Home Loan Deduction In Income Tax Rules Web The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business investment or other deductible purposes Otherwise it is considered personal interest and isn t deductible

Web 22 Sept 2023 nbsp 0183 32 In general you can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing Web 4 Jan 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages of up to 1 million A mortgage calculator can help you determine how much interest you paid each month last year

Home Loan Deduction In Income Tax Rules

Home Loan Deduction In Income Tax Rules

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

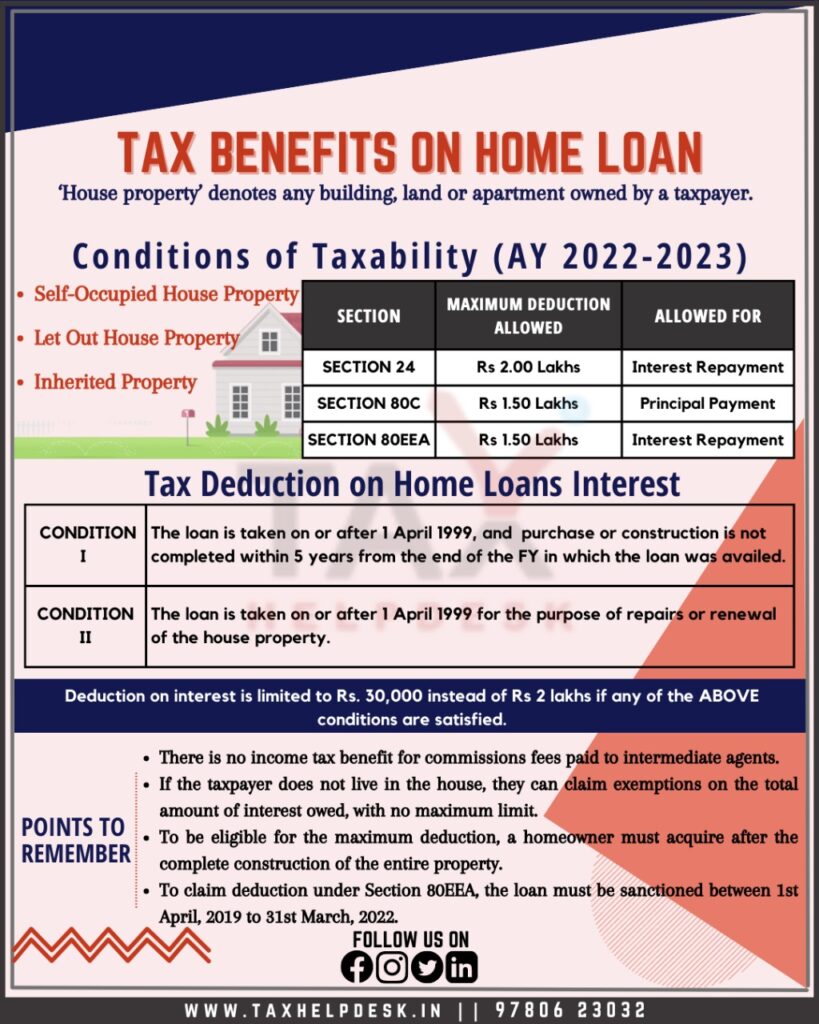

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

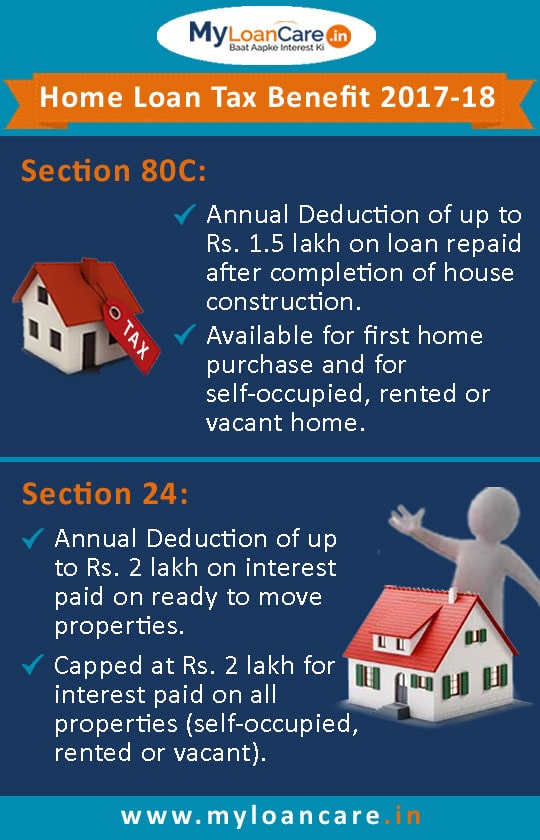

Web 18 Dez 2023 nbsp 0183 32 Home loan borrowers can avail of tax deductions on both principal and interest repayments under Sections 80C and 24 b Advantages of Home Loans When you take a home loan it comes with the benefit of tax savings There are two components of a home loan EMI the principal amount and the interest charged on the loan Web Reducing your home mortgage interest deduction Mortgage not more than certified indebtedness Mortgage more than certified indebtedness New MCC can t increase your credit Property transferred from a spouse Donor s adjusted basis equal to or less than the FMV Preparing and filing your tax return Using online tools to help prepare your return

