Hmrc Tax Return Dates Deadlines Send your tax return by the deadline You must tell HMRC by 5 October if you need to complete a tax return and you have not sent one before You could be fined if you do not

Refunds appeals and penalties Check how to claim a tax refund Disagree with a tax decision Estimate your penalty for late Self Assessment tax returns and payments HMRC must have received your tax return by midnight Usually the only time this deadline may differ is if you received a notice to make an online tax return from HMRC after 31 October 2023 in which case you have three months from the

Hmrc Tax Return Dates

Hmrc Tax Return Dates

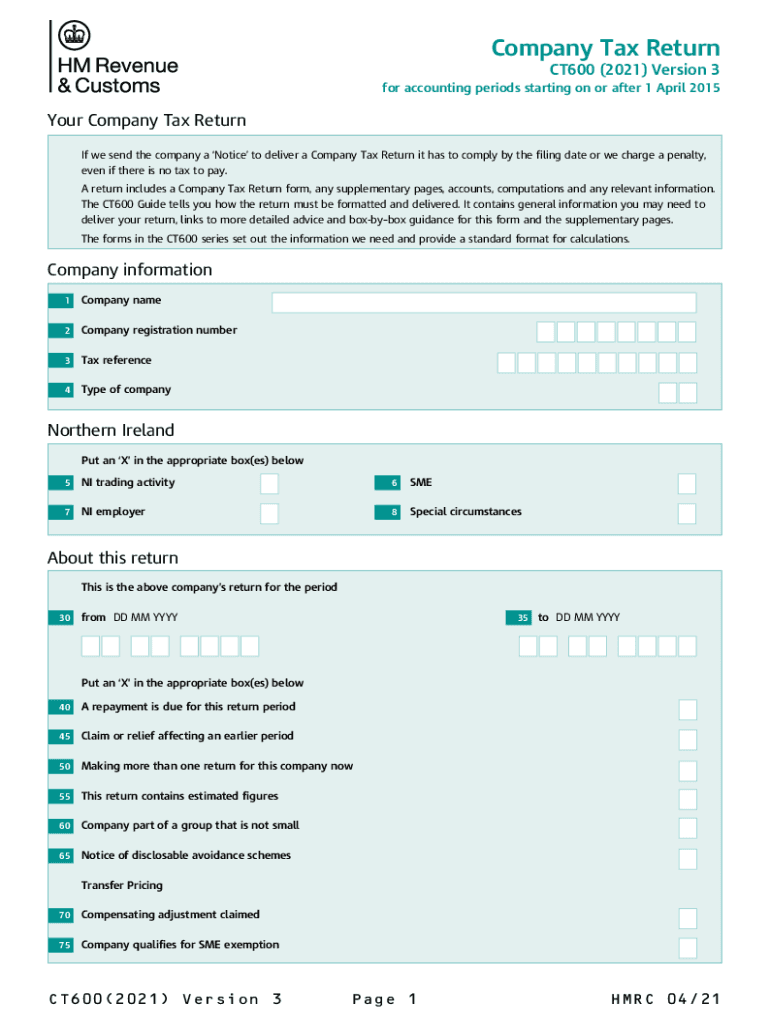

https://www.signnow.com/preview/560/820/560820246/large.png

