Heat Pump Requirements For Federal Tax Credit The taxpayer can claim a total credit of 3 200 1 200 for the doors windows skylights and home energy audit 2 000 for the heat pump

Q What is the federal tax credit for installing a heat pump The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the The Inflation Reduction Act IRA of 2022 introduced enhanced tax credits for energy efficiency and extended them through 2032 They cover many improvements including

Heat Pump Requirements For Federal Tax Credit

Heat Pump Requirements For Federal Tax Credit

https://goenergylink.com/wp-content/uploads/2021/07/AdobeStock_98024254-1536x1022.jpeg

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

https://www.achrnews.com/ext/resources/2022/04-April/Heat-Pump-Tax-Credit.jpg?1649877799

300 Federal Tax Credit For Heat Pumps Alaska Heat Smart

https://akheatsmart.org/wp-content/uploads/2022/04/heat-pump-indoor_300.jpg

Yes heat pumps are eligible for federal tax credits under the Inflation Reduction Act IRA which provides incentives for energy efficient home improvements Homeowners can receive a tax credit of up to 30 of the cost for installing You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000

The 25C credit has an annual cap of 1 200 except heat pump Up to 600 each for a qualified air conditioner or gas furnace Up to 2 000 with a qualified heat pump heat pump water heater or boiler There are no income requirements Tax Credits for Energy Efficiency Improvements Total Annual Limit The 2 000 heat pump credit can be combined with credits up to 1 200 for other qualified upgrades made in one tax

Download Heat Pump Requirements For Federal Tax Credit

More picture related to Heat Pump Requirements For Federal Tax Credit

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

https://www.rescueairtx.com/images/blog/iStock-1444118278.jpg

What Are The Requirements Of Water Source Heat Pump For Water Source

https://www.yesncer.com/u_file/2107/photo/e06fc2ff1d.jpg

Inflation Reduction Act Expands 45L Tax Credit For Energy Efficient

https://www.revireo.com/wp-content/uploads/2022/08/iStock-1360720433-1-1-1024x512.jpeg

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for It is a nonrefundable credit that can reduce or eliminate the amount of tax you owe The credit cannot be refunded The energy efficient home improvement credit has a yearly

What is the federal tax credit for heat pumps The Energy Efficient Home Improvement Credit EEHIC was introduced into law by the Inflation Reduction Act of 2022 You Can Get up to 2 000 in Federal Tax Credits When You Purchase a New Heat Pump or Air Conditioner 2023 2032 Learn About the Tax Credits Under the IRA

The Inflation Reduction Act pumps Up Heat Pumps Hvac

https://www.hvac.com/wp-content/uploads/2022/09/heat-pump-rebates-2023.png

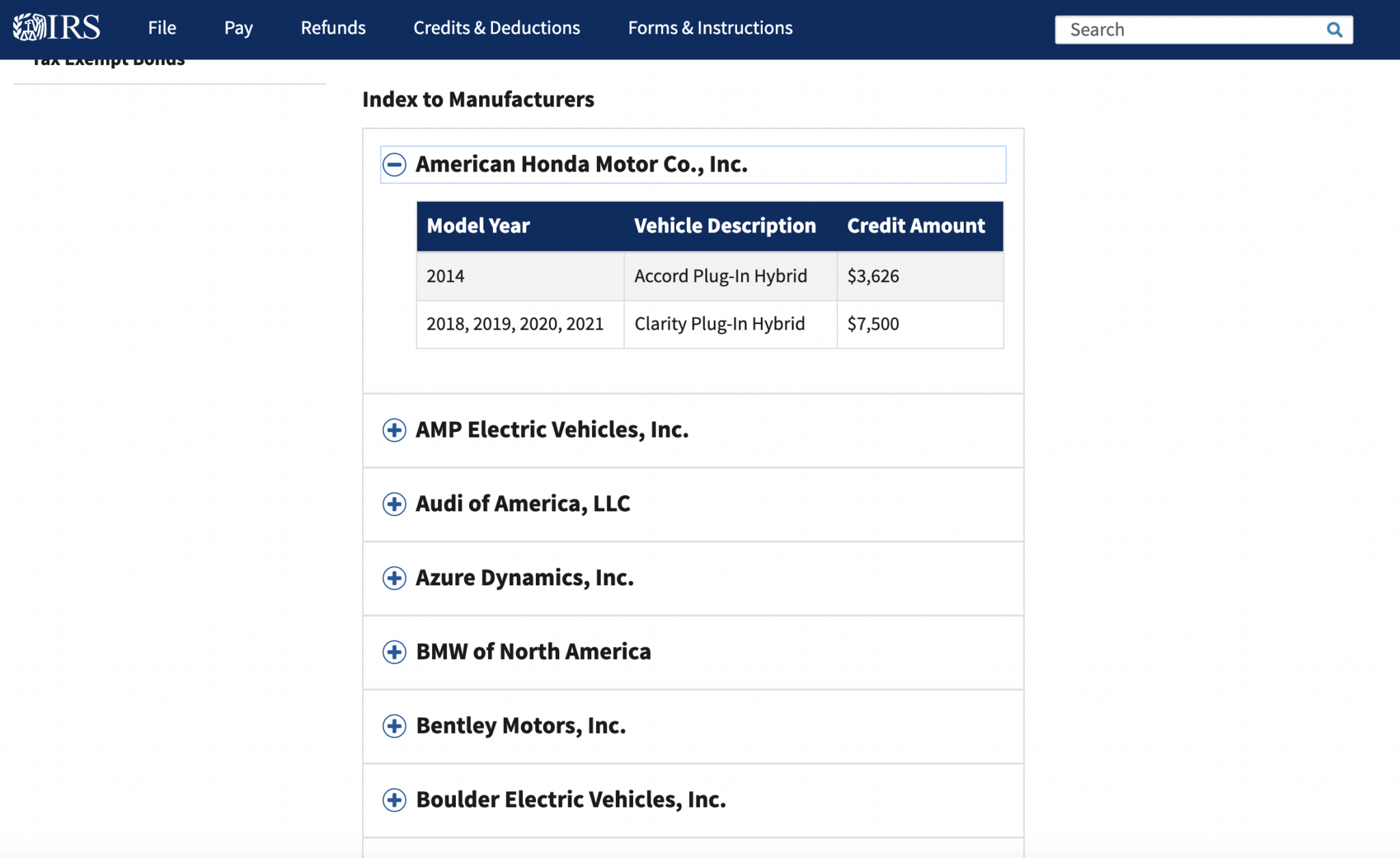

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

https://www.irs.gov › credits-deductions › frequently...

The taxpayer can claim a total credit of 3 200 1 200 for the doors windows skylights and home energy audit 2 000 for the heat pump

https://sealed.com › resources › heat-pump-tax-credits-and-rebates

Q What is the federal tax credit for installing a heat pump The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the

Federal Tax Credits For Air Conditioners Heat Pumps 2023

The Inflation Reduction Act pumps Up Heat Pumps Hvac

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

How Solar Federal Tax Credit Works

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Rebates For Heat Pumps Save Money And Energy USRebate

Federal Rebates For Heat Pumps Save Money And Energy USRebate

Heat Pumps Wattsmart Savings

The Federal Tax Credit For Electric Cars How To Save 7 500

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

Heat Pump Requirements For Federal Tax Credit - The 25C Energy Efficient Home Improvement Tax Credit provides a tax credit for eligible heat pumps up to 30 of project costs capped at 2 000 The most challenging part of using this