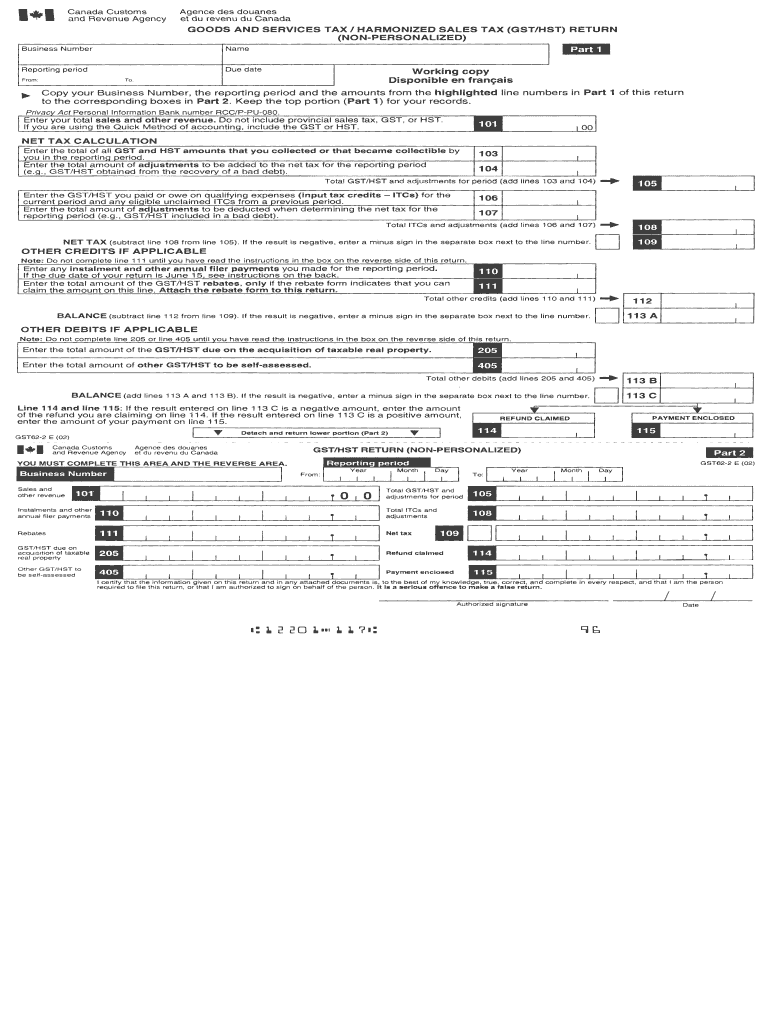

Gst Return Form Cra The following is a list of GST HST related forms and publications Guides Returns Election and application forms available to all businesses or individuals Election and application forms for public service and public sector bodies Election and application forms for corporations and financial institutions

