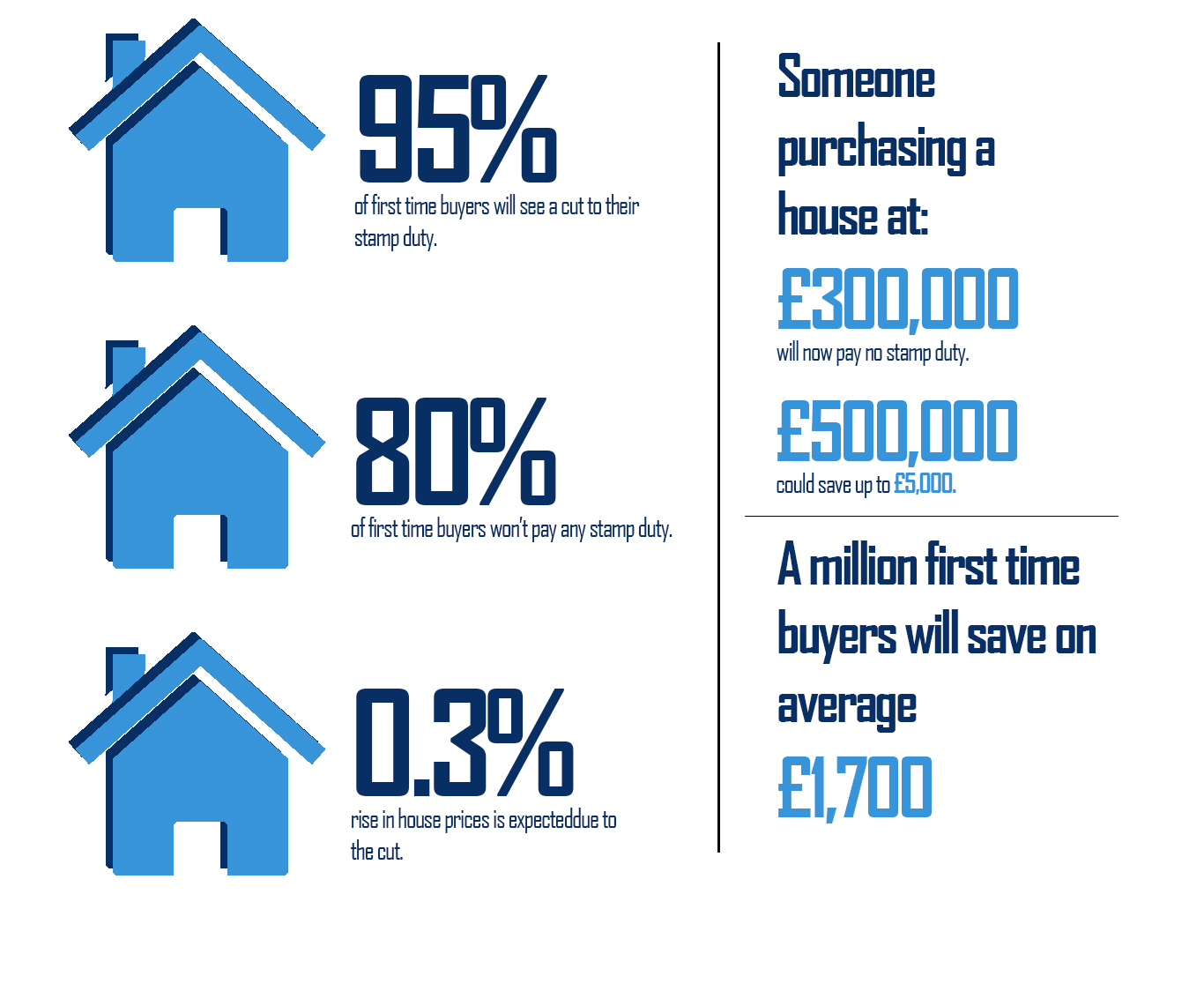

First Time Buyers Benefit From The Stamp Duty Cut Nabarro McAllister

https://www.nabarromcallister.co.uk/wp-content/uploads/2017/12/stamp-duty-infographic.jpg

First Time Buyer Stamp Duty HomeOwners Alliance

https://hoa.org.uk/wp-content/uploads/2018/12/Stamp-Duty-for-First-Time-Buyers.jpg

You ll pay Stamp Duty on residential properties costing more than 250 000 unless you qualify for first time buyer s relief Eligible first time buyers will pay no Stamp Duty on Published 04 December 2023 Reading Time 6 minutes First time Buyer Stamp Duty Relief Explained Saving for a first home can be challenging but if you qualify for first

While for first time buyers no stamp duty is payable on the first 425 000 of the property s value It s worth noting that stamp duty rules are set to change again in April If you re an eligible first time buyer you will pay no Stamp Duty on properties costing up to 425 000 and a discounted rate on property purchases up to 625 000 This tax

Stamp Duty

https://themortgageshop.net/images/stamp-duty-cover.jpg

First Time Buyer Stamp Duty Relief Greater London Properties GLP

https://www.greaterlondonproperties.co.uk/wp-content/uploads/2020/01/red-and-yellow-daisies.jpg

https://www.gov.uk/government/publications/stamp...

Changes reflect the increase to nil rate band from 125 000 to 250 000 increase to First Time Buyers Relief nil rate threshold from 300 000 to 425 000

https://hoa.org.uk/advice/guides-for-homeown…

For example if you were paying 500 000 for your first home you would have a 3 750 stamp duty tax bill That is 5 of the 75 000 above the

Higher Stamp Duty Rates For Higher Valued Residential And Non

Stamp Duty

First Time Buyer Stamp Duty 2019 YouTube

Stamp Duty For First Time Buyers A Guide And Explanation

Property Tax Singapore NelleNavdeep

Stamp Duty For First Time Buyers 2020 Do First time Buyers Pay Stamp

Stamp Duty For First Time Buyers 2020 Do First time Buyers Pay Stamp

Stamp Duty For First time Buyers Rules Around Exemption Ideal Home

First Time Home Buyer Information

Tax And Duty Schemes On Transfer Of Immovable Property KPMG Malta

First Time Buyer Stamp Duty Uk 2023 - The minimum cost of a property on which homebuyers pay stamp duty in England and Northern Ireland has been raised from 125 000 to 250 000 For first