2024 Federal Heat Pump Rebate For example Richardson says the average homeowner in Denver who installs a heat pump qualifies for an additional 8 000 in incentives 4 500 in rebates from the city 2 200 in rebates from the

Who can claim the credits You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying improvements Homeowners who improve their primary residence will find the most opportunities to claim a credit for qualifying expenses By Liam McCabe Updated August 15 2022 Photo Getty Images The Inflation Reduction Act is packed with provisions to incentivize homeowners to make energy efficiency upgrades to their home

2024 Federal Heat Pump Rebate

2024 Federal Heat Pump Rebate

https://i2.wp.com/constanthomecomfort.com/wp-content/uploads/2022/12/Copy-of-How-do-I-find-a-business-idea.jpg

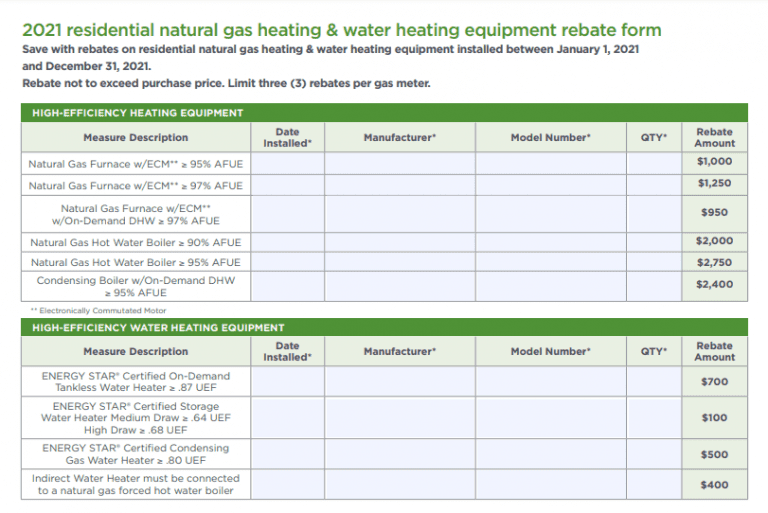

Mass Save PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

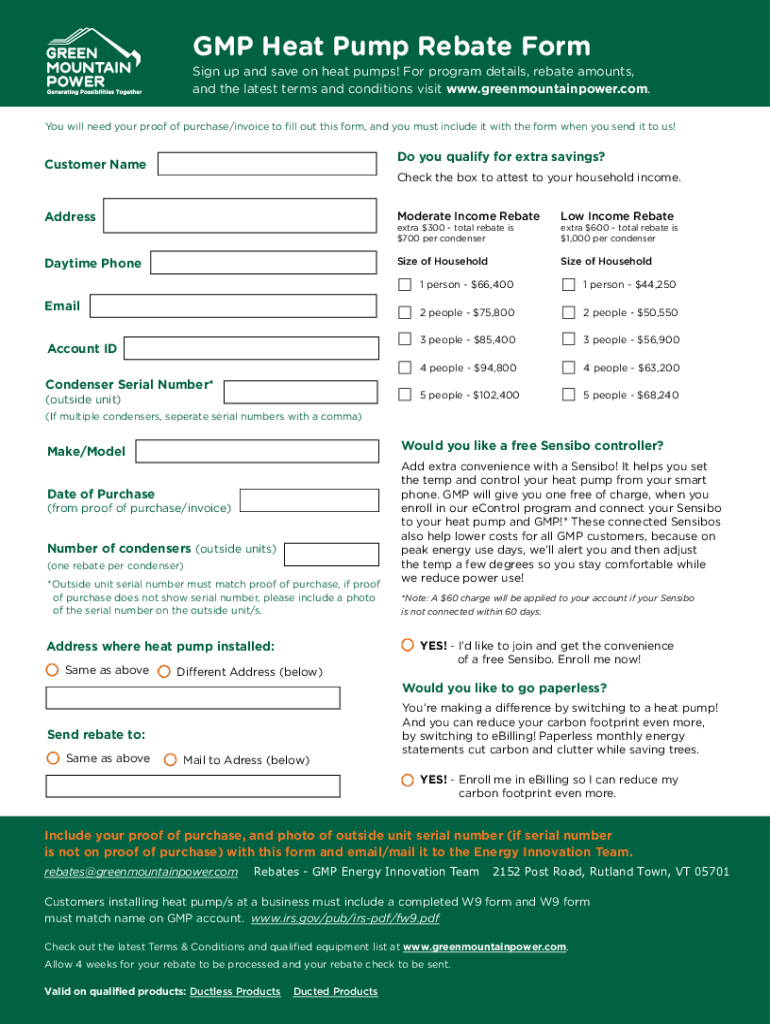

Fillable Online GMP Heat Pump Rebate Form Fax Email Print PdfFiller

https://www.pdffiller.com/preview/652/912/652912720/large.png

The law gives states until August 2024 to start handing out the rebates or lose the funding DOE has just taken the first step in a long process of getting these programs designed and those SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates programs and their top energy savings goals Video courtesy of the U S Department of Energy Latest News

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Download 2024 Federal Heat Pump Rebate

More picture related to 2024 Federal Heat Pump Rebate

Heat Pump Tax Credits And Rebates Now Available For Homeowners Moneywise

https://media1.moneywise.com/a/23311/heat-pump-tax-credit-rebate_facebook_thumb_1200x628_v20220927160351.jpg

Heat Pump Government Grant Or Rebate Aire One

https://aireone.com/wp-content/uploads/2023/06/banner-heat-pump.png

Federal Rebates For Heat Pumps PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/double-the-rebates-for-heat-pumps-capital-regional-district.jpg

Air Source Heat Pump To be eligible for the 30 tax credit an air source heat pump find out the cost of heat pump installation must be purchased and installed between January 1 2023 and December 31 2032 and meet the following criteria SEER2 rating greater than or equal to 16 EER2 rating greater than or equal to 12 Specifically the IRA offers two rebate programs that include money for heat pumps HOMES and HEEHRA The latter is most relevant for apartment dwelling renters it offers up to 14 000 in rebates

