Hmrc Tax Refund Number Ask HMRC s digital assistant to find information about PAYE tax codes claiming a tax refund proof of employment history

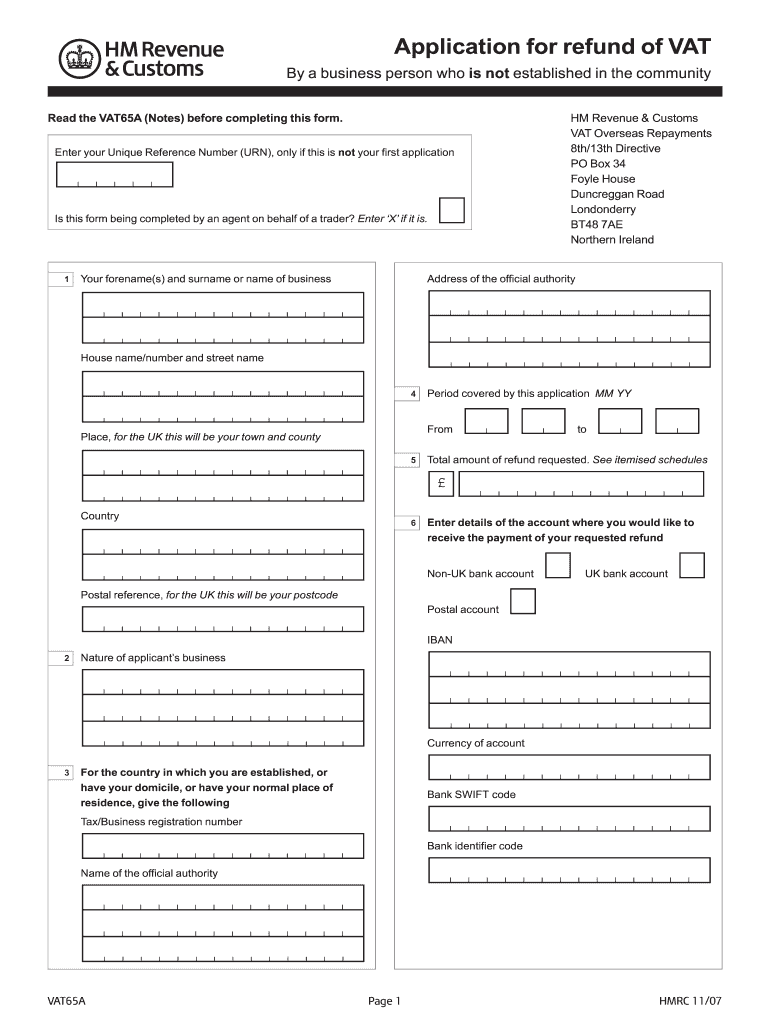

Claim an Income Tax refund by post or nominate someone else to receive the refund on your behalf using form R38 From HM Revenue Customs Published 15 August 2014 Last updated 15 Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601 VAT general enquiries 0300 200 3700 Tax Credits helpline 0345 300 3900