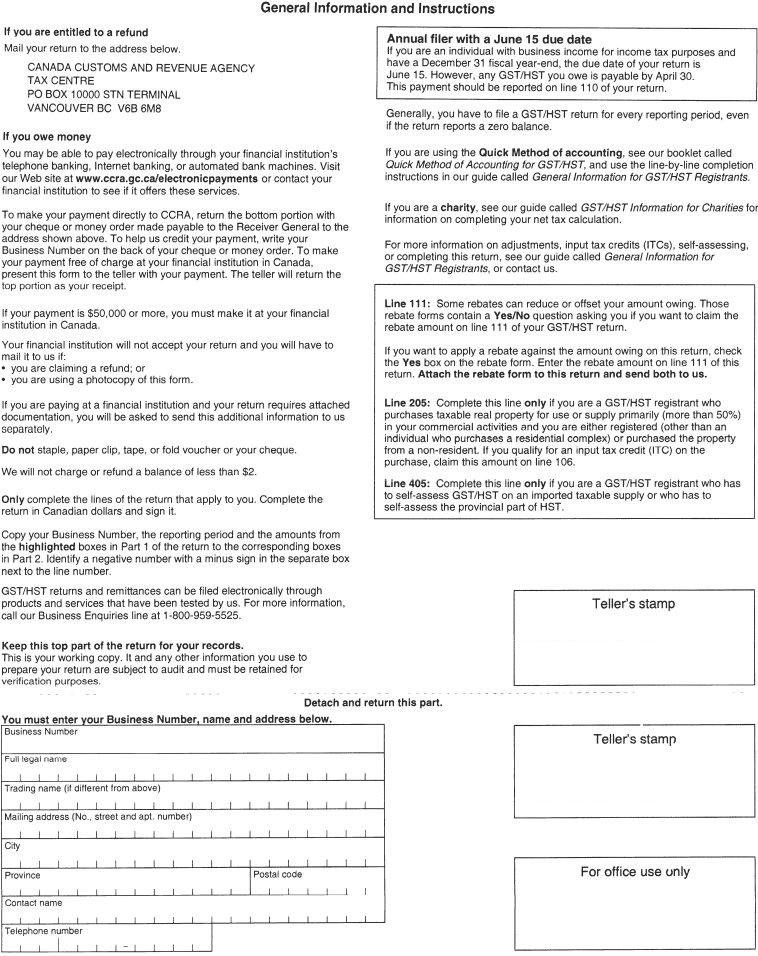

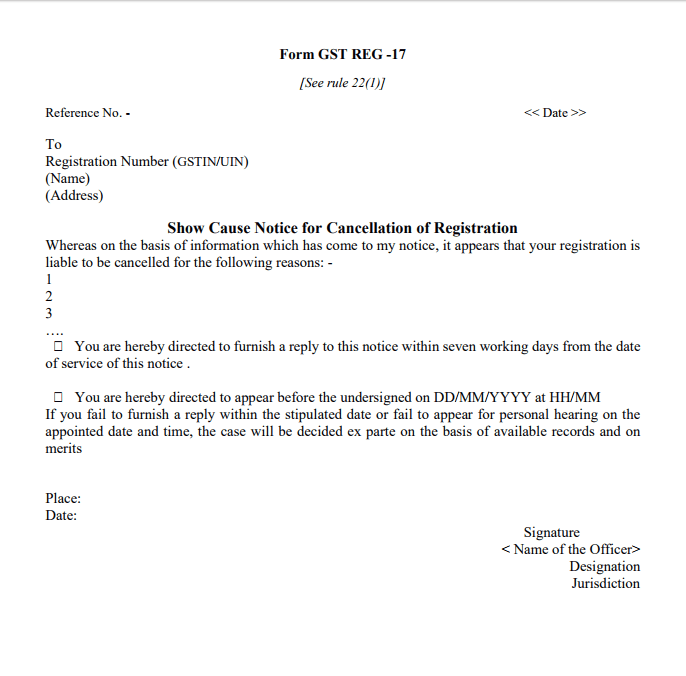

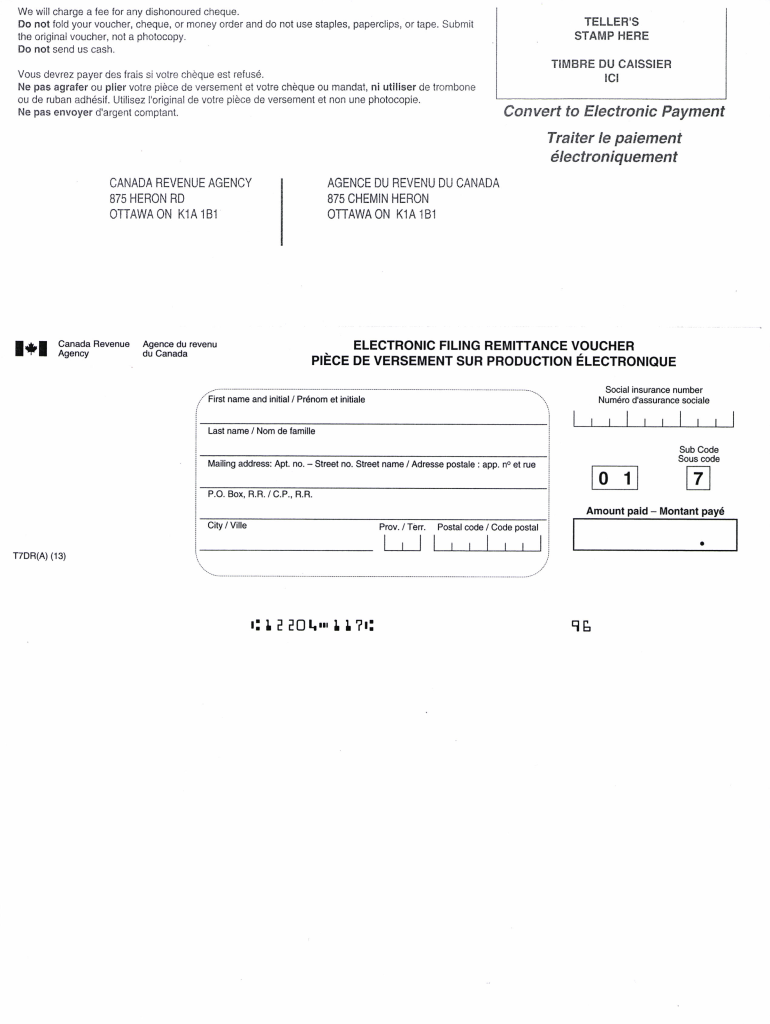

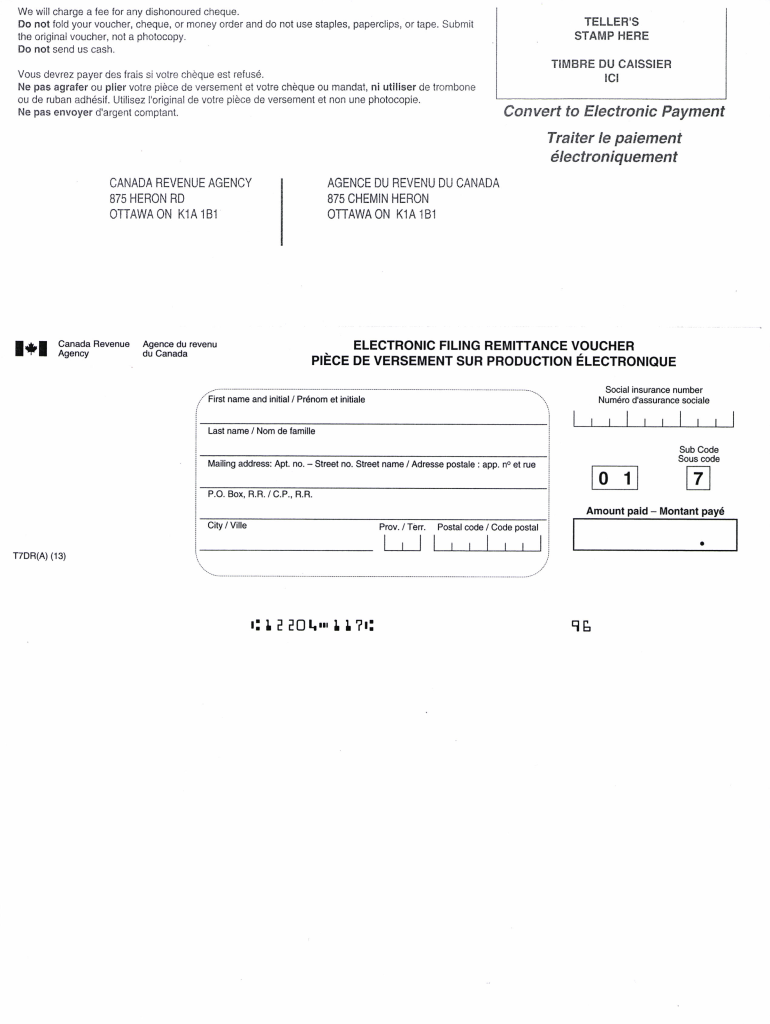

Canada ca Taxes GST HST for businesses Instructions for completing a GST HST Return We offer a printer friendly working copy to assist you in calculating your net tax and completing your GST HST return On this page Enter your personal business information Enter your total sales and other revenues If you electronically filed your last GST HST return the CRA will mail you an electronic filing information sheet Form GST34 