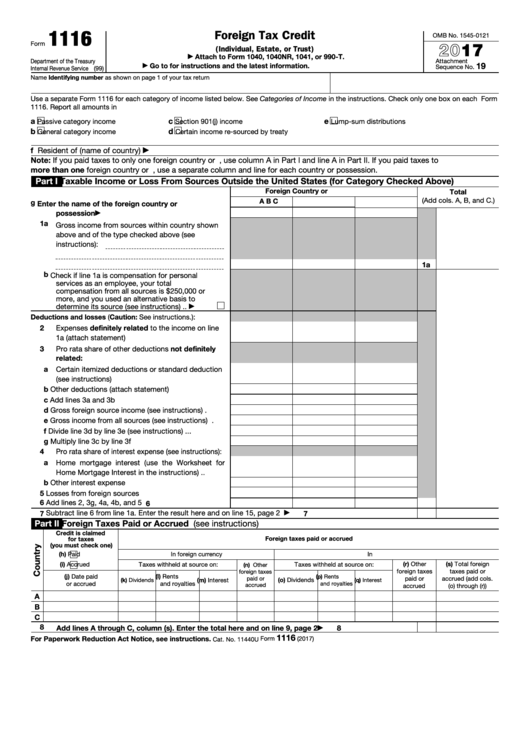

Foreign Tax Credit Example Your foreign tax credit is the amount of foreign tax you paid or accrued or if smaller the foreign tax credit limit You figure your foreign tax credit and the foreign tax credit limit on Form 1116 Foreign Tax Credit Foreign Tax Credit Limit Your foreign tax credit cannot be more than your total U S tax liability multiplied by a fraction

Fact checked by Vikki Velasquez What Is the Foreign Tax Credit The foreign tax credit is a U S tax credit used to offset income tax paid abroad U S citizens and resident aliens who IRS Form 1116 Foreign Tax Credit With An Example 1040 Abroad Filing Form 1116 Foreign Tax Credit With Examples May 2 2022 When talking about US taxes and taxation of US citizens who live abroad you may have heard of

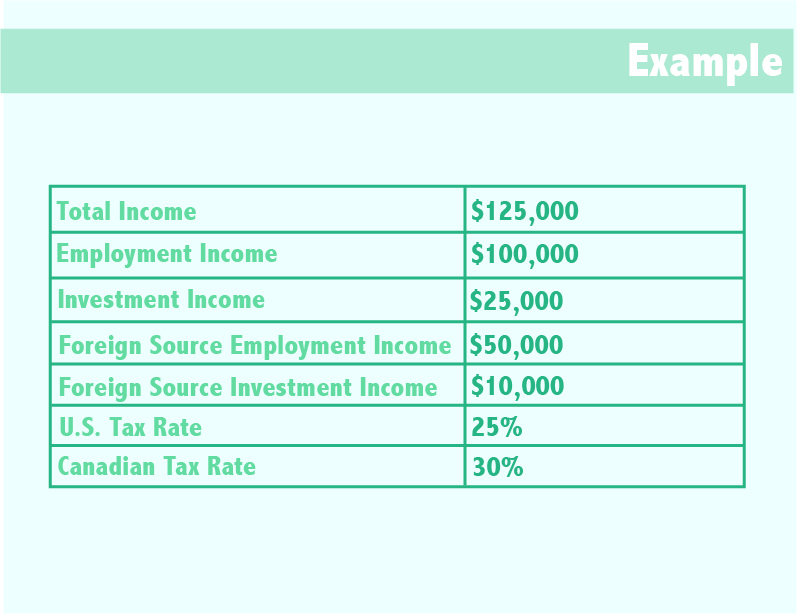

Foreign Tax Credit Example

Foreign Tax Credit Example

https://resize.hswstatic.com/w_1200/gif/foreign-tax-credit-orig.jpg

The Expat s Guide To Form 1116 Foreign Tax Credit

https://www.greenbacktaxservices.com/wp-content/uploads/2020/07/Screen-Shot-2.png

Schedule K 2 And K 3 Investment Partnership Part 3 YouTube

https://i.ytimg.com/vi/rT6kdp9fAyo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH8CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLC53xfJHnvp0Jv8XYkKbCU7XmHfWg

File Form 1116 Foreign Tax Credit to claim the foreign tax credit if you are an individual estate or trust and you paid or accrued certain foreign taxes to a foreign country or U S possession Corporations file Form 1118 Foreign Tax Credit Corporations to claim a foreign tax credit The amount of the foreign tax that qualifies for the credit must be reduced by any refunds of foreign tax made by the government of the foreign country or the U S possession Example 1 You received a 1 000 payment

To illustrate let s consider a Foreign Tax Credit example Tony a US citizen lives and works in the UK He s employed at a British company and earns the equivalent of 70 000 of foreign income He pays very roughly 20 000 a year in UK taxes An Example of the Foreign Tax Credit As an example suppose Jorge and Roberta own a house in Germany and Jorge is also employed there He pays 6 000 to Germany in income tax for the 2021 tax year Jorge can claim a U S tax credit on his 2021 tax return for that 6 000

Download Foreign Tax Credit Example

More picture related to Foreign Tax Credit Example

Foreign Tax Credit IRS Form 1116 Explained Greenback Expat Taxes

https://www.greenbacktaxservices.com/wp-content/uploads/2011/12/Screen-Shot-1.png

/GettyImages-840726260-7fe62acc78cf4854a147f0f9e03c6936.jpg)

