Hmrc Tax Relief For Charitable Donations If you re claiming tax relief on donations of 10 000 or more you also need to tell HMRC the date you made the donation who you made the donation to If you get Married Couple s Allowance

How to claim Corporation Tax relief when your limited company donates money land property or shares to charity Tax relief on charity donations can occur through schemes like Gift Aid Payroll Giving or when gifted in a will The information in this guide also explains where tax relief goes after donating to a charity

Hmrc Tax Relief For Charitable Donations

Hmrc Tax Relief For Charitable Donations

https://www.blunt4reigate.com/sites/www.blunt4reigate.com/files/2020-04/charitable-donations-1.jpg

Reasons Why We Donate To Charity And Non profit Zonaltra

https://zonaltrabajoandahuaylas.com/wp-content/uploads/2020/02/Charity-donations-scaled.jpg

:max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif)

Tax Deductions For Charitable Donations

https://www.thebalancemoney.com/thmb/Iv3JmDfVlOYV3g14ZuockNA4g9o=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif

If you pay UK tax and donate to charity Gift Aid means the charity gets more And if you re a higher or additional rate taxpayer you can claim extra tax relief on the donation This MoneysavingExpert guide takes you through how it works A number of tax incentives for giving to charity are made available to incentivise taxpayers to donate Gift Aid being the most commonly used income tax relief This article considers the various options available and the associated tax savings

In the case of a donor making a charitable donation of 100 the charity will receive the donation of 100 and because the donation is deemed to have been paid under the deduction of basic rate income tax the charity can Unless you are donating to charity through a workplace scheme you can claim your tax relief by filling out a self assessment tax return where you can declare your charitable income and reclaim any tax relief you are owed

Download Hmrc Tax Relief For Charitable Donations

More picture related to Hmrc Tax Relief For Charitable Donations

EPayMe If You Work From Home Then You May Be Eligible To Claim HMRC

https://www.epayme.co.uk/wp-content/uploads/2021/05/hmrc-blog-image.png

Give A Donation Craigieburn Trails

https://www.craigieburntrails.org.nz/wp-content/uploads/2015/04/donations-giving-donate-charity-FinanceFox.jpg

The Complete Charitable Deductions Tax Guide 2023 Updated

https://daffy.ghost.io/content/images/size/w2000/2022/05/Daffy-Donor-advised-funds-Tax-Deductions-2022-2.png

Your donation is taken from money you have earned after tax The charity can then claim back 20 of the amount of the donation from before tax was deducted from HMRC This gives a little extra to the charity from the government so if you want to maximise your donations this is the method to use Donations made by a UK individual will be treated as if they are made net of 20 basic rate tax Charities will reclaim the 20 tax from HMRC Gift aid also applies where gifts are made to a Community Amateur Sports Clubs CASC

The tax relief you get depends on the rate of tax you pay To donate 1 you pay 80p if you re a basic rate taxpayer 60p if you re a higher rate taxpayer 55p if you re an additional rate Tax reliefs are available for the donor in respect of certain donations to charity including the gift of money the gift of an asset eg land shares the gift of stock or plant and machinery used in a trade and a bequest to a charity in a will Tax reliefs are available to prevent a tax liability arising for the charity

Donation Tax Deductions The Benefits Of Giving Zoe Financial

https://zoefin.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-30-at-12.18.51-AM.png

Tips On Tax Deductions For Donations

https://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

https://www.gov.uk/donating-to-charity/gift-aid

If you re claiming tax relief on donations of 10 000 or more you also need to tell HMRC the date you made the donation who you made the donation to If you get Married Couple s Allowance

https://www.gov.uk/tax-limited-company-gives-to-charity

How to claim Corporation Tax relief when your limited company donates money land property or shares to charity

