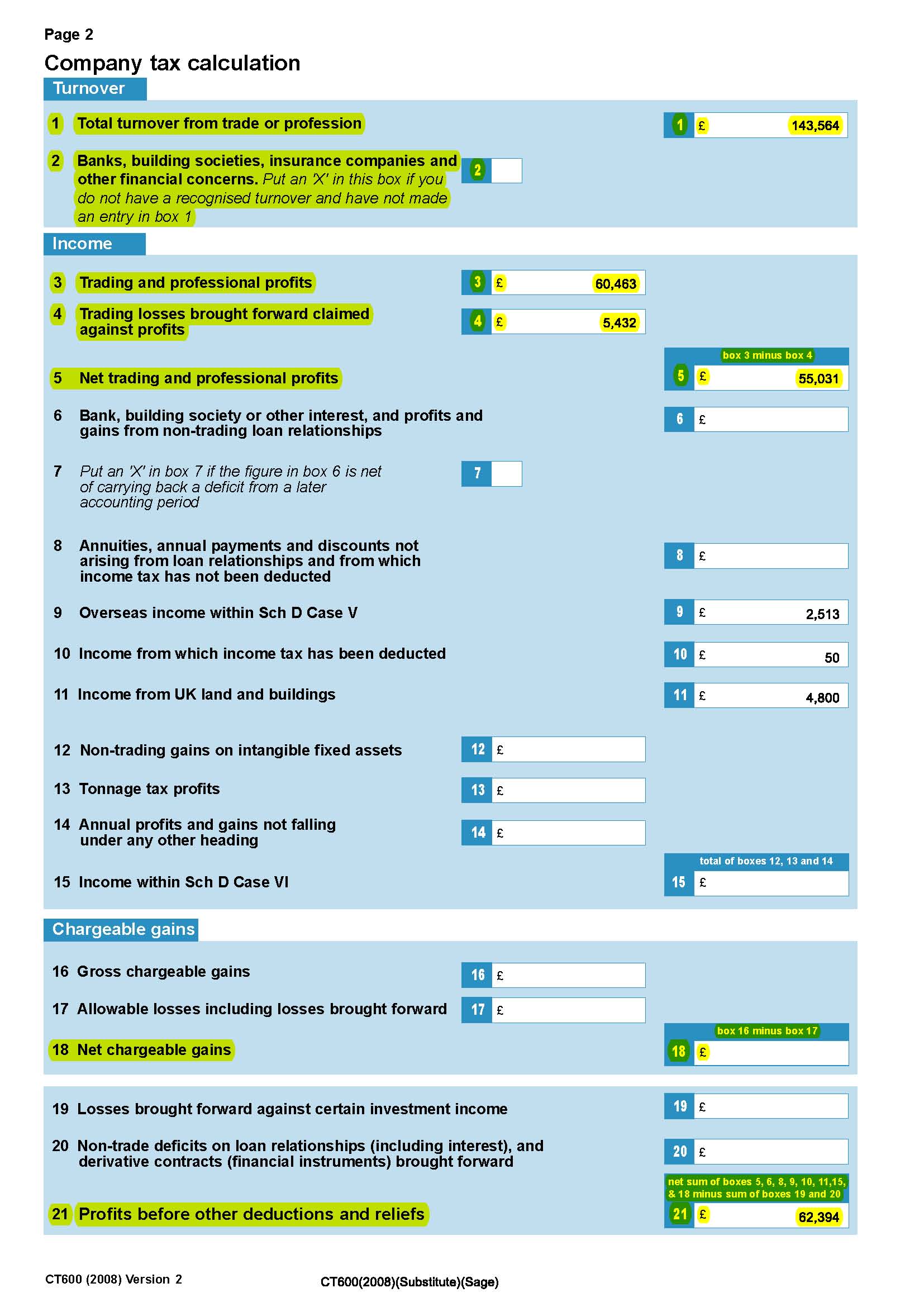

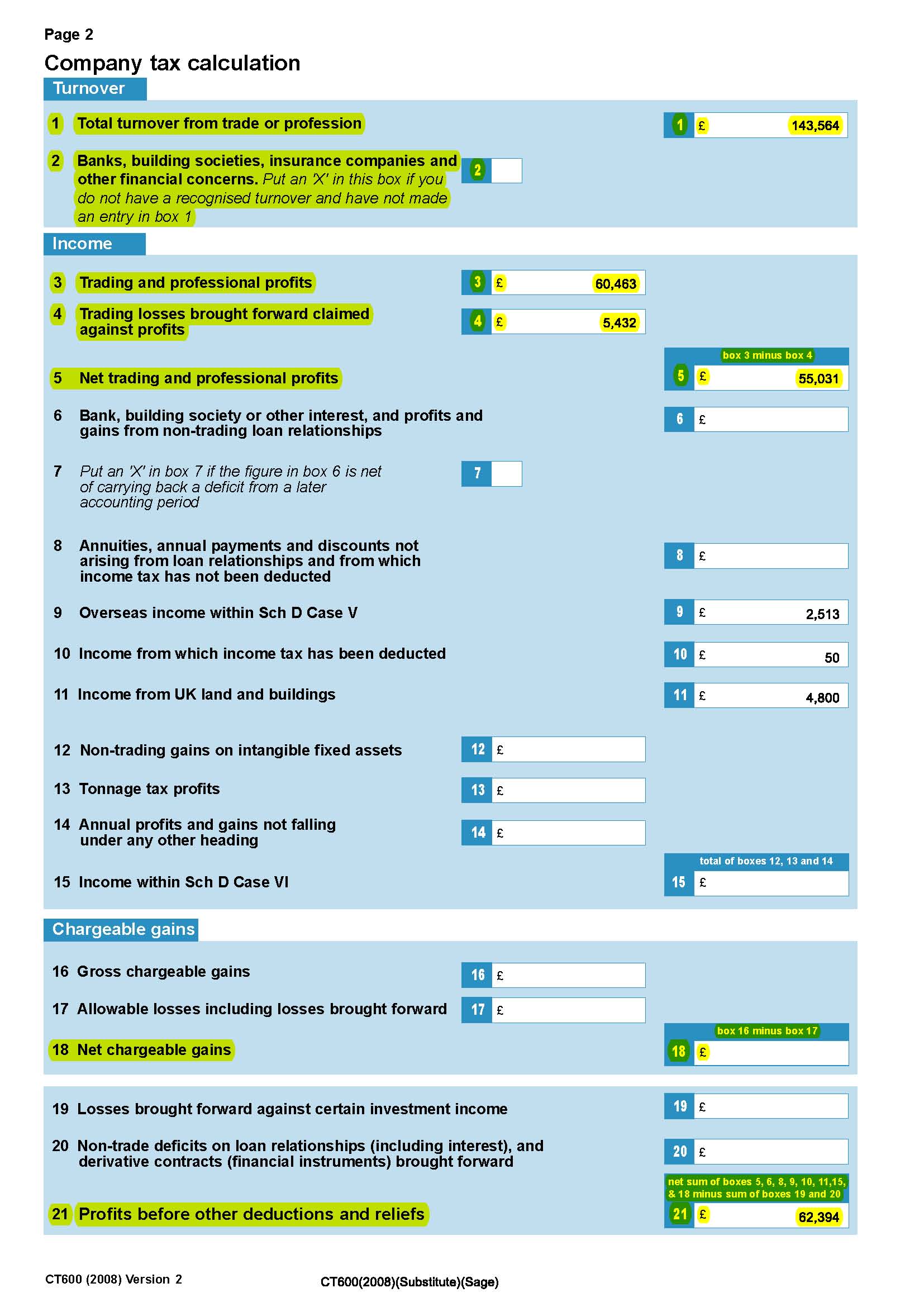

Hmrc Company Tax Return Deadline You need your accounts and tax return to meet deadlines for filing with Companies House and HM Revenue and Customs HMRC You can also use them to work out how much Corporation Tax to pay

