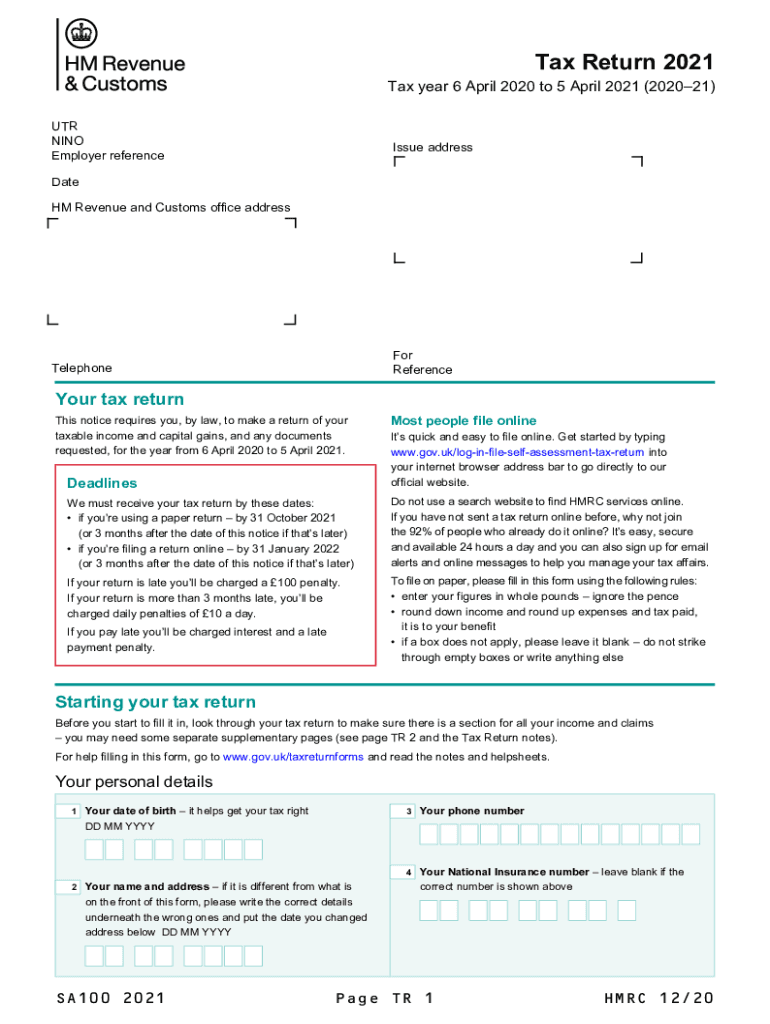

Hmrc Tax Return Example How to fill in your tax return 2022 Updated 8 April 2024 These notes will help you to fill in your paper tax return You can also complete it online which has several benefits it s

