Government Furnace Rebates 2024 2024 presents an excellent opportunity for you to upgrade to energy efficient furnaces thanks to the array of government and state rebates and incentives By taking advantage of these offers you can contribute to environmental sustainability while also enjoying significant financial savings

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

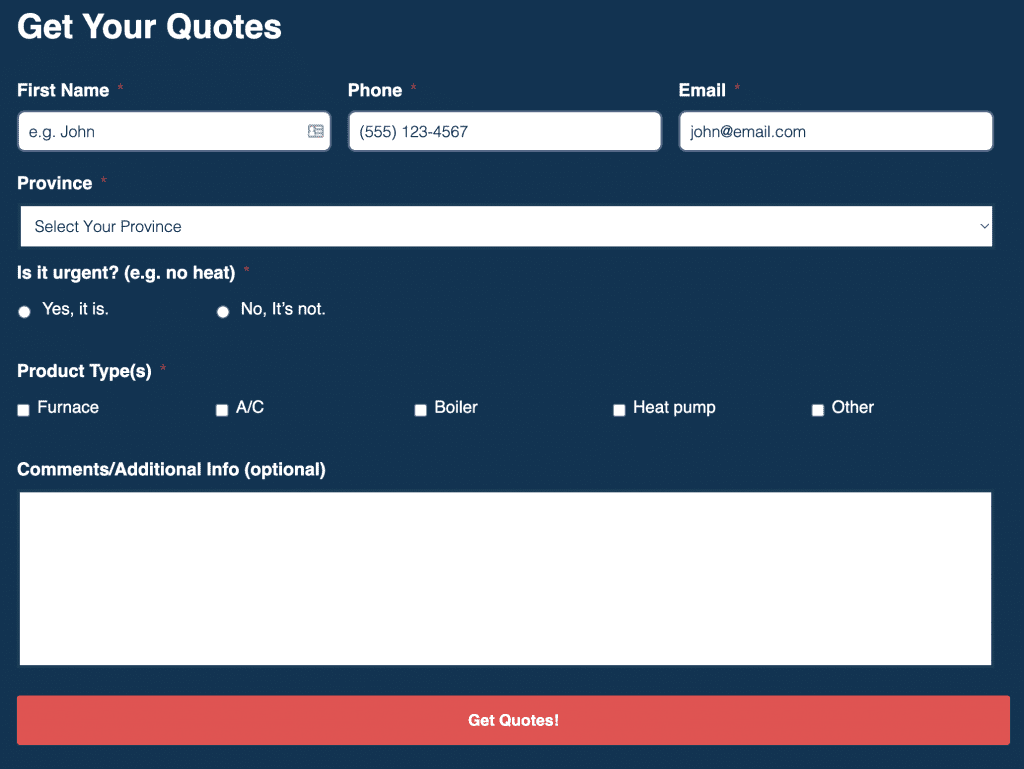

Government Furnace Rebates 2024

Government Furnace Rebates 2024

https://thehvacservice.ca/wp-content/uploads/2023/05/how-to-save-money-with-government-furnace-rebates-in-ontario-2048x711.jpg

How To Save Money With Government Furnace Rebates In Ontario YouTube

https://i.ytimg.com/vi/YMvf-a4-yYo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGEggZShlMA8=&rs=AOn4CLCje6q7hxStF3Xcds6wMfj9if6KVw

Affordable Furnace Installation 2016 Federal And Provincial Government Furnace Rebates

https://blog.antaplumbing.com/wp-content/uploads/2016/05/Furnace-Installation-768x512.jpg

Jan 13 2023 The Inflation Reduction Act also includes a 2 000 federal tax credit for heat pumps which can be taken now Some states and utilities also offer their own rebates An official website of the United States Government English In the case of property placed in service after December 31 2022 and before January 1 2024 22 150 for any qualified natural gas propane or oil furnace or hot water boiler 300 for any item of energy efficient building property

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 The Inflation Reduction Act of 2022 created two programs to encourage home energy retrofits Home Efficiency Rebates HOMES to fund whole house energy efficiency retrofits and the Home Electrification and Appliance Rebates HEEHRA to help low moderate income households go electric through qualified appliance rebates

Download Government Furnace Rebates 2024

More picture related to Government Furnace Rebates 2024

New Furnace Rebates 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/04/Government-Rebate-for-Furnaces-2022-1024x769.png

Budget 2022 GST Will Go Up To 8 Next Year Then 9 From 2024 Extra S 640 Million To Cushion

https://onecms-res.cloudinary.com/image/upload/s--bQEl11z1--/f_auto,q_auto/v1/mediacorp/cna/image/2022/02/18/20220217-gst-assurance-cash-payouts.png?itok=kk9CRjh1

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Check focusonenergy for current rebate amounts IR 2023 97 May 4 2023 The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project INFLATION REDUCTION ACT HOME ENERGY REBATES Home Efficiency Rebates Program Sec 50121 Home Electrification and Appliance Rebates Program Sec 50122 PROGRAM REQUIREMENTS APPLICATION INSTRUCTIONS Applications Due by January 31 2025 VERSION 1 1

