Gst Input Tax Credit Time Limit Fy 2022 23 Web 6 Okt 2022 nbsp 0183 32 Maximum time limit for availing ITC in respect of invoice pertaining to Financial Year 2021 22 is earlier of 1 30th November following the end of the relevant financial year i e 30th November 2022 or 2

Web 17 Nov 2023 nbsp 0183 32 With the approaching deadline of November 30 2023 for the 2022 23 financial year taxpayers must ensure adherence to GST regulations concerning Input Web 28 Sept 2022 nbsp 0183 32 CBIC has extended the time limit for claiming ITC including for FY 21 22 issuing CDN and doing amendments to returns of the previous year till 30th November

Gst Input Tax Credit Time Limit Fy 2022 23

Gst Input Tax Credit Time Limit Fy 2022 23

https://www.taxmann.com/post/wp-content/uploads/2021/08/Know-about-GST-Input-Tax-Credit-_Blog_Aug21.jpg

All About Input Tax Credit Under GST

https://www.caclubindia.com/editor_upload/2231891_20211125160155_infographic_21.png

Ready Reckoner On Input Tax Credit Under GST Taxmann

https://www.taxmann.com/post/wp-content/uploads/2021/07/Screenshot-2022-05-23-132914-e1653293146602.png

Web 17 Juli 2023 nbsp 0183 32 Circular No 193 05 2023 GST from the Central Board of Indirect Taxes amp Customs CBIC provides clarification on the availing of Input Tax Credit ITC in GSTR Web 9 Feb 2023 nbsp 0183 32 For instance XY Corp a buyer with a purchase invoice dated 8th December 2021 FY 2021 22 wants to claim GST paid on that purchase As per the criteria laid

Web 1st February 2022 Budget 2022 updates 1 ITC cannot be claimed if it is restricted in GSTR 2B available under Section 38 2 Time limit to claim ITC on invoices or debit notes of a financial year is revised to earlier of two Web Input tax is not allowed for goods and services for personal use No input tax credit shall be allowed after GST return has been filed for September following the end of the financial year to which such invoice pertains or

Download Gst Input Tax Credit Time Limit Fy 2022 23

More picture related to Gst Input Tax Credit Time Limit Fy 2022 23

GST Input Tax Credit Definitions And Conditions For Claiming GST ITC

https://www.taxmann.com/post/wp-content/uploads/2021/10/BlogBanner_Pushpinder1.jpg

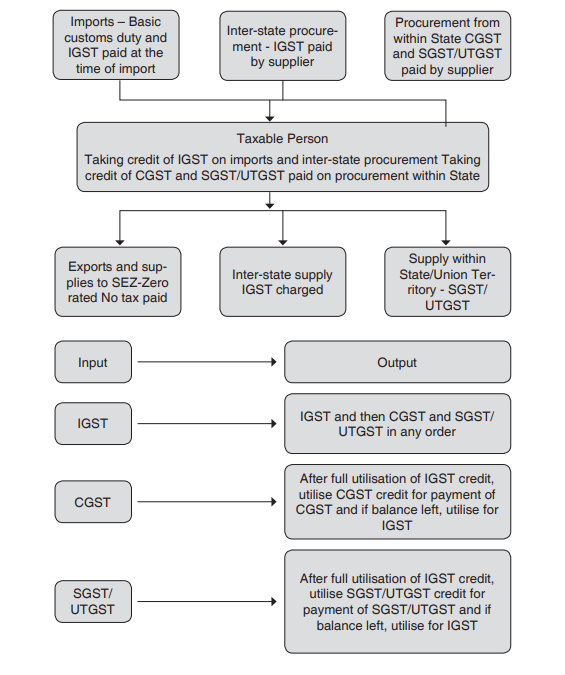

Input Tax Credit Under GST Input Tax Credit Under SGST IGST CGST

https://s3.amazonaws.com/cleartax-media/s/img/20161010141329/Taxes_under_GST.png

Point wise Guide For GST Input Tax Credit With FAQs

https://www.taxmann.com/post/wp-content/uploads/2022/08/09_Blog-Post-1.jpg

Web CGST Act provides for eligibility and conditions for availing Input Tax Credit ITC During the initial period of implementation of GST during the financial years 2017 18 and 2018 Web 15 Feb 2022 nbsp 0183 32 2 Extension in time limit to avail input tax credit u s 16 4 Section 16 4 of the CGST Act 2017 provides for the time limit to avail ITC of GST charged on the