When to submit a Company Tax Return The deadline for your return is 12 months after the end of the accounting period it covers The Company Taxation Manual CTM93030 filing date The tax return deadline for the 2021 to 2022 tax year is 31 October 2022 for those completed on paper forms and 31 January 2023 for online returns HMRC is encouraging customers to plan ahead to

Hmrc Company Tax Return Deadline

Hmrc Company Tax Return Deadline

https://www.datatracks.com/wp-content/uploads/2021/12/Company-Tax-Return-CT600.jpg

Tax Return Deadline How To Submit Your HMRC Self assessment Who Has

https://i.inews.co.uk/content/uploads/2021/01/PRI_178979538-1.jpg

TTT Your 2023 Tax Deadlines The Mad Accountant

https://themadaccountant.com/wp-content/uploads/2023/01/TTT_2023_01_05_Deadlines_V2.png

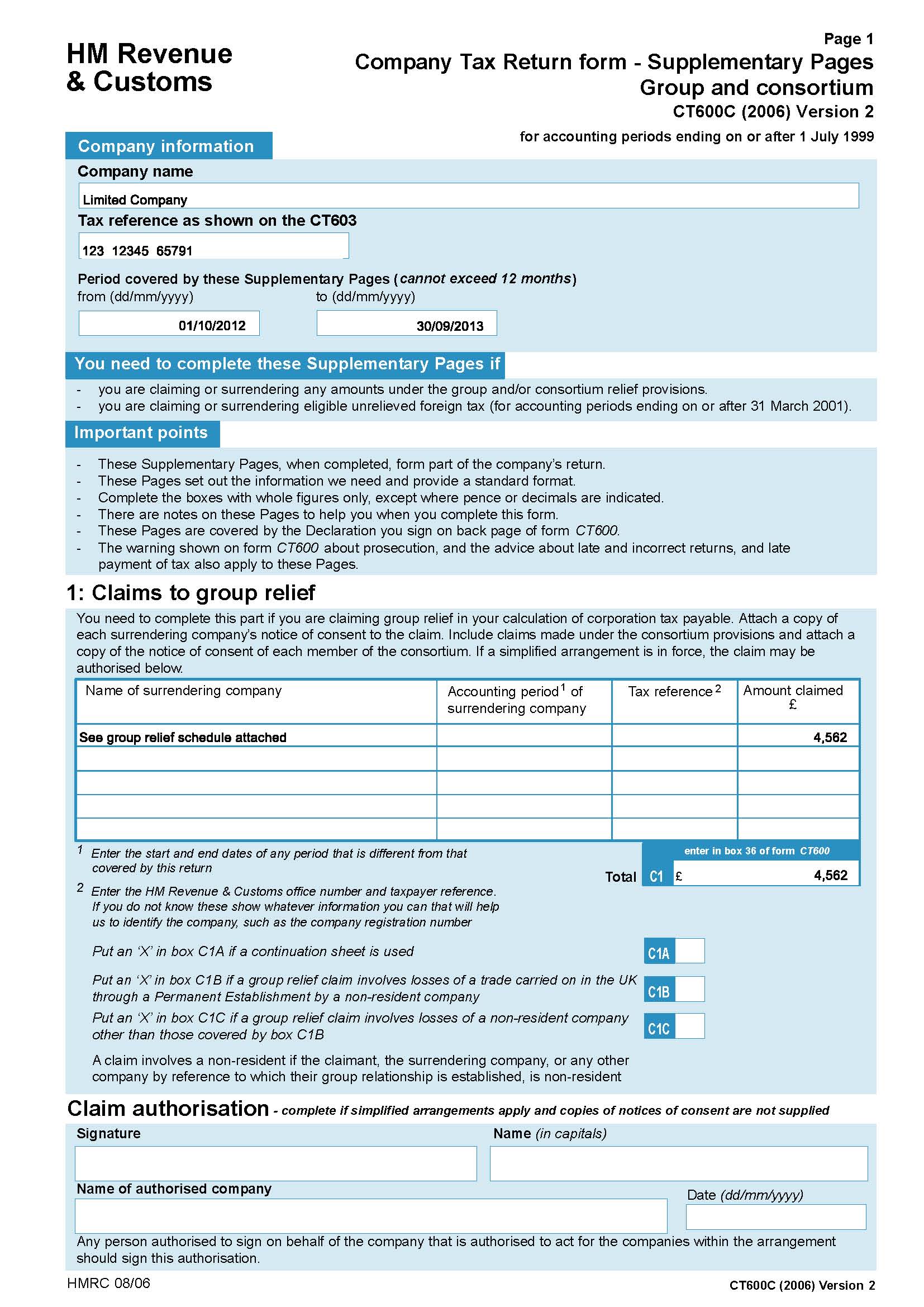

A Company Tax Return usually has to be delivered no later than 12 months after the end of the accounting period If the company delivers its Company Tax Return late it may be subject to a penalty An overview of deadlines for filing your Company Tax Return Company Tax Return CT600 2021 Version 3 for accounting periods starting on or after 1 April 2015 Your Company Tax Return If we send the company a Notice to deliver a Company Tax Return

