Hmrc Tax Refund Contact Number Uk Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

Details You can use this form to claim a refund if you ve overpaid tax nominate someone else to get the payment on your behalf You may be able to claim online There are also other Income Contacting the HM Revenue Customs Income Tax Office by phone or in writing The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain

Hmrc Tax Refund Contact Number Uk

Hmrc Tax Refund Contact Number Uk

https://www.whyattaccountancy.com/wp-content/uploads/2022/01/HMRC-tax-return.jpg

How Long To Get My Tax Refund From HMRC Swift Refunds

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-2-e1566379535551.jpg

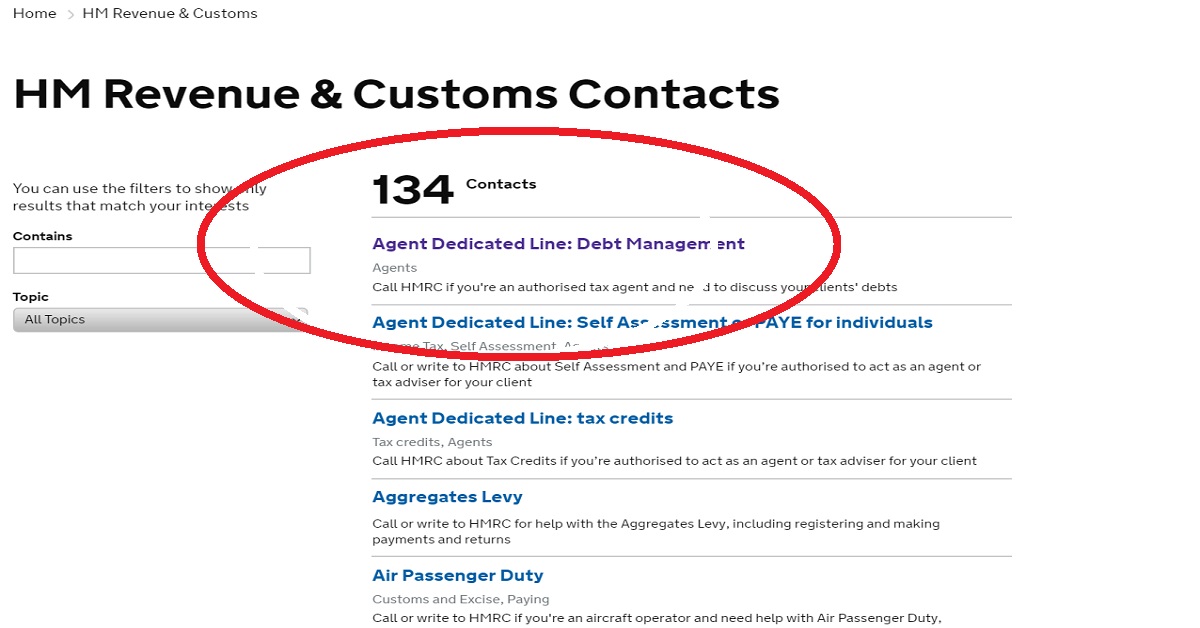

HMRC Customer Service Contact Numbers Tax Helpline 0300 200 3300

https://customerservicecontactnumber.uk/wp-content/uploads/2016/08/HMRC.jpg

If you believe you have overpaid tax and don t receive a P800 you can initiate the refund process by contacting HMRC directly This can be done either by phone or online through the By Kate Morgan Last updated Wednesday December 13 2023 Here s everything you need to know about HMRC tax refunds In this article What is a tax refund How is your tax obligation calculated What can you get a tax refund on Am I eligible for a tax rebate How to claim your tax rebate How much will I get back When

Here are some of the different numbers for the departments you might need to speak to Self Assessment helpline 0300 200 3310 Child Benefits helpline 0300 200 3100 Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Ways to reach a tax agent for disputed payments undeclared income and debt Rob White 21 April 2024 6 00am The main ways to get in touch with HMRC are by phone or post Credit Alphotographic

