Geothermal Tax Credit 2023 Irs Energy Eficient Home Improvement Credit For 2022 biomass stoves and boilers are treated as a Residential Clean Energy Credit with no lifetime maximum How to Claim the Credit File Form 5695 Residential Energy Credits Part II with your tax return You must claim the credit for the tax year when the improvement is installed not

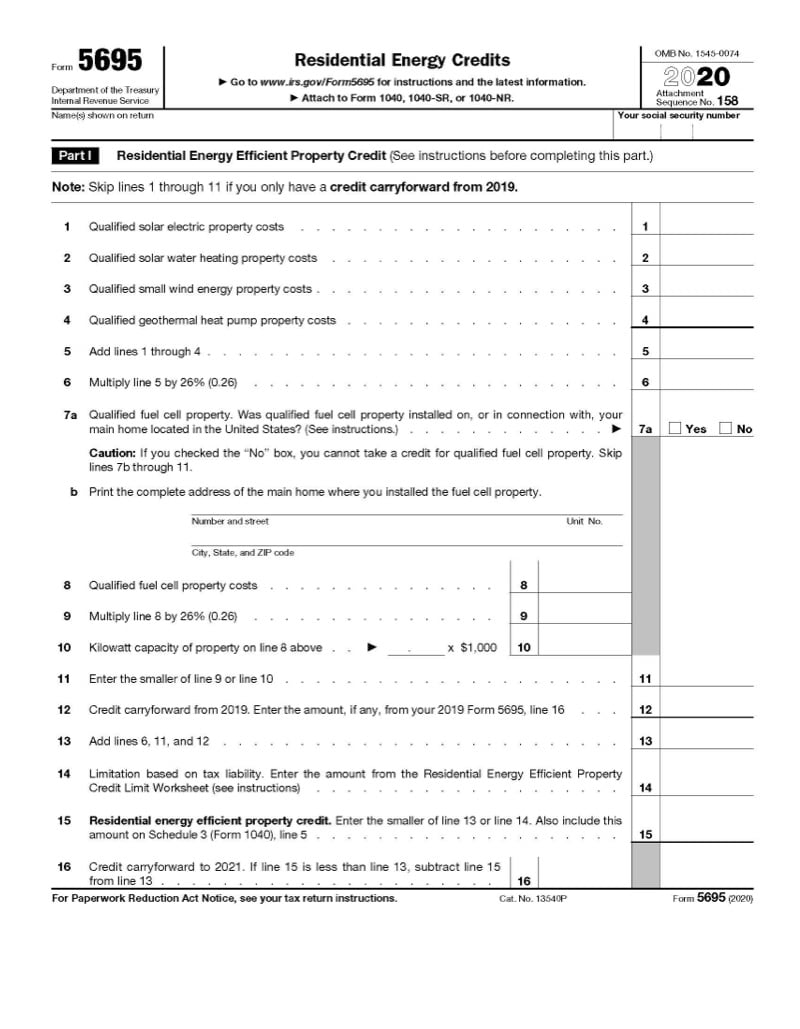

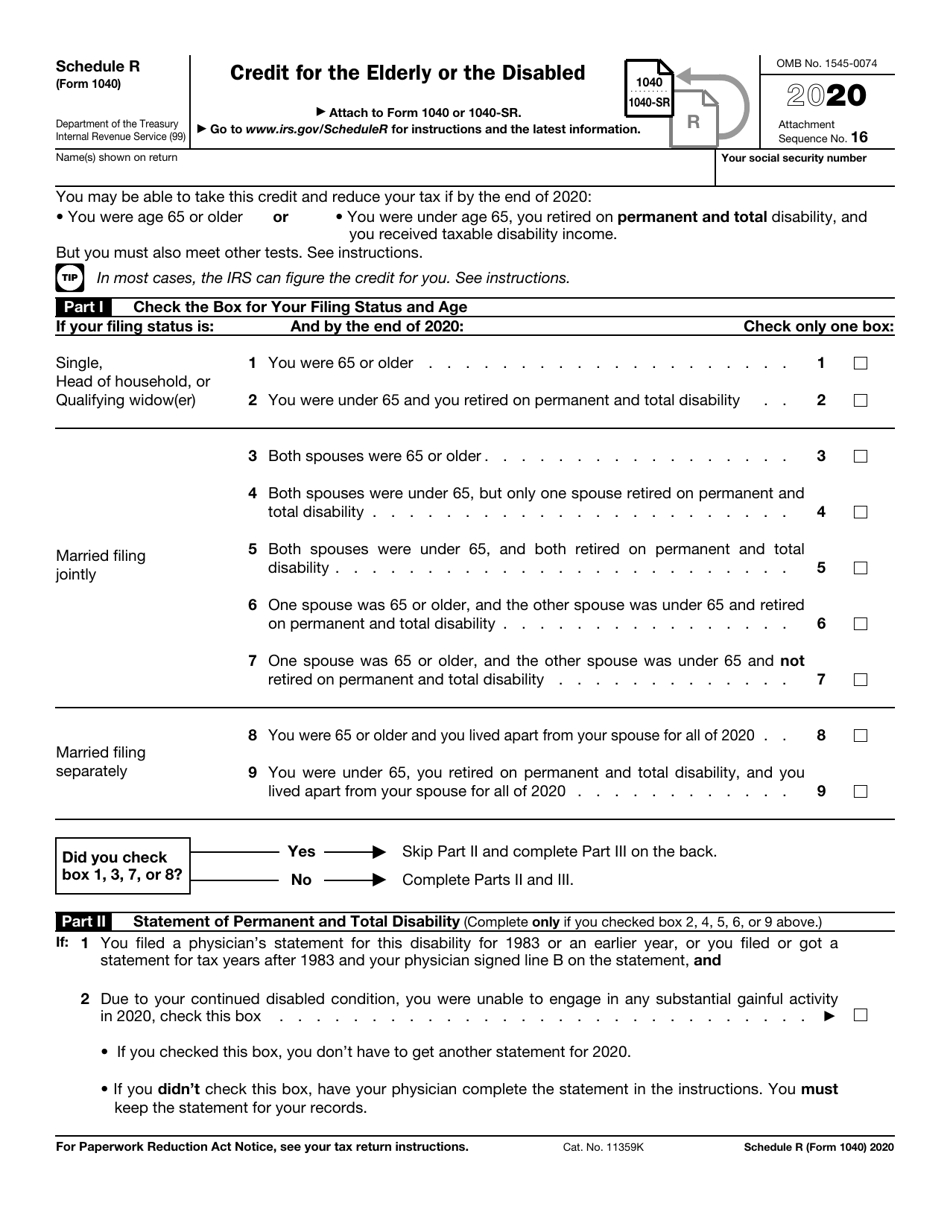

For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and New data from the Internal Revenue Service show that more than 3 4 million American families have already claimed more than 8 billion in residential clean energy and home energy efficiency credits against their 2023 federal income taxes the first year that the IRA s full adjustments to the value and scope of these tax credits were in effect

Geothermal Tax Credit 2023 Irs

Geothermal Tax Credit 2023 Irs

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_440097569-scaled.jpeg

Geothermal Tax Credits Are Back

https://static.wixstatic.com/media/245a47_6063b427c5ee4dea89f244fdcfb5da2e~mv2.png/v1/fill/w_1000,h_714,al_c,usm_0.66_1.00_0.01/245a47_6063b427c5ee4dea89f244fdcfb5da2e~mv2.png