The Home Energy Rebates will help American households save money on energy bills upgrade to clean energy equipment improve energy efficiency improve their comfort support a stable power grid and reduce indoor and outdoor air pollution 8 WHAT CAN I DO NOW AS A HOMEOWNER TO PREPARE FOR THE REBATES 9 I M A CONTRACTOR INTERESTED IN DELIVERING HOME ENERGY REBATES TO CUSTOMERS HOW CAN I PREPARE FOR THESE PROGRAMS 10 HOW WILL IMPLEMENTATION OF THE HOME ENERGY REBATES PROGRAMS BE COORDINATED WITH FEDERAL PROGRAMS AND TAX CREDITS 11

Heat Pump Water Heater Rebate Program La Plata Electric Association

https://lpea.coop/sites/default/files/news/ABC.jpg

2023 Residential Air Source Heat Pump Energy Optimization Rebate Form Printable Forms Free Online

https://www.star-supply.com/images/content/Heat_Pump_Rebate.PNG

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For example Richardson says the average homeowner in Denver who installs a heat pump qualifies for an additional 8 000 in incentives 4 500 in rebates from the city 2 200 in rebates from the

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Who can claim the credits You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying improvements Homeowners who improve their primary residence will find the most opportunities to claim a credit for qualifying expenses

Federal Rebates For Heat Pumps HERETAB

Heat Pump Water Heater Rebate Program La Plata Electric Association

Green Mountain Power Heat Pump Rebate PumpRebate

Geothermal Ground Source Heat Pump Factory BLUEWAY PumpRebate

How To Take Advantage Of New Federal Heat Pump Rebates Service Champions Plumbing Heating AC

Federal Rebates For Heat Pumps Save Money And Energy USRebate

Federal Rebates For Heat Pumps Save Money And Energy USRebate

Jump On A New Heat Pump CleanBC Heat Pump Rebate Program YouTube

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

Are There Any Federal Rebates For Heat Pump PumpRebate

2024 Federal Heat Pump Rebate - SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates programs and their top energy savings goals Video courtesy of the U S Department of Energy Latest News