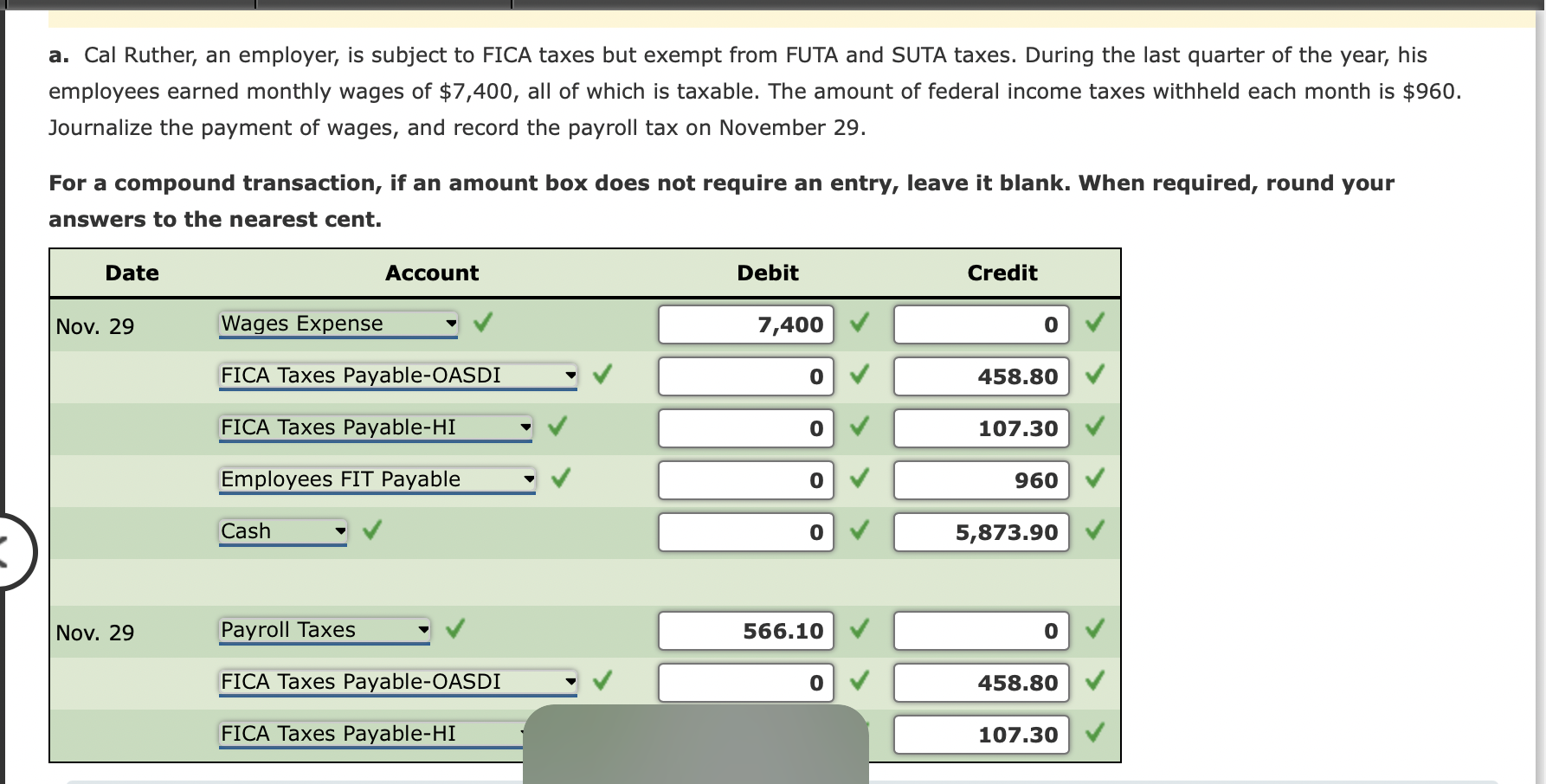

Government Contribution In Nps Is Taxable Or Not Verkko 30 maalisk 2023 nbsp 0183 32 The third deduction is in the form of employer s contribution of up