Foreign Tax Credit Definition

https://www.investopedia.com/thmb/TNTJVCCZU27Omt5Ce0i_jxBRL7A=/1500x1000/filters:fill(auto,1)/GettyImages-840726260-7fe62acc78cf4854a147f0f9e03c6936.jpg

Complying With New Schedules K 2 And K 3

https://www.thetaxadviser.com/content/dam/tta/newsletters/schedule-k-3.PNG

We ll run through some examples further down Who can claim the Foreign Tax Credit Who is eligible for the foreign tax credit In general you re eligible for the credit if you re a U S citizen or resident who earns foreign income abroad and already paid income taxes to your country of residence In general the foreign earned income exclusion allows you to treat up to 120 000 of your income in 2023 taxes due in 2024 as not taxable by the United States In 2024 taxes due 2025 the

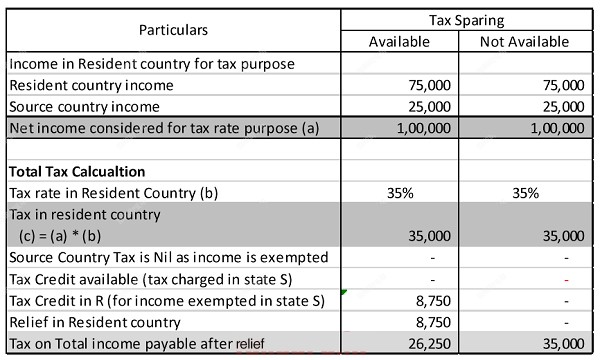

Portfolio 6060 1st The Foreign Tax Credit Limitation Under Section 904 Learn about one part of the U S foreign tax credit mechanism the foreign tax credit limitation under 904 The basic purpose of the limitation is to ensure that the United States does not allow foreign taxes to be used as a credit against U S tax on U S source The IRS limits the foreign tax credit you can claim to the lesser of the amount of foreign taxes paid or the U S tax liability on the foreign income For example if you paid 350 of foreign taxes and owed 250 of U S taxes on that same income your tax credit will be limited to 250

Foreign Tax Credit Form 1116 And How To File It example For US Expats

https://1040abroad.com/wp-content/uploads/2019/02/How-to-file-Foreign-Tax-Credit-part-4.png

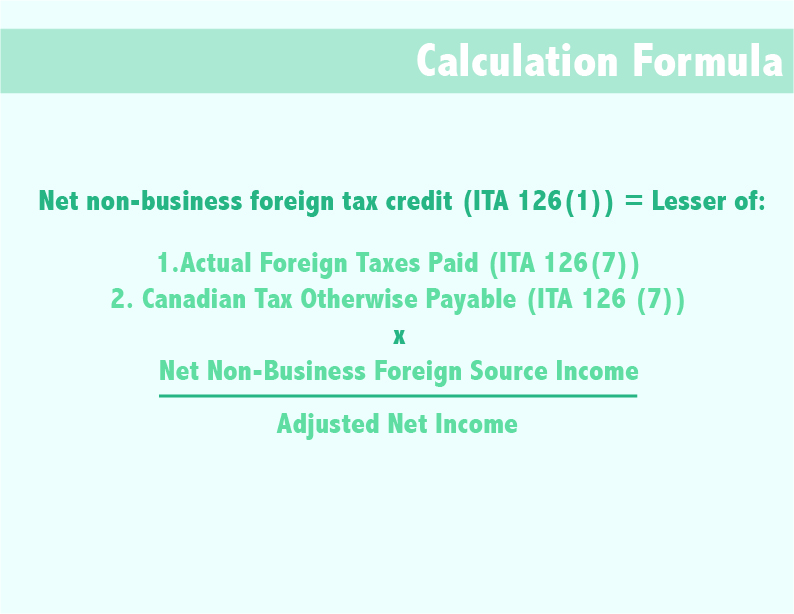

Foreign Tax Credits For Canadians Madan CA

https://madanca.com/wp-content/uploads/2019/11/Image2-1.jpg

https://www.irs.gov/individuals/international...

Your foreign tax credit is the amount of foreign tax you paid or accrued or if smaller the foreign tax credit limit You figure your foreign tax credit and the foreign tax credit limit on Form 1116 Foreign Tax Credit Foreign Tax Credit Limit Your foreign tax credit cannot be more than your total U S tax liability multiplied by a fraction

https://www.investopedia.com/terms/f/foreign-tax-credit.asp

Fact checked by Vikki Velasquez What Is the Foreign Tax Credit The foreign tax credit is a U S tax credit used to offset income tax paid abroad U S citizens and resident aliens who

Fillable Form 1116 Foreign Tax Credit 2017 Printable Pdf Download

Foreign Tax Credit Form 1116 And How To File It example For US Expats

Cite Foreign Tax Credit Presentation By Randy Free January 2011

All About Foreign Tax Credit

Foreign Tax Credits For Canadians Madan CA

Filing Form 1116 Foreign Tax Credit With Examples TaxConnections

Filing Form 1116 Foreign Tax Credit With Examples TaxConnections

Claim Foreign Tax Credit With Form 1116

Filing Form 1116 Foreign Tax Credit With Examples TaxConnections

Filing Form 1116 Foreign Tax Credit With Examples TaxConnections

Foreign Tax Credit Example - The U S foreign tax credit forms are as follows Individuals estates and trusts that paid tax to a different country will have to use Form 1116 to claim the US foreign tax credit Corporations of the same eligibility should file Form 1118 Foreign Tax Credit Corporations A US foreign tax credit reduces the overall taxable income Each