Form For Extra Tax Deductions Verkko 11 elok 2023 nbsp 0183 32 How to file deductions in MyTax You can file travel expenses a credit for household expenses also tax credit for electricity expenses for the production of income a deduction for second home for work or a credit due to maintenance obligation for your tax card or for your pre completed tax return in MyTax

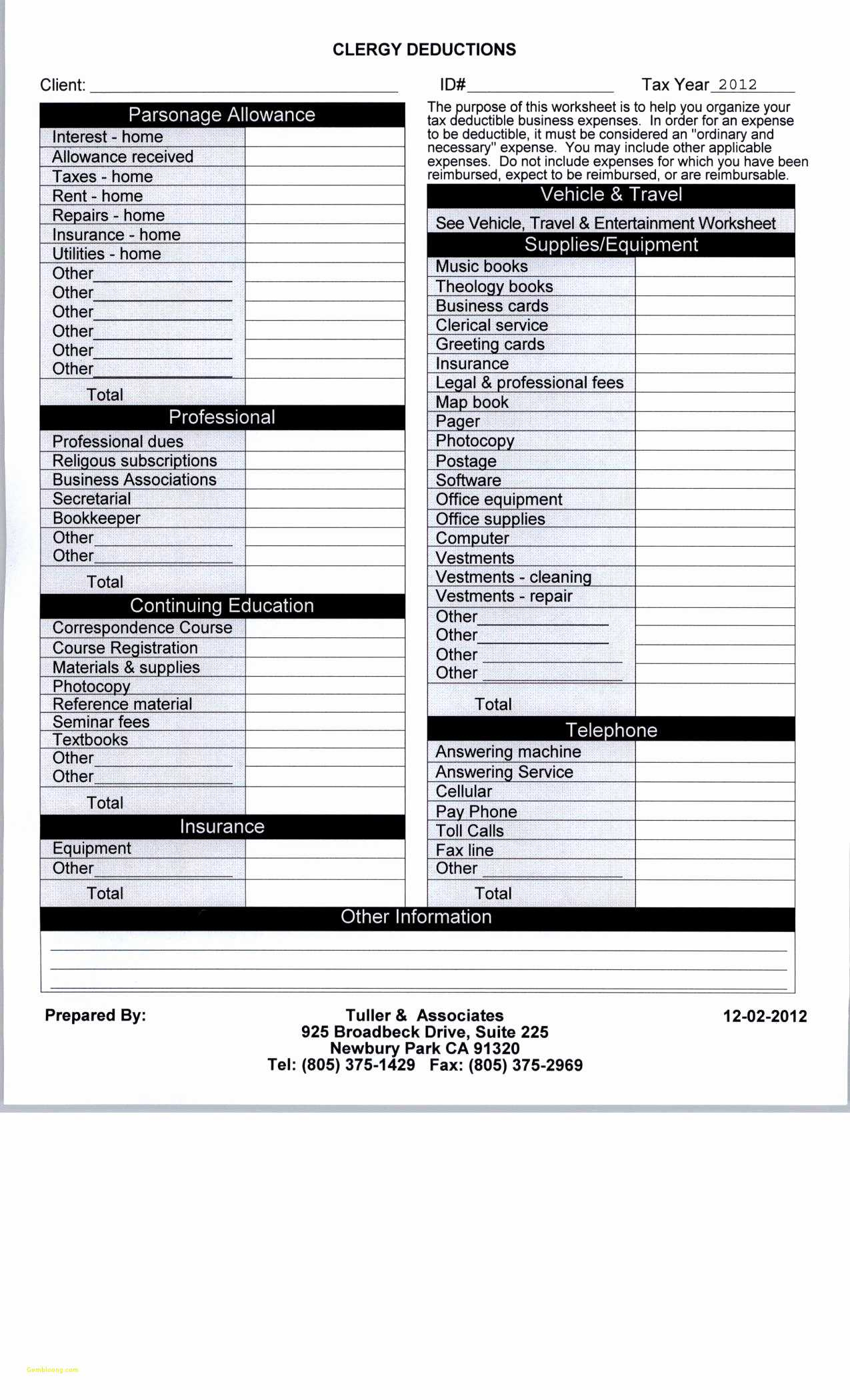

Verkko 17 jouluk 2021 nbsp 0183 32 The additional deduction is 50 until the end of the 2021 Further information Government Proposal 186 2021 eduskunta fi available in Finnish and Swedish link to Finnish Business operators and self employed individuals no longer receive tax return forms by post Business tax return forms for 2021 Form 5 Verkko Review the back of the TD1 form to make sure the individual has not included any additional information for example requesting additional tax to be deducted Use the Total Claim Amount from the TD1 form to calculate the correct amount of federal and provincial or territorial income tax deductions

Form For Extra Tax Deductions

Form For Extra Tax Deductions

https://www.worksheeto.com/postpic/2009/10/list-itemized-tax-deductions-worksheet_449386.png

