Florida Property Tax Exemption For 100 Disabled Veterans Learn how to apply for property tax exemptions and discounts for veterans with service connected disabilities in Florida Find out the eligibility criteria documentation requirements

Learn about the property tax exemptions and discounts available to veterans and their spouses in Florida Find out the eligibility requirements how to apply and what documents to submit Learn how to apply for a prorated refund of property taxes paid on newly acquired homestead property by permanently and totally disabled veterans or their surviving spouses in Florida

Florida Property Tax Exemption For 100 Disabled Veterans

Florida Property Tax Exemption For 100 Disabled Veterans

https://assets.site-static.com/userFiles/3705/image/dis-vet-tax-do.jpg

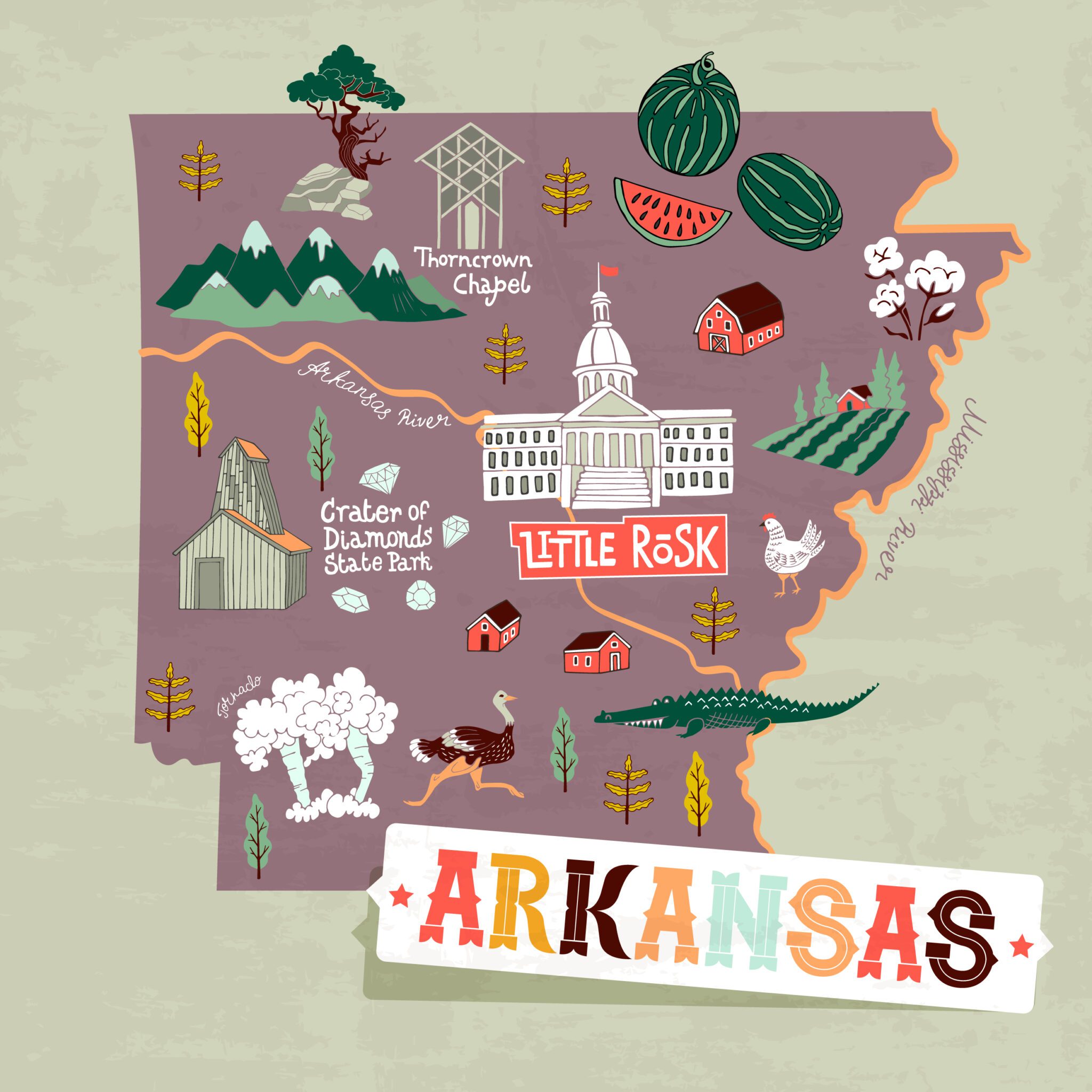

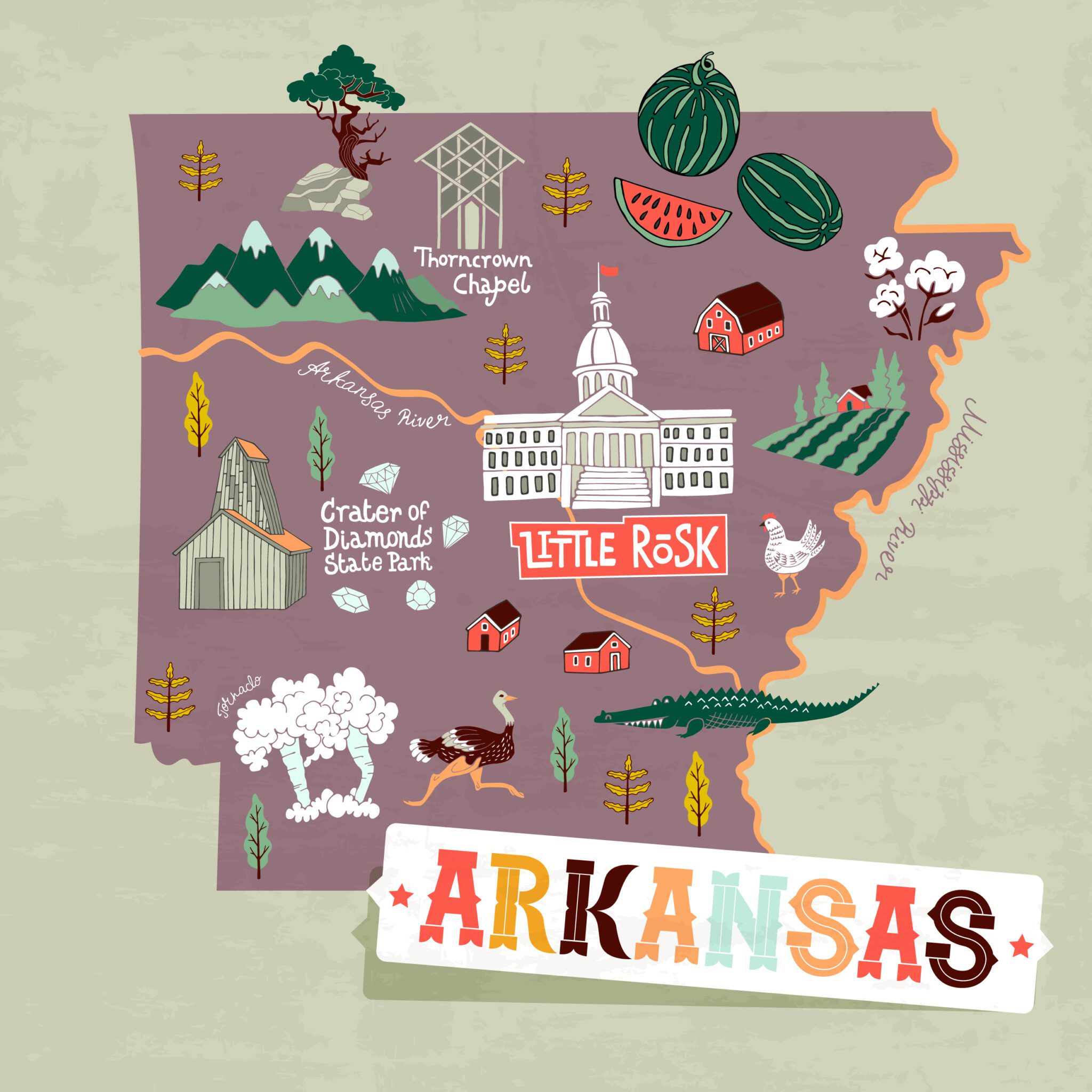

18 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/Arkansas-100-Disabled-Veteran-Property-Tax-Exemption-2048x2048.jpg

Which States Offer Disabled Veteran Property Tax Exemptions Military

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-2048x1152.jpg

Resident Veterans in Florida with a 100 disability rating may receive a full property tax exemption Other homestead exemptions may exist for Veterans over the age of 65 and surviving spouses See all exemption requirements In Florida retired veterans with a service connected disability may be eligible for a tax break including property tax exemptions The Department of Veterans Affairs runs these programs and offers financial help for veterans

11 rowsFurther benefits are available to property owners with disabilities senior citizens veterans and active duty military service members disabled first responders and properties Eligible resident veterans with a VA certified service connected disability of 10 percent or greater shall be entitled to a 5 000 property tax exemption The veteran must establish this