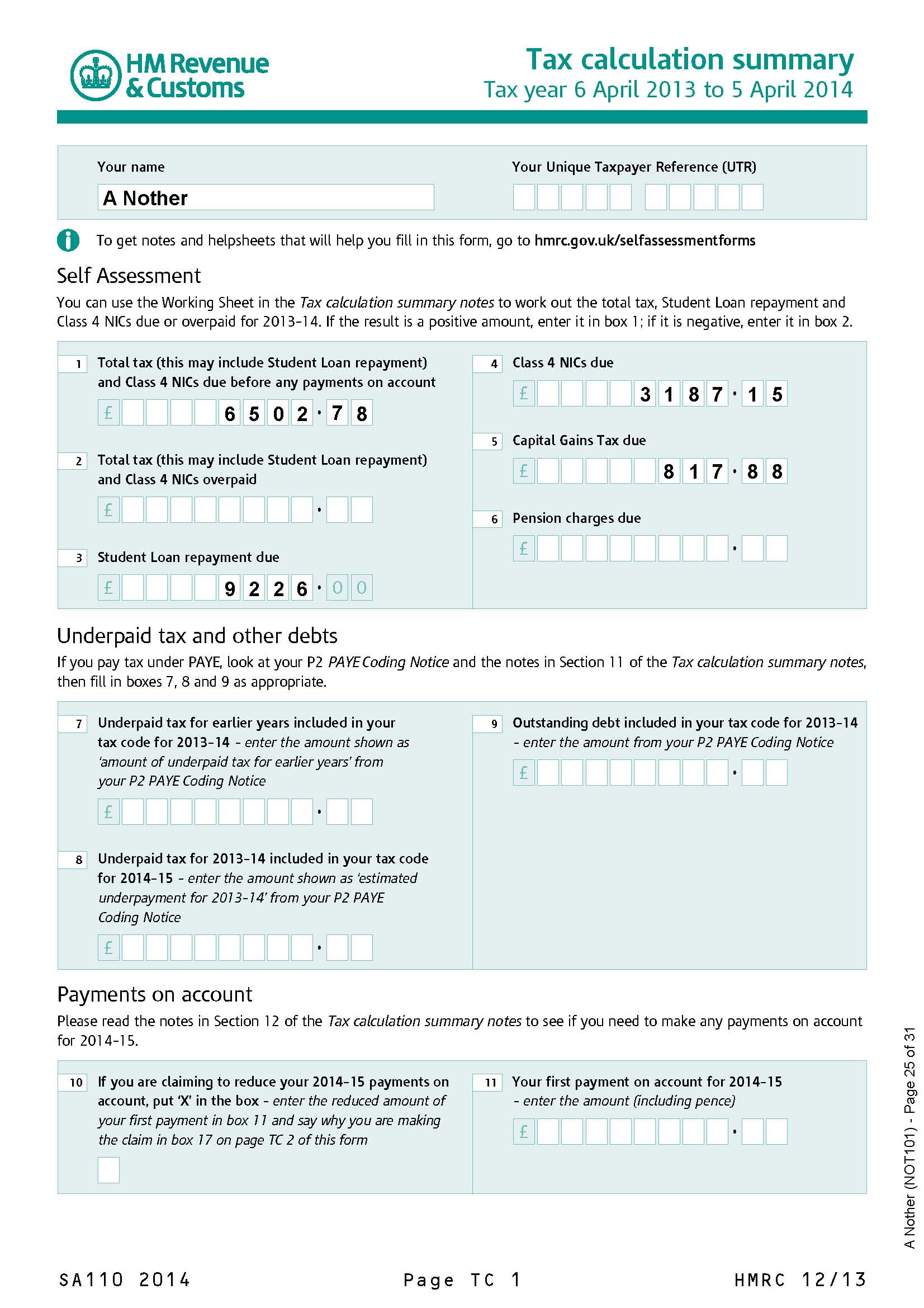

The SA100 is the main tax return for individuals Use it to file your tax return for student loan repayments interest and dividends UK pensions and annuities paying into registered pension How to fill in your tax return Tax Return notes Tax year 6 April 2022 to 5 April 2023 2022 23 Use these notes to help you fill in your tax return These notes will help you to fill in

