Healthcare Worker Tax Credit 2020 Form Verkko 3 maalisk 2022 nbsp 0183 32 Eligible Employers may claim tax credits for qualified leave wages paid to employees on leave due to paid sick leave or expanded family and medical

Verkko 24 helmik 2022 nbsp 0183 32 Suspension of Repayment of Excess Advance Payments of the Premium Tax Credit Excess APTC for Tax Year 2020 Questions 31 37 Verkko If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax

Healthcare Worker Tax Credit 2020 Form

Healthcare Worker Tax Credit 2020 Form

https://s36394.pcdn.co/wp-content/uploads/2022/05/Untitled-design.jpg

Who Benefits Most From Expanded Low Middle Income Worker Tax Credit

https://image.cnbcfm.com/api/v1/image/106160947-1570040639580gettyimages-1154550290r.jpg?v=1638978744&w=1920&h=1080

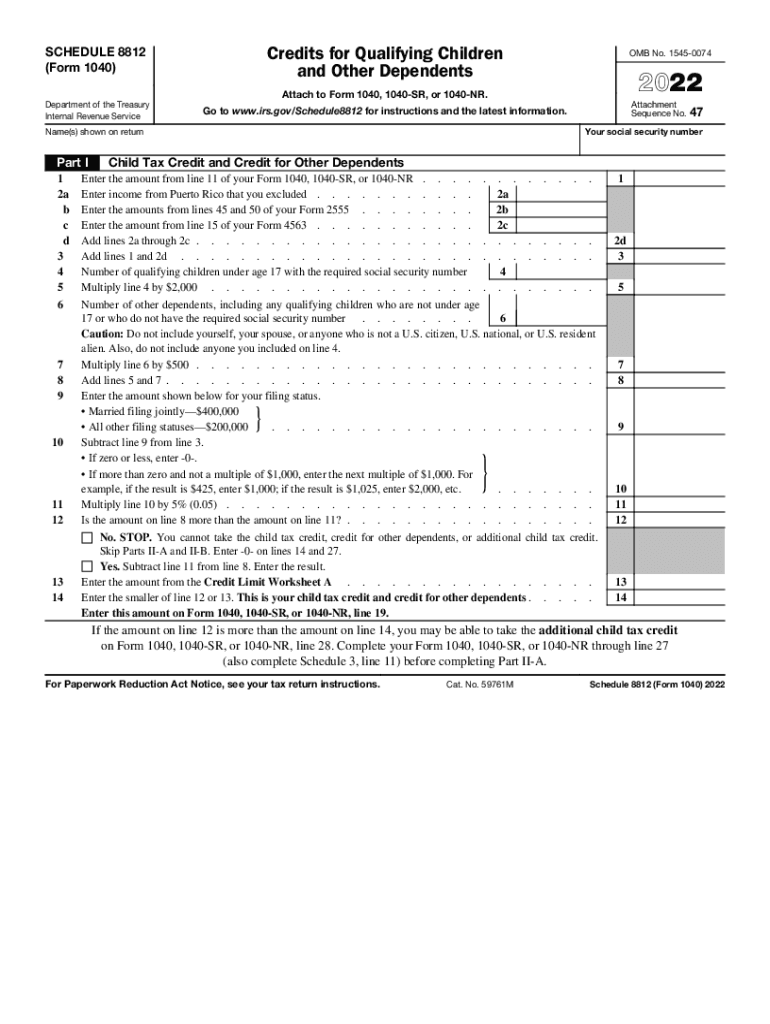

2022 Form IRS 1040 Schedule 8812 Fill Online Printable Fillable

https://www.pdffiller.com/preview/621/821/621821322/large.png

Verkko Proof that your insurance was qualified health insurance coverage Proof of payment of insurance premiums If you e file you must complete Form 8453 U S Individual Verkko If you qualify for a premium tax credit based on your estimate you can use any amount of the credit in advance to lower your premium Refer to glossary for more details for

Verkko Work Opportunity Tax Credit The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring and employing individuals from certain Verkko 8 helmik 2021 nbsp 0183 32 The FFCRA passed in March 2020 allows eligible self employed individuals who due to COVID 19 are unable to work or telework for reasons relating

