Foreign Tax Credit Calculation Canada The calculation for the tax credit uses the total foreign non business income such as pension income employment income director s fees commissions interest dividends

A foreign tax credit of up to 15 for any foreign tax withheld at source on property income other than income from real property is allowed although the credit To claim foreign tax credits in Canada taxpayers must complete and file Form T2209 Federal Foreign Tax Credits This form is used to calculate the amount of foreign tax credits that a taxpayer is

Foreign Tax Credit Calculation Canada

Foreign Tax Credit Calculation Canada

https://sftaxcounsel.com/wp-content/uploads/2020/07/shutterstock_1719160864.jpg

Foreign Tax Credit Eligibility Limits Form 1116 How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiGVYW453n0rJ9HYr-WXTuCc_WbHgGJWBCYnfCvgMCYM2kOSi3Mdhn_in3bsrltNXQIKQUe0yhET4vk19FZxJ0BZCYG-av-JnS8vbDxBC2d6ofxaHs3xjcxYX4HsnMWKOSo-3vtJo5vItO1VTWWxSAFNP3Pnfbczcr50ZyDgHE_LerNoBR33vy44mQC/s928/ftc.jpg

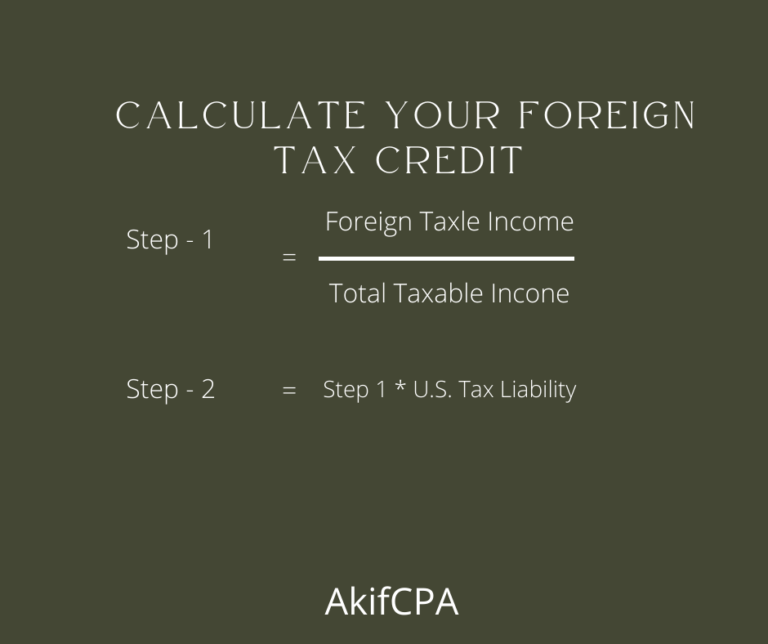

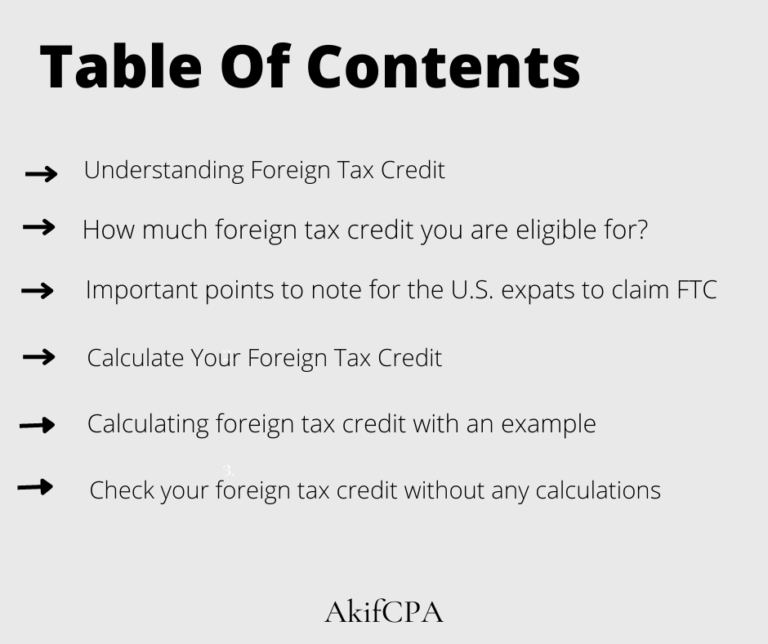

Everything You Need To Know About Foreign Tax Credit Calculation AKIF CPA

https://akifcpa.com/wp-content/uploads/2022/05/Steps-to-apply-for-itin-768x644.png

The amount of foreign income tax you claim is equal to the lesser of the foreign income or profits tax you paid or the amount of Canadian income tax you Foreign tax credit calculation PwC Canada Surplus Calculator Foreign tax Easily prepare complex tax calculations for each of your Canadian company s foreign

The tax treaty between Canada and the foreign country is an essential document to the computation of FTC Foreign tax credit calculation As mentioned The Foreign Federal Tax Credit FFTC can be claimed by using the T2209 tax form when you file your return The amount of the credit depends on whether the

Download Foreign Tax Credit Calculation Canada

More picture related to Foreign Tax Credit Calculation Canada

Foreign Tax Credit Calculation PwC Canada

https://www.pwc.com/ca/en/services/816505-cost-of-an-ipo.jpg

Is Foreign Tax Credit Allowed For Taxes That Are Paid Or Accrued

https://klasing-associates.com/wp-content/uploads/2018/03/WHY-IS-FOREIGN-TAX-CREDIT-ALLOWED.jpg

Everything You Need To Know About Foreign Tax Credit Calculation AKIF CPA