Hmrc Tax Return Example

Hmrc Tax Return Example

https://www.pdffiller.com/preview/569/541/569541319/large.png

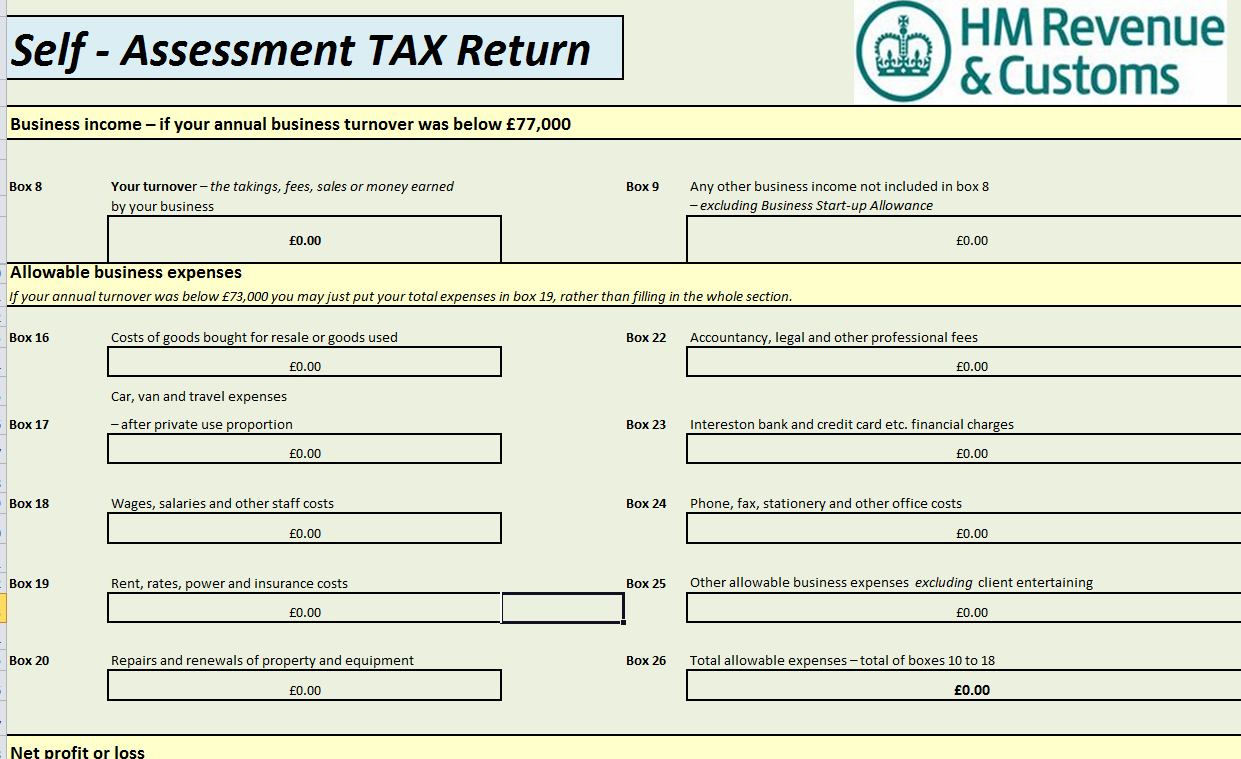

Unique Self Assessment Tax Return Spreadsheet Template Fitness Tracker

https://www.nohassleaccounting.com/wp-content/uploads/2014/08/taxreturn.png

HMRC Tax Archives Huston And Co

http://huston.co.uk/wp-content/uploads/2015/11/9000-231115.jpg

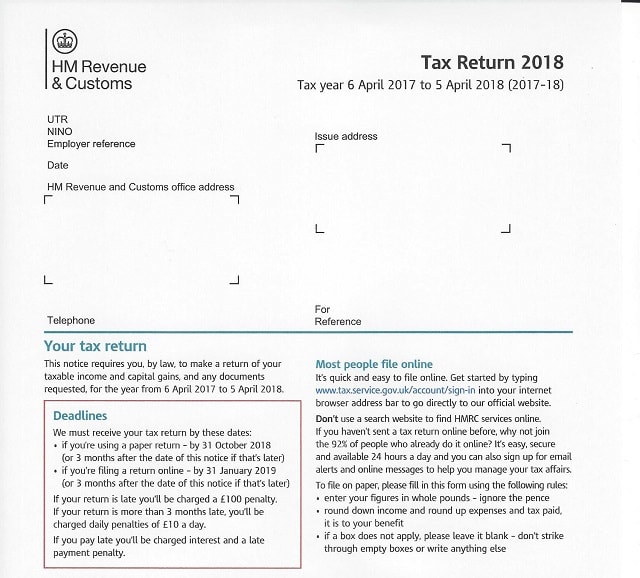

Want to fill in a paper tax return you must send it to us by 31 October 2021 decide to fill in your tax return online or you miss the paper deadline you must send it online by 31 Before you fill in this tax return please make sure it s the right one for you If your circumstances changed in the tax year 6 April 2021 to 5 April 2022 you may need to fill in a full tax

