Germany Tax Benefits Web 25 Okt 2022 nbsp 0183 32 1 Income related expenses lump sum The German tax office grants a 1 000 euro in 2021 income related expenses lump sum Werbungskostenpauschale that you can deduct for any costs incurred through your work From the 2022 tax year onwards this lump sum will be increased to 1 200 euros per year

Web 24 Juni 2022 nbsp 0183 32 Increase in the basic tax free allowance The basic tax free allowance Grundfreibetrag will also increase retroactively from January 1st 2022 The increase raises the allowance by 363 euros from 9 984 euros to 10 347 euros This is beneficial as tax is only due on income earned above this basic amount Web 27 Juli 2023 nbsp 0183 32 This article is a comprehensive guide to the German tax system for expats living in Germany It explains how to determine your German tax residence status income tax rates how to pay taxes and what other taxes may be applicable

Germany Tax Benefits

Germany Tax Benefits

https://www.mylifeingermany.com/wp-content/uploads/2020/02/featured-image_tax-return-in-germany_guide-for-expats_my-life-in-germany_hkwomanabroad-min.jpg

United States Germany Income Tax Treaty SF Tax Counsel

https://sftaxcounsel.com/wp-content/uploads/2022/02/shutterstock_1652240032.jpg

Taxes In Germany The Only Free Easy Way To File A Tax Return

https://nomadandinlove.com/wp-content/uploads/taxes-in-germany-768x1152.jpg

Web 23 Dez 2023 nbsp 0183 32 Germany Individual Deductions Last reviewed 23 December 2023 Employment expenses Various properly documented and necessarily incurred income related expenses may be deducted by an individual unless they are in cases of employment relationship reimbursed by the employer For employees common tax deductions include Web 7 Feb 2022 nbsp 0183 32 Families can benefit from many different tax advantages but often don t due to simply not knowing about them Those who wish to benefit from these tax advantages should find out as soon as possible which amounts can be deducted and which reliefs they are entitled to While raising children even with tax advantages remains

Web The German tax system allows for a relatively wide variety of deductions that can reduce your tax liability You are also able to claim tax credits such as child benefits Tax deductions are possible for the following types of payments Employment expenses unless already reimbursed by an employer Relocation expenses Web 21 Feb 2022 nbsp 0183 32 The German tax and social welfare system is a complicated network featuring six different tax classes and numerous quirks involving how residents pay tax make contributions to their health

Download Germany Tax Benefits

More picture related to Germany Tax Benefits

Tax Classes In Germany Relosophy

https://www.therelosophy.com/wp-content/uploads/2022/02/Tax-classes-2-2-1080x675.jpg

Tax Identification In Germany JEA

https://jeagermany.org/wp-content/uploads/2022/11/Example-of-tax-ID-Germany.jpeg

A Lucrative Tax Break For Manufacturers The Domestic Production

https://blog.concannonmiller.com/hubfs/mfg emblem-TAX BENEFITS copy.png#keepProtocol

