Gst Rate On Hotel Services Verkko Taking booking from online portals It has become very common for hotels to get their clients from online portals like Goibibo and MakeMyTrip If the turnover of hotelier is

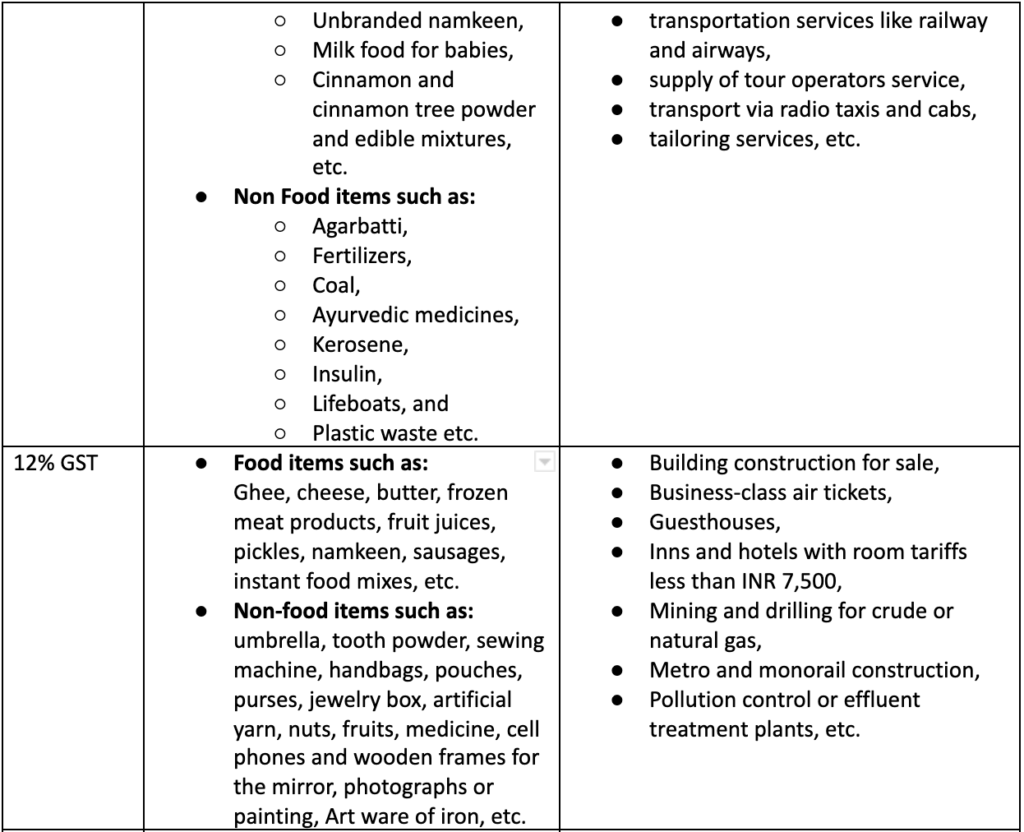

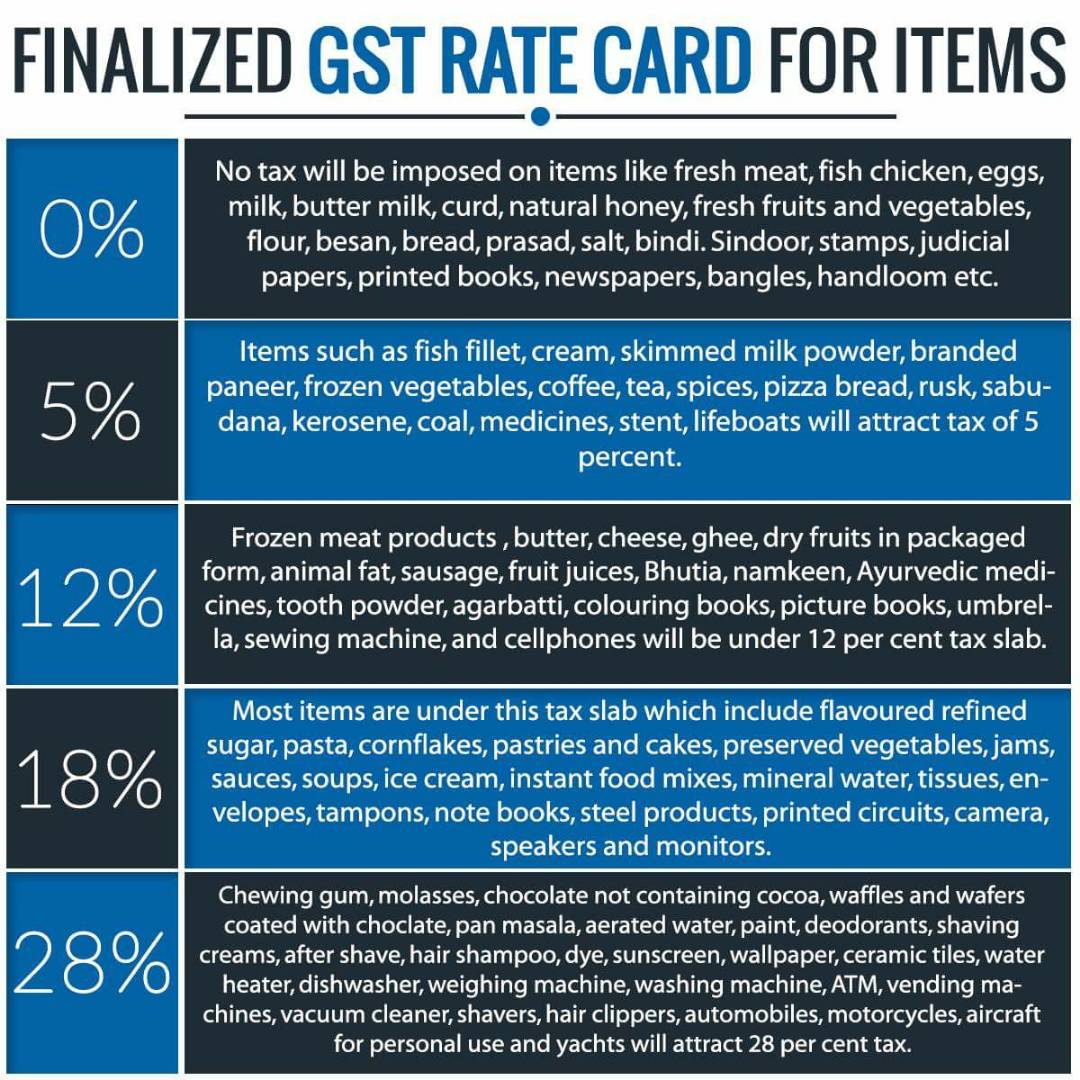

Verkko 29 jouluk 2022 nbsp 0183 32 GST Rate for Hotels The GST rate applicable for hotels inns guest houses clubs campsites or other places for temporary stay would depend on the type of facility star rating and Verkko 5 toukok 2023 nbsp 0183 32 G S T Rates in the Hotel and Tourism Industry W E F July 18 2022 Hotel accommodations are subject to G S T at 12 for room rent up to 7 500 per day

Gst Rate On Hotel Services

Gst Rate On Hotel Services

https://discuss.erpnext.com/uploads/default/original/3X/6/9/69d8ba4fc31fa1cb47fac890745c514908682a35.jpg

GST On Hotels And Restaurants Services

http://howtoexportimport.com/UserFiles/Windows-Live-Writer/GST-on-Hotels-and-restaurants-services_13F32/GST on hotels and restaurants_2.jpg

GST Rate Restaurant Service Canteen Composition Scheme Meteorio

https://i.pinimg.com/564x/82/40/1a/82401a10990745d50df192113b508a4c.jpg

Verkko 5 lokak 2023 nbsp 0183 32 The GST rate on hotel accommodation services is kept at 18 although it can be 12 as per the room tariff in the hotel TCS Provisions on E Commerce Operators is not included in the above Verkko 28 maalisk 2023 nbsp 0183 32 Accommodation services 18 12 Restaurant services 18 5 w o ITC Liquor Sale No GST Section 17 of the CGST Act restricts the input tax credit on goods or services or both to

Verkko Tax on Room Tariff exceeding Rs 1 000 Service tax 15 with an abatement of 40 the effective rate was 9 VAT 12 to 14 5 Luxury tax 4 to 12 depending on the state Hotels also levied a service Verkko 2 huhtik 2022 nbsp 0183 32 All about GST on Hotels GST rates with effect from 1st October 2019 are as follows Rooms in hotels with a daily rate of less than INR 1000 Rooms in hotels with a daily rate of less than INR

