Hmrc Ppi Tax Refund Contact Number Free Published 11 May 2023 Last updated 30 January 2024 See all updates Get emails about this page Contents Payment Protection Insurance PPI claims Before you start Apply for a repayment

A pension a Self Assessment tax return a redundancy payment UK income if you live abroad interest from savings or payment protection insurance PPI income from a life or pension annuity Contact your tax office or call the income tax helpline on 0300 200 3300 if you need more info Please use the comments section below or the forum to let me know how you get on if you get money back how easy it was and how much you got back

Hmrc Ppi Tax Refund Contact Number Free

Hmrc Ppi Tax Refund Contact Number Free

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

How Long To Get My Tax Refund From HMRC Swift Refunds

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-2-e1566379535551.jpg

HMRC Tax Refund Form R40 PPI A Complete Guide

https://static.wixstatic.com/media/a2fe96_fa523be98a3f49d3b750e8e1ca4700c3~mv2.png/v1/fill/w_720,h_384,al_c,lg_1,q_85/a2fe96_fa523be98a3f49d3b750e8e1ca4700c3~mv2.png

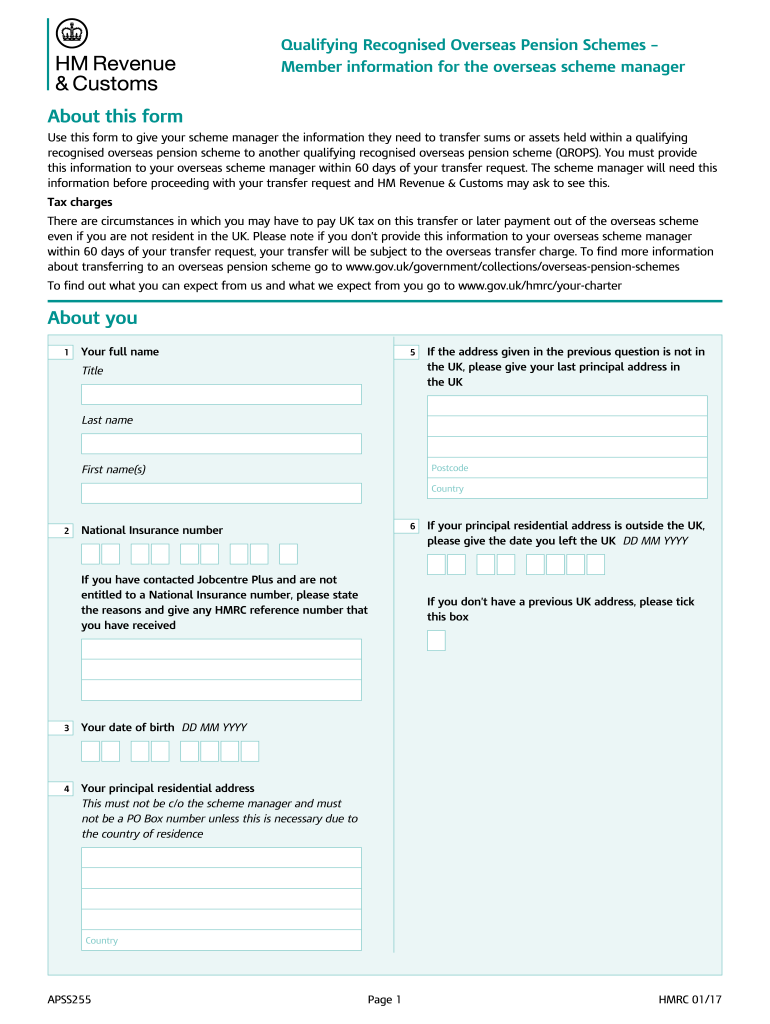

Our team can help you amend your earlier tax return to declare any PPI interest and claim a tax refund so please feel free to contact us For those not within the self assessment system you will need to claim your tax refund using the form R40 PPI tax refunds Tax may have been deducted at source from the interest element of a payment protection insurance PPI pay out If the tax deduction means that you overpaid tax in the tax year in which you received the PPI pay out you can claim a

October 21 2020 7 00 am Dear Gareth I have been getting calls telling me that I m owed some tax back from HMRC on a PPI refund I received The company that called will charge 39 per cent HMRC gives people four year from the end of the tax year in which they made an overpayment to claim it back as a refund Unfortunately this means that you cannot reclaim tax on any PPI payouts that you received before 6th April 2019

Download Hmrc Ppi Tax Refund Contact Number Free

More picture related to Hmrc Ppi Tax Refund Contact Number Free

HMRC Customer Service Contact Numbers Tax Helpline 0300 200 3300

https://customerservicecontactnumber.uk/wp-content/uploads/2016/08/HMRC.jpg

HMRC PPI Refund Of Tax Claim My Tax Back

https://claimmytaxback.co.uk/wp-content/uploads/2020/02/euro-870756_1920.jpg

Claim PPI Tax Back What Is PPI Tax All Questions Answered Reclaim

https://reclaimmyppitax.co.uk/wp-content/uploads/2020/07/Blvdkicks.png

You are perfectly free to use a third party company if you wish however they may keep 40 of any refund as their fee It is your choice whether to accept their terms If you have a valid claim Feb 3 2023 16 min read HMRC Tax Refund Form R40 PPI A Complete Guide Updated 4 days ago What is Form R40 PPI The R40 form PPI is a form used by individuals in the UK to claim tax relief or tax repayment for overpaid tax on savings and investment income

HMRC will now require evidence of a PPI payment before they progress a claim for a tax refund Claims can continue to be made using the existing R40 form but from 26 October 2023 onwards supplementary evidence must be attached Complain Reclaim PPI Can I still reclaim The reclaim deadline has now passed but there may be some exceptions Kit Sproson Edited by Martin Lewis Updated 5 December 2023 The PPI deadline passed on 29 August 2019 so the normal reclaim route is now no longer open be that direct to a bank using our free reclaim tool or via a claims firm

Have You Paid Excessive Tax On Your PPI Refund Instant Bazinga

https://instantbazinga.com/wp-content/uploads/2021/03/Untitled-1.png

If You ve Had A PPI Payout You Can Reclaim Tax

https://moneybackhelpdesk.co.uk/images/articles/ppi-tax/_articleHero/PPI-Tax-Refund.jpg

www.gov.uk/guidance/claim-a-refund-of...

Published 11 May 2023 Last updated 30 January 2024 See all updates Get emails about this page Contents Payment Protection Insurance PPI claims Before you start Apply for a repayment

www.gov.uk/claim-tax-refund

A pension a Self Assessment tax return a redundancy payment UK income if you live abroad interest from savings or payment protection insurance PPI income from a life or pension annuity

PPI Tax Refunds Money Back Helpdesk

Have You Paid Excessive Tax On Your PPI Refund Instant Bazinga

C1603 Form Fill Out And Sign Printable PDF Template SignNow

PPI Tax Refunds Money Back Helpdesk

Received A PPI Payout In The Last 4 Years Nationwide PPI Advice

HMRC R D Compliance Check Eligibility Nudge Letters

HMRC R D Compliance Check Eligibility Nudge Letters

How To Claim PPI Tax Returns R40 Best Accountants Finder

If You Received A PPI Payout You Could Be Owed PPI Tax From HMRC

PPI Tax Refunds Money Back Helpdesk

Hmrc Ppi Tax Refund Contact Number Free - Great news We have been successful in reclaiming your PPI related tax refund We have received a cheque from HMRC and are ready to send you your payment All we need now is for you to provide your bank details via our secure online form so we can send you your refund of 301 21 Click here to provide this now https bd then tax