Is Geothermal Tax Credit Refundable Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after

The Geothermal Tax Credit is classified as a non refundable personal tax credit It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or To offset the high upfront cost of geothermal heat pump installation and to incentivize renewable energy integration within commercial businesses the federal government issued a tax credit for

Is Geothermal Tax Credit Refundable

Is Geothermal Tax Credit Refundable

https://www.elderheatingandair.com/wp-content/uploads/2020/03/geothermal-illustration.jpg

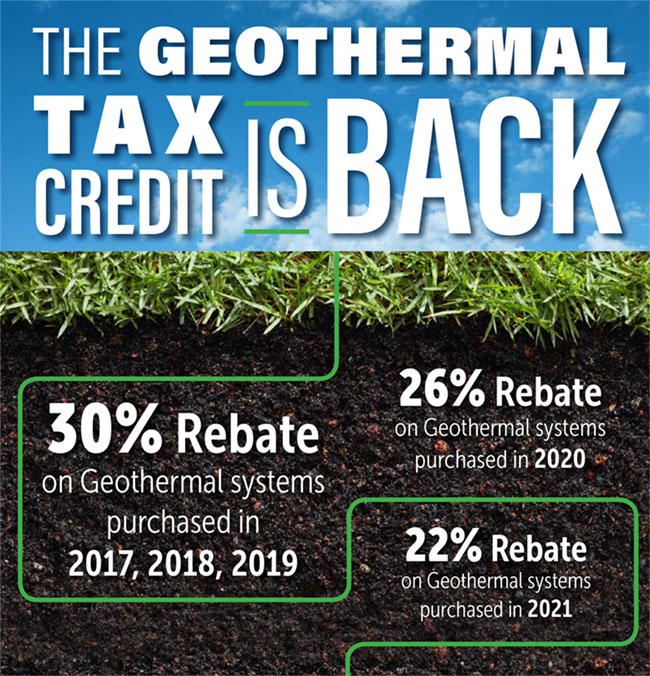

Geothermal Tax Credits Are Back

https://static.wixstatic.com/media/245a47_6063b427c5ee4dea89f244fdcfb5da2e~mv2.png/v1/fill/w_1000,h_714,al_c,usm_0.66_1.00_0.01/245a47_6063b427c5ee4dea89f244fdcfb5da2e~mv2.png

New York Homeowners Could Qualify For Geothermal Tax Credit

https://s7d2.scene7.com/is/image/TWCNews/homes-aerial_AP

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump The credit is not refundable so you will need to owe federal taxes to claim the credit This personal tax credit is applied to your tax liability to the IRS including any

