Hmrc Reference Number You can find your UTR number in your Personal Tax Account in the HMRC app on previous tax returns and other documents from HMRC for example notices to file a return or payment reminders

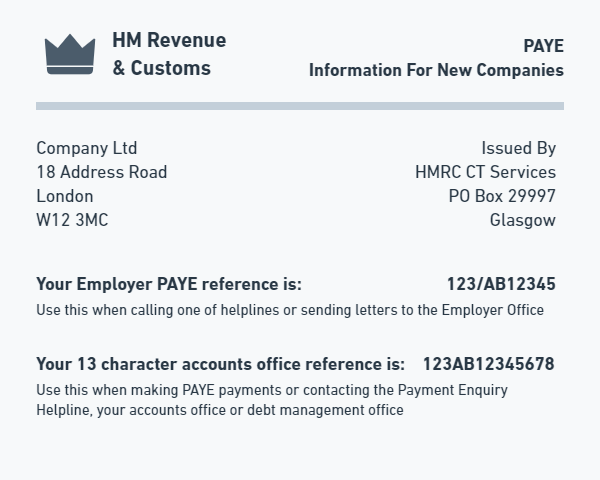

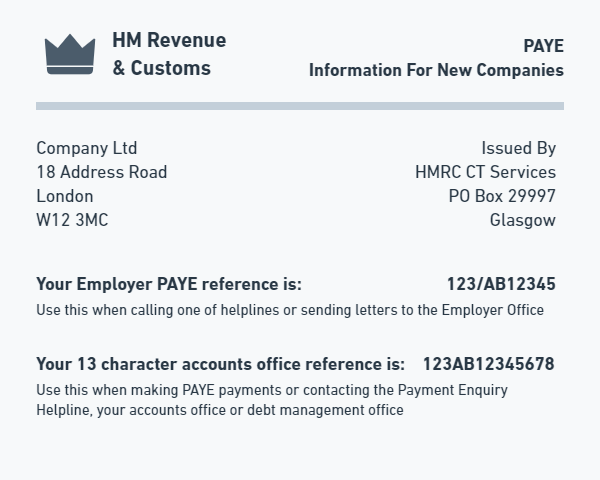

Sign into or set up a personal tax account to check and manage HMRC records including Income Tax change of address Self Assessment and company car tax The Accounts Office Reference Number AORN is a unique identifier that HMRC issues to UK employers and is the reference used by an Employer when making payments to HMRC This number is essential for businesses because it

Hmrc Reference Number

Hmrc Reference Number

https://i.pinimg.com/736x/f9/d7/b1/f9d7b1535691fbb75961aee8cb255987--scene-numbers.jpg

Information Guide For Unique Tax Reference Numbers

https://www.friendandgrant.co.uk/wp-content/uploads/2019/01/SA-UTR-example-768x1086.jpg

Exp Code On Invoice Hybridlasopa

https://i2.wp.com/www.invoiceberry.com/blog/wp-content/uploads/2018/09/HMRC-UTR-Number.jpg