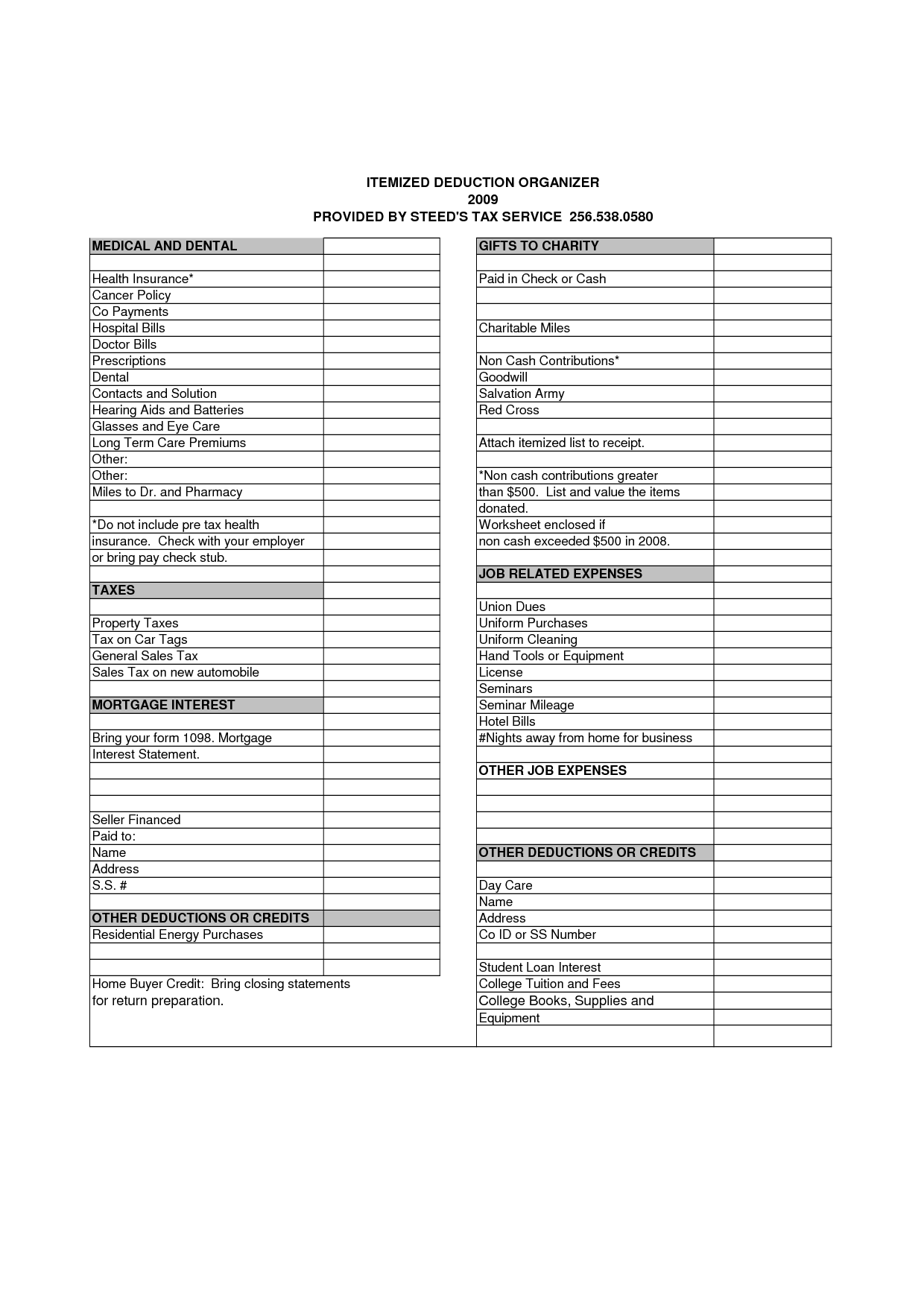

Tax Deduction Cheat Sheet

https://i.pinimg.com/originals/75/d1/5f/75d15fa5a7b613dfa842ca9286638fde.jpg

How To Find Extra Tax Deductions

https://edgefinancial.com/wp-content/uploads/2019/03/find-extra-tax-dexuctions.png

Verkko 1 jouluk 2023 nbsp 0183 32 2024 standard deduction over 65 The just released additional standard deduction amount for 2024 returns usually filed in early 2025 is 1 550 1 950 if unmarried and not a surviving Verkko 4 jouluk 2023 nbsp 0183 32 Taxes Advertiser Disclosure Standard Deductions for 2023 and 2024 Tax Returns and Extra Benefits for People Over 65 Janet Berry Johnson Contributor Kemberley Washington editor Updated Dec

Verkko To reduce income tax deductions the employee must get a letter of authority The employee must send to the CRA either A Form T1213 Request to Reduce Tax Deductions at Source A written request to the Sudbury Tax Centre and include documents that support their position why less income tax should be deducted at source Verkko 2 jouluk 2023 nbsp 0183 32 Home taxes tax forms W 4 Form Extra Withholding Exemptions and Other Things Workers Need to Know Knowing how the IRS Form W 4 form works can help with new jobs tax refunds and avoiding