Verkko 25 toukok 2023 nbsp 0183 32 A resounding yes If your employer is contributing to your NPS account you can claim deduction under section 80CCD 2 There is no monetary limit on how much you can claim but it should Verkko 27 lokak 2022 nbsp 0183 32 Vipul Das National Pension System NPS is a voluntary pension

Government Contribution In Nps Is Taxable Or Not

Government Contribution In Nps Is Taxable Or Not

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nominee-in-nps.jpg

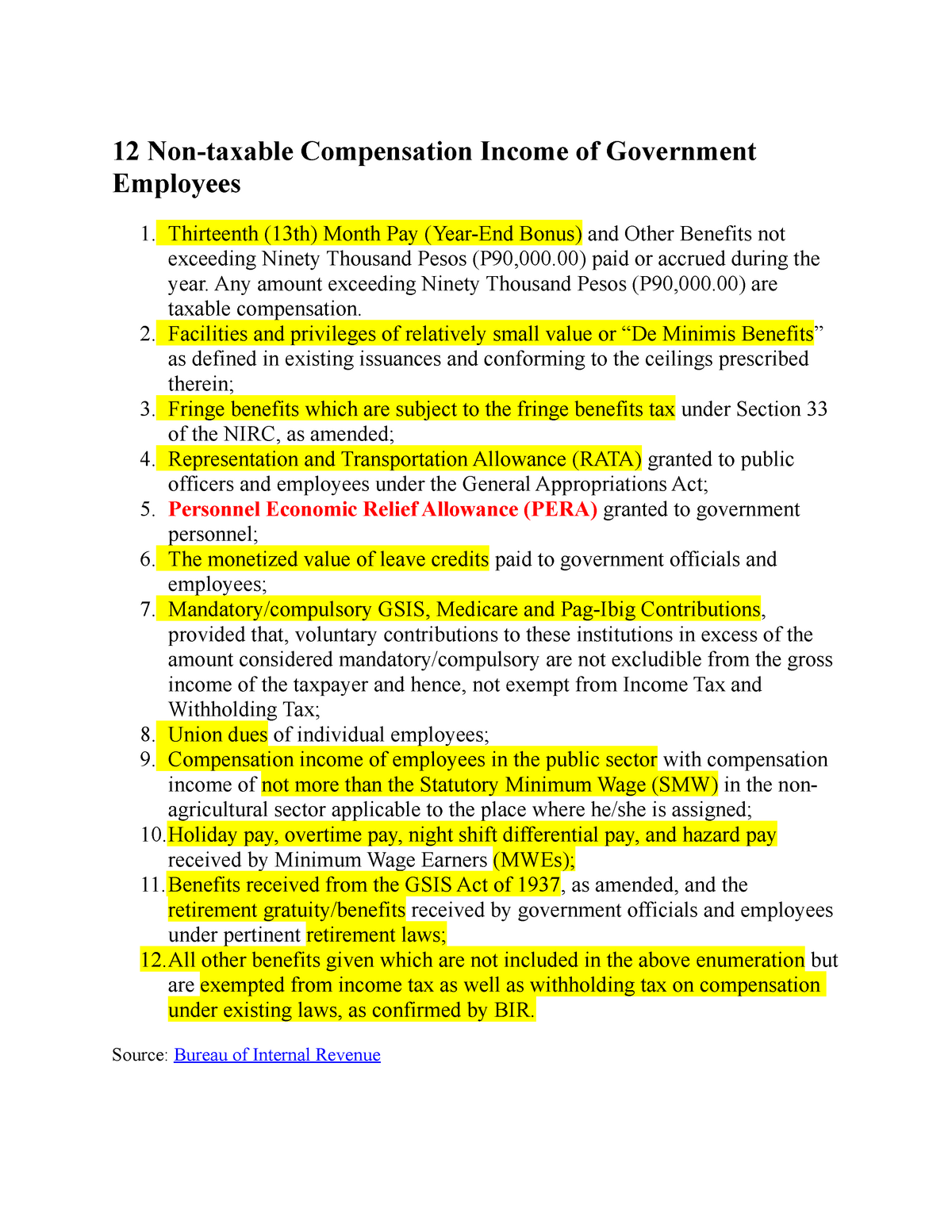

12 Non Taxable Compensation Of Government Employees 12 Non taxable

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8def460a118dbf58656d6da484651792/thumb_1200_1553.png