Published 22 October 2021 HM Revenue and Customs HMRC is reminding Self Assessment customers that on Sunday 24 October they have one week left to submit paper tax returns and 100 days to Every company will have an accounting reference date The deadline for filing your accounts will be calculated from this date For new companies it will be the anniversary of the last day in the month the company was incorporated For existing companies it will be the anniversary of the day after the previous financial year ended

Download Hmrc Company Tax Return Deadline

More picture related to Hmrc Company Tax Return Deadline

How To Pay Your Self assessment Tax Return HMRC Deadline Payment

https://wp.inews.co.uk/wp-content/uploads/2023/01/GettyImages-1022813134-4.jpg?crop=0px%2C44px%2C2233px%2C1260px&resize=1200%2C675

2023 Tax Deadline Important Extension Filing Dates Incite Tax

https://incitetax.com/wp-content/uploads/2023/01/2023-tax-deadline.jpg

HMRC Rejects Calls To Relax Tax Return Deadline AccountingWEB

https://www.accountingweb.co.uk/sites/default/files/istock-181853961_0.jpg

More than 10 2 million people filed a 2020 to 2021 self assessment tax return by 31st January 2022 deadline You ll need to file a Self Assessment if any of the conditions below apply If you re self employed or earned more than 1 000 working for yourself You re a director of a limited company or partner in a partnership 3 January 2024 Before you can pay corporation tax you usually need to work on your company tax return While the deadlines for paying your corporation tax and filing a company tax return are different in practice they re often done at the same time

[desc-10] [desc-11]