Hmrc Tax Refund Number

Hmrc Tax Refund Number

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-2-e1566379535551.jpg

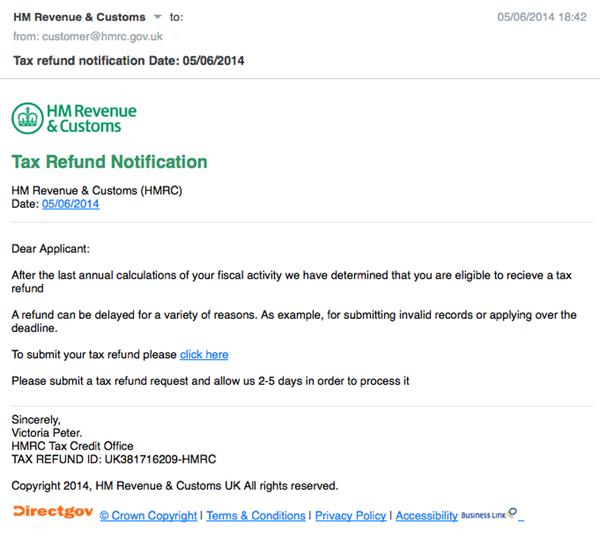

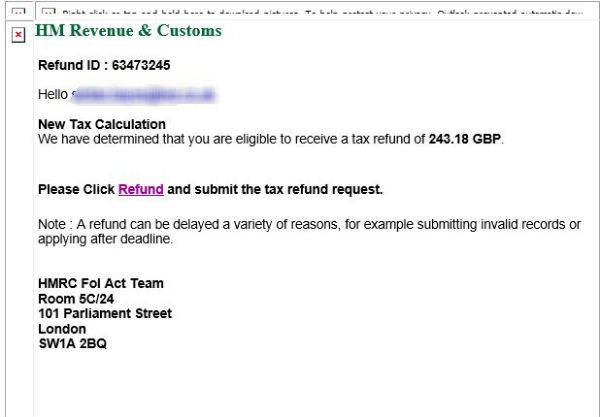

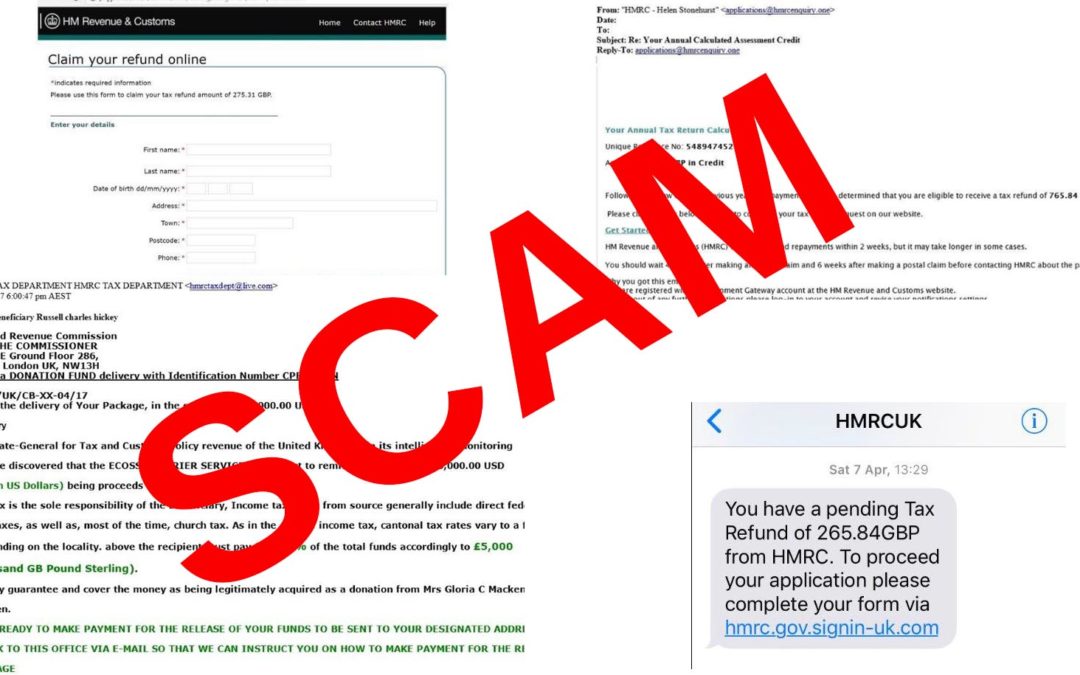

Beware Fake HMRC Tax Refund Notification Emails Graham Cluley

https://grahamcluley.com/wp-content/uploads/2014/06/tax-refund-phishing.jpeg

HMRC EoghannAsa

https://forrestbrown.co.uk/wp-content/uploads/2021/03/Example-HMRC-compliance-check-nudge-letter.png

Contacting the HM Revenue Customs Income Tax Office by phone or in writing The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help you decide how to contact HMRC How do I use the HMRC app to claim a tax refund HMRCgovuk 72 3K subscribers Subscribed 577 166K views 1 year ago HMRC app This video looks at how you can view manage and update

Last updated Wednesday December 13 2023 Here s everything you need to know about HMRC tax refunds In this article What is a tax refund How is your tax obligation calculated What can you get a tax refund on Am I eligible for a tax rebate How to claim your tax rebate How much will I get back When do you get it This guide provides a list of regularly used HMRC contact information It includes telephone numbers and postal addresses together with a number of tips The guide seeks to help direct tax agents to the appropriate point of contact within HMRC

Download Hmrc Tax Refund Number

More picture related to Hmrc Tax Refund Number

Don t Fall For These HMRC Tax Refund Scams

https://cdn.londonbusinessnews.com/wp-content/uploads/2022/11/New-Tax-Collection-Scams.jpg