Nps Contribution By Employee Werohmedia

https://www.jagoinvestor.com/wp-content/uploads/files/Tax-Benefits-of-contributing-in-NPS.png

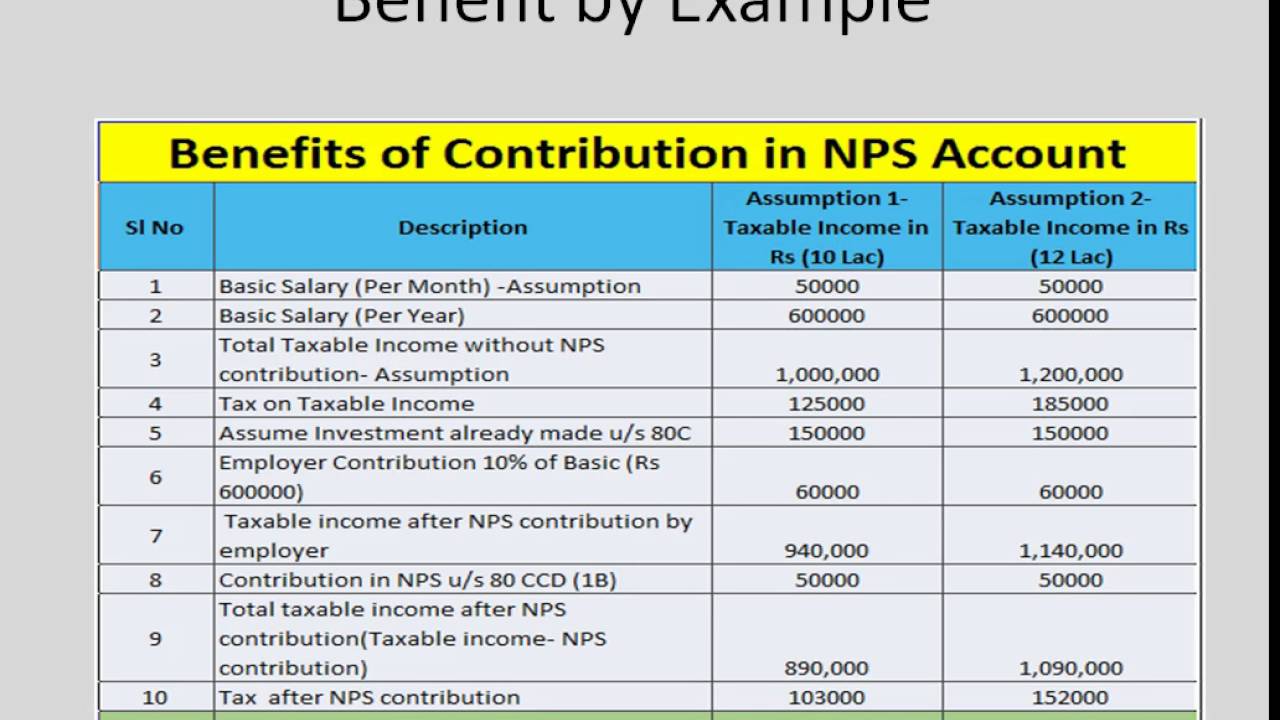

Verkko 21 syysk 2022 nbsp 0183 32 What are NPS tax benefits to employees on self contribution Employees can claim tax deductions upto Rs 1 5 lakh under Section 80CCD 1 for NPS contribution Also they can claim Verkko 18 maalisk 2020 nbsp 0183 32 Tax Benefit on Contribution to NPS 5 Tax Treatment of Employer Contribution In NPS Any payment made by the Employer to employees NPS account is a part of Gross Salary and thereafter the