Download Form For Extra Tax Deductions

More picture related to Form For Extra Tax Deductions

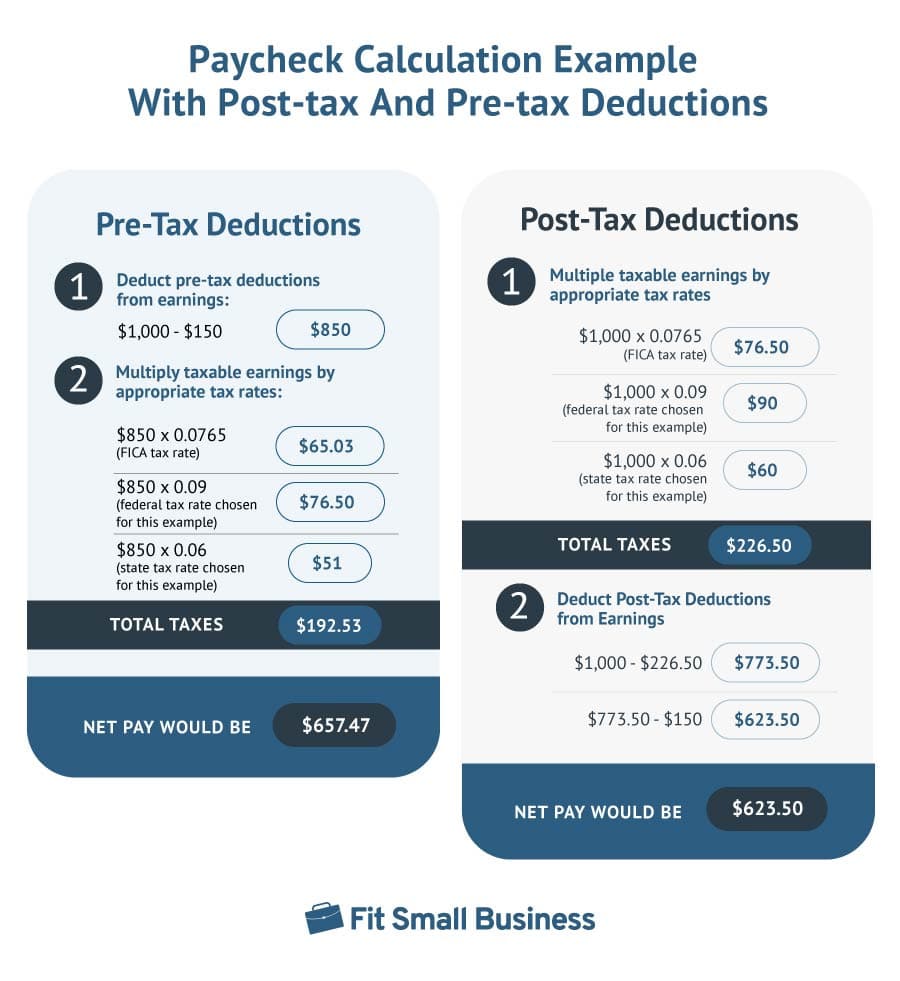

Pre tax Deductions Post tax Deductions An Ultimate Guide

https://fitsmallbusiness.com/wp-content/uploads/2022/11/Infographic_Paycheck_Calculation_Example_with_Post_tax_and_Pre-tax_Deductions.jpg