3 Goods and Services Tax Harmonized Sales Tax Return for Registrants If you didn t file electronically the CRA will mail you a personalized four page return Form GST34 2

Gst Return Form Cra

Gst Return Form Cra

https://www.pdffiller.com/preview/100/37/100037070/large.png

Blank Hst Remittance Form Printable

https://artistproducerresource.ca/tiki-download_file.php?fileId=68&display

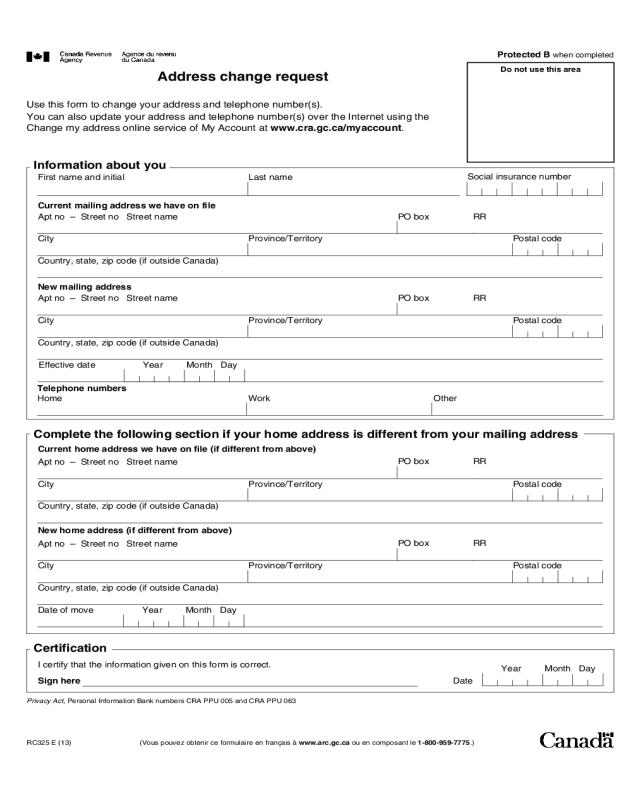

2024 CRA Change Of Address Form Fillable Printable PDF Forms

https://handypdf.com/resources/formfile/images/10000/sample-cra-change-of-address-form-page1.png