Download Hmrc Tax Refund Contact Number Uk

More picture related to Hmrc Tax Refund Contact Number Uk

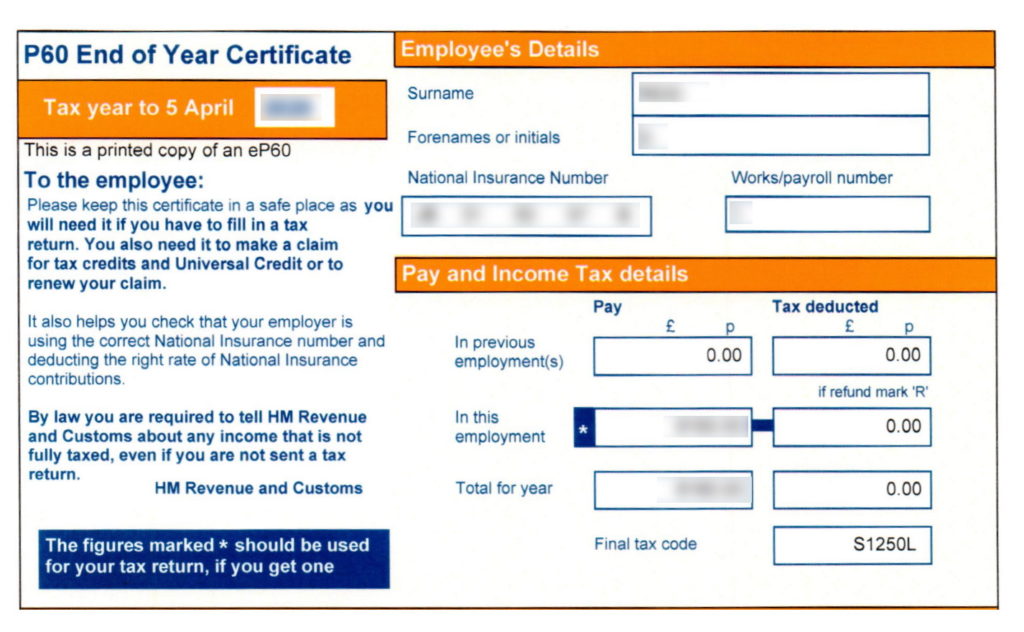

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

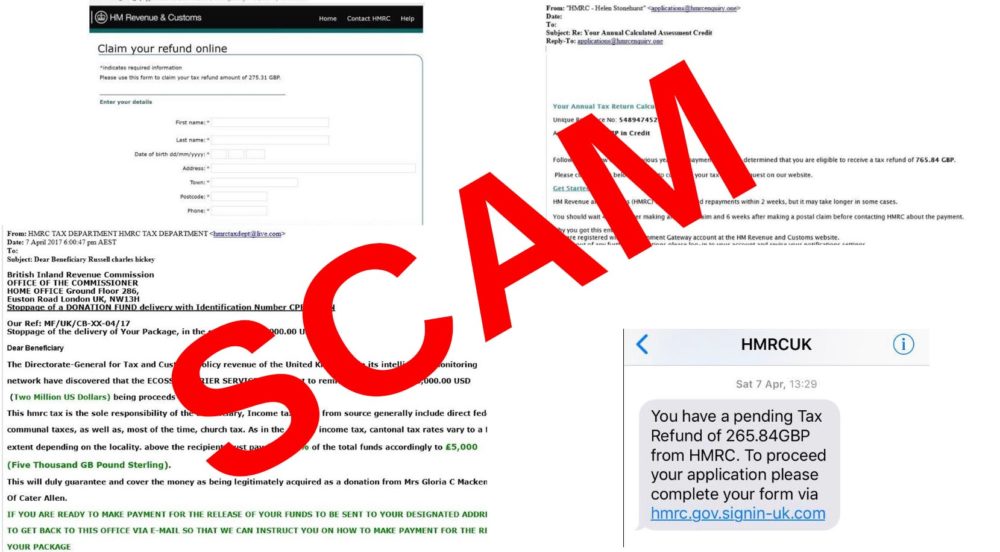

Beware Fake HMRC Tax Refund Notification Emails Graham Cluley

https://grahamcluley.com/wp-content/uploads/2014/06/tax-refund-phishing.jpeg

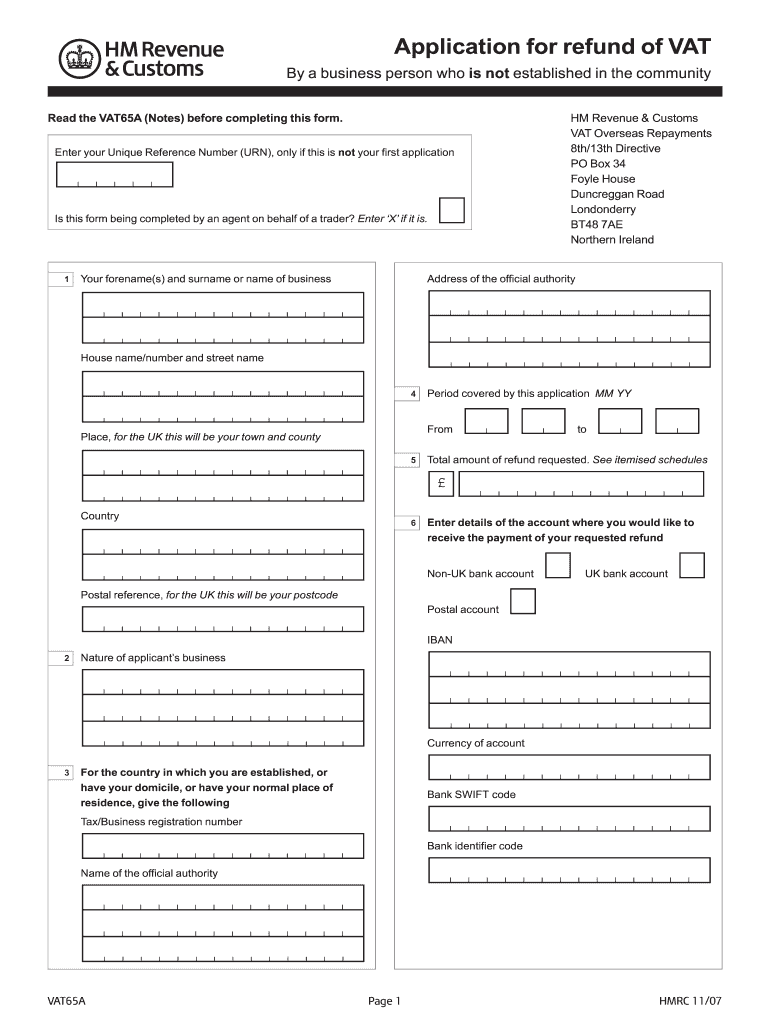

Hmrc Tax Return Self Assessment Form PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/09/HMRC-Tax-Rebate-Form-768x731.png

Resources Tax administration HMRC contact information Back to top This guide provides a list of regularly used HMRC contact information It includes telephone numbers and postal addresses together with a number of tips The guide seeks to help direct tax agents to the appropriate point of contact within HMRC Five tips for tackling delays 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not in my experience Before you

Overview HMRC have various channels you can use to contact them about tax credits including digital webchat telephone and post The main contact details are available on the GOV UK website There are also options to contact them using the HMRC App and X formerly Twitter In most cases HMRC will calculate that you have paid too much tax and it will send you a tax calculation letter known as a P800 or Simple Assessment letter Only employed workers or

2017 Form UK HMRC APSS255 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/454/115/454115474/large.png

New National Insurance Number Letter Aspiring Training

https://www.aspiringtraining.co.uk/wp-content/uploads/2015/01/HMRC-Tax-code.jpg

https://www.gov.uk/government/organisations/hm...

Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

https://www.gov.uk/government/publications/income-tax-tax-claim-r38

Details You can use this form to claim a refund if you ve overpaid tax nominate someone else to get the payment on your behalf You may be able to claim online There are also other Income