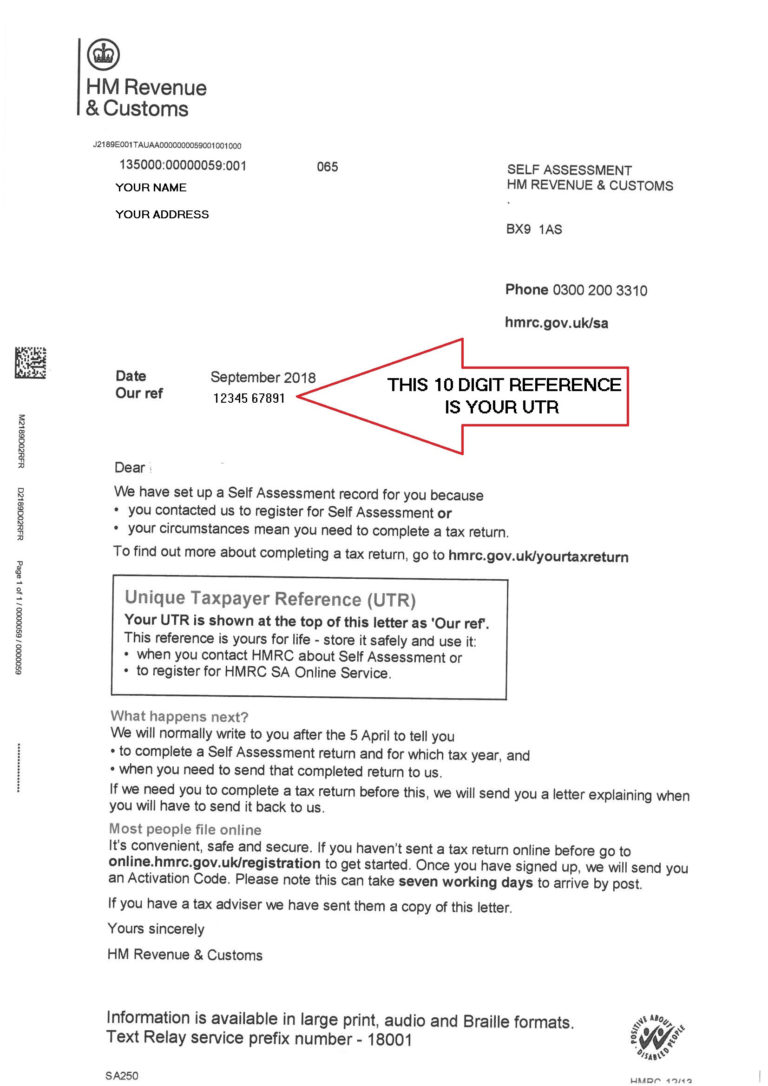

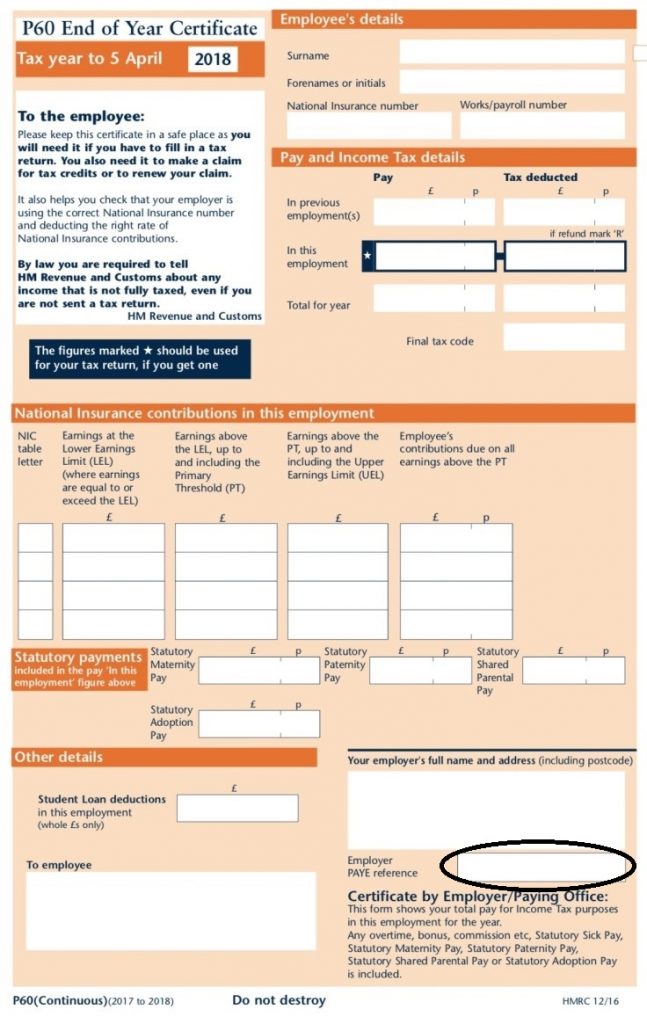

An Employer Reference Number Number ERN Number or Employer PAYE Reference is a unique reference number issued in the United Kingdom by HMRC to an employer 1 A Unique Taxpayer Reference UTR is a 10 digit number for example 12345 67890 provided by HMRC when someone registers for Self Assessment for the first time It might just be called your tax reference