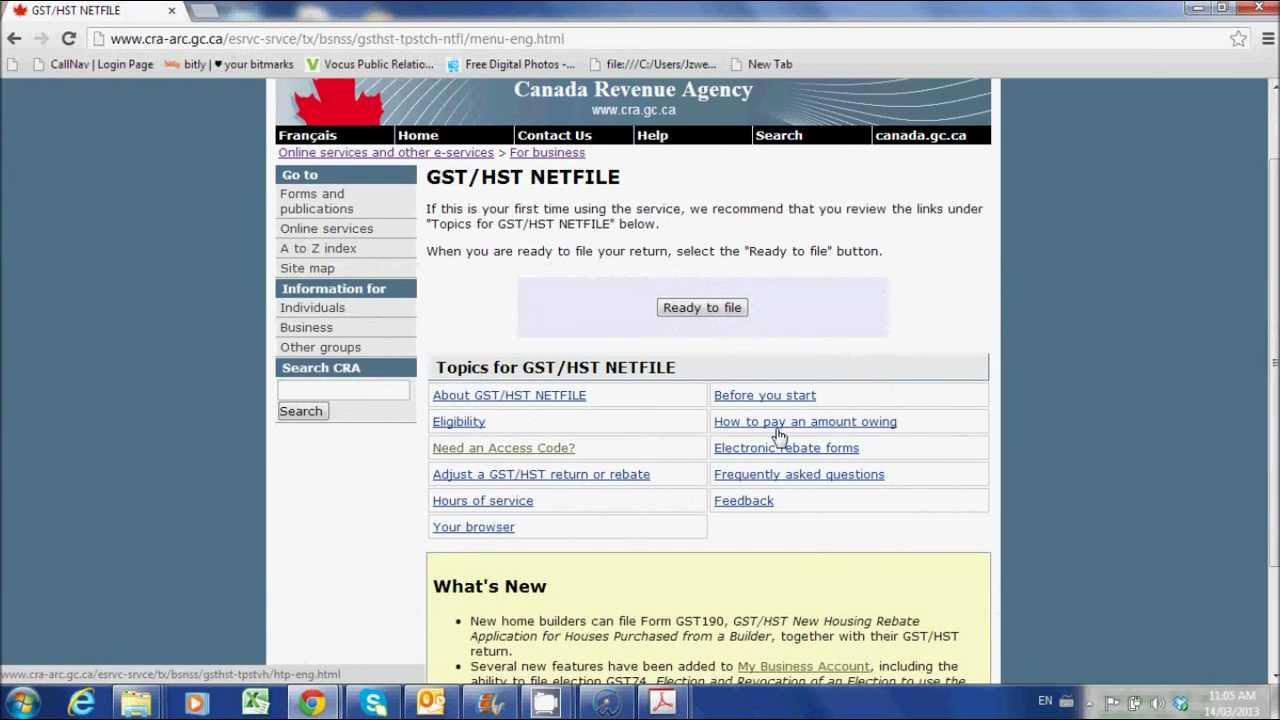

In this video tutorial I show you exactly how to file your GST HST return online to the CRA and pay it It s actually a super simple process but can be i How to complete a GST HST return Canada Revenue Agency This webinar is about goods and services tax harmonized sales tax GST HST returns It provides employers with step by step instructions on how to claim input tax credits calculate the net tax and complete the return Provided by publisher Permanent link to

