Name Of Gst Returns GST Returns are required by the tax authorities for calculation of tax liability pertaining to a business This guided explores the different types of GST returns due dates and penalties applicable

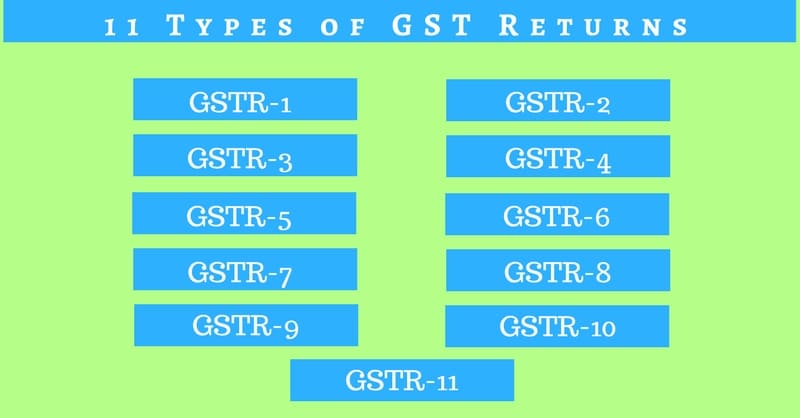

Filing GST returns is mandatory for all businesses registered under GST identified by their GSTIN Goods and Services Tax Identification Number There are 22 types of GST returns with 11 currently active There are 13 types of GST returns such as GSTR 1 GSTR 3B GSTR 4 etc In this article we will explore what GST returns are who should file them the types of GST returns and the due dates for filing them Additionally

Name Of Gst Returns

Name Of Gst Returns

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/07/Types-of-GST-Returns.jpg

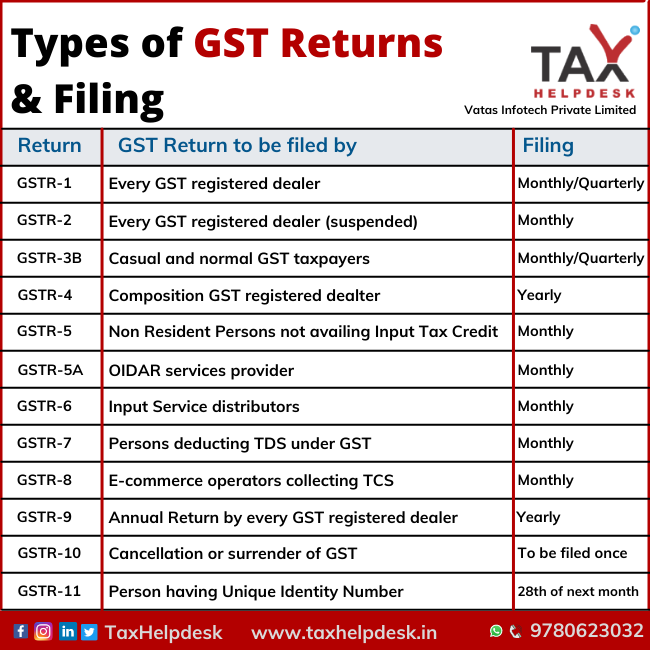

Types Of GST Returns Filing Period And Due Dates

https://www.taxhelpdesk.in/wp-content/uploads/2021/02/Types-of-GST-Returns-Filing.png

New GST Return Filing System Will Simplify Process Sushil Modi BW

https://static.businessworld.in/article/article_extra_large_image/1531309290_xD31He_shutterstock_gst-470.jpg

Explore the different types of GST returns in India This guide explains each type of GST return and their filing requirements Explore types of GST returns including filing dates late fees Learn what you need to know before filing your GST returns Read more

Check all GST returns along with form and submission procedure with due dates monthly or quarterly A GST Return is a legal document persisting GST invoices receipts payments etc of a certain period It is a collection of all the details of income sales expenses and purchases of a GST

Download Name Of Gst Returns

More picture related to Name Of Gst Returns

Transformational Journey Of GST Either view

https://eitherview.com/wp-content/uploads/2021/07/GST.jpg

GST Returns enterslice Enterslice

https://enterslice.com/learning/wp-content/uploads/2017/06/GST-Returns-enterslice.png

Is GST Mandatory For Udyam Registration Compulsory Or Not

https://udyamregistrationform.com/wp-content/uploads/2021/09/is-gst-mandatory-for-udyam-registration.jpg