Download Healthcare Worker Tax Credit 2020 Form

More picture related to Healthcare Worker Tax Credit 2020 Form

We Can Create A Fair Feminist Tax Code Ms Magazine

https://msmagazine.com/wp-content/uploads/2023/04/GettyImages-1480647983.jpg

Healthcare Worker Tax Rebate Free Stuff

https://freestuff.co.uk/wp-content/uploads/2016/10/HealthCareWorkers-869x260.jpg

Tax Time Beware The 1099 Classification Matchwell

https://www.wematchwell.com/wp-content/uploads/2022/07/the-difference-between-w2-1099-and-corp-to-corp-workers.jpeg

Verkko 18 toukok 2020 nbsp 0183 32 Specifically the HEROES Act would allow first responders and COVID 19 front line employees who performed at least 1 000 hours of essential work during Verkko A small employer is eligible for the credit if a it has fewer than 25 full time equivalent employees b the average annual wages of its employees are less than 50 000

Verkko 1 tammik 2022 nbsp 0183 32 Editor Valrie Chambers CPA Ph D COVID 19 legislation enacted in March 2020 created significant temporary employment tax credits to help employers Verkko premium subsidies and tax credits For information about insurance plans offered through a SHOP Marketplace visit Healthcare gov For tax exempt eligible small

How To Pay Taxes Quarterly A Simple Tax Guide For The Self Employed

https://www.gkaplancpa.com/wp-content/uploads/2020/11/how-to-pay-taxes-quarterly.jpeg

H 2B Seasonal Workers And Tax What You Need To Know

https://blog.sprintax.com/wp-content/uploads/2021/05/H2B-worker-tax-guide-1500x844.jpg

https://www.irs.gov/newsroom/covid-19-related-tax-credits-basic-faqs

Verkko 3 maalisk 2022 nbsp 0183 32 Eligible Employers may claim tax credits for qualified leave wages paid to employees on leave due to paid sick leave or expanded family and medical

https://www.irs.gov/.../questions-and-answers-on-the-premium-tax-credit

Verkko 24 helmik 2022 nbsp 0183 32 Suspension of Repayment of Excess Advance Payments of the Premium Tax Credit Excess APTC for Tax Year 2020 Questions 31 37