Web 16 Nov 2022 nbsp 0183 32 The Central Board of Indirect Taxes and Customs CBIC furnishes the notification to permit Input Tax Credit ITC claims and revisions of invoices till 30th November 2022 From the former week a Web 31 Jan 2021 nbsp 0183 32 1 Every registered person shall subject to such conditions and restrictions as may be prescribed be entitled to take the credit of eligible input tax as

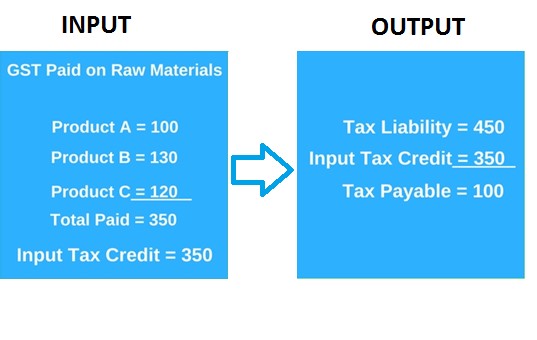

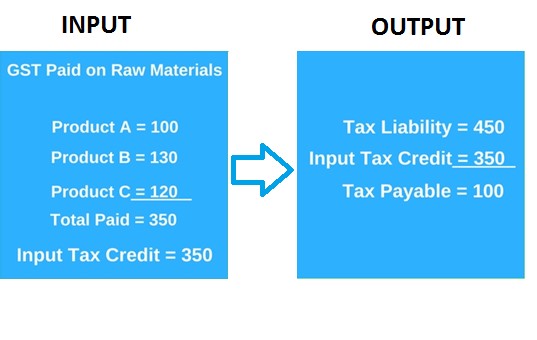

Input Tax Credit ITC In GST Meaning How To Claim It And Examples

https://www.tickertape.in/blog/wp-content/uploads/2022/02/TT-23-Feb-22-Input-Tax-Credit-BB.jpg

Input Tax Credit Under GST All You Want To Know

https://taxguru.in/wp-content/uploads/2020/03/CLAIM-INPUT-TAX-CREDIT.jpg

https://taxguru.in/goods-and-service-tax/maxi…

Web 6 Okt 2022 nbsp 0183 32 Maximum time limit for availing ITC in respect of invoice pertaining to Financial Year 2021 22 is earlier of 1 30th November following the end of the relevant financial year i e 30th November 2022 or 2

https://blog.saginfotech.com/claim-gst-itc-reversal

Web 17 Nov 2023 nbsp 0183 32 With the approaching deadline of November 30 2023 for the 2022 23 financial year taxpayers must ensure adherence to GST regulations concerning Input