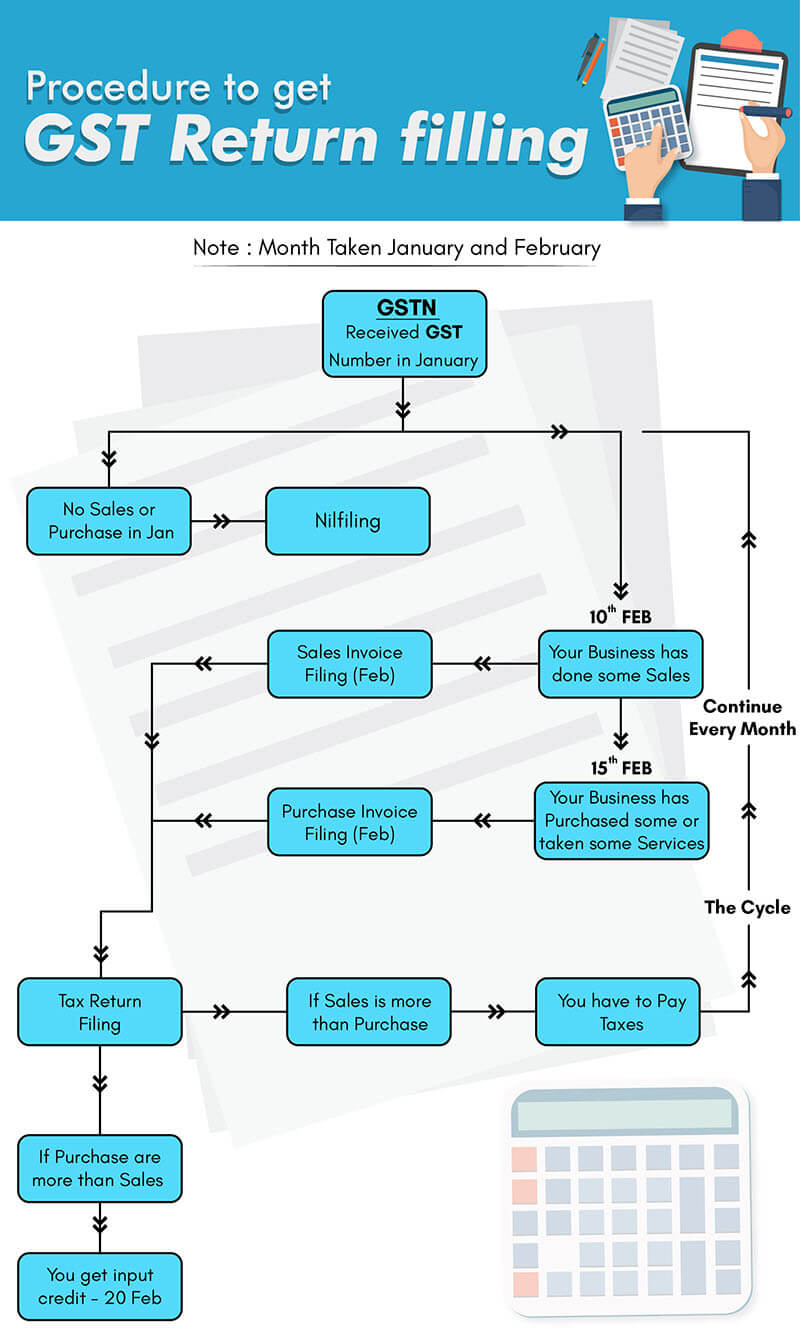

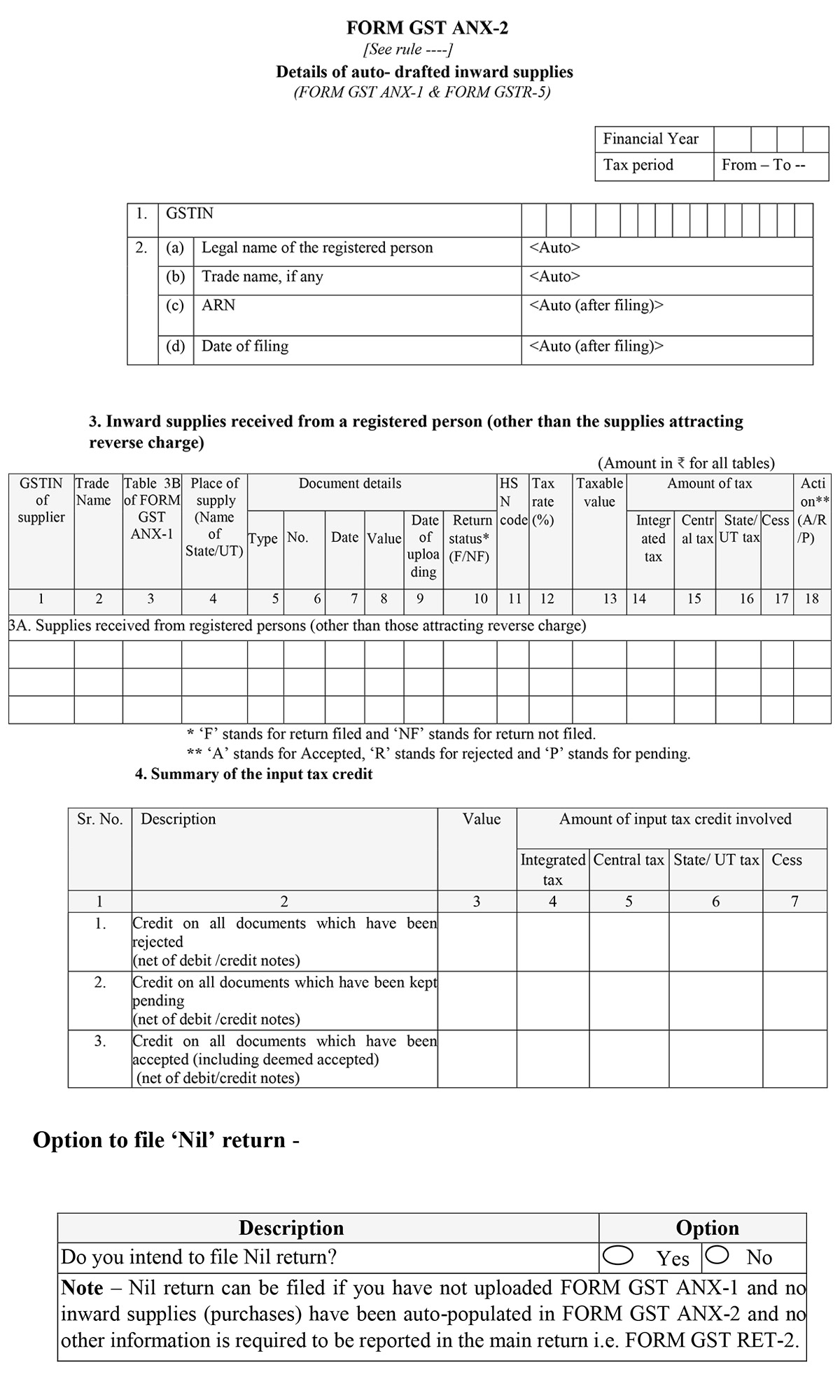

To file your GST HST return you will need to gather all the relevant information including your total sales the amount of GST HST collected and any Input Tax Credits ITCs you are eligible to claim Make sure to keep accurate records of your business transactions as the CRA may request documentation to 1 Calculate the net tax 2 Complete the return 3 Send file the return 