Furnace Air Conditioner Rebates Ontario AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/furnace-air-conditioner-rebates-ontario-scaled.jpg?w=2100&ssl=1

All Rebate Forms Available 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

https://www.furnacepriceguides.com/rebates-and-incentives/

2024 presents an excellent opportunity for you to upgrade to energy efficient furnaces thanks to the array of government and state rebates and incentives By taking advantage of these offers you can contribute to environmental sustainability while also enjoying significant financial savings

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Furnace Rebates 2019 Coastal Energy

Furnace Air Conditioner Rebates Ontario AirRebate

How To Claim FortisBC s Furnace Rebates Murray s Solutions

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

Furnace Installation In Canada Your Easy Step by Step Guide For 2023

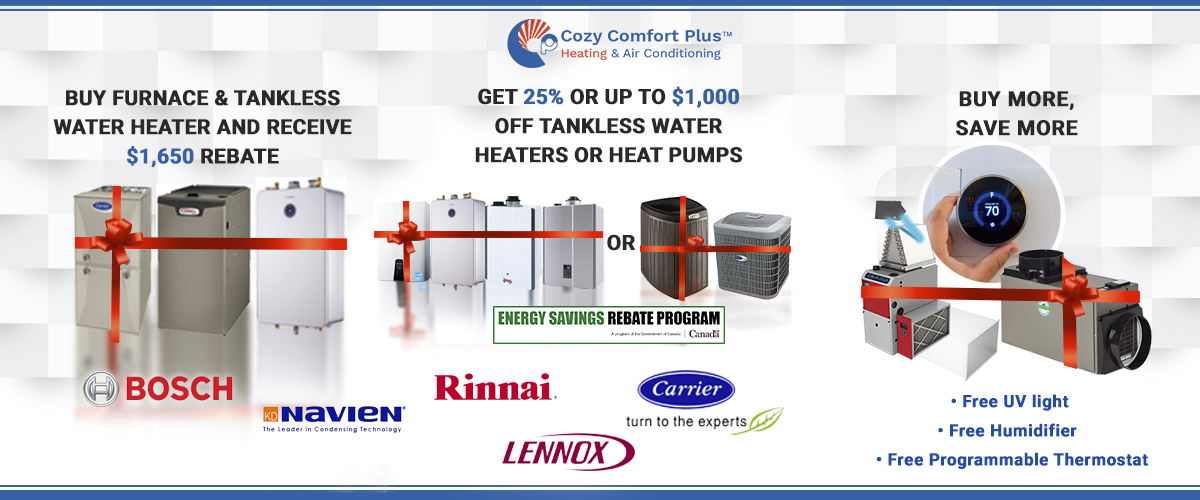

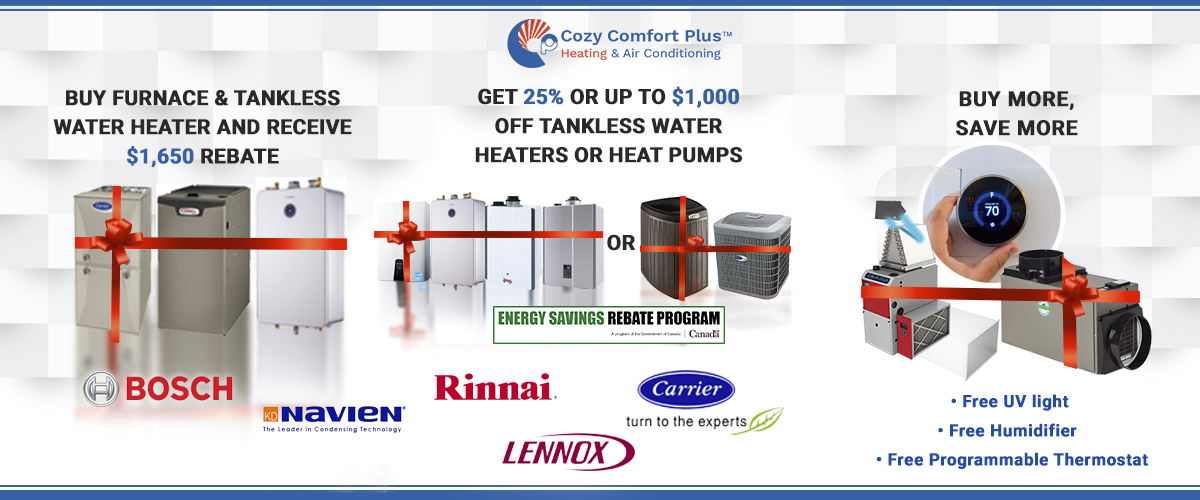

Ontario Government Energy Rebates Tankless Water Heater Heat Pump Furnace

Ontario Government Energy Rebates Tankless Water Heater Heat Pump Furnace

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Mass Save Rebates For 2023 N E T R Inc

Canadian Government Home Renovation Grants Rebates Show Me The Green

Government Furnace Rebates 2024 - The Inflation Reduction Act of 2022 created two programs to encourage home energy retrofits Home Efficiency Rebates HOMES to fund whole house energy efficiency retrofits and the Home Electrification and Appliance Rebates HEEHRA to help low moderate income households go electric through qualified appliance rebates