HMRC Tax Refunds Tax Rebates 3 Options Explained

https://www.ratednearme.com/wp-content/uploads/employee-tax-calculation.jpg

How Long Does It Take To Get A Tax Refund From HMRC UK Salary Tax

https://www.income-tax.co.uk/wp-content/uploads/2023/03/how-long-does-it-take-to-get-a-refund-from-hmrc.jpeg

Five tips for tackling delays 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not in my experience Before you 16 Jan 2024 How to spot HMRC phone text and email tax scams Listen to two real automated messages from fraudsters pretending to be from the HMRC We explain how this voicemail scam works so you can spot it Which Editorial team In this article HMRC scam emails and texts Tax rebate or refund scams Tax email phishing scams

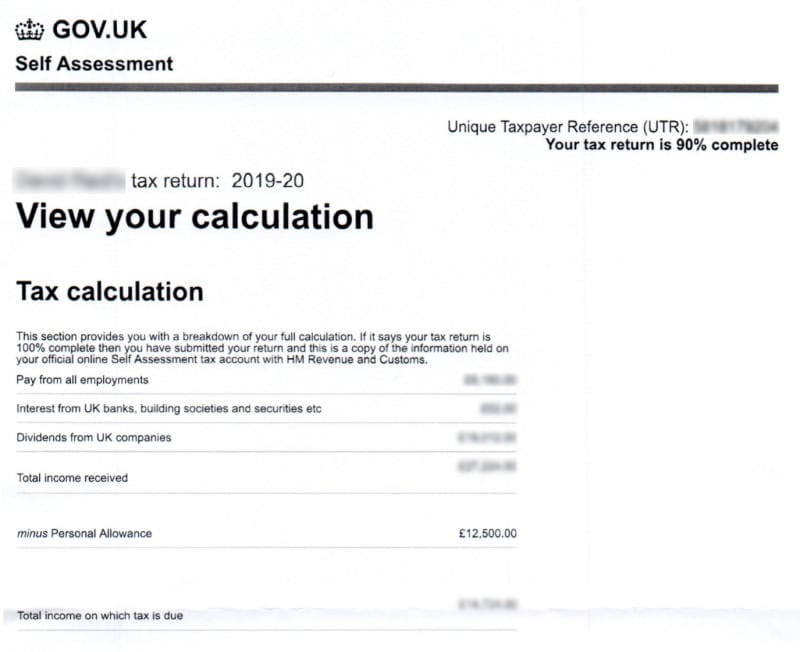

In this guide we ll explore Common reasons why you might be owed a tax refund How to check whether you are owed a tax refund How to claim a tax refund How long you can expect a tax refund to take Common Reasons Why Does HMRC Refund Overpaid Tax Claim a Refund Do You Get an Automatic Refund for Overpaid Tax How Do I Claim Tax Back If I Have Overpaid and It Isn t Refunded What Information Do I Need to Reclaim My Tax Through Self Assessment What s the Deadline for Filing a Self assessment Tax Return

Hmrc Tax Refund Calculator CALCULATORUK GDR

https://i2.wp.com/resources.mynewsdesk.com/image/upload/c_fill,dpr_auto,f_auto,g_auto,q_auto,w_864/wu3khd1ps92oohw3jzn8.jpg

New National Insurance Number Letter Aspiring Training

https://www.aspiringtraining.co.uk/wp-content/uploads/2015/01/HMRC-Tax-code.jpg

https://www.gov.uk/government/organisations/hm...

Ask HMRC s digital assistant to find information about PAYE tax codes claiming a tax refund proof of employment history

https://www.gov.uk/government/publications/income-tax-tax-claim-r38

Claim an Income Tax refund by post or nominate someone else to receive the refund on your behalf using form R38 From HM Revenue Customs Published 15 August 2014 Last updated 15

Why Is My Tax Refund Taking So Long Hmrc DTAXC

Hmrc Tax Refund Calculator CALCULATORUK GDR

HMRC Form Refund Fill Out And Sign Printable PDF Template SignNow

Fake HMRC Tax Refund Notices Scam What You Need To Know Surrey

HMRC Tax Return Get The Information You Need

2019 UK Form SA100Fill Online Printable Fillable Blank PdfFiller

2019 UK Form SA100Fill Online Printable Fillable Blank PdfFiller

HMRC JamilMeryem

How To Fill In A Self assessment Tax Return Which

Hmrc Customs Contact Number

Hmrc Tax Refund Number - Last updated Wednesday December 13 2023 Here s everything you need to know about HMRC tax refunds In this article What is a tax refund How is your tax obligation calculated What can you get a tax refund on Am I eligible for a tax rebate How to claim your tax rebate How much will I get back When do you get it