4 After you file 3 Send file the return What is the due date to file a GST HST return The personalized GST HST return Form GST34 2 will show the due date at the top of the form The due date of your return is determined by your reporting period

Download Gst Return Form Cra

More picture related to Gst Return Form Cra

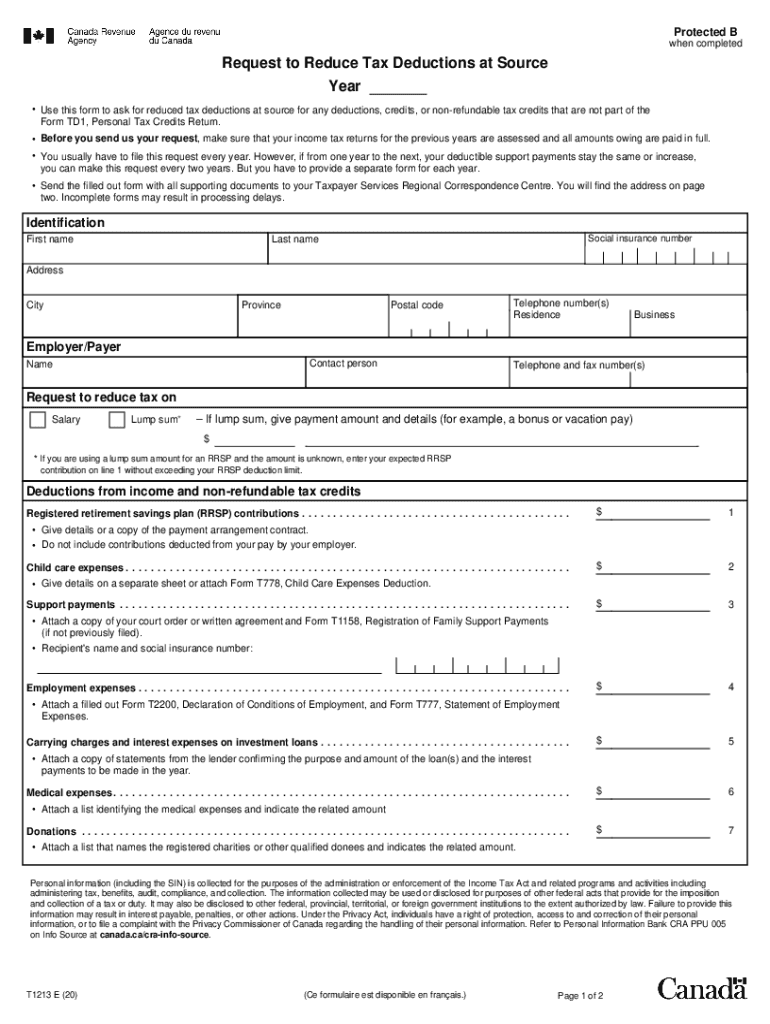

T1213 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/535/276/535276248/large.png