You submit tax returns for tax years not calendar years And you do this in arrears For example for the 2023 24 tax year running 6 April 2023 to 5 April 2024 you would need to register for Self Assessment by 5 October 2024 if you ve never submitted a return before submit your return by midnight 31 October 2024 if filing a paper A self assessment tax return is an online or paper form that has to be submitted to HMRC every year by those who owe tax on income they ve received In some cases tax is deducted automatically from your wages or pension known as PAYE

Download Hmrc Tax Return Example

More picture related to Hmrc Tax Return Example

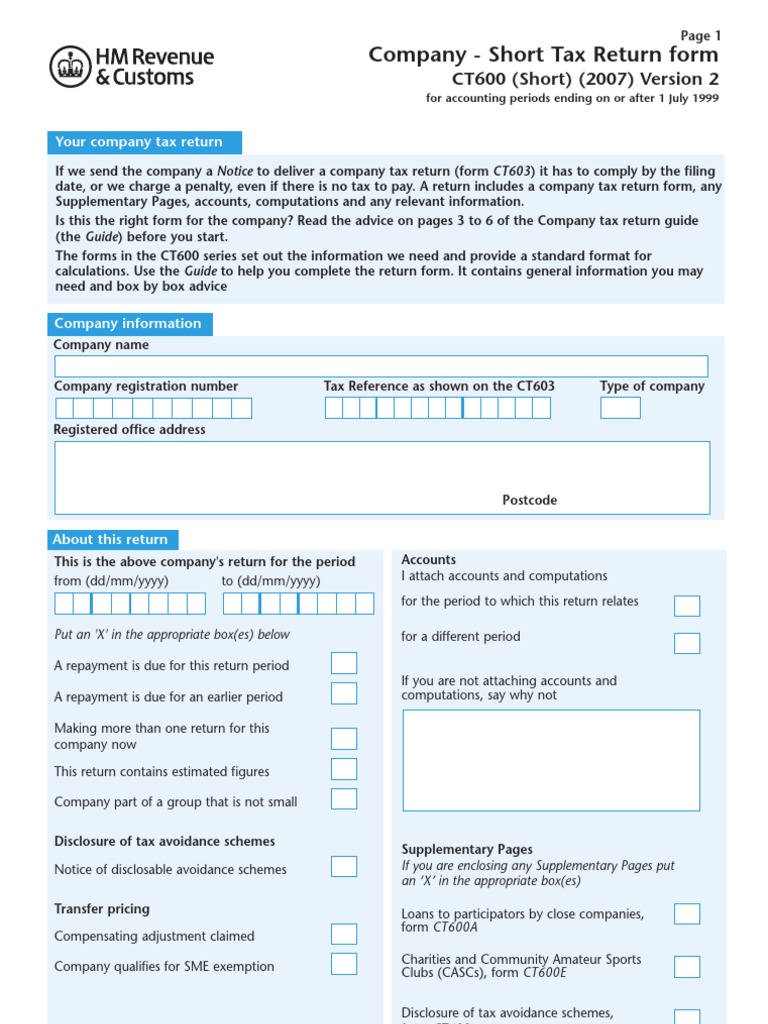

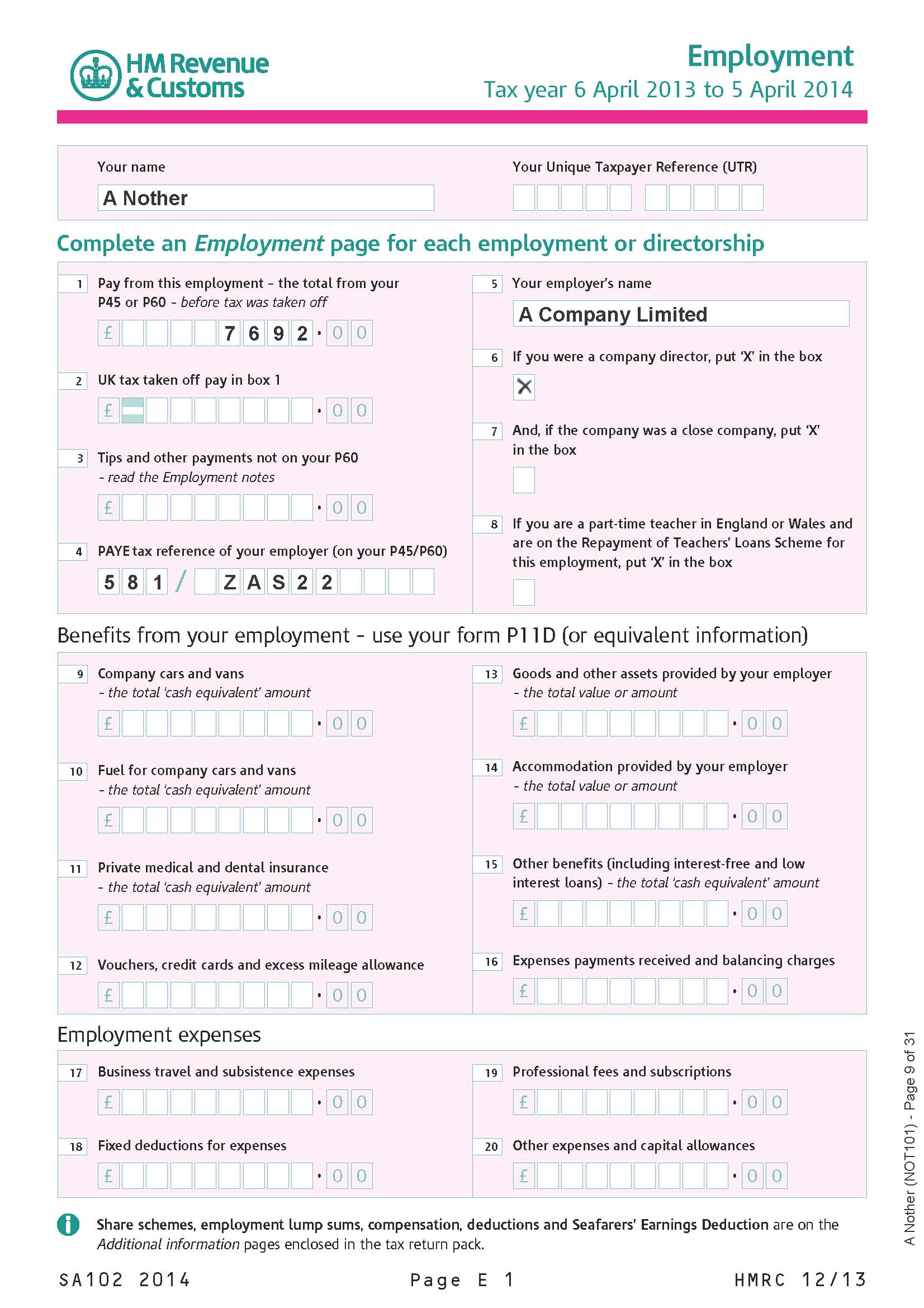

UK Company Short Tax Return Form CT600 United Kingdom Corporation

https://imgv2-2-f.scribdassets.com/img/document/44576473/original/1294f26ec8/1571749065?v=1