Verkko 1 helmik 2022 nbsp 0183 32 Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for central government employees and 10 for others Verkko 10 helmik 2016 nbsp 0183 32 Employer s contribution to NPS qualifies for a tax deduction of up

Download Government Contribution In Nps Is Taxable Or Not

More picture related to Government Contribution In Nps Is Taxable Or Not

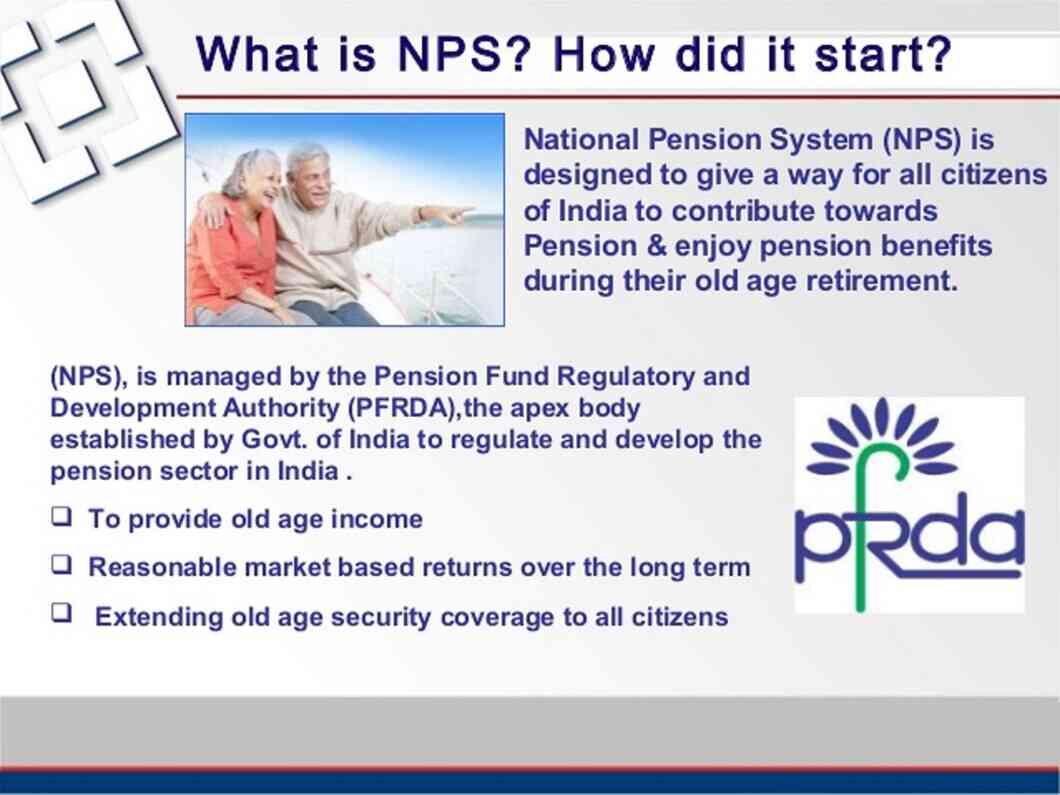

Solved Problem 3 38 LO 1 3 In The Current Year Tanager Chegg

https://media.cheggcdn.com/media/3b5/3b57bfd4-2630-4092-b2a5-816759e03488/phpTYLgrt.png

How To Make Online Contributions To NPS Tier I And Tier II Accounts

https://freefincal.com/wp-content/uploads/2015/12/Online-contribution-NPS.jpg

Required Information The Following Information Applies To The

https://img.homeworklib.com/questions/44fe2c80-109d-11eb-8a97-ed54f8951f2e.png?x-oss-process=image/resize,w_560

Verkko 22 syysk 2022 nbsp 0183 32 NPS Government Contribution While NPS is a voluntary option for private sector employees NPS contribution is mandatory for all central government employees except the armed Verkko 5 tuntia sitten nbsp 0183 32 National Pension Scheme NPS INCOMETAX Budget 2024

Verkko 1 syysk 2020 nbsp 0183 32 Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals Verkko 5 lokak 2022 nbsp 0183 32 How is employer s contribution to NPS treated in income tax