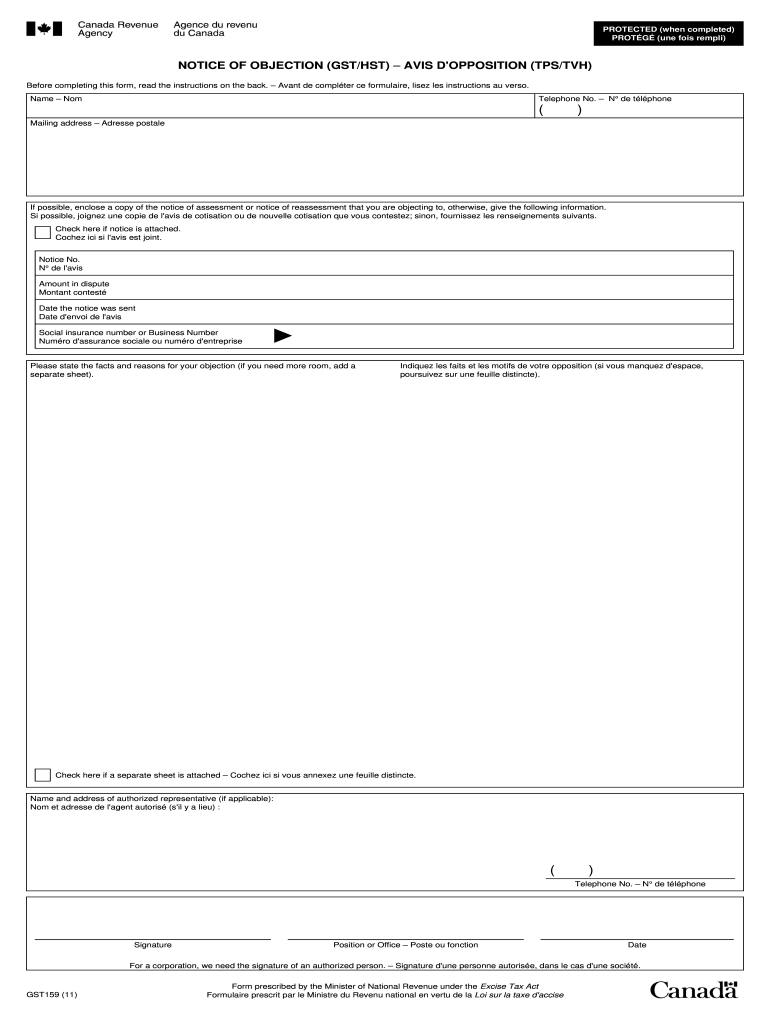

2011 Form Canada GST159 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/18/779/18779026/large.png

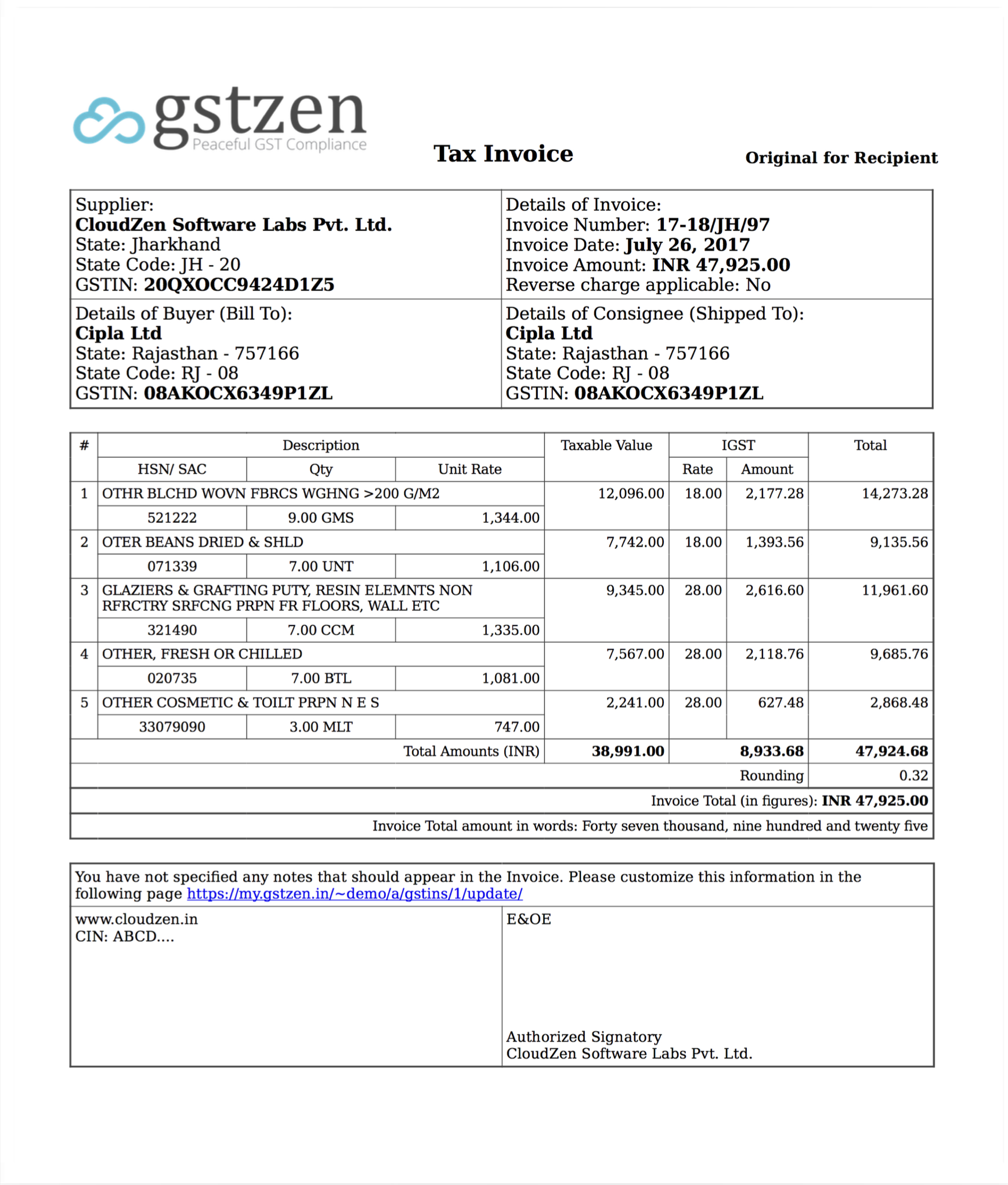

GST Invoice Format Overview GSTZen

https://img-www.gstzen.in/articles/gst/writings/invoice-sample-copy.png

You have to file your returns with Revenu Qu bec using its forms unless you are a person that is a selected listed financial institution SLFI for GST HST or QST purposes or both For more information see the Revenu Qu bec publication IN 203 V General Information Concerning the QST and the GST HST available at The CRA categorizes goods and services into three groups Taxable GST HST is charged collected and remitted As a registrant you may also claim credits called input tax credits ITCs for GST HST paid to produce the goods and or services Zero rated GST HST is not charged collected or remitted

Complete and file a GST HST return If you are a GST HST registrant with a reporting period that begins in 2024 you must file your returns electronically except for charities and selected listed financial institutions If you don t the Canada Revenue Agency may charge you a penalty Once a year any business that pays GST or HST needs to file a return to collect report and remit their due taxes to the CRA Using accounting software is the easiest and most accurate way for small businesses to keep track of their GST and HST Here s What We ll Cover What Is GST How Do You Calculate GST

How To Complete A Canadian GST Return with Pictures WikiHow

https://www.wikihow.com/images/thumb/2/21/Complete-a-Canadian-GST-Return-Step-9-Version-2.jpg/aid442859-v4-728px-Complete-a-Canadian-GST-Return-Step-9-Version-2.jpg