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

https://www.depledgeswm.com/wp-content/uploads/2018/04/HMRC-scaled.jpeg

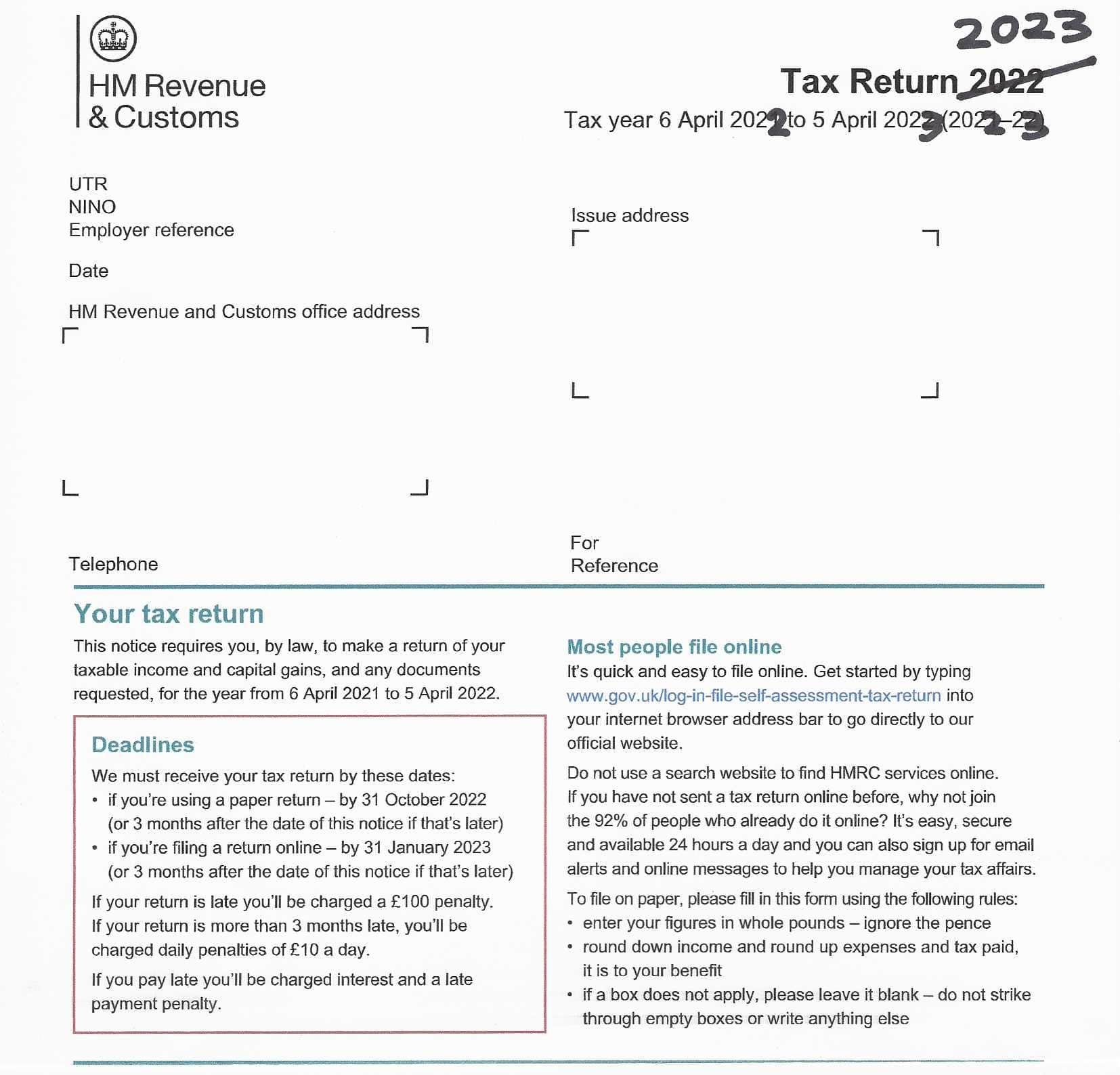

Trying To Locate The 2023 HMRC Paper Tax Return Form Online

https://taxhelp.uk.com/wp-content/uploads/Where-is-the-2023-HMRC-SA100-Tax-Return-Form-m.jpg

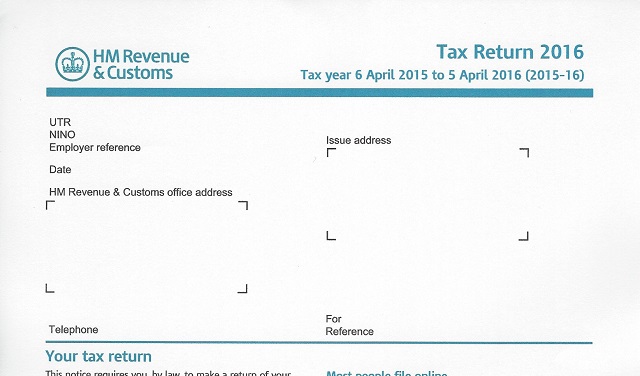

Tax year 6 April 2021 to 5 April 2022 2021 22 Help with filling in your tax return These notes will help you fill in your paper Short Tax Return Alternatively why not send us your You can submit your Self Assessment tax return for this period between 6 April 2023 until 31 January 2024 The deadline for paper tax returns is 31 October 2023 You must have registered