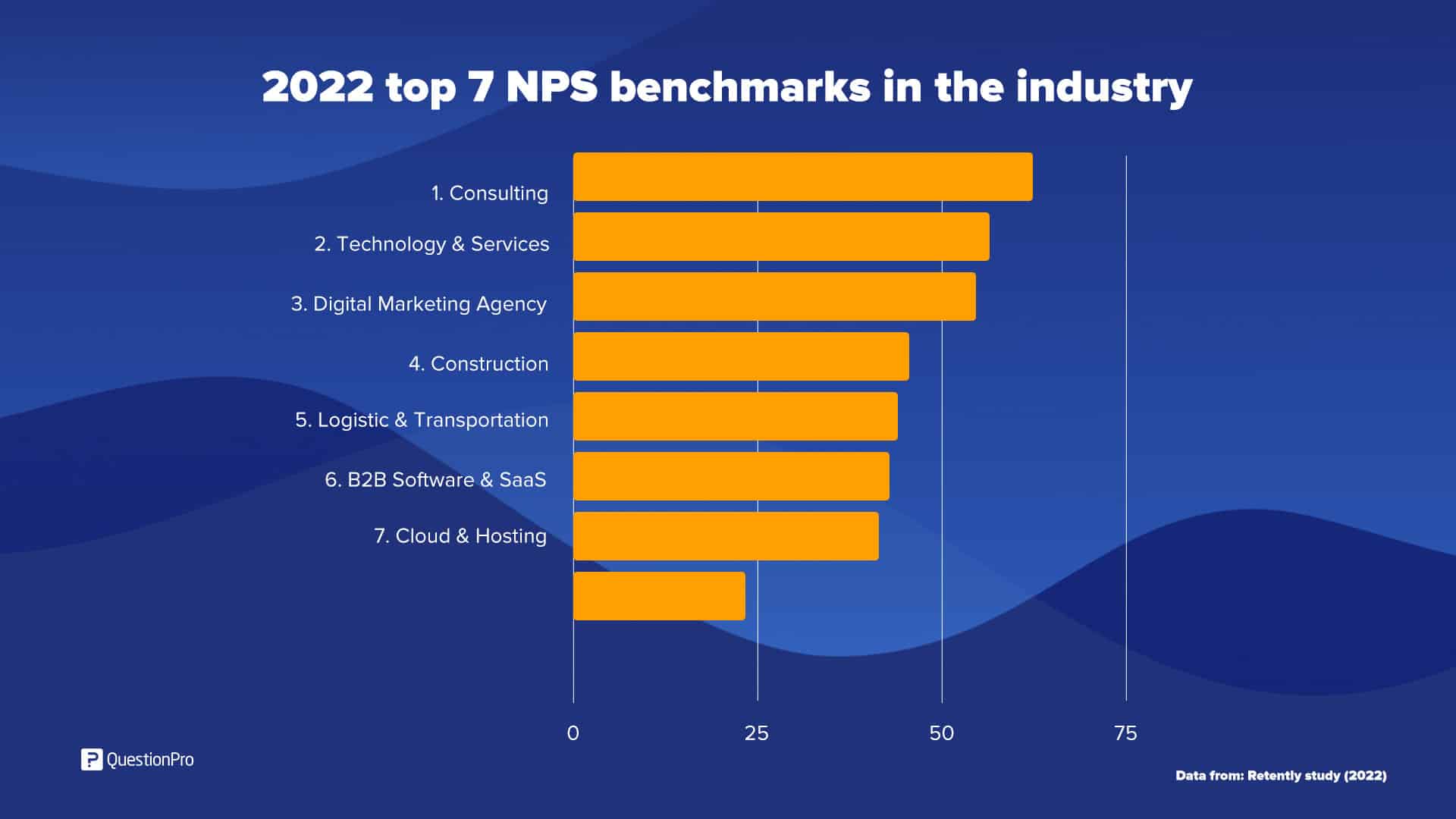

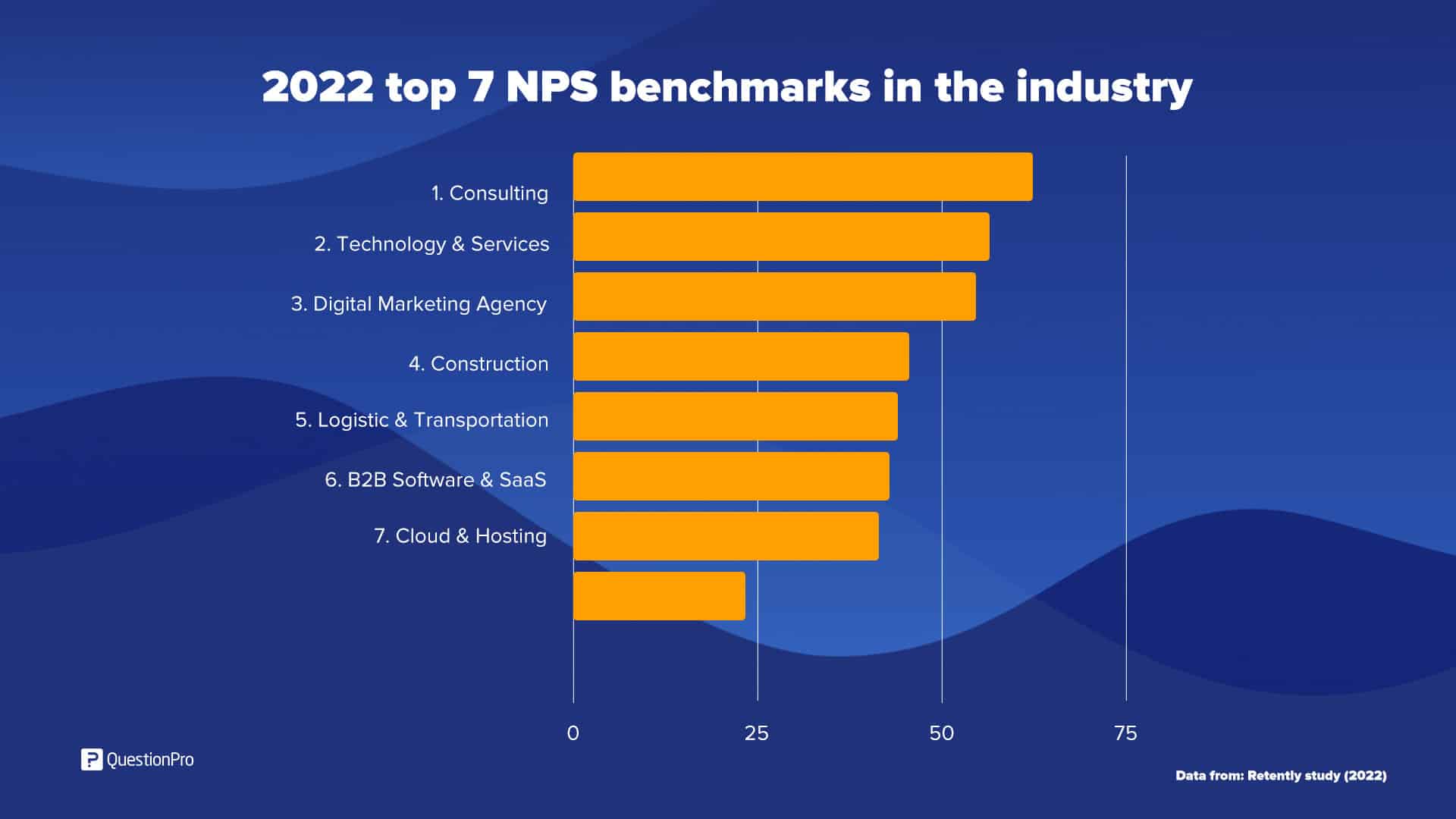