Web Vor einem Tag nbsp 0183 32 The Tax Cuts and Jobs Act TCJA established new limits to the amount of home mortgage interest you can deduct Here are some critical points For tax years 2018 through 2025 the deduction is limited to interest paid on the first 750 000 of mortgage debt 375 000 for married filing separately which applies to loans taken out after Web 28 Nov 2023 nbsp 0183 32 The interest on an additional 100 000 of debt can be deductible if certain requirements are met Starting in 2018 deductible interest for new loans is limited to principal amounts of 750 000 Loans originated prior to 12 16 2017 or under a binding contract that closes prior to 4 1 2018 remain under the old rules for tax years prior to 2018

Download Home Loan Deduction In Income Tax Rules

More picture related to Home Loan Deduction In Income Tax Rules

Home Loan Benefits After Budget Home Sweet Home Modern Livingroom

https://smedia2.intoday.in/btmt/images/stories/budget_housing_660_070519022024.jpg

Home Loan Deduction In Income Tax itrfiling YouTube

https://i.ytimg.com/vi/njHxoT7mh2s/hq720.jpg?sqp=-oaymwEkCJUDENAFSFryq4qpAxYIARUAAAAAJQAAyEI9AICiQ3gB0AEB&rs=AOn4CLBUutH9OBPYm4piPGsbqyn-z8tmkw