Download Gst Rate On Hotel Services

More picture related to Gst Rate On Hotel Services

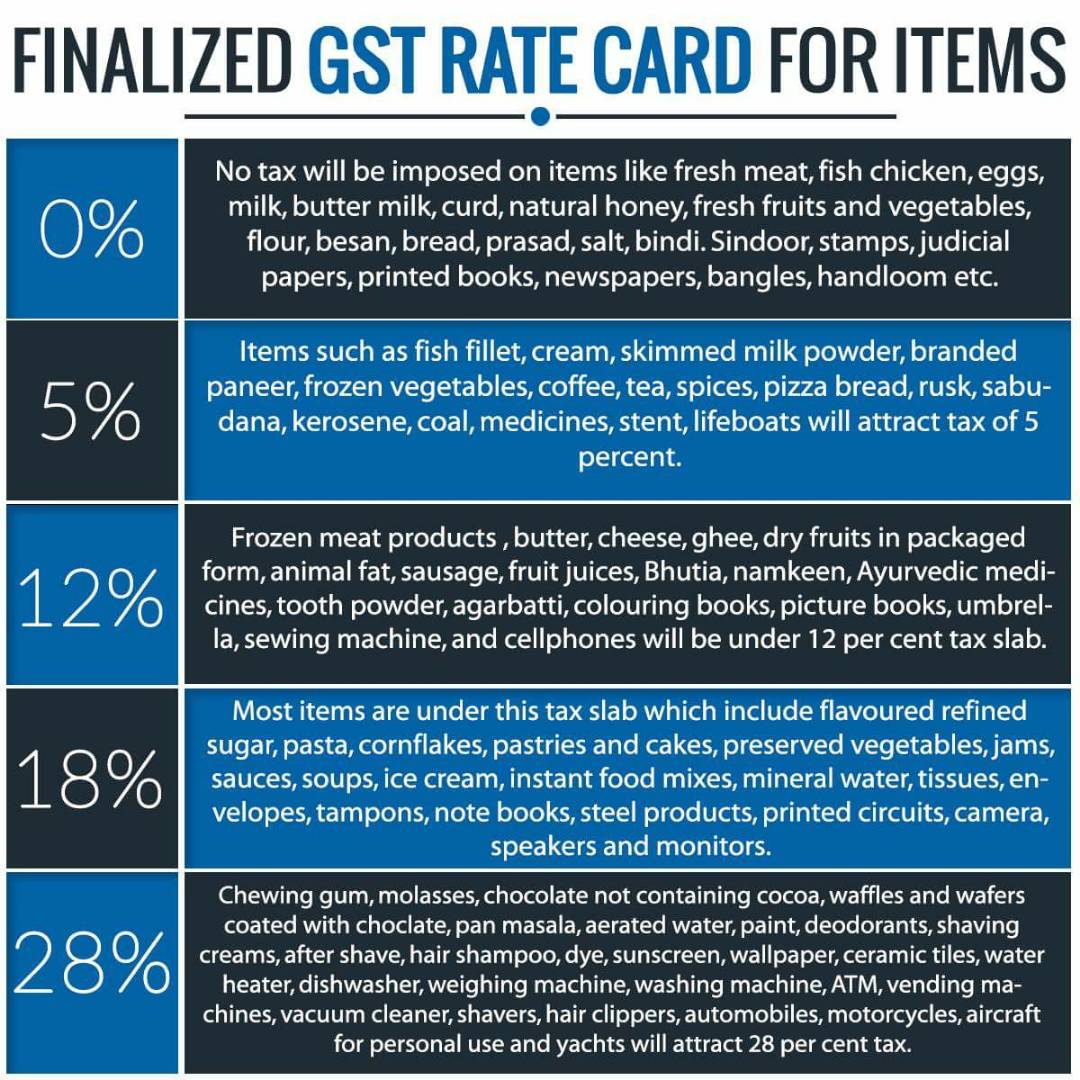

GST Rates In 2023 List Of Goods Service Tax Rates Slabs

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2021/07/Screenshot-2021-07-26-at-2.17.31-PM-1024x832.png

A Complete Guide On GST Rate On Food Items Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/01/gst-on-food.png

Complete List Of GST Rates MyBillBook

https://mybillbook.in/blog/wp-content/uploads/2021/05/gst-rates-1024x576.png

Verkko 21 hein 228 k 2022 nbsp 0183 32 GST on Hotel amp Tourism Industry Budget Holidays will become expensive by 12 from 18th July 2022 Supplying accommodation in hotels is Verkko 11 toukok 2020 nbsp 0183 32 The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 The Act came into effect on 1st July 2017 Goods amp Services Tax Law in

Verkko 10 toukok 2021 nbsp 0183 32 Talking about the restaurants there was a 60 abatement Meaning the service tax was charged at an effective rate of 6 on the F amp B bills And this is Verkko 15 kes 228 k 2018 nbsp 0183 32 As per rules GST rate for restaurants in hotel premises having room tariff of less than 7 500 a day will attract GST of 5 per cent without input tax credit