Download Florida Property Tax Exemption For 100 Disabled Veterans

More picture related to Florida Property Tax Exemption For 100 Disabled Veterans

Property Tax Exemption For Disabled Veterans Esper Aiello Law Group

https://www.esperaiellolawgroup.com/wp-content/uploads/property-tax-exemption-for-disabled-veterans.jpg

18 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/Texas-100-Disabled-Veteran-Property-Tax-Exemption-768x768.jpg

Disabled Veterans Property Tax Exemptions By State Tax Exemption

https://i.pinimg.com/originals/72/de/b0/72deb08487ef56182fd2f5060ab36198.jpg

Florida Property Tax Exemptions and Discounts for Service Members Disabled Veterans Spouses and Surviving Spouses Florida offers several property tax exemptions or discounts for Florida Statute 196 24 provides an exemption of up to 5 000 off the property value of an ex service member who is a permanent resident of Fl was discharged honorably and who has a

A veteran who was honorably discharged from the armed forces and who sustained a service connected total and permanent disability can qualify for exemption from all ad valorem Learn about the additional exemptions available to qualifying veterans and the unremarried spouse of a veteran in Lee County Florida Find out how to apply for disability deployment or

Additional Benefits For 100 Disabled Veterans CCK Law

https://cck-law.com/wp-content/uploads/2020/01/blog-Copy-15-scaled.jpg

Disabled Veterans Benefits VA Disability Rates 2021

https://va-disability-rates.com/wp-content/uploads/2021/08/disabled-veterans-guide-to-social-security-disability-and.png

https://floridabeginner.com/florida-disabled...

Learn how to apply for property tax exemptions and discounts for veterans with service connected disabilities in Florida Find out the eligibility criteria documentation requirements

https://floridarevenue.com/property/Documents/pt109.pdf

Learn about the property tax exemptions and discounts available to veterans and their spouses in Florida Find out the eligibility requirements how to apply and what documents to submit

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Additional Benefits For 100 Disabled Veterans CCK Law

18 States With Full Property Tax Exemption For 100 Disabled Veterans

18 States With Full Property Tax Exemption For 100 Disabled Veterans

2023 Disabled Veteran Property Tax Exemption Lake County Veterans And

Florida Property Tax Exemption For Disabled Veterans Military

Florida Property Tax Exemption For Disabled Veterans Military

Jefferson County Property Tax Exemption Form ExemptForm

Property Tax Exemption For Disabled Veterans

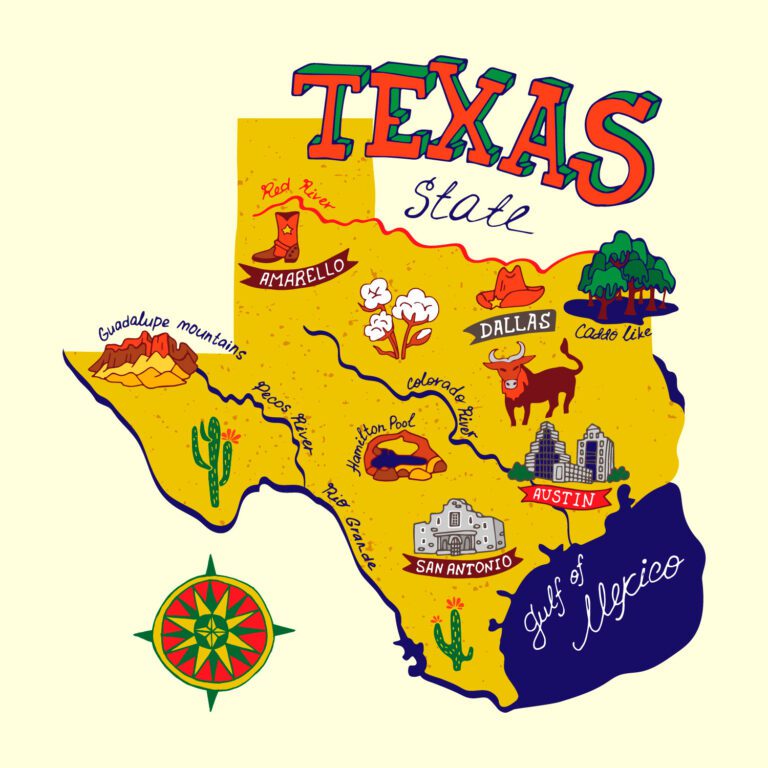

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

Florida Property Tax Exemption For 100 Disabled Veterans - In Florida retired veterans with a service connected disability may be eligible for a tax break including property tax exemptions The Department of Veterans Affairs runs these programs and offers financial help for veterans