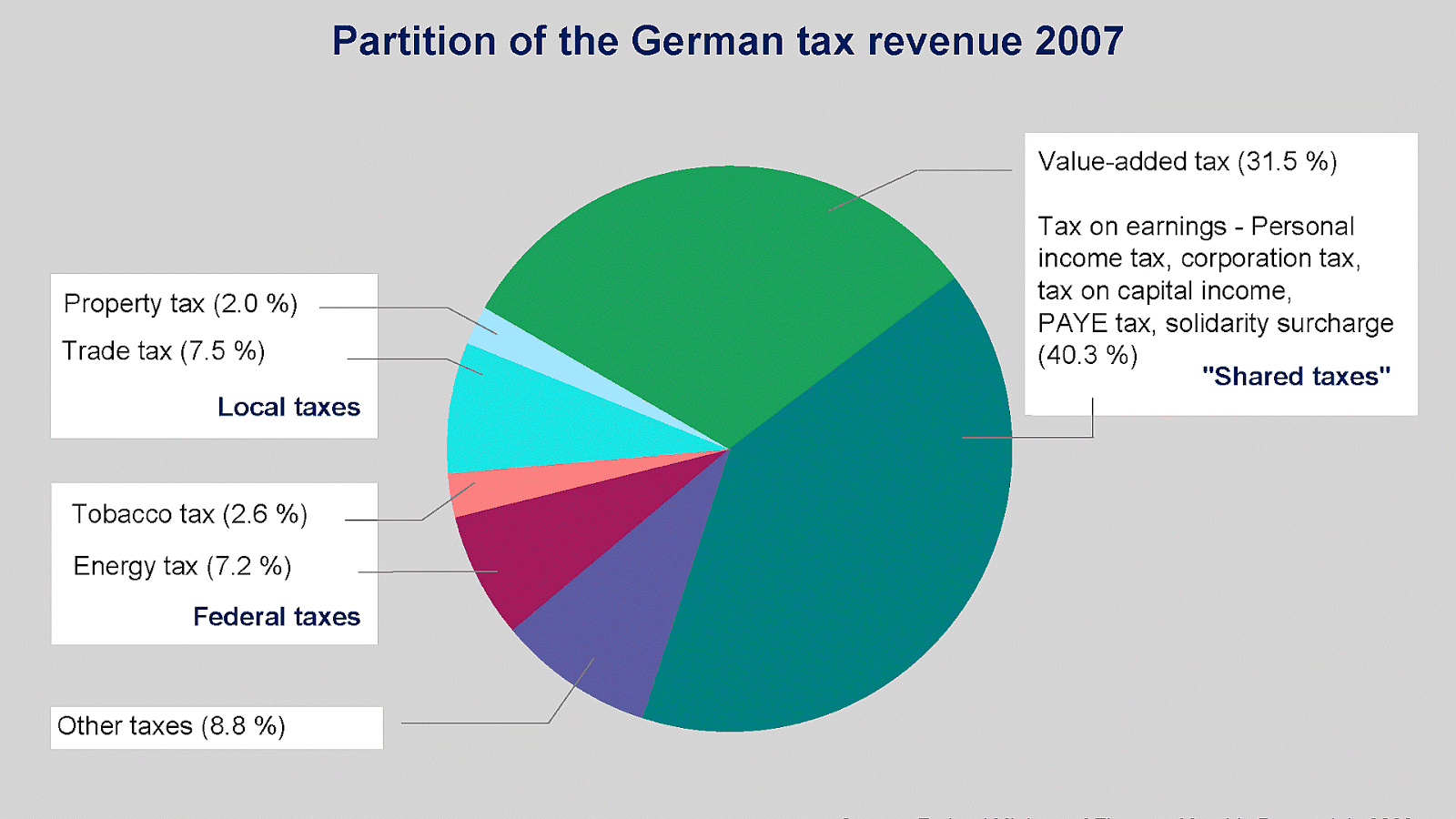

Web 2 Mai 2023 nbsp 0183 32 20 645 Payroll Frequency Monthly Employee Costs 31 05 Capital Berlin Date Format dd mm yyyy Fiscal Year 1 January 31 December Download PDF guide Get a Demo Learn How to Comply with Local Labour Law Transportation commuter allowance Wellness allowance Phone and internet allowance Vacation and Christmas bonus Web On make it in Germany you can find detailed information about the German payroll tax Each time we go to a supermarket or caf 233 drop by at a gas station or receive a payroll we are paying taxes Taxation is the primary source of revenue for the state and enables the government to perform its duties The German state is responsible for

Web 13 Jan 2023 nbsp 0183 32 Child benefits Child benefits supplement and child allowance As of January 2023 child benefits Kindergeld are being increased to 250 euros per child per month and are applied uniformly for each child The increase initially only applies to 2023 and 2024 as a new form of basic child benefits Kindergrundsicherung are to be Web Filing your tax return in Germany Find out which expenses are tax deductible

Tax Rates On Income In Germany Expat Tax

https://expattax.de/wp-content/uploads/2016/08/pexels-photo-87485.jpg

Tax App

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100087510464361

https://www.iamexpat.de/expat-info/german-expat-news/7-tax-allow…

Web 25 Okt 2022 nbsp 0183 32 1 Income related expenses lump sum The German tax office grants a 1 000 euro in 2021 income related expenses lump sum Werbungskostenpauschale that you can deduct for any costs incurred through your work From the 2022 tax year onwards this lump sum will be increased to 1 200 euros per year

https://germantaxes.de/tax-tips/tax-reliefs-2022

Web 24 Juni 2022 nbsp 0183 32 Increase in the basic tax free allowance The basic tax free allowance Grundfreibetrag will also increase retroactively from January 1st 2022 The increase raises the allowance by 363 euros from 9 984 euros to 10 347 euros This is beneficial as tax is only due on income earned above this basic amount

Income Tax ShareChat Photos And Videos

Tax Rates On Income In Germany Expat Tax

German Annual Income Tax Return Declaration Form For 2022 Year Close Up

Difference Between Tax ID TIN And Tax Number In Germany

Democratic Plan Would Close Tax Break On Exchange traded Funds

Guide To Crypto Taxes In Germany Updated 2022

Guide To Crypto Taxes In Germany Updated 2022

Report State Could Lose millionaires Tax Benefits If High earning

Taxes In Germany Explained Income Tax Tax Classes Church Tax

Taxation In Germany German Choices

Germany Tax Benefits - Web 23 Dez 2023 nbsp 0183 32 Germany Individual Deductions Last reviewed 23 December 2023 Employment expenses Various properly documented and necessarily incurred income related expenses may be deducted by an individual unless they are in cases of employment relationship reimbursed by the employer For employees common tax deductions include