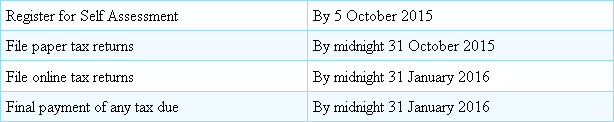

We must receive your tax return by these dates if you re using a paper return by 31 October 2019 or 3 months after the date of this notice if that s later if you re filing a The official deadline for completing a return is 31 January after which a 100 late filing penalty would be automatically imposed HMRC said the deadline to file a return and pay any due

Download Hmrc Tax Return Dates

More picture related to Hmrc Tax Return Dates

Beware Of Incorrect HMRC Tax Code Notices Rosslyn Associates

https://www.rosslynassociates.co.uk/wp-content/uploads/2018/04/HMRC-mistakes-2.jpg

Stock Photo HMRC Tax Return Paul Maguire

https://paulmaguirephoto.com/wp-content/uploads/2020/07/c40910-1024x683.jpg

Hmrc Tax Return Self Assessment Form PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/09/HMRC-Tax-Rebate-Form-768x731.png

You have until 11 59pm on Wednesday 31 January 2024 to send HMRC an online tax return for the 2022 2023 tax year which ended on 5 April 2023 The same deadline also applies to those who need to make payments towards their tax bill The deadline is 31 January 2024 and if you miss it you face a fine But it s not just self employed people who need to file a tax return Here we explain everything you need to know HMRC

Last updated 4 Jan 2024 The UK tax year for individuals starts and ends in April After that you ll have 7 to 10 months to prepare your tax return Never miss a tax deadline Get tax deadline reminders straight in your calendar And all you need is a Gmail account Download now UK tax year dates You can submit your Self Assessment tax return for the 23 24 tax year from 6th April 2024 onwards Is it better to submit my tax return early Completing and submitting your Self Assessment tax return early has several advantages over waiting to do it later You re more likely to receive your tax refund sooner