Gst Tax Rate Chart For Fy Ay Goods And Service Hot Sex Picture

https://taxdose.b-cdn.net/wp-content/uploads/2016/09/GST-Easy-Chart.jpg

GST Advantages And Disadvantages Of GST Explained Kikali in

https://kikali.in/wp-content/uploads/2018/01/GST.jpg

https://taxadda.com/gst-on-hotels

Verkko Taking booking from online portals It has become very common for hotels to get their clients from online portals like Goibibo and MakeMyTrip If the turnover of hotelier is

https://www.indiafilings.com/learn/gst-rate-ho…

Verkko 29 jouluk 2022 nbsp 0183 32 GST Rate for Hotels The GST rate applicable for hotels inns guest houses clubs campsites or other places for temporary stay would depend on the type of facility star rating and

GST Revised Rates Come Into Effect From Today Here s What Gets

Gst Tax Rate Chart For Fy Ay Goods And Service Hot Sex Picture

5 GST Rate Items HSN Code For Goods Updated 2023 AUBSP

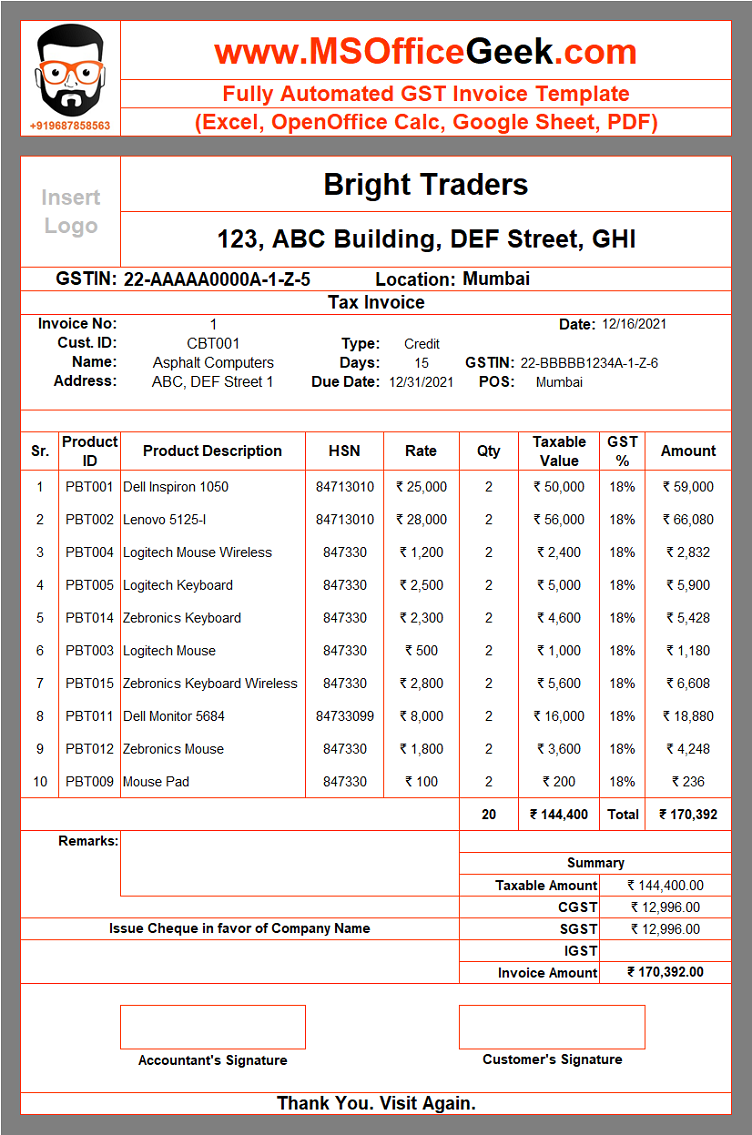

Ready to use Fully Automated GST Invoice Template MSOfficeGeek

Rate Of GST On Hotel Rooms Based On Actual Room Rent W e f 27 07

Everything You Need To Know On GST On Hotels And Restaurants

Everything You Need To Know On GST On Hotels And Restaurants

Changes In GST Rates To Be Applicable From 18 July Mint

Gst On Hotels And Restaurant Industry CA Rajput JAIN

SERVICE WISE GST RATE CHART ON ALL SERVICES SIMPLE TAX INDIA

Gst Rate On Hotel Services - Verkko HSN Code Services ACCOMMODATION SERVICES GST RATES amp SAC CODE 9963 Accommodation Services Origin Chapter Chapter 99 Disclaimer Rates given above