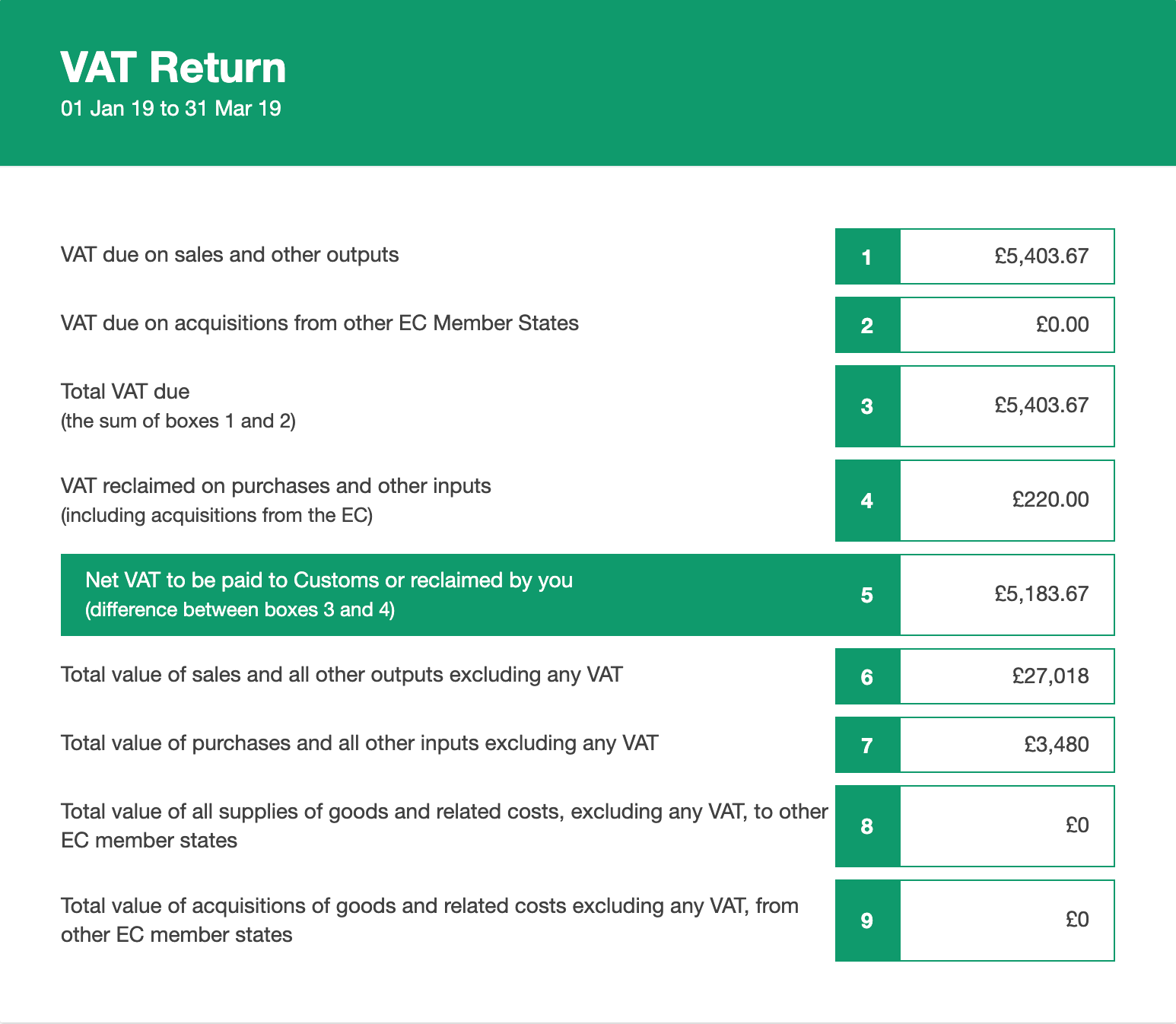

The VAT Flat Rate Scheme FRS FreeAgent

https://support.freeagent.com/hc/article_attachments/360002300679/KB-V-SUV-VFR-01-Final.png

Filing A Self Assessment Tax Return YogaTax

https://yogatax.co.uk/wp-content/uploads/yt5.jpg

There s a lot to remember if you need to submit a Self Assessment tax return to HMRC To help you keep track our Self Assessment checklist details everything you need to include when sending your tax return Guide with easy steps to completing a HMRC self assessment tax return including this year s deadlines what to declare and penalties for late submission It might sound dull but it could save you receiving a massive fine

How you get into your tax return online for the first time will depend on a couple of factors if you have previously registered for Self Assessment with HMRC and if you have previously set up access to your Personal Tax Account Your Personal Tax Account is available online through HMRC and brings all of your tax details together in one It might be that they have multiple income streams are self employed or have made a profit on an asset they have sold known as capital gains In these instances HMRC doesn t know how much tax you owe so you have to work it out yourself and tell them You do this by completing a tax return

Buttons Placement For Next Prev And Complete Form Later Actions

https://i.stack.imgur.com/0xCc9.gif

Product Detail

http://www.real-price.co.uk/images/product-images/SPI1001_Page_25_3.jpg

https://www.gov.uk/government/publications/self...