Hmrc Tax Refund Address Contact Number Of Hmrc Tax Refund

2017 Form UK HMRC APSS255 Fill Online Printable Fillable Blank

HMRC Tax Refunds Tax Rebates 3 Options Explained

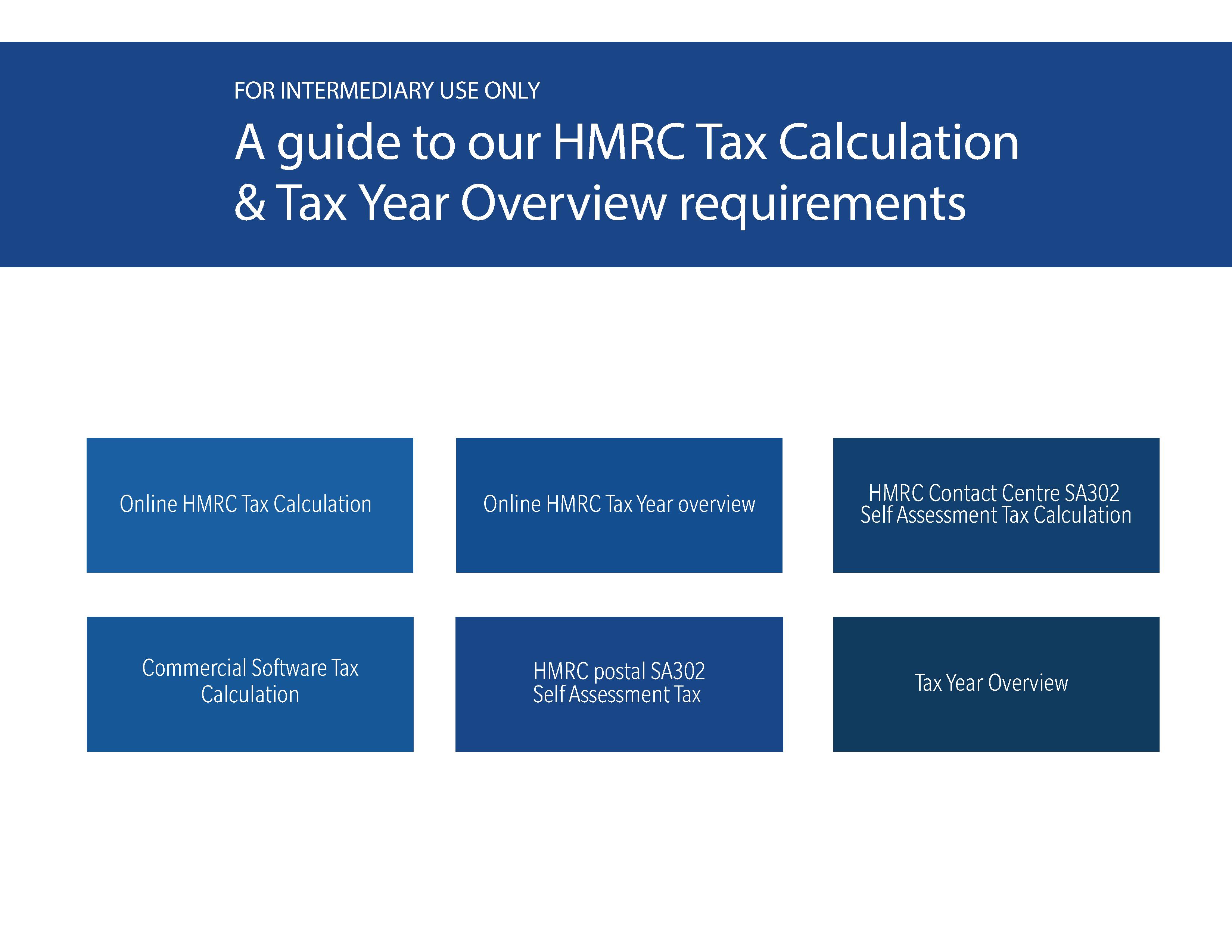

A Guide To Our HMRC Tax Calculation Tax Year Overview Requirements

HMRC Refund Scams Must Read Guidelines And Reminder

HMRC R D Compliance Check Eligibility Nudge Letters

HMRC R D Compliance Check Eligibility Nudge Letters

HMRC Form Refund Fill Out And Sign Printable PDF Template SignNow

UK Payroll Tax Calendar 2022 2023 Shape Payroll

HMRC Customer Service Contact Numbers Tax Helpline 0845 697 0288

Hmrc Tax Refund Contact Number Uk - 13 Jul 2022 Think you re owed a tax refund Here s how to get 100 of your rebate Claiming back overpaid tax should be easy enough to do yourself directly through HMRC Matthew Jenkin Senior writer If you think you ve paid too much tax over the course of a financial year then you may be eligible for a rebate