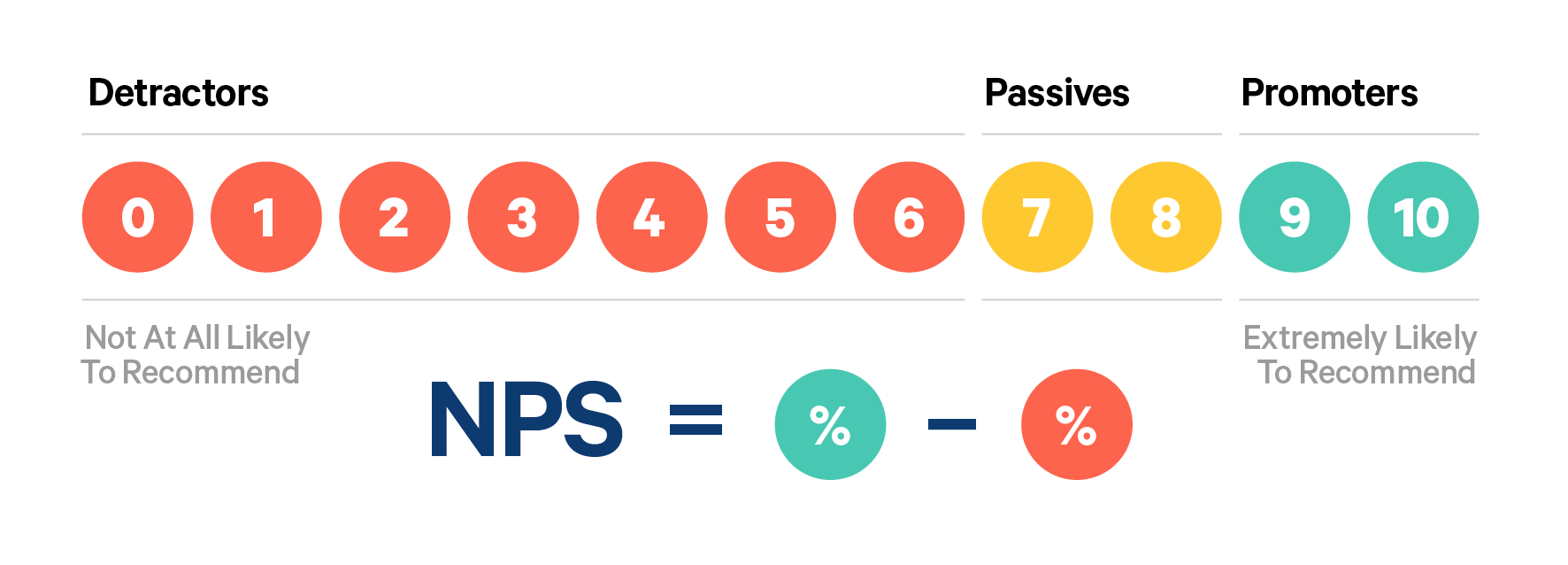

30 NPS Benchmarks For Leading Industries In 2023 QuestionPro

https://www.questionpro.com/blog/wp-content/uploads/2020/07/NPS-Benchmarkign-by-industry-2022-1.jpg

