Hmrc Tax Rebate Number Web 15 ao 251 t 2014 nbsp 0183 32 Details If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get the

Web 13 juil 2023 nbsp 0183 32 If you ve left employment and received your last pay before 5 April the previous tax year use form 38 to claim a refund Claim online The quickest way to claim Web 3 mars 2016 nbsp 0183 32 Claim online Before you start You cannot use this service if you are claiming on behalf of someone else complete Self Assessment tax returns except current year

Hmrc Tax Rebate Number

Hmrc Tax Rebate Number

https://i.imgur.com/NPT0C0n.png

HMRC UTR Number InvoiceBerry Blog

https://i2.wp.com/www.invoiceberry.com/blog/wp-content/uploads/2018/09/HMRC-UTR-Number.jpg

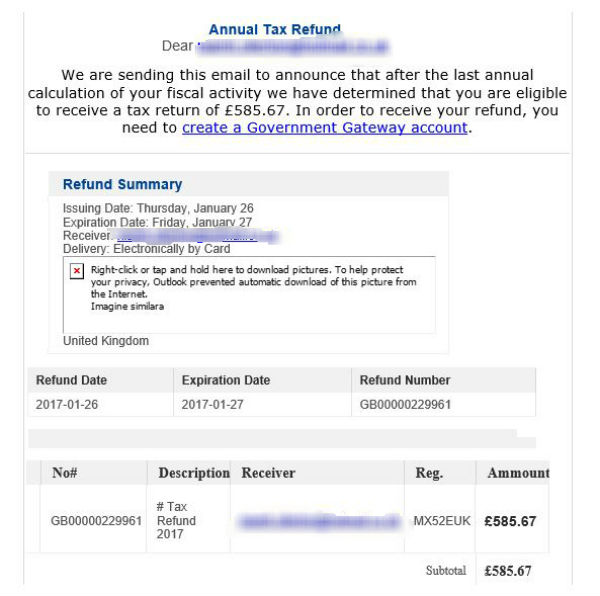

The HMRC Scam Email That s Catching People Out What You Need To Watch

https://i2-prod.mirror.co.uk/incoming/article9611507.ece/ALTERNATES/s615b/HMRC-fraudJPG.jpg