2023 Tax Tables Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/624/911/624911793/big.png

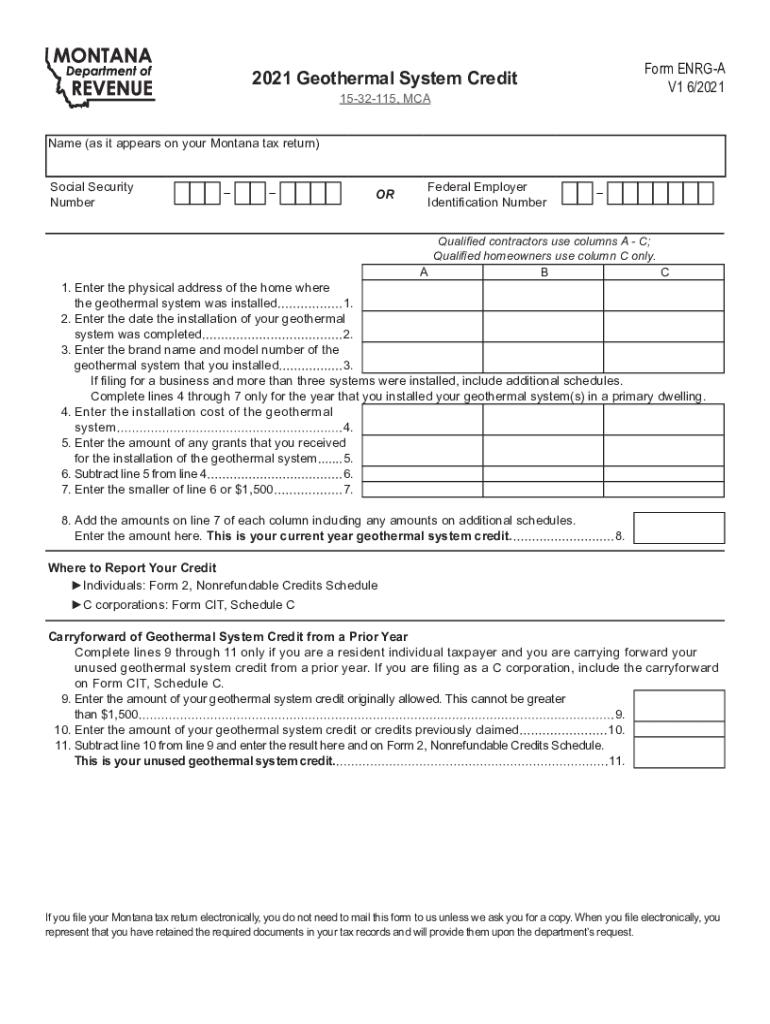

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts Residential Tax Credits for Geothermal Heat Pumps Homeowners are eligible for a 30 tax credit under the Inflation Reduction Act IRA Residential Energy Efficient Property Credit Section 25D for ENERGY STAR rated GHPs that are in service by Jan 1 2033 The tax credits expire at the end of 2034

The Renewable Energy tax credits have also been extended and now will be available through the end of 2023 These include incentives for Geothermal Heat Pumps Residential Wind Turbines Solar Energy Systems and Fuel Cells Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and before January 1 2020 26 for property placed in service after December 31 2019 and before January 1 2022 30 for property placed in service

Download Geothermal Tax Credit 2023 Irs

More picture related to Geothermal Tax Credit 2023 Irs

Understanding The 26 Geothermal Heat Pump Tax Credit

https://blog.hydronmodule.com/hs-fs/hubfs/GEO-Rep-Tom-Reed-Steve-Tax-Credit-Blog-Image.jpg?width=1800&name=GEO-Rep-Tom-Reed-Steve-Tax-Credit-Blog-Image.jpg

For 346PRODUCTION Www directingactors

https://www.jacksonhewitt.com/siteassets/tax-help-main/blogs/form-images/irs-notice_5695_1.jpg

Geothermal Energy Geothermal Energy

https://i.pinimg.com/originals/1b/5b/2b/1b5b2bb22e346c8cae48da09f846c165.jpg

Geothermal heat pumps 48 840 Battery storage technology 35 850 Fuel cells Most Popular Uses for Credits Number of 2023 tax returns that claimed credit for each use Solar panels 752 300 Table 1 summarizes the new data on the residential clean energy and energy efficient home improvement tax credits for tax year 2023 tax returns filed and processed through May 23 2024 small wind turbines geothermal heat pumps batteries and fuel cells For reported investments in energy efficient home improvements more than

IR 2024 202 Aug 7 2024 WASHINGTON The Department of the Treasury and the Internal Revenue Service today issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 The Inflation Reduction Act or IRA extended and expanded tax credits PDF that allow taxpayers to claim residential and energy efficient home To offset the high upfront cost of geothermal heat pump installation and to incentivize renewable energy integration within commercial businesses the federal government issued a tax credit for geothermal systems

ITL Online 2023

https://itl2023.groovestats.com/assets/itl-blue-1ceea5d7.png

What Is The 2021 Geothermal Tax Credit ClimateMaster Geothermal HVAC

https://geothermal.climatemaster.com/wp-content/uploads/2021/01/2021-geothermal-tax-credits.jpg

https://www.irs.gov › pub › irs-pdf

Energy Eficient Home Improvement Credit For 2022 biomass stoves and boilers are treated as a Residential Clean Energy Credit with no lifetime maximum How to Claim the Credit File Form 5695 Residential Energy Credits Part II with your tax return You must claim the credit for the tax year when the improvement is installed not

https://www.irs.gov › instructions

For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

ITL Online 2023

Congress Extends Tax Benefits For Geothermal Heat Pumps Colorado

Learning To Cope Without The Geothermal Tax Credit 2017 03 01

Tax Brackets Chart 2023 IMAGESEE

Agnus Good

Agnus Good

Expiring Geothermal Tax Credits What Will The Industry Do ACCA HVAC

Breaking Down The Federal Geothermal Tax Credit For Commercial Business

Irs Printable Forms

Geothermal Tax Credit 2023 Irs - Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit and there s no limit on the credit amount The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT