Furnace Tax Deduction Learn how to distinguish between deductible repairs and capital improvements for HVAC replacement costs Find out the common HVAC components the unit of property and the betterment rules

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Learn how to claim a 30 tax credit for ENERGY STAR certified gas or oil furnaces installed between 2023 and 2032 Find out the eligibility criteria annual limits and strategies to

Furnace Tax Deduction

Furnace Tax Deduction

https://lifttrucksupplyinc.com/wp-content/uploads/2016/05/12369179_537911586377015_8736271735998525545_n.png

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Tax Deductions For Furnaces Finance Zacks

https://img-aws.ehowcdn.com/600x600p/photos.demandstudios.com/getty/article/129/115/78463533_XS.jpg

Are you investing in energy efficient appliances Doing so may result in some valuable tax breaks to lower the cost TABLE OF CONTENTS Does the IRS offer tax breaks Learn how to claim a tax credit for installing energy efficient water heaters in your home Find out the eligibility limitations and qualifying products for the residential energy property credit

Learn how to claim the energy efficient home improvement credit for qualified expenses on your 2023 tax return Find out the eligibility requirements annual limit and categories of eligible Learn how to save up to 3 200 annually on taxes for energy efficient home upgrades with federal tax credits and deductions Find out how to claim the credits for heat pumps windows insulation solar wind geothermal fuel cells

Download Furnace Tax Deduction

More picture related to Furnace Tax Deduction

Is There A Tax Deduction For A New Furnace Germany Wallpaper

https://www.aeroseal.com/wp-content/uploads/2018/03/2018-section-179-deduction-example.jpg

Is A New Hvac System Tax Deductible

https://i2.wp.com/comfortsystems.net/wp-content/uploads/2019/02/are-hvac-systems-tax-deductable.jpg

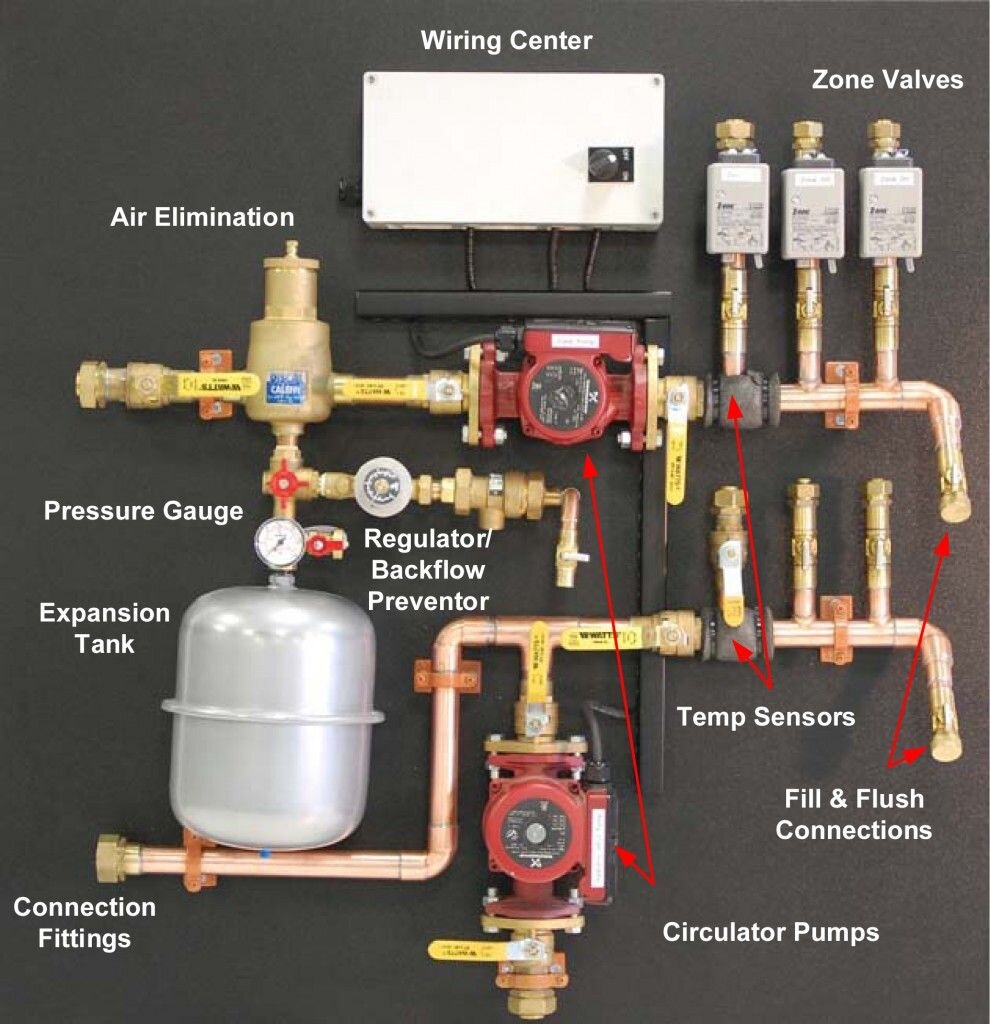

Hydronic Heating For Custom Home Builds BVM Contracting

https://images.squarespace-cdn.com/content/v1/5d7fa39bce4fc13b8f07cc6d/1614782019248-HCRR7UZP3MPZDPYQ7N4F/Hydronic+Heating+System+Components.jpg

Furnace Tax Credit You can earn 30 of the project cost or a maximum of 600 credit for installing a qualified gas furnace ENERGY STAR certified gas furnaces with AFUE Learn how to qualify for federal tax credits on HVAC systems purchased and installed between 2023 and 2034 Find out the criteria rates and benefits for different types of

Learn how to claim tax credits for ENERGY STAR certified furnaces and other home improvements that save energy and money Find out the eligibility criteria the credit amounts and the application process for 2022 Learn how the Inflation Reduction Act extends and enhances tax credits for energy efficient home improvements such as windows doors water heaters and more Find

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

https://www.thetaxadviser.com › newslet…

Learn how to distinguish between deductible repairs and capital improvements for HVAC replacement costs Find out the common HVAC components the unit of property and the betterment rules

https://airconditionerlab.com › what-hva…

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000

The California Furnace Tax Credit An FAQ For Homeowners Bell Brothers

What Will My Tax Deduction Savings Look Like The Motley Fool

Section 80GG Deduction In 2023 24 Claim Tax Deduction For Rent Paid

Hvac Can I Remove The Fresh Air Supply That Is Attached Next To My

Is A New Hvac System Tax Deductible

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Furnace Qualify For Tax Credit Cozy Heat

How To Fully Maximize Your 1099 Tax Deductions Steady

How To Deduct HVAC Equipment Purchases For Your Business With Section

Furnace Tax Deduction - Are you investing in energy efficient appliances Doing so may result in some valuable tax breaks to lower the cost TABLE OF CONTENTS Does the IRS offer tax breaks