Fuel Reimbursement Tax Exemption India There can be no tax exemption on the fuel and driver salary reimbursement if the car is used only for personal purposes In other words the entire

The benefit categorized as either fuel allowance car allowance petrol allowance or fuel allowance by corporate if availed by Reimbursement of fuel expenses and conveyance allowance both are two different aspects So an employee is eligible to get both conveyance allowance of

Fuel Reimbursement Tax Exemption India

Fuel Reimbursement Tax Exemption India

https://lh5.googleusercontent.com/proxy/j4mOQddD5-1FkIZi30o19VDVtHe4y6mELoZ0vyqyue5n7DWA4Mn1O_nkWkuM4K3Vrn59iIPd2SWrxRkfNaomxfjASorwF7clNsO67cCcr6H2lzJpzZQfjHgSIF2EteQ=s0-d

Corporate Tax Exemption For Companies And Startup India In Budget 2020

https://i.pinimg.com/originals/80/ec/8f/80ec8f44c6e24f28d449224cd7996b8f.png

Can My Work related Phone Bills And WiFi Bills Help Me Reduce Taxes

https://life.futuregenerali.in/media/qptadiyc/reduce-taxes-with-phone-and-wifi-bills.jpg

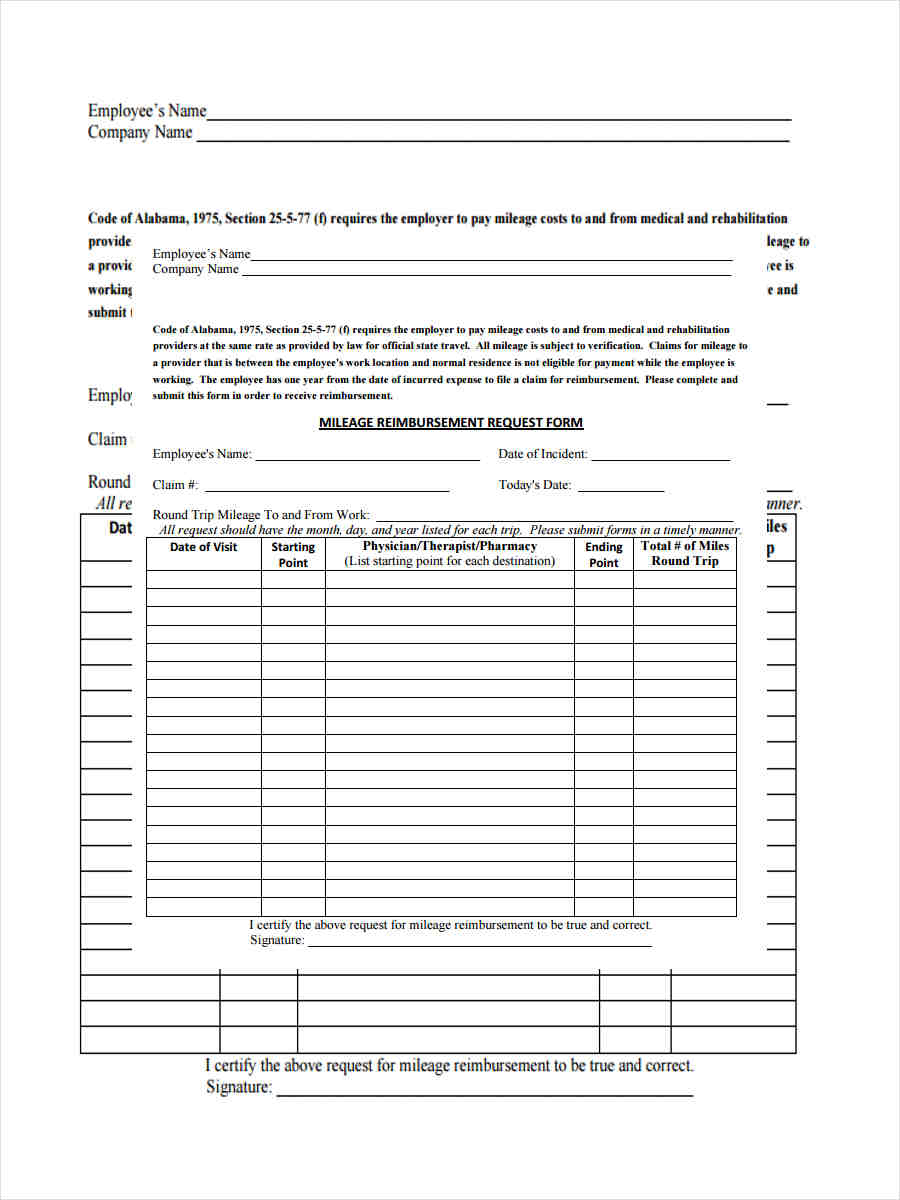

Find out the list of benefits available to a salaried person in India and save your tax legally The question raised is car allowance income tax liability There are some of the facts or points you must understand regarding Tax Exemption on Car Allowances

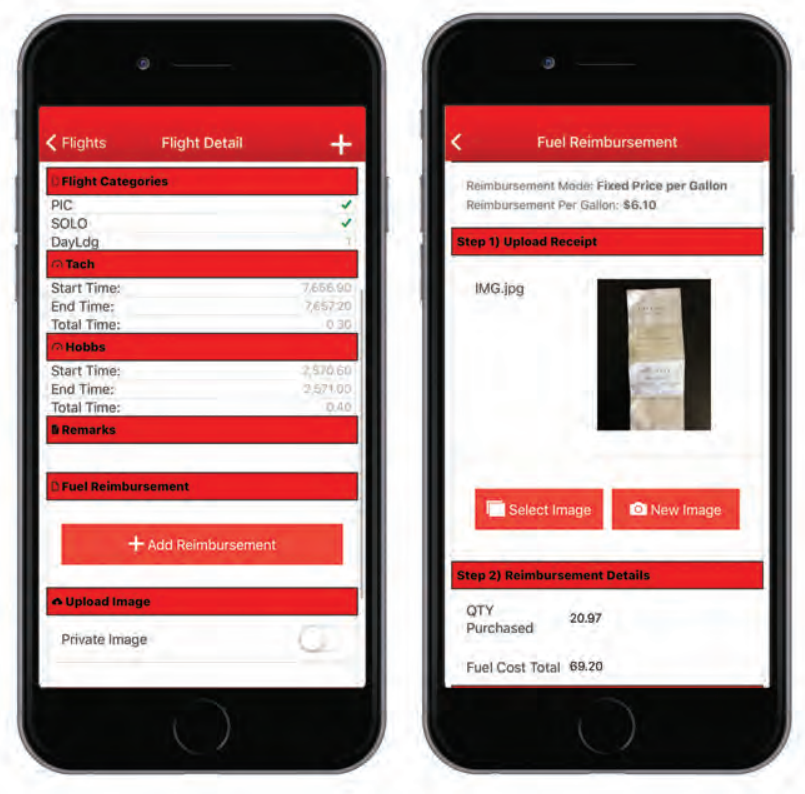

In case the car is used only for personal purposes then the whole amount i e the actual expenditure incurred or reimbursed by the employer on running The way fuel reimbursement is structured is employees get a full tax exemption to the extent of the receipts submitted Employees can save up to 30 in taxes on the billed amount And if they happen