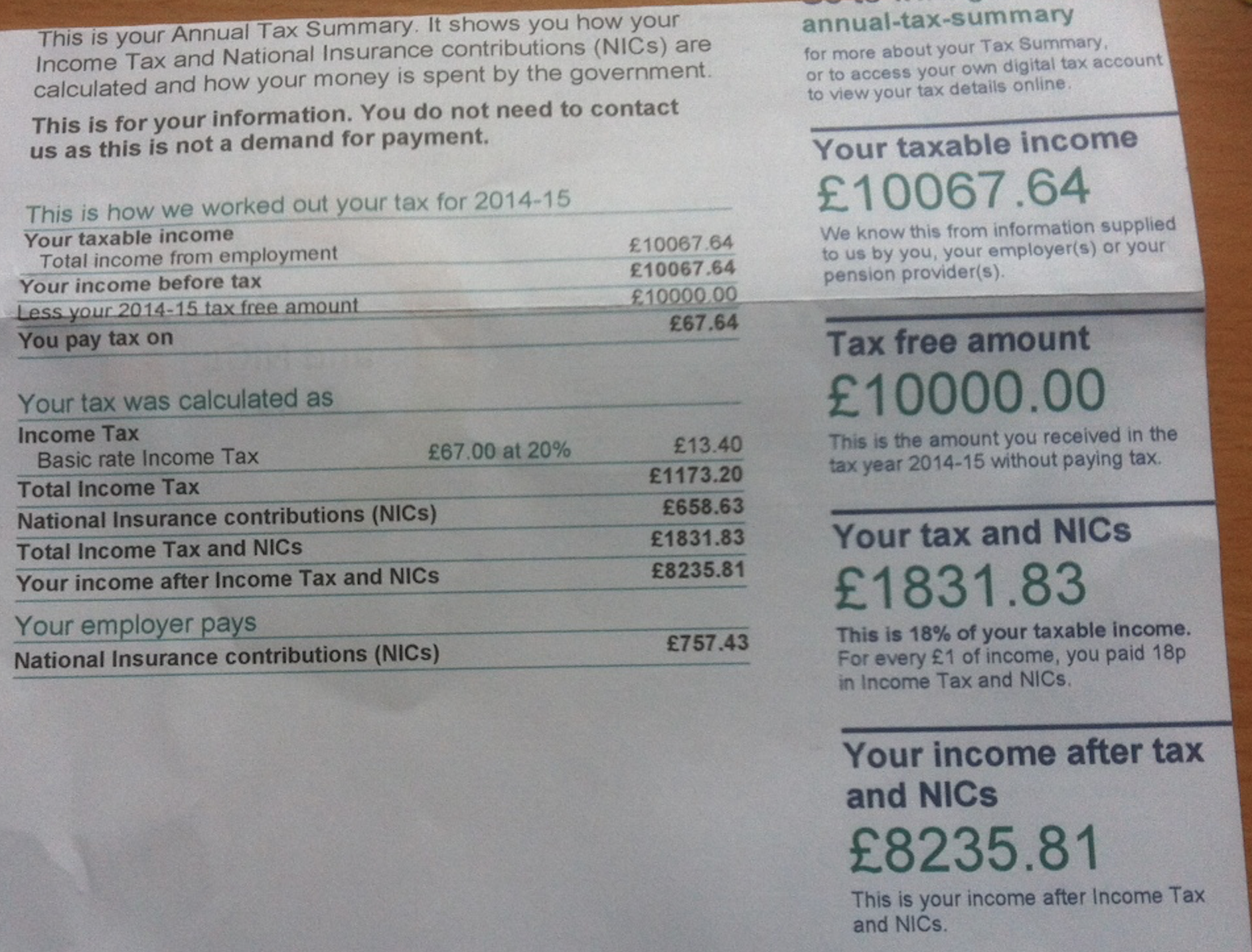

Web Home Money and tax Income Tax Check your Income Tax for the current year This service covers the current tax year 6 April 2023 to 5 April 2024 This page is also available in Web With the new school term starting HM Revenue and Customs HMRC is reminding families to open a Tax Free Childcare account today to save up to 163 2 000 per child on their yearly childcare bills

Web Have your National Insurance number with you before you start The Extra Support Team can only help you with questions about PAYE Self Assessment Contact HMRC using Web The UK HMRC contact number for tax refunds is 0300 200 3300 This is a freephone number and the telephone lines are open from Monday to Friday 8am to 6pm excluding bank holidays Before you contact HMRC it may

Download Hmrc Tax Rebate Number

More picture related to Hmrc Tax Rebate Number

Hmrc Tax Return Self Assessment Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/HMRC-Tax-Rebate-Form.png

HMRC Tax Return Get The Information You Need

https://pdfimages.wondershare.com/pdf-forms/hmrc.png

Hmrc Archives Huston And Co

http://huston.co.uk/wp-content/uploads/2015/11/9000-231115.jpg

Web 2 juin 2023 nbsp 0183 32 The allowance is currently 163 12 570 for the current tax year and has been the same since the 2021 2022 tax year How to claim a tax refund If you are self employed Web There are many telephone numbers for HMRC however we have taken the courtesy of detailing the most common contact numbers for you Self Assessment 0300 200 3310 Tax Credits 0345 300 3900 Child

Web Refunds appeals and penalties Check how to claim a tax refund Disagree with a tax decision Estimate your penalty for late Self Assessment tax returns and payments Web 6 avr 2023 nbsp 0183 32 If you have not received a P800 you can still claim a tax refund by contacting HMRC directly through its online portal or by calling 0300 200 3300 When will I receive