Work Opportunity Tax Credit Available To Employers

How To Pay Taxes Quarterly A Simple Tax Guide For The Self Employed

Not Done Your 2020 Self Assessment Tax Return Yet

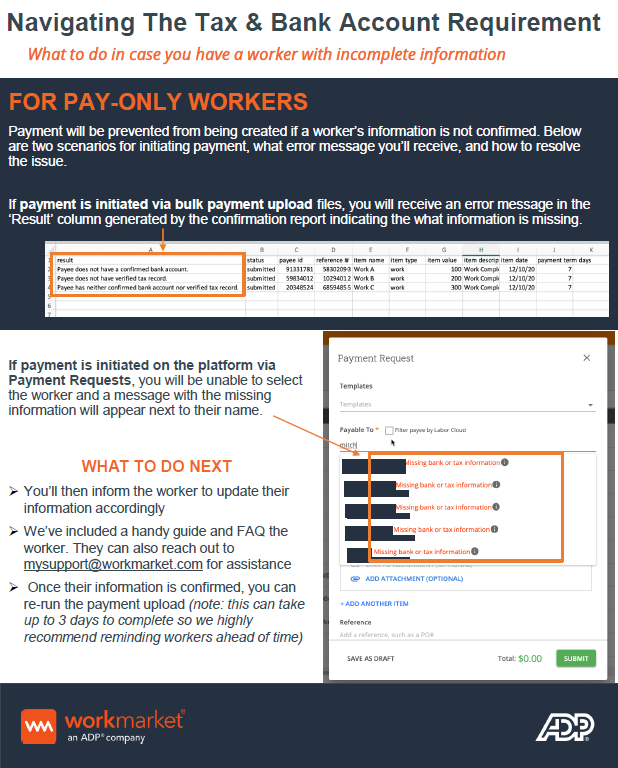

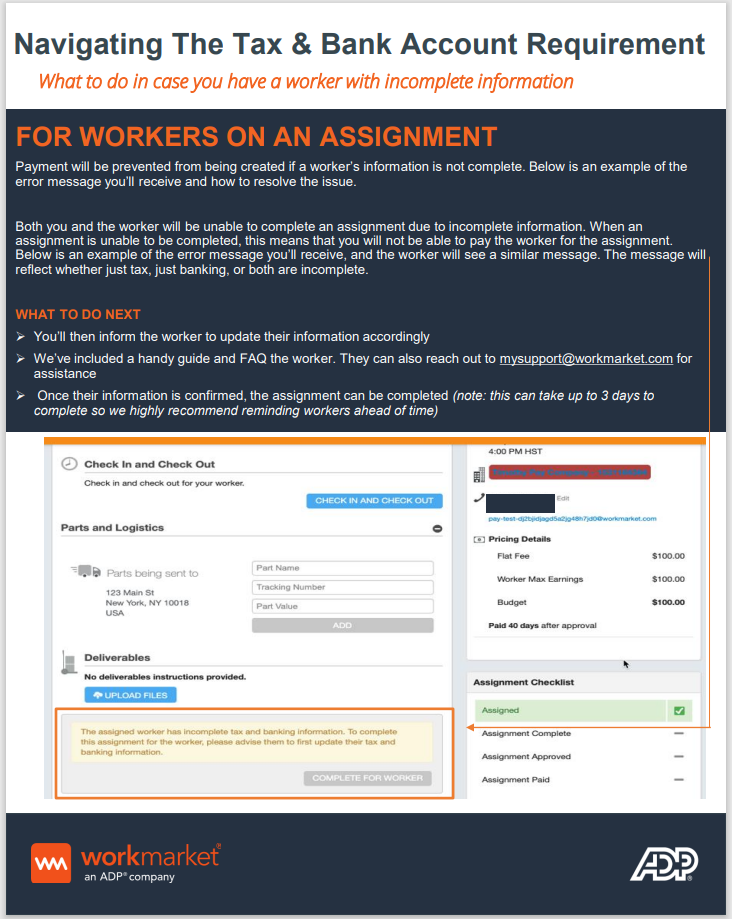

Worker Tax Bank Info Process And FAQ Help Center

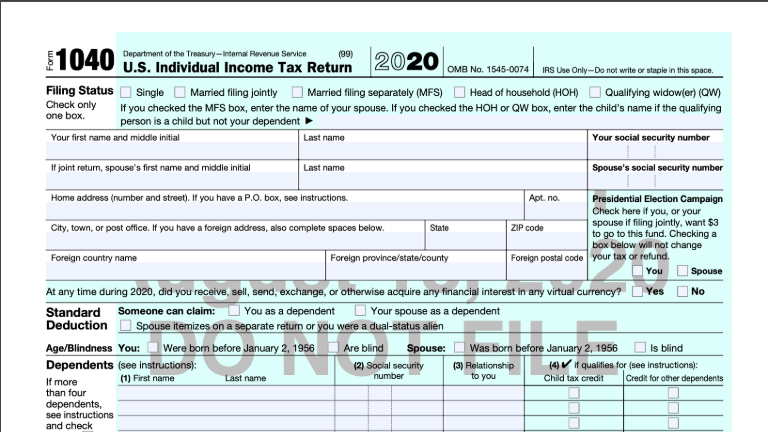

FREE 2020 Printable Tax Forms

Tax Breaks For Healthcare Workers

Tax Breaks For Healthcare Workers

Tax Year 2020 Changes To IRS Form 1040 TaxSlayer Pro s Blog For

Worker Tax Bank Info Process And FAQ Help Center

Four Policies To Help The Middle Class And How To Pay For Them Brookings

Healthcare Worker Tax Credit 2020 Form - Verkko If you qualify for a premium tax credit based on your estimate you can use any amount of the credit in advance to lower your premium Refer to glossary for more details for