How to fill in your tax return 2022 Updated 8 April 2024 These notes will help you to fill in your paper tax return You can also complete it online which has several benefits it s

https://www.gov.uk/government/publications/self...

The SA100 is the main tax return for individuals Use it to file your tax return for student loan repayments interest and dividends UK pensions and annuities paying into registered pension

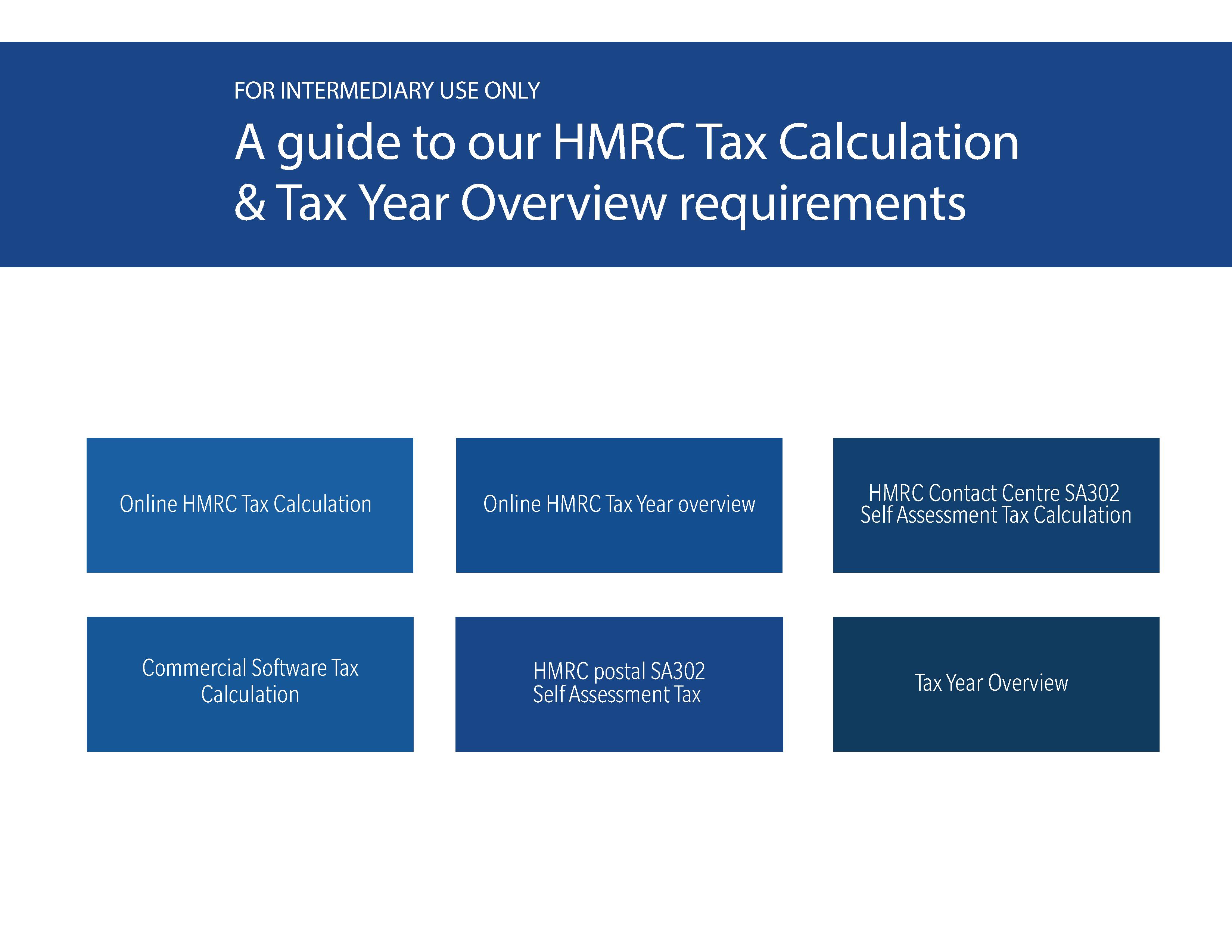

How To Obtain Your Tax Calculations And Tax Year Overviews

Buttons Placement For Next Prev And Complete Form Later Actions

Exp Code On Invoice Hybridlasopa