HMRC No Longer Fining 100 For Late Tax Returns Market Business News

http://marketbusinessnews.com/wp-content/uploads/2015/02/HMRC.jpg

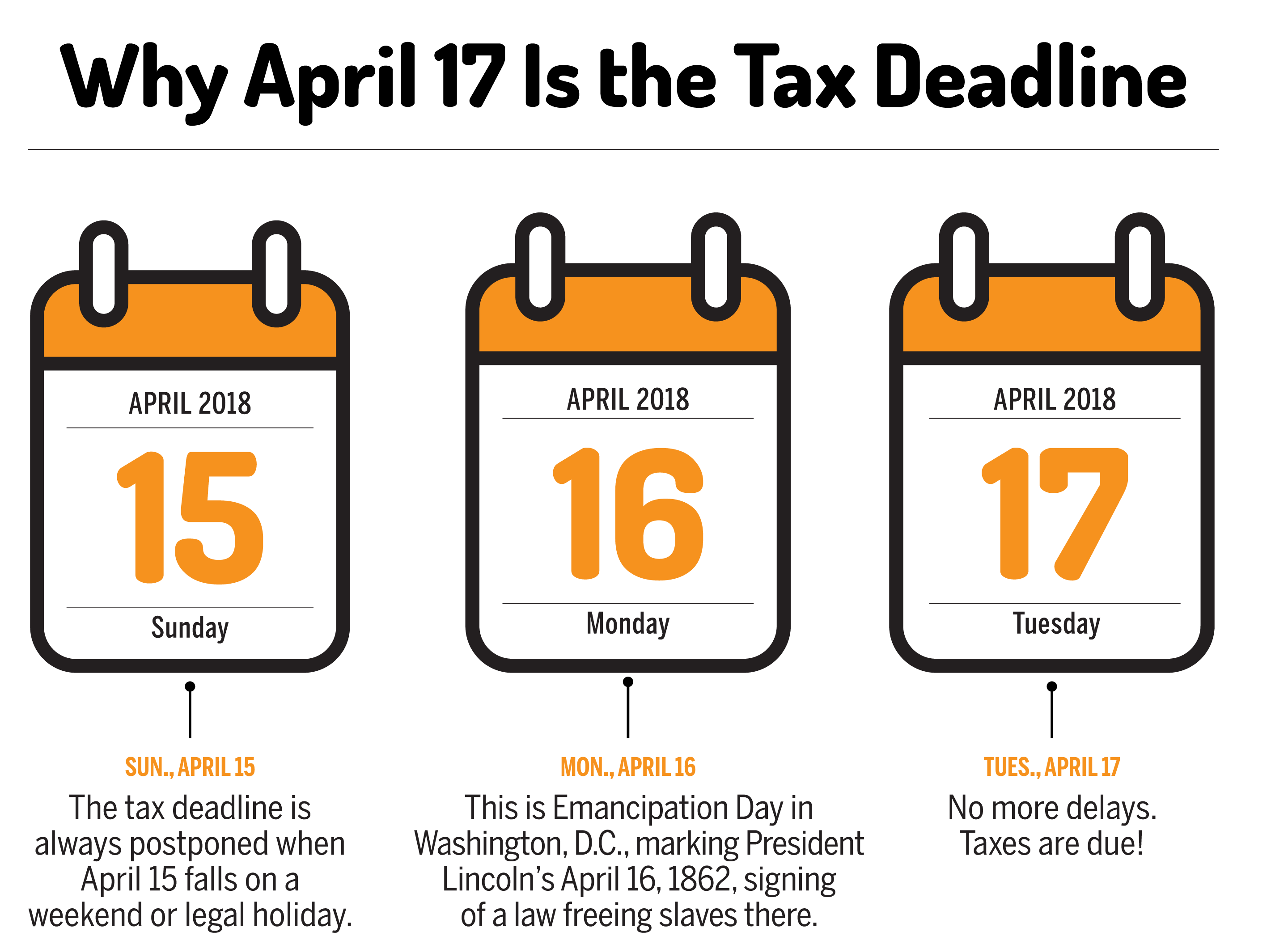

When Are Taxes Due In 2018 Not April 15 Money

https://content.money.com/wp-content/uploads/2018/01/tax-calendar-2018-updated.png?quality=60

https://www. gov.uk /self-assessment-tax-returns

Deadlines Send your tax return by the deadline You must tell HMRC by 5 October if you need to complete a tax return and you have not sent one before You could be fined if you do not

https://www. gov.uk /browse/tax/self-assessment

Refunds appeals and penalties Check how to claim a tax refund Disagree with a tax decision Estimate your penalty for late Self Assessment tax returns and payments