https://akifcpa.com/wp-content/uploads/2022/05/Reasons-Why-You-Need-an-ITIN-6-768x644.png

Use our Free Canadian Tax Software to help ensure you don t miss any of the deductions or credits you deserve It s Easy fast and 100 accurate guaranteed A detailed description of the foreign tax credit calculation was found in the Canada Revenue Agency CRA income tax folio S5 F2 C1 Foreign Tax Credit In

Ideally the tax credits you receive from filing the T2209 should offset the contributions you made to a foreign country if there s an existing tax treaty with Canada Last Updated April 26 2021 Find out how Canada provides relief from double taxation and how section 126 of Canada s Income Tax Act affects this mechanism

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

https://www.greenbacktaxservices.com/wp-content/uploads/2023/01/Screen-Shot-2023-01-24-at-12.18.53-PM-1024x978.png

/79336052-F-56a938475f9b58b7d0f95aa3.jpg)

Foreign Tax Credit Information

https://fthmb.tqn.com/irp3Dz5-VuynezrPzgXaBlWI4aM=/1280x854/filters:fill(auto,1)/79336052-F-56a938475f9b58b7d0f95aa3.jpg

https://www.taxtips.ca/filing/foreign-tax-credit-non-business-income.htm

The calculation for the tax credit uses the total foreign non business income such as pension income employment income director s fees commissions interest dividends

https://taxsummaries.pwc.com/Canada/Individual/...

A foreign tax credit of up to 15 for any foreign tax withheld at source on property income other than income from real property is allowed although the credit

How To Apply For Tax Number Cloudanybody1

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

Foreign Tax Credit Form 1116

Foreign Tax Credit Part 2 YouTube

Calculating The Credit How Foreign Tax Credits Work HowStuffWorks

Foreign Tax Credit Requirements To Qualify For The Credit

Foreign Tax Credit Requirements To Qualify For The Credit

Foreign Tax Credit How To Claim Tax Credit On Foreign Income

Computing The Deemed Paid Foreign Tax Credit Tax Professionals Member

Foreign Tax Credit Your Guide To The Form 1116 SDG Accountant

Foreign Tax Credit Calculation Canada - Tax otherwise payable above less foreign non business income tax credit taken Example Foreign Non Business Income Tax Credit Calculation In the year 2020