HMRC Tax Code Bank Statement Go Online Pensions To Tell Tax Coding

Product Detail

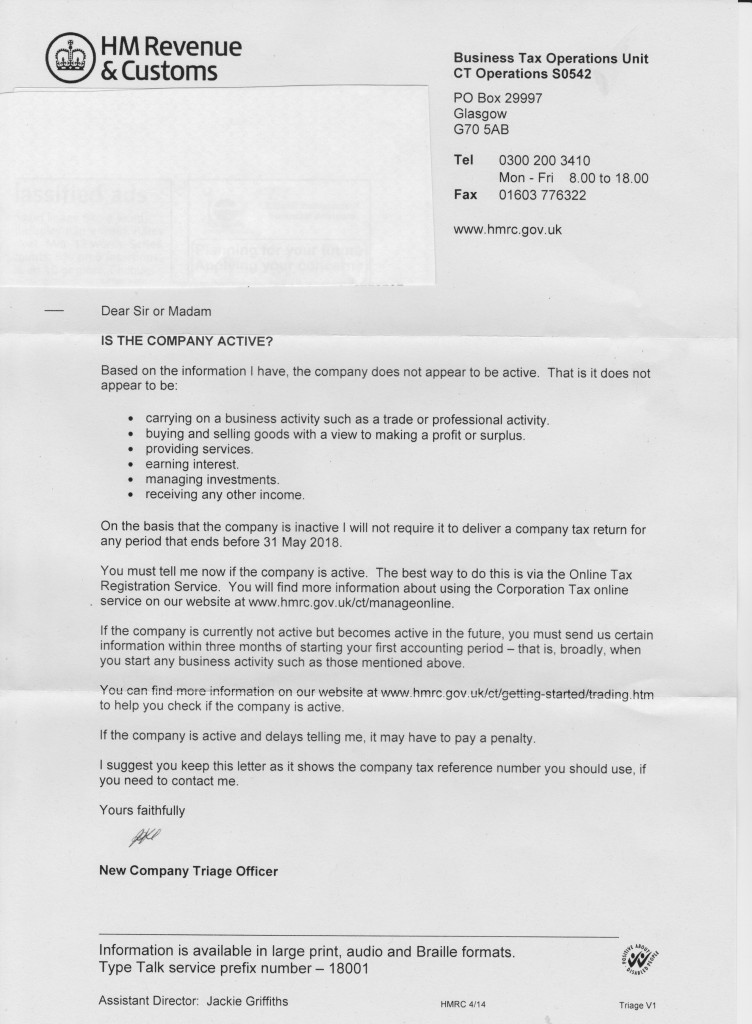

HMRC Really Do Not Want To Collect Corporation Tax

HMRC Really Do Not Want To Collect Corporation Tax

How To Print Your SA302 Or Tax Year Overview From HMRC Love

A Guide To Our HMRC Tax Calculation Tax Year Overview Requirements

HMRC 2018 Tax Return Form

Hmrc Tax Return Example - A self assessment tax return is an online or paper form that has to be submitted to HMRC every year by those who owe tax on income they ve received In some cases tax is deducted automatically from your wages or pension known as PAYE