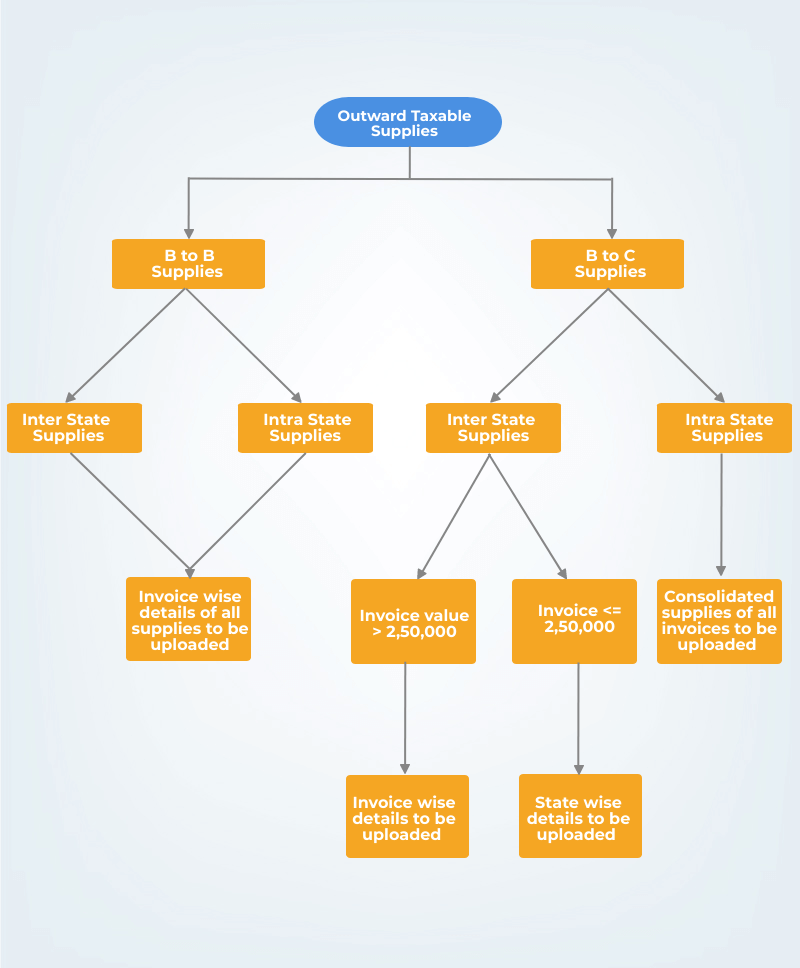

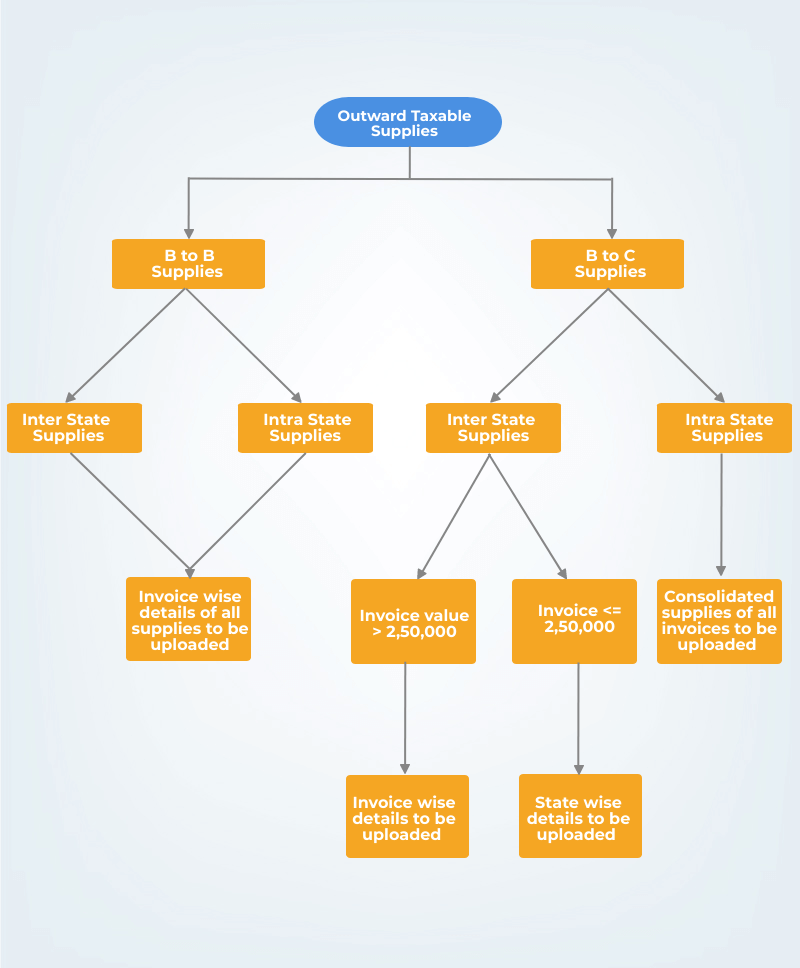

Following table lists the various types of returns under GST Law The basic features of the returns mechanism in GST include electronic filing of returns uploading of invoice level information Types of GST Returns There are several kinds of Goods and Services Tax GST returns under the Indian GST system each with a distinct function and target audience The

This in depth article explains various types of GST Returns format of GST returns process of filing GST returns and important due dates Check out now Master GST return filing with this comprehensive guide Understand the new system different forms filing deadlines consequences of non compliance and more Everything you need to

Types Of Gst Returns TaxGuru Edu

https://taxguruedu.com/wp-content/uploads/2021/07/GST-Return-and-types-of-GST-returns.jpg

Who Should File GST Return The Types Of GST Returns Due Date SuperCA

https://superca.in/storage/app/public/blogs/1623485994.jpeg

https://tax2win.in/guide/return-under-gst

GST Returns are required by the tax authorities for calculation of tax liability pertaining to a business This guided explores the different types of GST returns due dates and penalties applicable

https://razorpay.com/learn/types-gst-taxes …

Filing GST returns is mandatory for all businesses registered under GST identified by their GSTIN Goods and Services Tax Identification Number There are 22 types of GST returns with 11 currently active

Gst returns Certicom

Types Of Gst Returns TaxGuru Edu

Why You Should Hire Experts Or A Tax Agency Services To Help With New

GST Unique Identification Number

16 Types Of GST Return Your Business Should Be Aware Of Corpbiz

GST Returns Due Dates Late Fees AKT Associates

GST Returns Due Dates Late Fees AKT Associates

Types Of GST Returns Due Dates Late Filing Penalties All Forms

Types Of GST Returns Format How To File Due Dates

GST

Name Of Gst Returns - A GST Return is a legal document persisting GST invoices receipts payments etc of a certain period It is a collection of all the details of income sales expenses and purchases of a GST