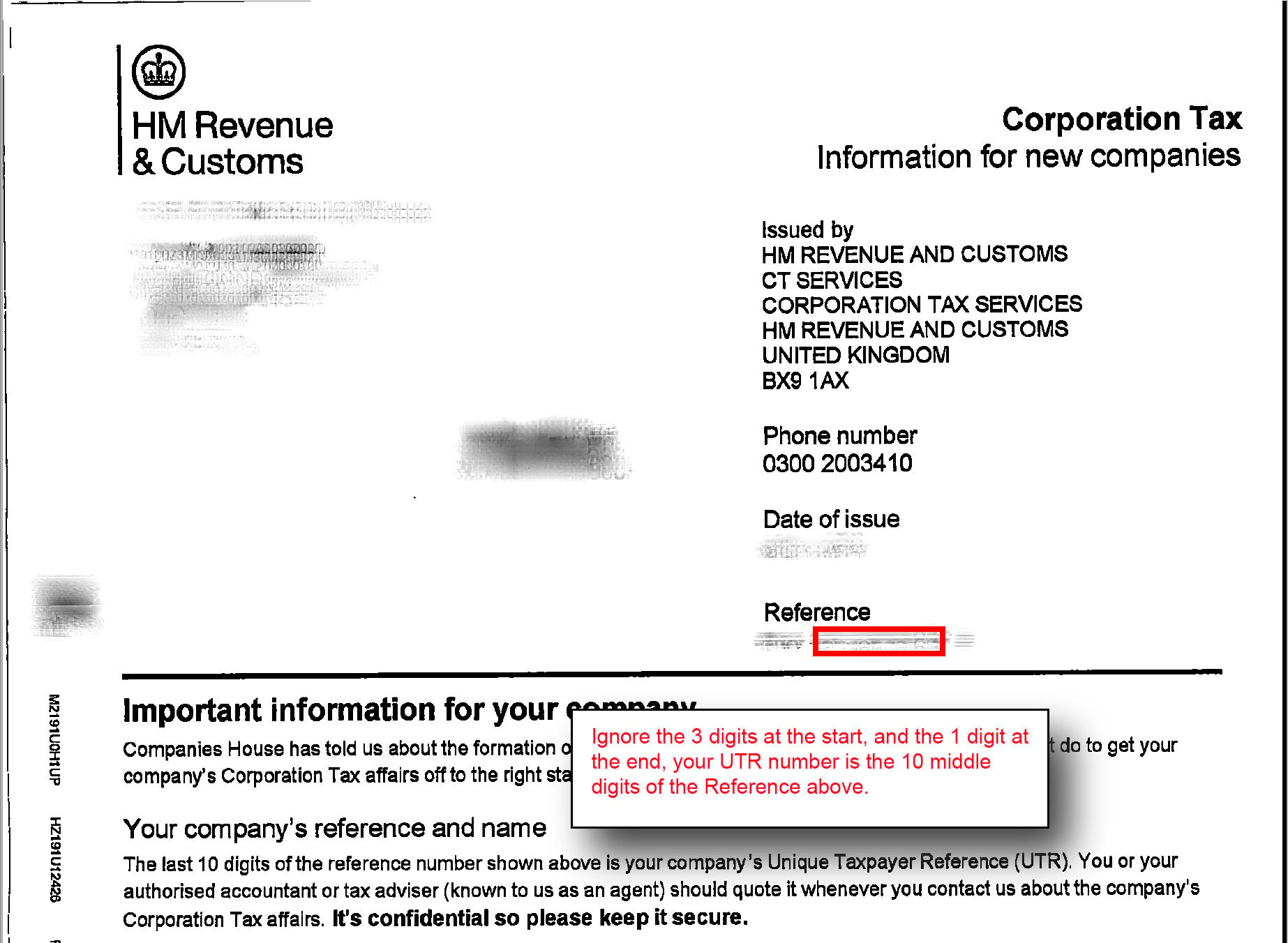

A UTR number is your unique taxpayer reference number HMRC assigns each self assessment taxpayer a different number in order to track their tax records All UTR numbers have 10 digits and sometimes there s a letter K at the end Along with your name and date of birth HMRC uses unique reference numbers to help them locate and manage your tax records A Unique Taxpayer Reference UTR number is a 10 digit reference number which identifies your business

Download Hmrc Reference Number

More picture related to Hmrc Reference Number

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

https://www.depledgeswm.com/wp-content/uploads/2018/04/HMRC-scaled-1024x683.jpeg

HMRC Liability Imbalance Qtac Payroll QTAC Solutions Ltd

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/17012682908/original/zUF4YAjXRfpU55FuU2LFPztTVcVdUP0J9A.png?1499960500

How To Register For HMRC Self Assessment Online YouTube

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

18 Digit Reference for payments Posted Tue 26 Mar 2024 23 16 32 GMT by Graeme I have received the details of the amount of volntary contributions required to cover years I ve not been working Reference number You ll need to use your 13 character accounts office reference number as the payment reference You can find this in your HMRC online account on the letter HMRC sent you

[desc-10] [desc-11]

Getting Started With HMRC For Limited Companies

https://www.numble.co.uk/content/images/2020/08/GOV-min-wage---HMRC---PAYE-Letter.png

Where To Find Your Company Unique Taxpayer Reference Or UTR Number

https://www.office-serv.co.uk/wp-content/uploads/2022/06/hmrc-utr-form-scaled.jpeg

https://www.gov.uk/find-utr-number

You can find your UTR number in your Personal Tax Account in the HMRC app on previous tax returns and other documents from HMRC for example notices to file a return or payment reminders

https://www.gov.uk/personal-tax-account

Sign into or set up a personal tax account to check and manage HMRC records including Income Tax change of address Self Assessment and company car tax

Where Can I Find My UTR Number

Getting Started With HMRC For Limited Companies

UTR UTR JapaneseClass jp

What Is A Tax Reference Number

What Is Employer s PAYE Ref Number Claim My Tax Back

How To Address A Letter To Hmrc Astar Tutorial

How To Address A Letter To Hmrc Astar Tutorial

How Can I Work Out My Payment Reference When Paying PAYE To HMRC

What Is Employer s PAYE Ref Number Claim My Tax Back Employer PAYE

HMRC Warning As Automated Phone Call Scam Circulates Targeting Britons

Hmrc Reference Number - A Unique Taxpayer Reference UTR is a 10 digit number for example 12345 67890 provided by HMRC when someone registers for Self Assessment for the first time It might just be called your tax reference