List Of Tax Deductions Examples And Forms

https://www.qtoffice.com/ckfinder/userfiles/images/1312/Tax Deductions.png

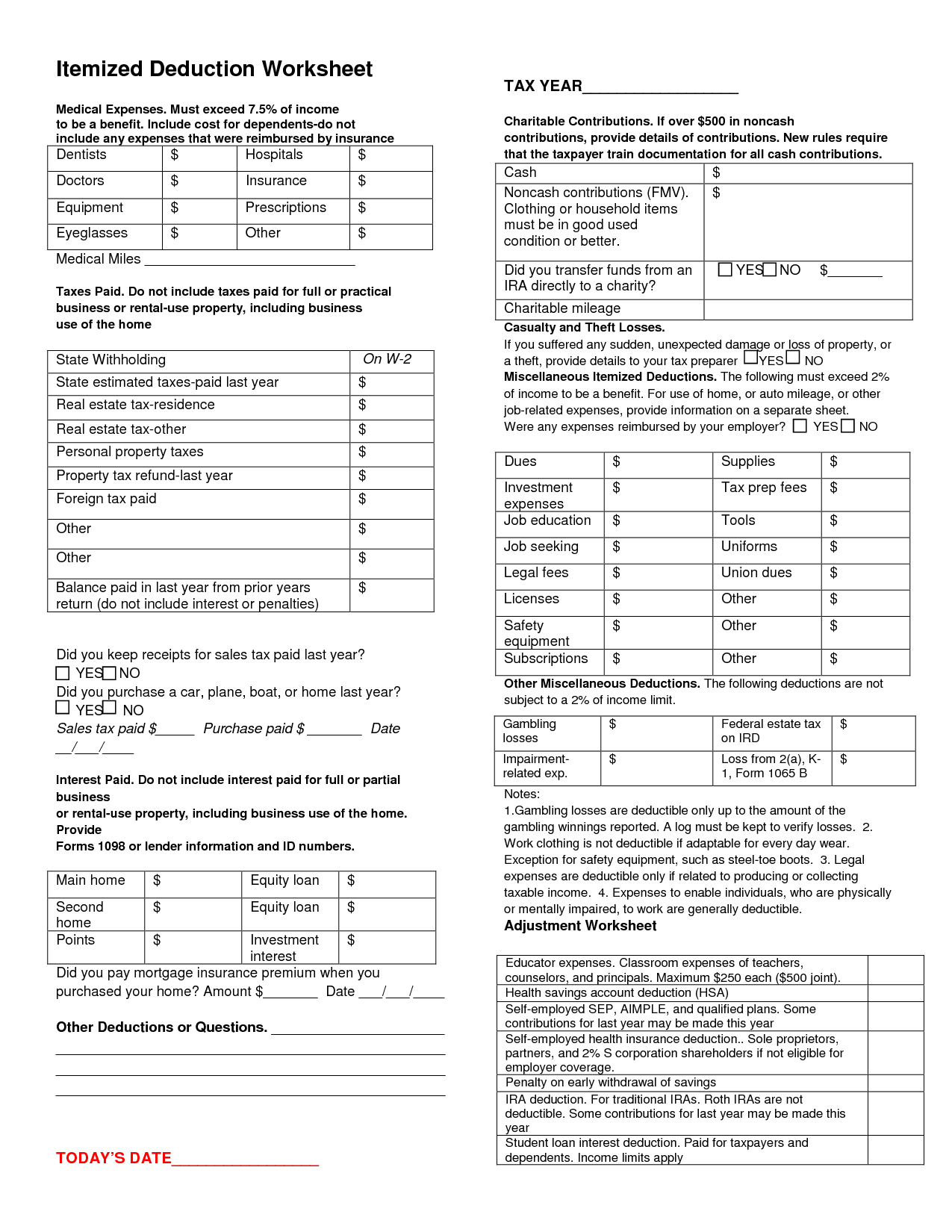

10 Best Images Of Business Tax Deductions Worksheet Tax Itemized

http://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

Verkko 4 jouluk 2023 nbsp 0183 32 Generally there are two ways to claim tax deductions Take the standard deduction or itemize deductions You can t do both The standard deduction is a flat dollar no questions asked Verkko 18 jouluk 2023 nbsp 0183 32 What Extra Tax Deductions Should I Make Sure To Take Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 December 18 2023 12 35 PM OVERVIEW The federal government offers tax deductions and credits to reduce taxable income under certain circumstances

Verkko Deduction of Additional Tax Income Less Than Total Personal Tax Credits TD1 For Non Resident Employees TD1 When You Have Multiple Jobs Multiple Jobs But Total Income Less Than Claim Amount Letter of Authority to Reduce Tax Deductions Tuition Carried Forward and Other Carry Forwards Commission Employees TD1X Form Verkko 2024 Form W 4 Complete Steps 2 4 ONLY if they apply to you otherwise skip to Step 5 See page 2 for more information on each step who can claim exemption from withholding and when to use the estimator at www irs gov W4App Step 2 Multiple Jobs or Spouse Works

How To Avoid Withholding Tax Economicsprogress5

https://cdn.biblemoneymatters.com/wp-content/uploads/2020/03/04100218/w4-withholding-allowance-worksheet-taxes.jpg

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2014-itemized-deductions-worksheet_426933.png

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/...

Verkko 11 elok 2023 nbsp 0183 32 How to file deductions in MyTax You can file travel expenses a credit for household expenses also tax credit for electricity expenses for the production of income a deduction for second home for work or a credit due to maintenance obligation for your tax card or for your pre completed tax return in MyTax

https://www.vero.fi/en/About-us/newsroom/news/uutiset/2021/taxation...

Verkko 17 jouluk 2021 nbsp 0183 32 The additional deduction is 50 until the end of the 2021 Further information Government Proposal 186 2021 eduskunta fi available in Finnish and Swedish link to Finnish Business operators and self employed individuals no longer receive tax return forms by post Business tax return forms for 2021 Form 5

Top 20 Tax Deductions For Small Business

How To Avoid Withholding Tax Economicsprogress5

Tax Itemized Deductions Worksheet Universal Network

Tax Act Where Can You Claim Tax Deductions

Income Tax Deductions Available For The Financial Year 2017 18

List Of Tax Deductions Examples And Forms

List Of Tax Deductions Examples And Forms

The Deductions You Can Claim Hra Tax Vrogue

Self Employed Tax Deduction Worksheet

S Corp Tax Deductions Everything You Need To Know

Form For Extra Tax Deductions - Verkko Available in most U S time zones Monday Friday 8 a m 7 p m in English and other languages Call 1 800 772 1213 Tell the representative you want to submit a request to withhold taxes from your Social Security benefit throughout the year Call TTY 1 800 325 0778 if you re deaf or hard of hearing Submit a request to pay taxes on