Types Of GST Return And Their Due Dates Enterslice

https://enterslice.com/learning/wp-content/uploads/2017/06/GST-Returns-enterslice.png

https://www.canada.ca/.../forms-publications.html

The following is a list of GST HST related forms and publications Guides Returns Election and application forms available to all businesses or individuals Election and application forms for public service and public sector bodies Election and application forms for corporations and financial institutions

https://www.canada.ca/en/revenue-agency/services/...

Canada ca Taxes GST HST for businesses Instructions for completing a GST HST Return We offer a printer friendly working copy to assist you in calculating your net tax and completing your GST HST return On this page Enter your personal business information Enter your total sales and other revenues

Hst Gst Return Form Fill Out Printable PDF Forms Online

How To Complete A Canadian GST Return with Pictures WikiHow

Canada GST HST Return Fill And Sign Printable Template Online US

GSTR 3A Notice For Not Filing GST Return IndiaFilings

Processing GST HST Payments Telpay

Cra Remittance 2013 2024 Form Fill Out And Sign Printable PDF

Cra Remittance 2013 2024 Form Fill Out And Sign Printable PDF

PROCESS FOR GST RETURN FILING SERVICES ONLINE CA CS ADV Service PUNE

File Your GST HST Return Online YouTube

Easy Guide To GST SAHAJ Return RET 2 Form With Filing Process Blog

Gst Return Form Cra - In this video tutorial I show you exactly how to file your GST HST return online to the CRA and pay it It s actually a super simple process but can be i