Florida Homestead Tax Reduction In Florida now homeowners are permitted to reduce by 50 000 the assessed value of their home which in turn reduces the property tax burden

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the property s taxable value by 1 The Save Our Homes Act Due to this long standing law homestead properties in Florida will not see an increase of more than 3 a year or CPI whichever is less in their taxable value no matter how much the market value of the home increases

Florida Homestead Tax Reduction

Florida Homestead Tax Reduction

https://i.pinimg.com/originals/0a/87/bb/0a87bba3faf5f6d508a2e26e4ebb276b.jpg

-1920w.jpg)

Florida Homestead Exemption What You Should Know

https://lirp.cdn-website.com/17d53756/dms3rep/multi/opt/Homestead+exemption+(2)-1920w.jpg

How Do I Register For Florida Homestead Tax Exemption W Video

https://www.yourwaypointe.com/wp-content/uploads/2017/07/Florida-Homestead-Tax-Exemption.jpg

The Florida homestead exemption is a property tax break that s offered based on your home s assessed value and provides exemptions within a certain value limit With it you can reduce the taxable value of your home by as much as 50 000 if you use the property as your primary residence Every person who owns real property in Florida on January 1 makes the property his or her permanent residenceor the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to 50 000 The first 25 000 applies to all property taxes

The Florida Constitutional homestead exemption offers virtually absolute protection from forced sale to meet the demands of creditors except under four special circumstances and should not be confused with the Florida Ad Valorem tax reduction savings which is a product of the Florida legislature The save our home rule stipulates that the homestead s value can t increase by more than 3 per year or the rate of inflation if less than 3 To obtain this exemption the homestead s owner must apply for it at the property appraiser s office for the county where the homestead is located

Download Florida Homestead Tax Reduction

More picture related to Florida Homestead Tax Reduction

Florida Homestead Exemption Application Deadline ASR Law Firm

https://asrlawfirm.com/wp-content/uploads/2021/02/homestead-exemption-featured.jpg

How To File For Florida Homestead Exemption Smart Title

https://smart-title.com/wp-content/uploads/2021/01/0121-homestead-blog-banner-d1.jpg

PRORFETY Homestead Property Tax Exemption Kissimmee Fl

https://i.ytimg.com/vi/QXPFtfP_0fU/maxresdefault.jpg

Primary home homestead If you own a house in Florida as your permanent residence you might be entitled to a property tax exemption known as a homestead exemption of up to 50 000 The first 25 000 applies to all property taxes including school district taxes At its core the Homestead Exemption in Florida allows homeowners to exempt up to 50 000 of the value of their primary residence from property taxes The first 25 000 applies to all property taxes including school district taxes

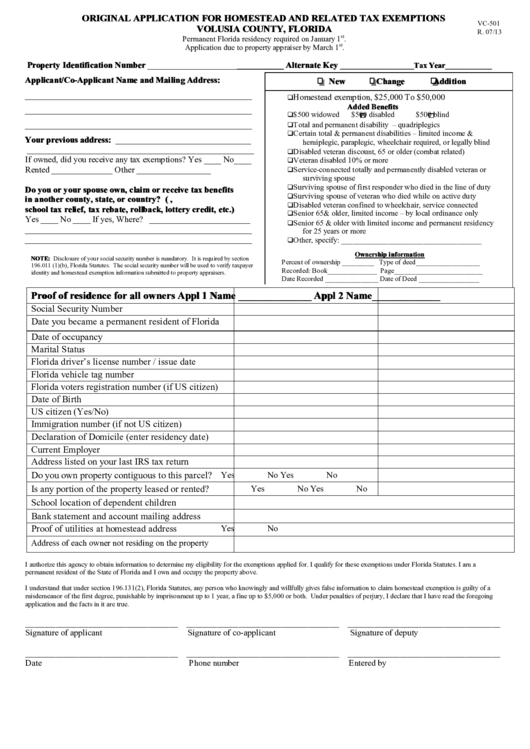

You can claim the Florida Homestead Exemption by contacting your local property appraiser or tax collector Each county has an office where you can file for a new Florida homestead or transfer your Homestead Exemption from an existing home The Homestead Exemption lowers property taxes by reducing a home s assessed value for tax purposes by up to 50 000 The Homestead Exemption consists of a 25 000 Homestead Exemption and a Second Homestead Exemption of 25 000 for a total of up to 50 000

How Do I Register For Florida Homestead Tax Exemption W Video

https://www.yourwaypointe.com/wp-content/uploads/Screen-Shot-2018-12-27-at-10.12.10-PM-1200x568.png

Are Your Property Taxes Lowered If The Assessed Value Is Less Than The

https://i.pinimg.com/originals/87/61/f1/8761f1219da2fb10478265012850f4fb.jpg

https://www.nbcmiami.com/news/local/florida...

In Florida now homeowners are permitted to reduce by 50 000 the assessed value of their home which in turn reduces the property tax burden

-1920w.jpg?w=186)

https://floridarevenue.com/property/pages/taxpayers_exemptions.aspx

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the property s taxable value by

Miami dade County Claim Of Exemption Form ExemptForm

How Do I Register For Florida Homestead Tax Exemption W Video

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

What Are The Filing Requirements For The Florida Homestead Exemption

Florida Homestead Exemption Explained Easily YouTube

Florida Property Tax Lawyer FLORIDA PROPERTY TAX NEWS MARCH 1 IS

Florida Property Tax Lawyer FLORIDA PROPERTY TAX NEWS MARCH 1 IS

Florida Homestead Tax Exemption Form ExemptForm

Homestead Exemption In Florida

The Fund 2019 Florida Homestead Exemption

Florida Homestead Tax Reduction - The save our home rule stipulates that the homestead s value can t increase by more than 3 per year or the rate of inflation if less than 3 To obtain this exemption the homestead s owner must apply for it at the property appraiser s office for the county where the homestead is located