HMRC Still Suspects QROPS Are Breaking Pension Rules IExpats

https://www.iexpats.com/wp-content/uploads/2015/11/HMRC.jpg

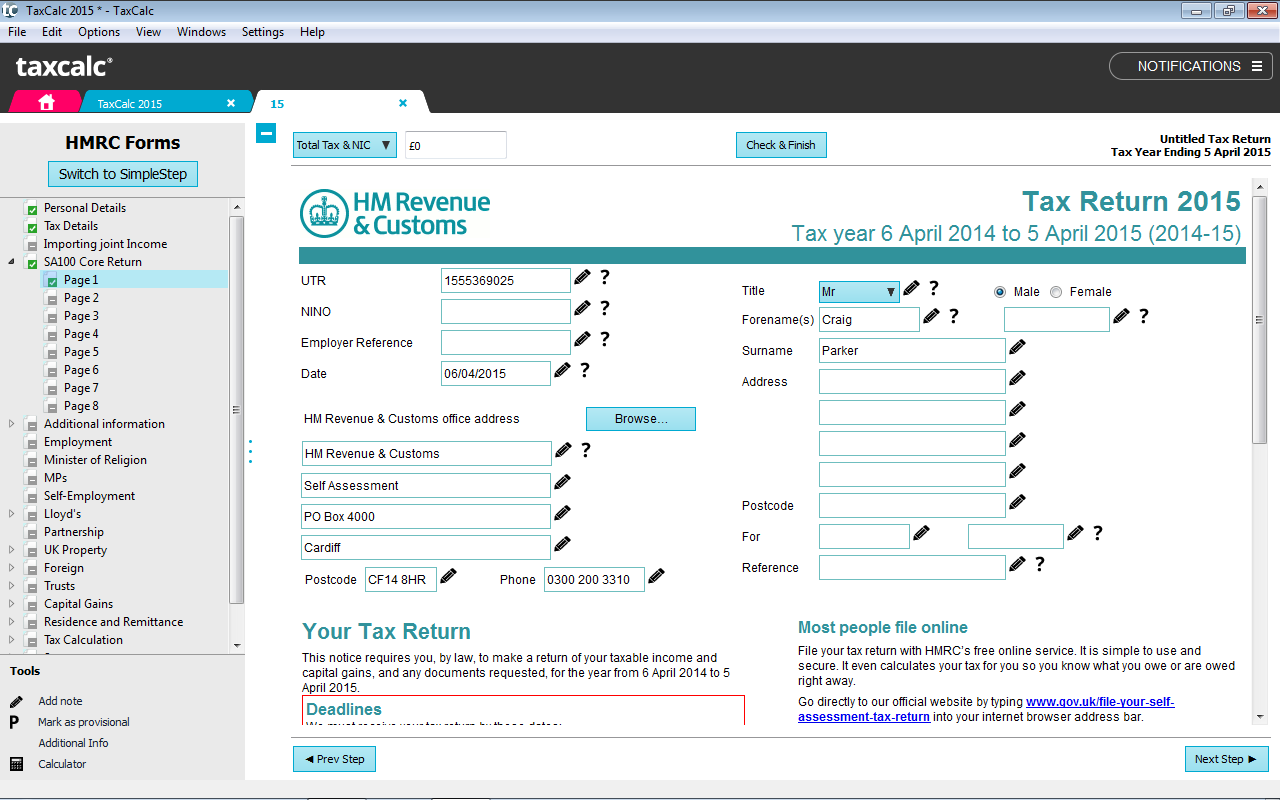

Online Tax Hmrc Online Tax Return

https://www.taxcalc.com/images/products/productScreenshots/Individual4.png

https://www.gov.uk/prepare-file-annual-accounts-for-limited-company

You need your accounts and tax return to meet deadlines for filing with Companies House and HM Revenue and Customs HMRC You can also use them to work out how much Corporation Tax to pay

https://www.gov.uk/guidance/company-tax-return-obligations

When to submit a Company Tax Return The deadline for your return is 12 months after the end of the accounting period it covers The Company Taxation Manual CTM93030 filing date

Tax Return Deadline HMRC Issue Daily Fines

HMRC Still Suspects QROPS Are Breaking Pension Rules IExpats

Hmrc Ssp Form Printable Printable Forms Free Online

Company Tax Return Hmrc Company Tax Return Guide

What Are The Penalties For Missing The Tax Return Deadline Tax

Company Tax Return Hmrc Company Tax Return Guide

Company Tax Return Hmrc Company Tax Return Guide

2017 Hmrc Vat Certificate Of Registration Vistech Security Free Nude

Remember To File Your Self Assessment Tax Return By 31st January

Hmrc Tax Return Letters With Logos And Cash Stock Photo Royalty Free

Hmrc Company Tax Return Deadline - A Company Tax Return usually has to be delivered no later than 12 months after the end of the accounting period If the company delivers its Company Tax Return late it may be subject to a penalty An overview of deadlines for filing your Company Tax Return