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

Donation Tax Deductions The Benefits Of Giving Zoe Financial

Free Tax Donation Form Template Addictionary Tax Deductible Donation

How To Ensure You Get Tax Relief On Charitable Donations

Charitable Deductions For 2020

Tax Relief On Donations To Charity Part 1 YouTube

Tax Relief On Donations To Charity Part 1 YouTube

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

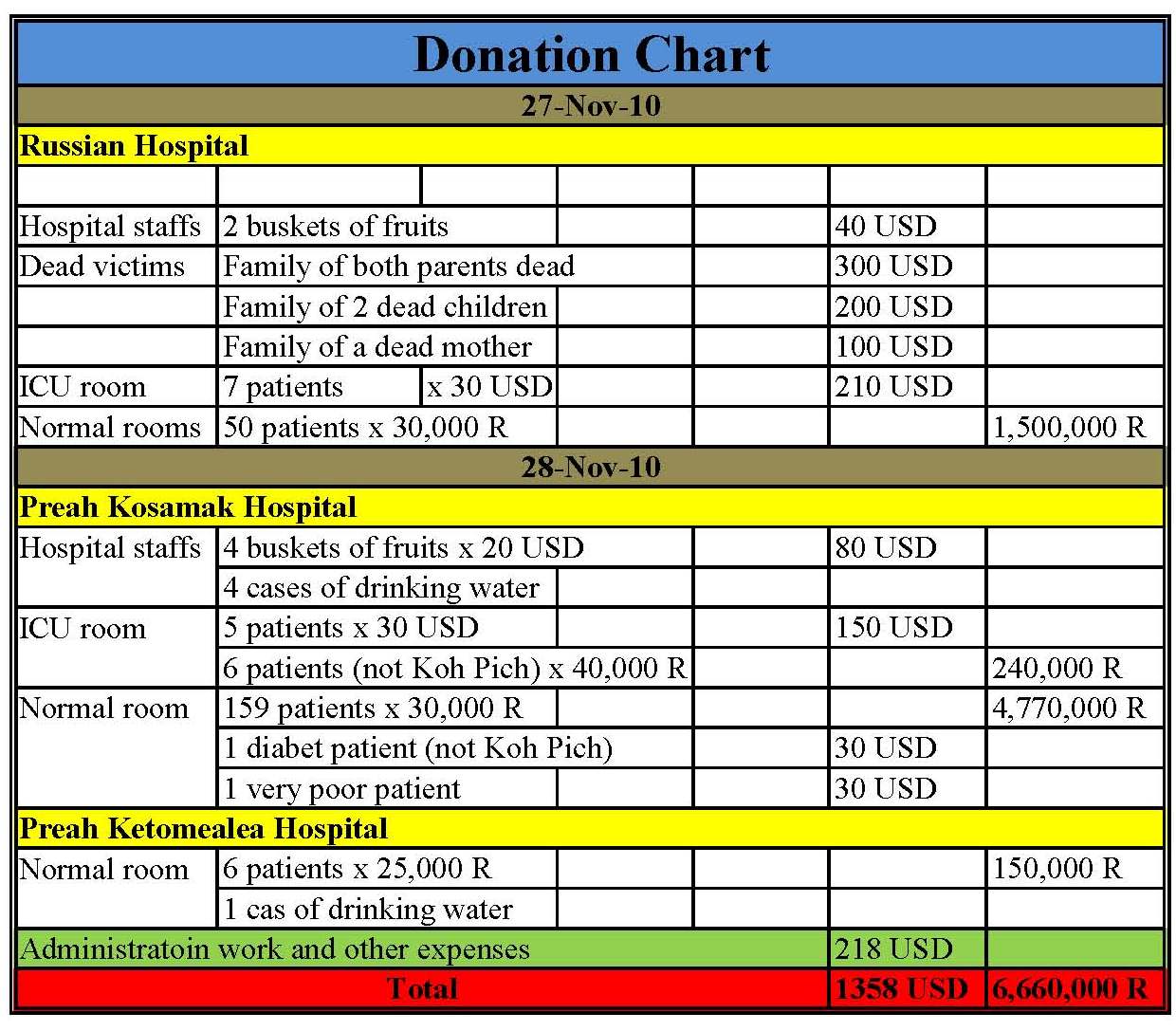

Donation Chart Template

How To Get Tax Relief For Charitable Donations

Hmrc Tax Relief For Charitable Donations - For each 1 donated the charity can claim 25p from HMRC at no extra cost to the donor which increases the amount available for use by the charity Higher rate and additional rate taxpayers can also personally claim income tax relief on the amounts donated to charity