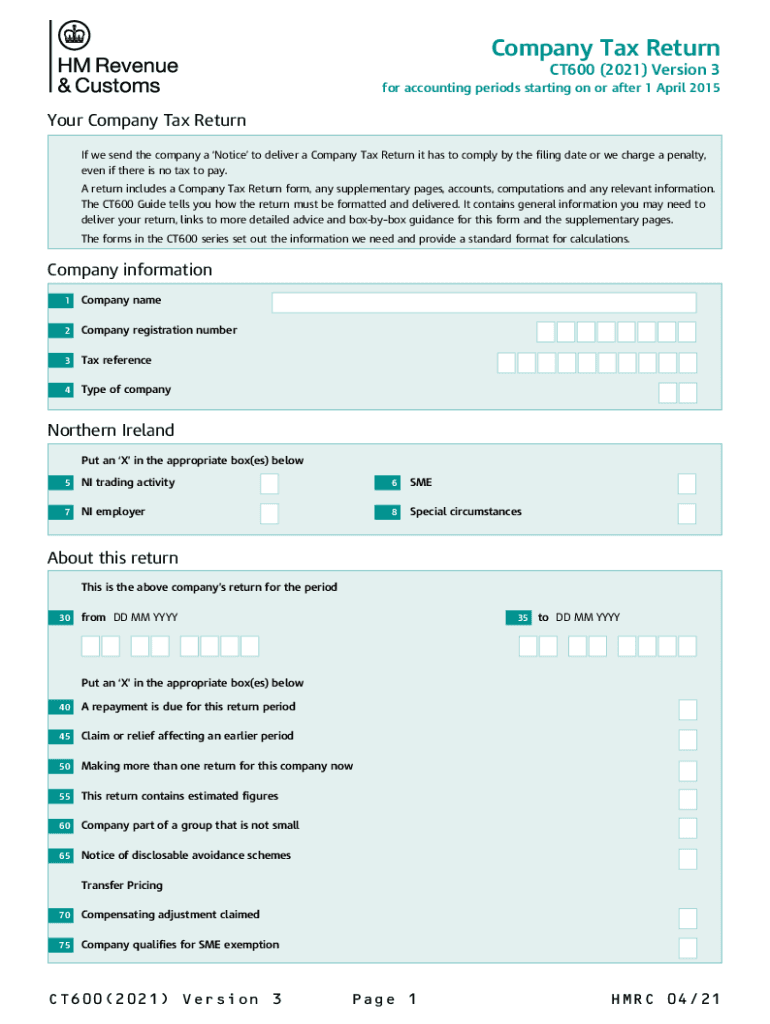

2016 HMRC Tax Return Form

HMRC No Longer Fining 100 For Late Tax Returns Market Business News

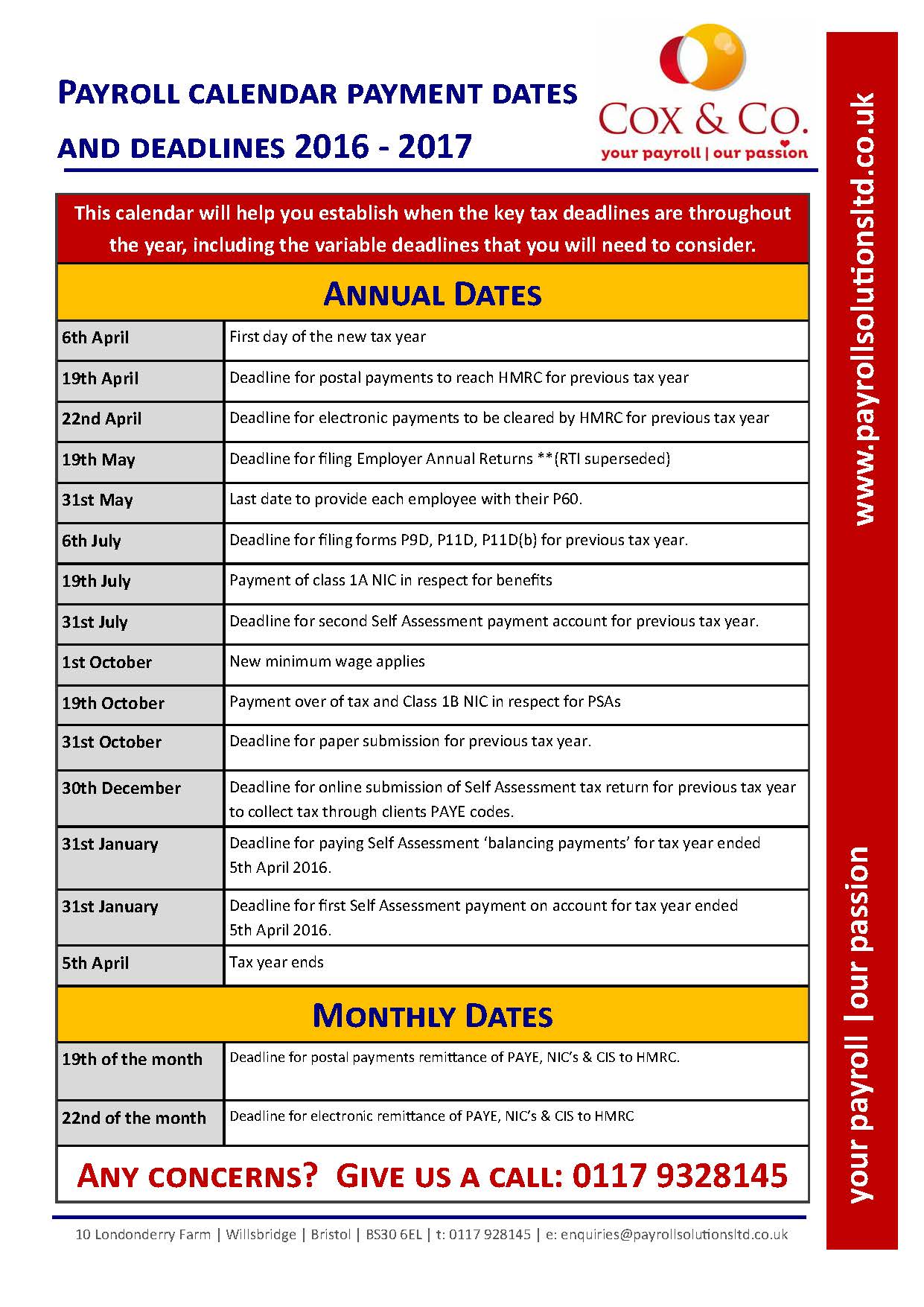

Payroll Calendar HMRC Tax Dates And Deadlines 2016 2017

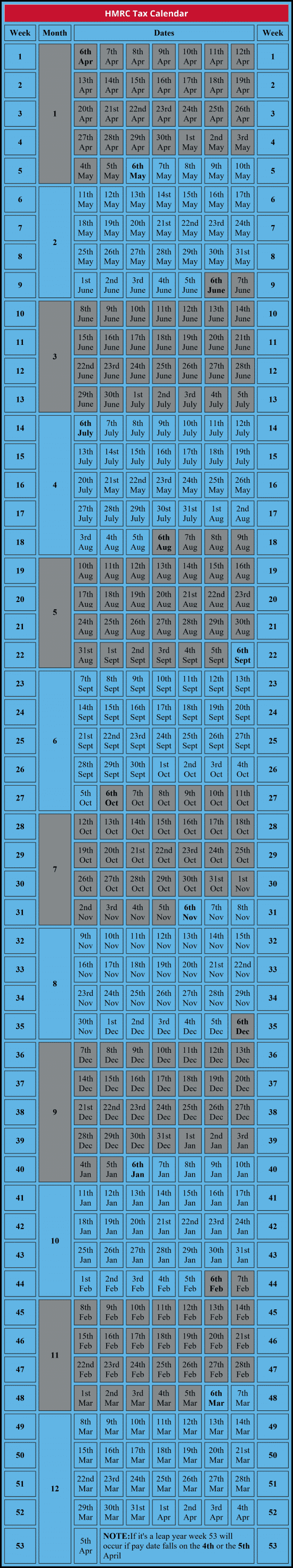

Pay Dates And The HMRC Tax Calendar Knowledge Base

How To Print Your SA302 Or Tax Year Overview From HMRC Love

HMRC A HMRC Tax Return Calculator And A Pen Like Much Of Flickr

HMRC A HMRC Tax Return Calculator And A Pen Like Much Of Flickr

Avoid Significant HMRC Penalties File Your Tax Return On Time The

How To Obtain Your Tax Calculations And Tax Year Overviews

Dates For The Tax Year Free Calendar Download Money Donut

Hmrc Tax Return Dates - The tax return deadline for the 2021 to 2022 tax year is 31 October 2022 for those completed on paper forms and 31 January 2023 for online returns HMRC is encouraging customers to plan