Input Tax Credit Under GST Input Tax Credit Under SGST IGST CGST

Input Tax Credit ITC In GST Meaning How To Claim It And Examples

GST Input Tax Credit Eligibility Time Limit And Ineligible Items

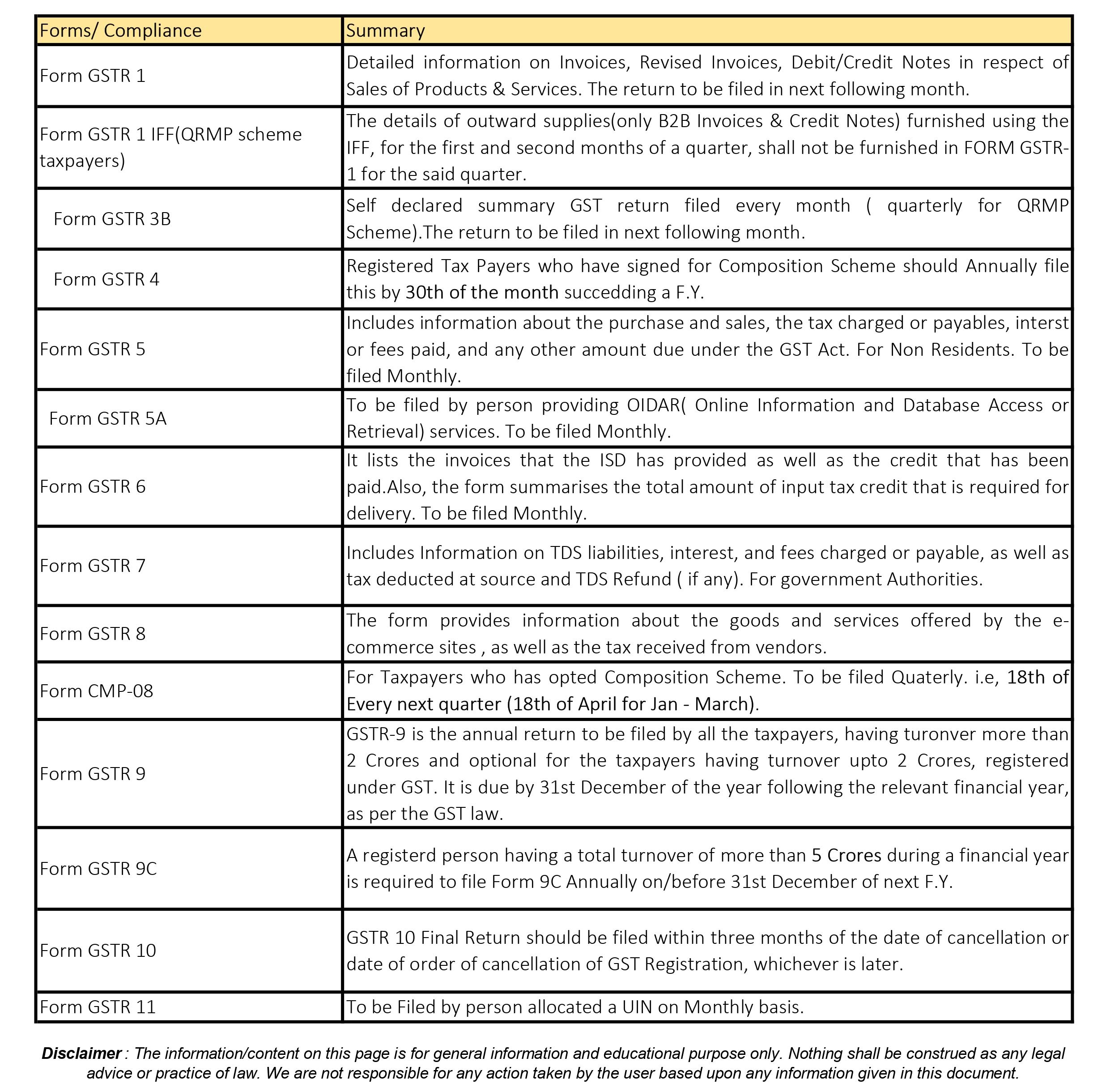

GST COMPLIANCE CALENDAR FOR THE FY 2022 23 CA Rajput Jain

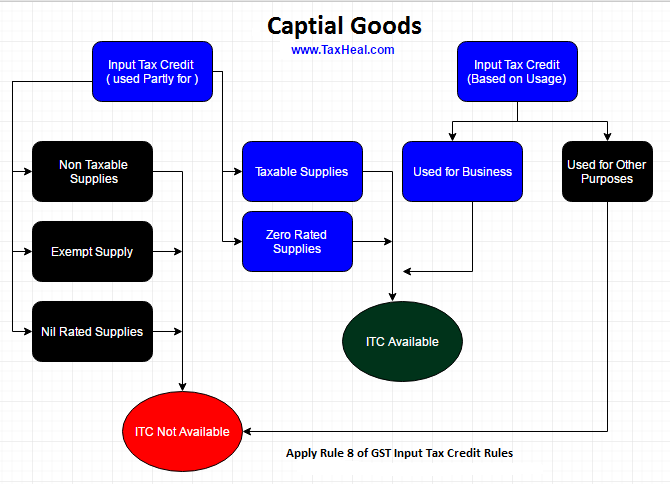

TaxHeal GST And Income Tax Complete Guide Portal

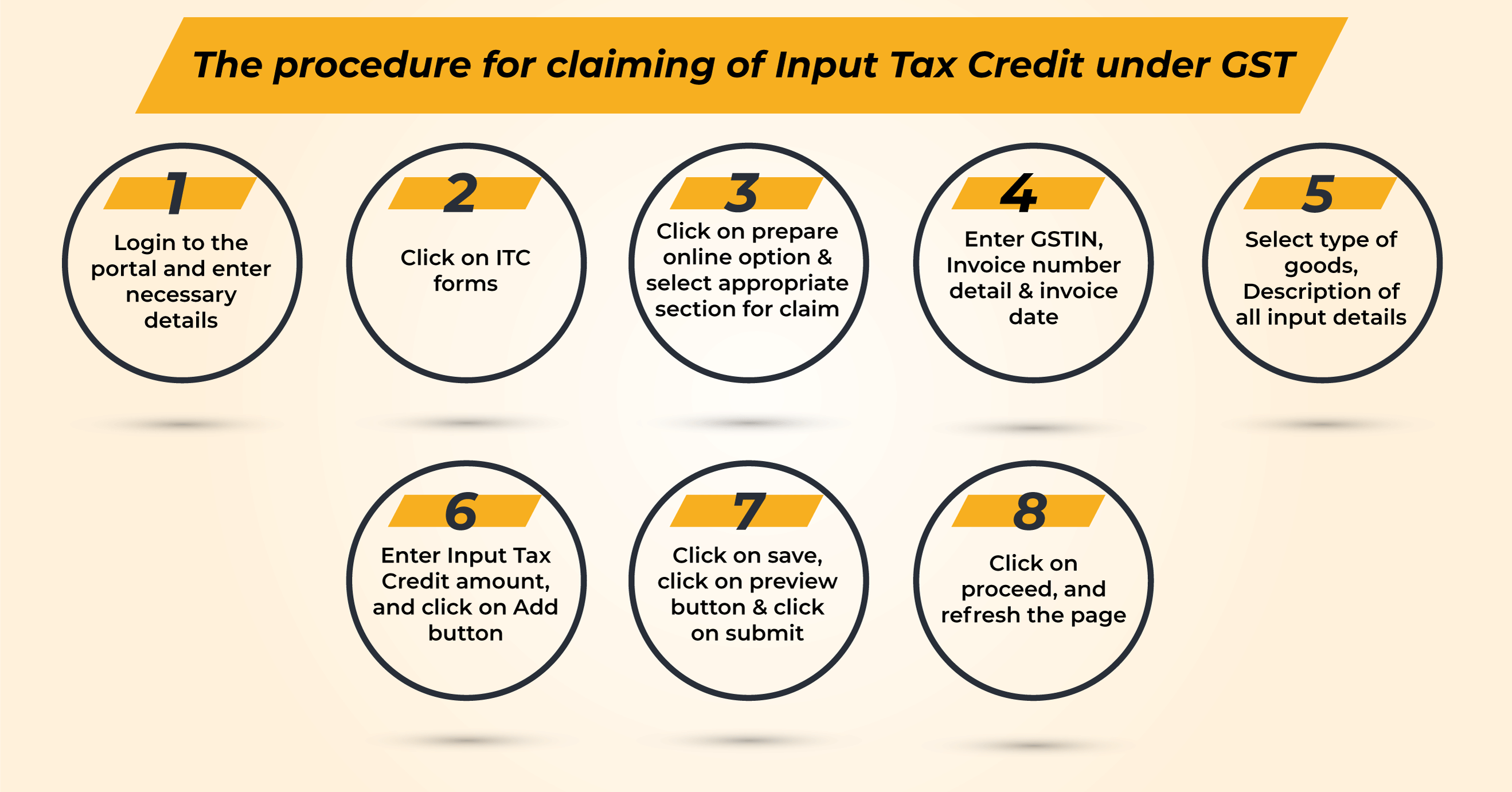

GST And How To Avail Input Tax Credit In India

GST And How To Avail Input Tax Credit In India

What Is Input Credit ITC Under GST

Guide To Maximizing The Utilization Of GST Input Tax Credit

Input Tax Credit Provision And Rules Under GST TaxGuru

Gst Input Tax Credit Time Limit Fy 2022 23 - Web 22 Nov 2023 nbsp 0183 32 In order to comply with the fiscal year 2022 2023 deadline and maintain compliance with GST requirements pertaining to Input Tax Credit ITC taxpayers had