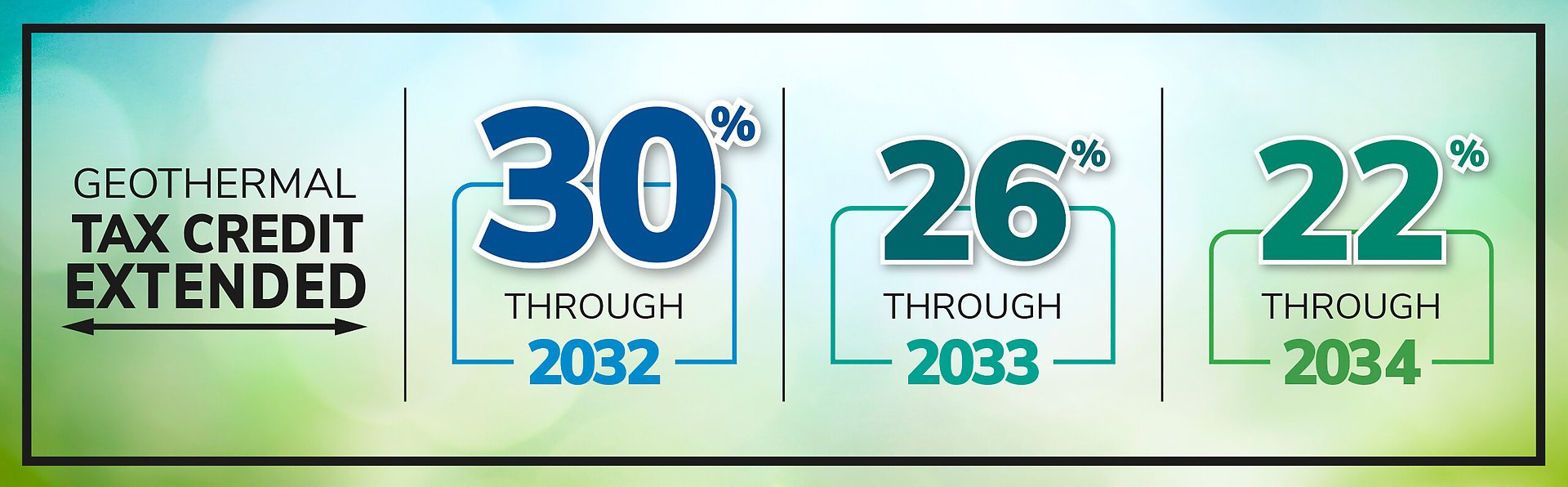

Understanding the Federal Tax Incentives for Geothermal Heat Pumps The 30 federal tax credit was extended through 2032 and will drop to 26 in 2033 and to 22 in 2034 Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property Qualifying properties are solar

Download Is Geothermal Tax Credit Refundable

More picture related to Is Geothermal Tax Credit Refundable

Geothermal Wins With New IRA Tax Credits HVAC Distributors

https://www.climatemaster.com/images/18.4965ec86185e30c7df5eae/1677095040452/x1920p/Infographic-Geothermal-Tax-Credit-Extended.jpg

30 Percent Tax Credit Geothermal 06 16 HB McClure Company

https://hbmcclure.com/wp-content/uploads/30-Percent-Tax-Credit-Geothermal-06-16.jpg

What Is The 2021 Geothermal Tax Credit ClimateMaster Geothermal HVAC

https://geothermal.climatemaster.com/wp-content/uploads/2021/01/2021-geothermal-tax-credits.jpg

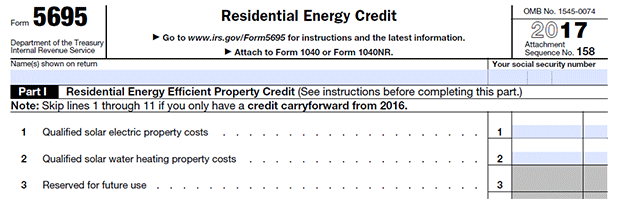

Claiming a geothermal tax credit is as simple as filing your taxes next year The IRS issues federal tax credits themselves When submitting a tax return file Form 5695 under Residential Energy THE FINE PRINT Like with all tax rebates there are a few additional provisions you will need to know before applying You can use the heat pump for heating water in the home but it is not a requirement to

The geothermal heat pump also known as the ground source heat pump must meet Energy Star requirements upon installation finalization to qualify for the federal tax The tax credit is not refundable The credit can be carried forward for a maximum of ten years The geothermal tax credit covers expenses associated with ground source heat

Nonrefundable Tax Credit Requirements Examples How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgTMqGwItilexEoZQJNU2GLzvaTnbp258m3Nzi1jN5_u_xZrw9g4yvAOf-x19hxqiU9DeOiOw1hi2gBes0jtQ0dcT_GInA7ahKGKakdw3MTzOcVxOwEOQGghxnLpUEkrfRSkg2e_WCMS9N8qZQ0gbar9AiZYRe4B7qUOtVIttiBL_Nbs8SN0XKhBm7fd4k/s944/non.jpg

What Is The Non Refundable Portion Of Employee Retention Credit By

https://image.isu.pub/220711201423-ceef0c63a5a648c4bb522acef891f854/jpg/page_1.jpg

https://www.energystar.gov/about/federal-tax...

Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after

https://blog.enertechusa.com/claim-your-geothermal-tax-credit

The Geothermal Tax Credit is classified as a non refundable personal tax credit It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or

Learning To Cope Without The Geothermal Tax Credit 2017 03 01

Nonrefundable Tax Credit Requirements Examples How To Claim

Read This Regarding The Changes Just Announced Regarding The Geothermal

Tax Credit Vs Tax Deduction What s The Difference Expat US Tax

Breaking Down The Federal Geothermal Tax Credit For Commercial Business

Geothermal Tax Credit Reinstated Corken Steel Products

Geothermal Tax Credit Reinstated Corken Steel Products

Is The 2020 Child Tax Credit A Refundable Credit Leia Aqui Is The IRS

2017 Geothermal Tax Credit Instructions Are Here

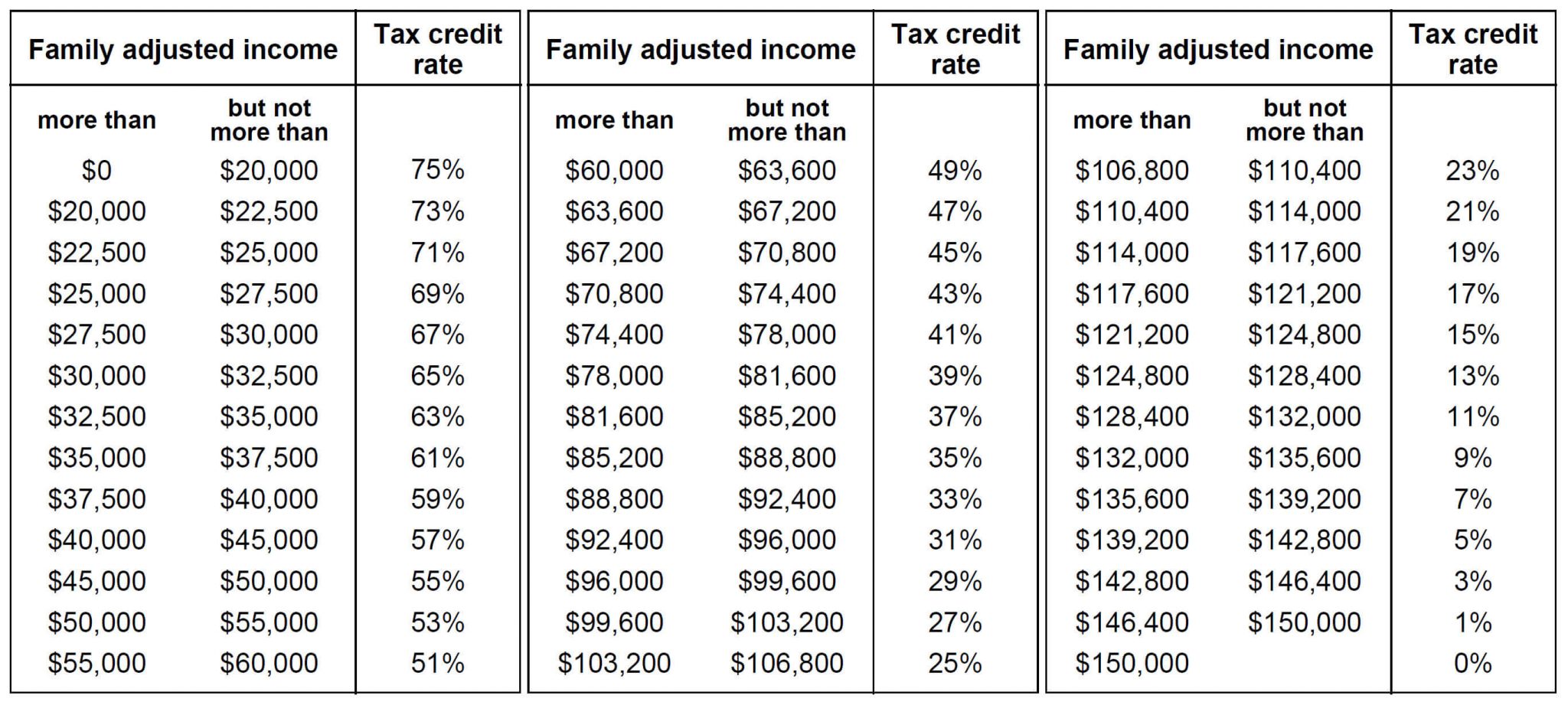

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

Is Geothermal Tax Credit Refundable - A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032 The incentive will be lowered to 26 for systems