Download Fuel Reimbursement Tax Exemption India

More picture related to Fuel Reimbursement Tax Exemption India

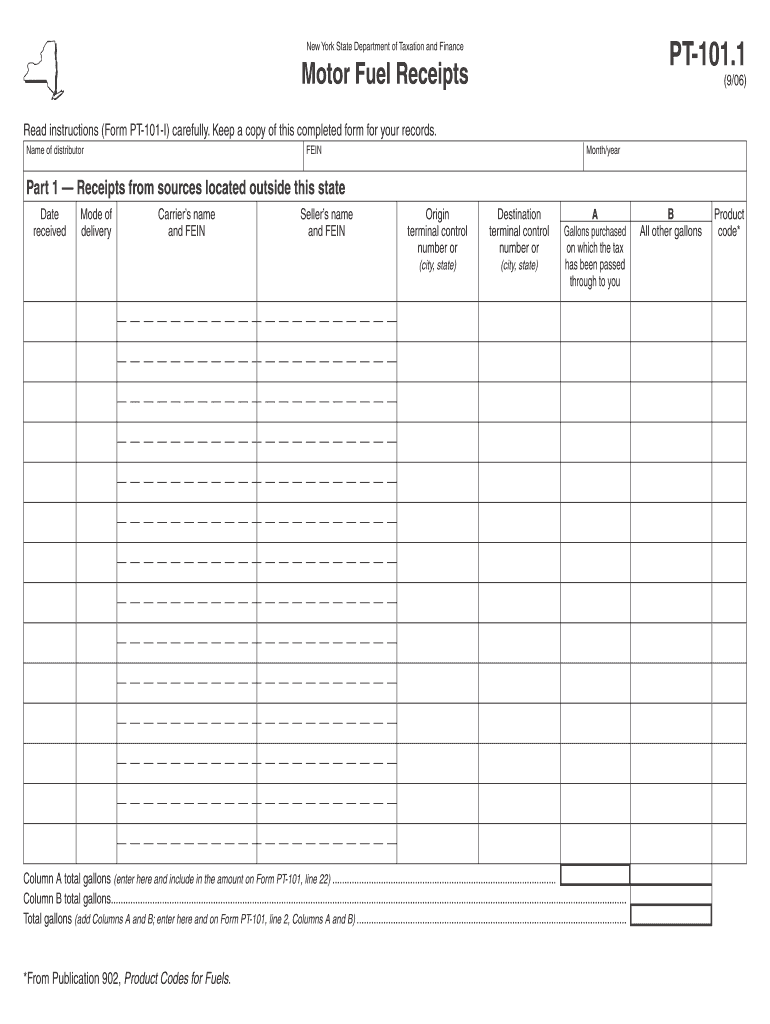

Finance Fuel Receipts Form Template Fill Out And Sign Printable PDF

https://www.signnow.com/preview/100/763/100763723/large.png

Fleet Member How To Submit Fuel Reimbursement Pilot Partner

http://www.pilotpartner.net/wp-content/uploads/2021/04/FuelReimbursement.png

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

For example if a company reimburses Rs 1 lakh per month for the purpose of fuel expenses to an employee the entire Rs 1 lakh shall be tax free as long as the This report seeks to address some typical issues relating to taxability of reimbursements in light of the prevalent tax legislation and the courts rulings in India 2 Meaning of

As per the first ever Employee Benefits study in India 72 employees prefer to opt for fuel allowances Photo Pixabay There are host of benefits offered by a The amount of exemption is as follows Changes by Finance Act 2018 From the financial year 2018 2019 the tax exemption for medical and transport allowances has been

Mileage Reimbursement 2023 Form Printable Forms Free Online

https://source.cocosign.com/images/employee/mileage-reimbursement-form/mileage-reimbursement-form_1.jpg

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/free-12-mileage-reimbursement-forms-in-pdf-ms-word-excel.jpg

https://www.hinote.in/taxability-of-fuel-expense...

There can be no tax exemption on the fuel and driver salary reimbursement if the car is used only for personal purposes In other words the entire

https://www.goodreturns.in/2019/05/30/y…

The benefit categorized as either fuel allowance car allowance petrol allowance or fuel allowance by corporate if availed by

Capital Gains Tax India Simplified Read This If You Invest In Stocks

Mileage Reimbursement 2023 Form Printable Forms Free Online

Legacy Tax Service Mobile AL

What Is The Due Date For Reimbursement Time news Time News

USDA Announces SY2023 24 Reimbursement Rates School Nutrition Association

Income Tax Exemption Limit May Get Doubled To Rs 2 Lacs

Income Tax Exemption Limit May Get Doubled To Rs 2 Lacs

Tax Reduction Company Inc

The Estate Tax The Motley Fool

NFocus Tax Service LLC Clearwater FL

Fuel Reimbursement Tax Exemption India - Tax on amount received for fractional shares IS IT MANDATORILY TO DEDUCT TDS AFTER DISALLOWING EXPENSES IN INCOME TAX RETURN