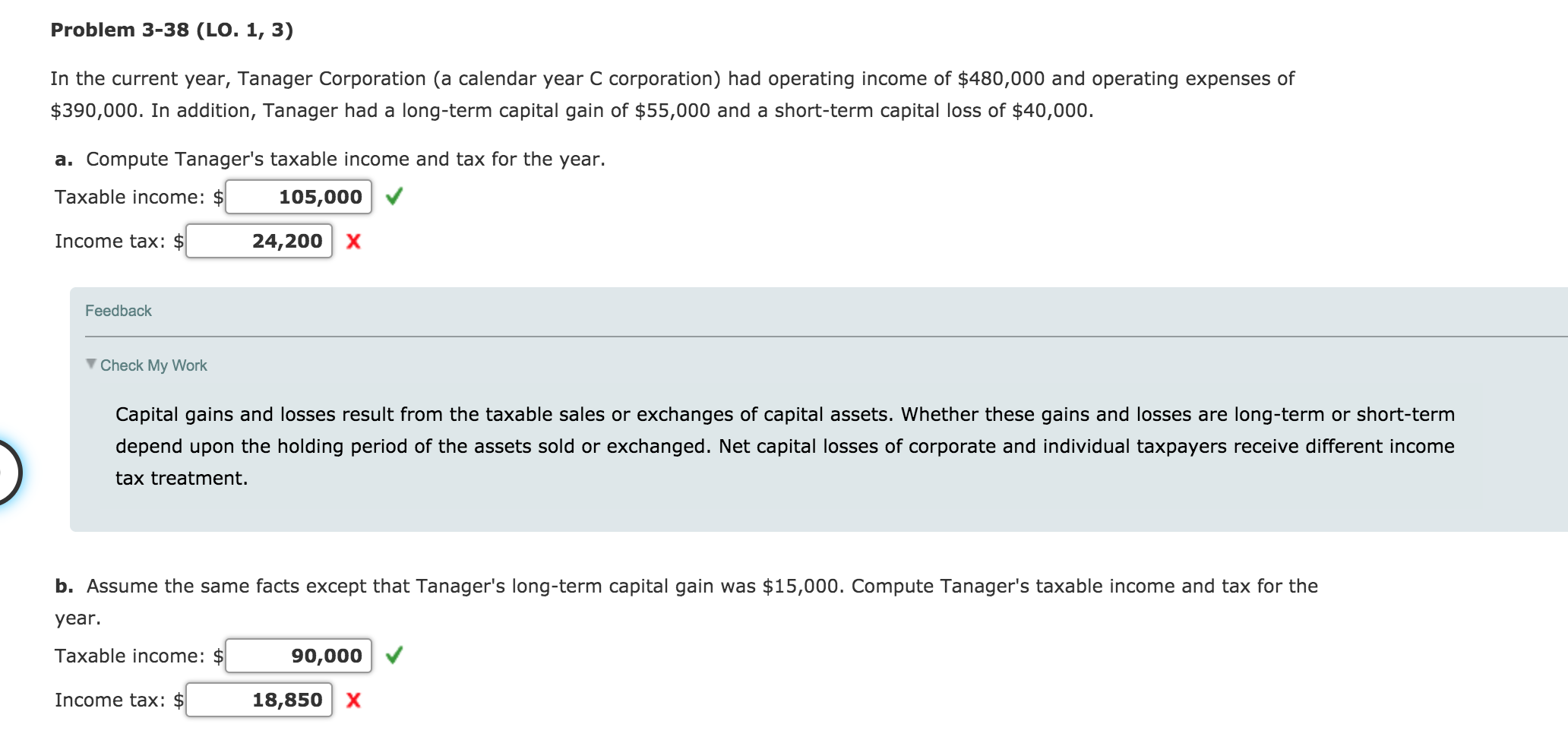

Solved Example 6 5 The Journal Entry To Record The Payroll Chegg

https://media.cheggcdn.com/media/859/8592e85c-c25e-4730-b02c-a5d783d4f5d9/phpviTIyb

https://www.valueresearchonline.com/stories/52395/what-should-i-do...

Verkko 30 maalisk 2023 nbsp 0183 32 The third deduction is in the form of employer s contribution of up

https://cleartax.in/s/taxability-on-nps-employer…

Verkko 25 toukok 2023 nbsp 0183 32 A resounding yes If your employer is contributing to your NPS account you can claim deduction under section 80CCD 2 There is no monetary limit on how much you can claim but it should

What Is Taxable Income Explanation Importance Calculation Bizness

30 NPS Benchmarks For Leading Industries In 2023 QuestionPro

Calculate My Income Tax SuellenGiorgio

Solved Please Note That This Is Based On Philippine Tax System Please

How To Invest In The National Pension Scheme nps 2021 2020 national

NPS Tips To Turn Your Small Monthly Investment Into Over Rs 2 Crores

NPS Tips To Turn Your Small Monthly Investment Into Over Rs 2 Crores

Pin On SHAMEEM

What Is Best Pension Fund For NPS

Your Employer s Contribution To NPS Can Make A Huge Difference

Government Contribution In Nps Is Taxable Or Not - Verkko Yes Investment in NPS is independent of subscription to any other pension fund 6