Income Tax Refund Hm Revenue Customs Home Pag

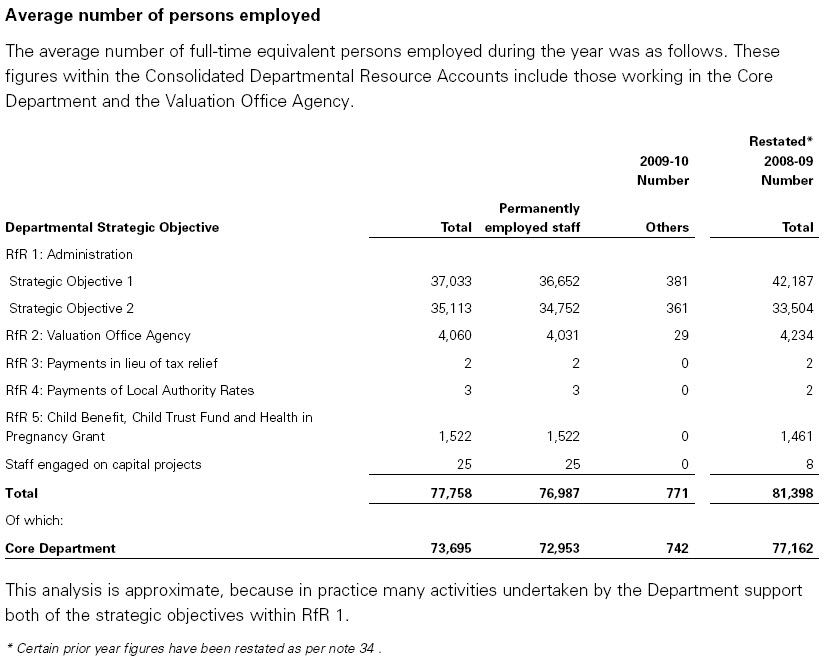

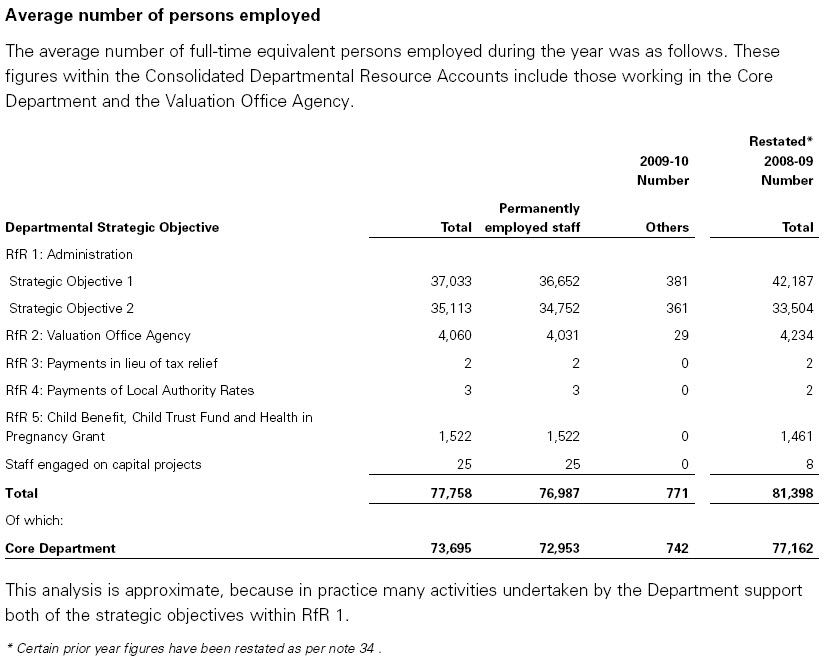

http://www.taxresearch.org.uk/Documents/hmrcstaff.jpg

HMRC Tax Refund Scams 2020 How To Spot A Fake Refund Email Or Text

https://loveincstatic.blob.core.windows.net/lovemoney/Niamh annual tax refund.jpg

https://www.gov.uk/government/publications/income-tax-tax-claim-r38

Web 15 ao 251 t 2014 nbsp 0183 32 Details If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get the

https://www.gov.uk/guidance/claim-back-income-tax-when-youve-stopped...

Web 13 juil 2023 nbsp 0183 32 If you ve left employment and received your last pay before 5 April the previous tax year use form 38 to claim a refund Claim online The quickest way to claim

Screen Shot 2015 12 16 At 07 01 09

Income Tax Refund Hm Revenue Customs Home Pag

P60

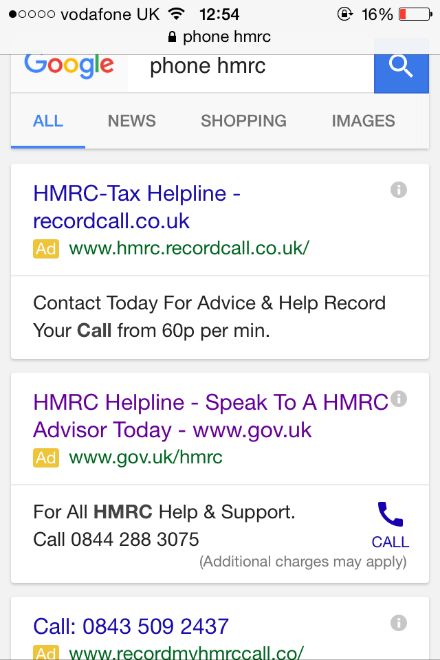

Don t Get Caught Out By Fake HMRC Phone Numbers Low Incomes Tax

Pin On Jamies

What Is A UTR Number And How Do I Get One GoSimpleTax

What Is A UTR Number And How Do I Get One GoSimpleTax

What Is A UTR Number What To Do If I Have Lost My UTR Number DNS

HMRC TAX SCAM If You Get This Surprising refund E mail Do NOT Click

Hmrc Document London Uk January 24th 2019 Hmrc Her Majesty S Revenue

Hmrc Tax Rebate Number - Web Have your National Insurance number with you before you start The Extra Support Team can only help you with questions about PAYE Self Assessment Contact HMRC using