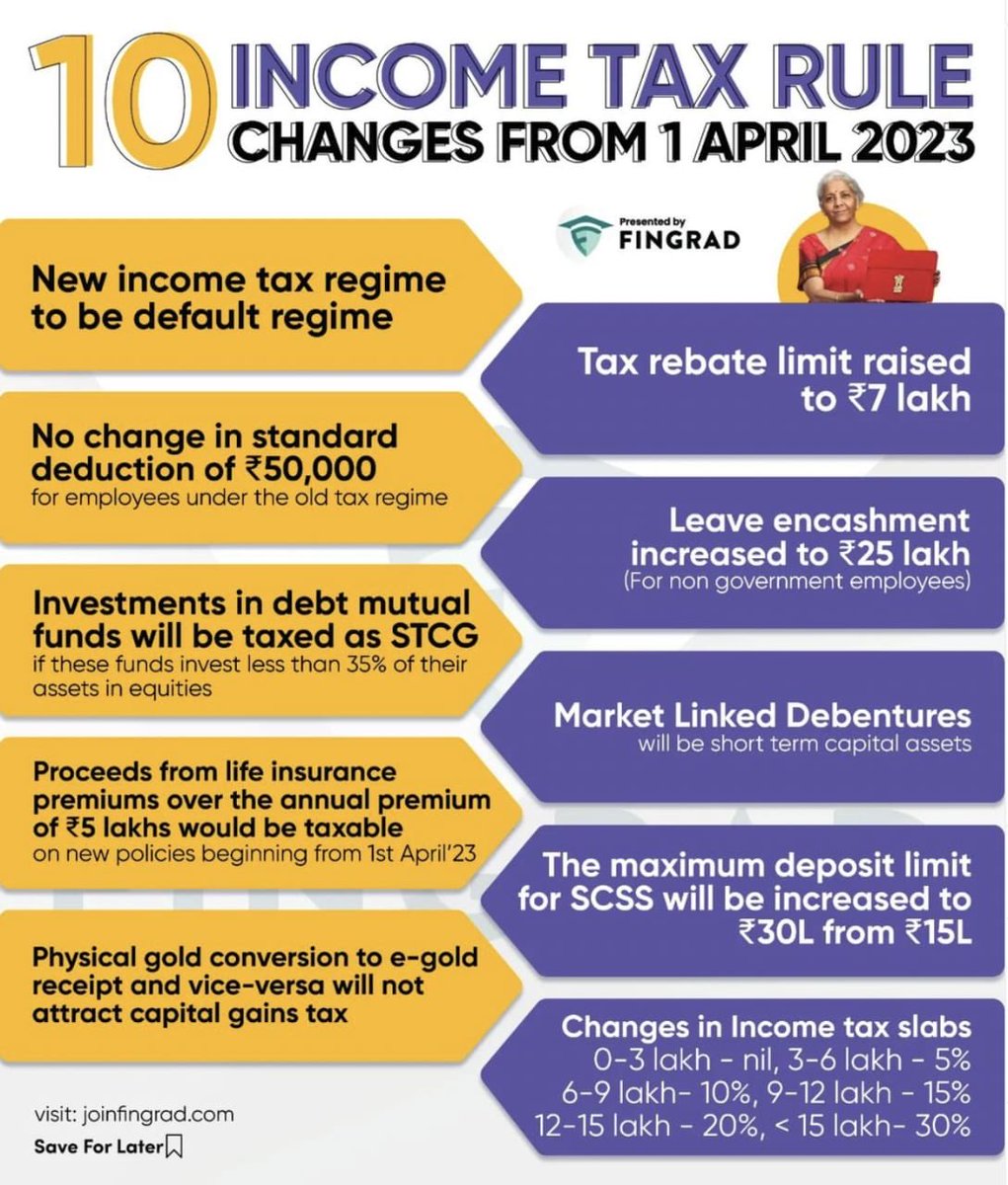

New Income Tax Rules To Come Into Effect From Today 01 04 2023 New

https://pbs.twimg.com/media/FsookcyaAAEqDqC.jpg

Web 30 Dez 2020 nbsp 0183 32 This means their home mortgage interest is more likely to exceed the federal income tax s new higher standard deduction of 24 800 for couples filing jointly or 12 400 for individual tax filers Web 5 Dez 2023 nbsp 0183 32 The standard deduction for tax year 2023 is 13 850 for single filers and 27 700 for married taxpayers filing jointly That means that the mortgage interest you paid plus any other tax

Web 5 Feb 2023 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can claim an additional deduction of Rs 1 5 lakh We have discussed Section 80EEA later in this article Web 11 Sept 2023 nbsp 0183 32 Step 2 Submit the documents to your employer Step 3 Calculate the deductions you can claim on your home loan Step 4 Visit the official Income Tax website to complete the submission of your home loan tax After following all the mentioned steps download your tax statement for verification

Section 24 Of Income Tax Act Deduction For Home Loan Interest

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/09/section-24-of-income-tax-act.jpg

Income Tax Rules Change Income Tax Has Made 3 Major Changes You Must

https://admin.myitronline.com/app/uploads/29-07-22/62e3bbd89fecd.jpeg

https://www.irs.gov/publications/p936

Web The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business investment or other deductible purposes Otherwise it is considered personal interest and isn t deductible

https://www.nerdwallet.com/article/taxes/mortgage-interest-rate-deduction

Web 22 Sept 2023 nbsp 0183 32 In general you can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing

Home Loan Benefits For Income Tax Home Sweet Home Modern Livingroom

Section 24 Of Income Tax Act Deduction For Home Loan Interest

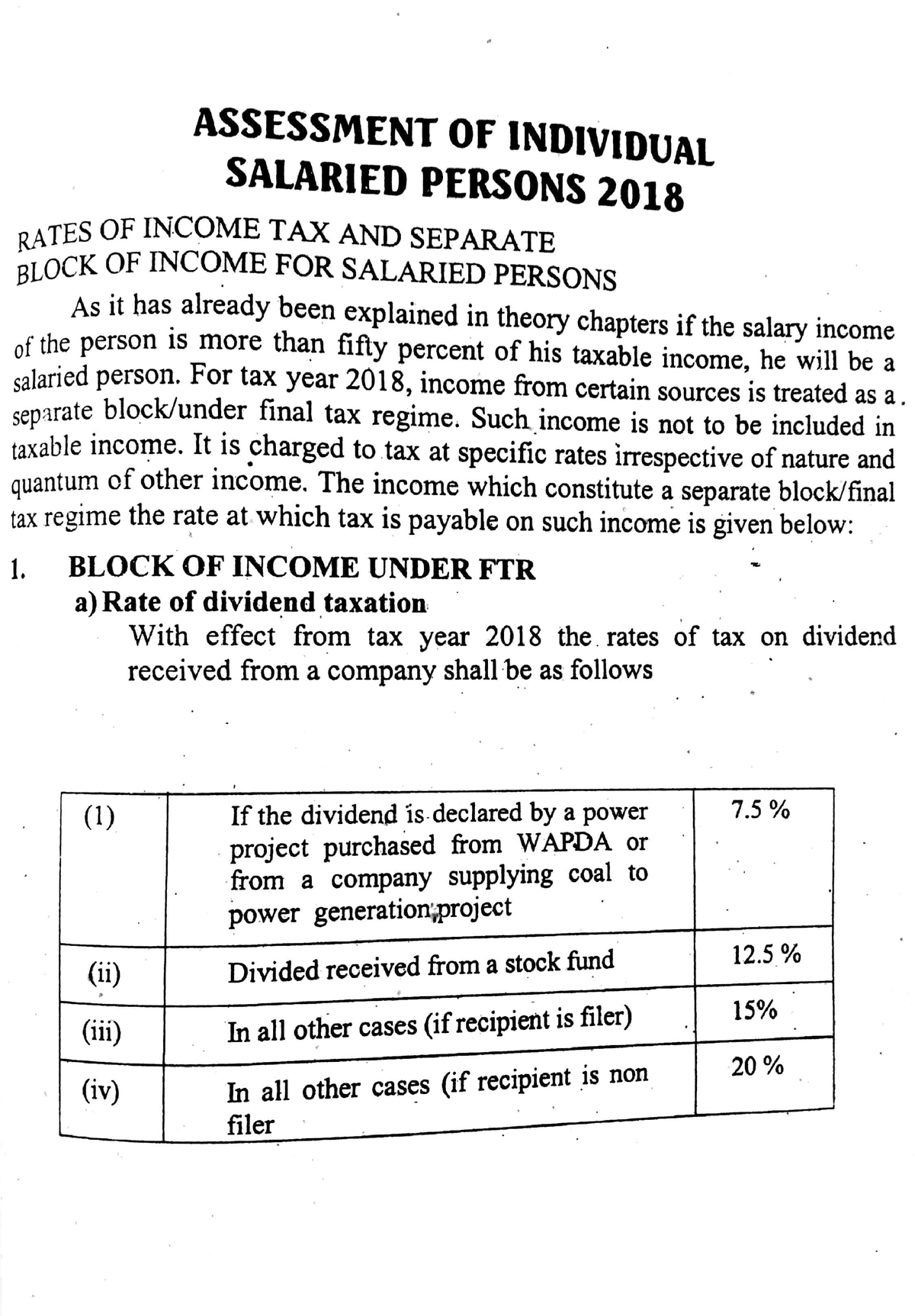

Income Tax Rules Business Taxation I Studocu

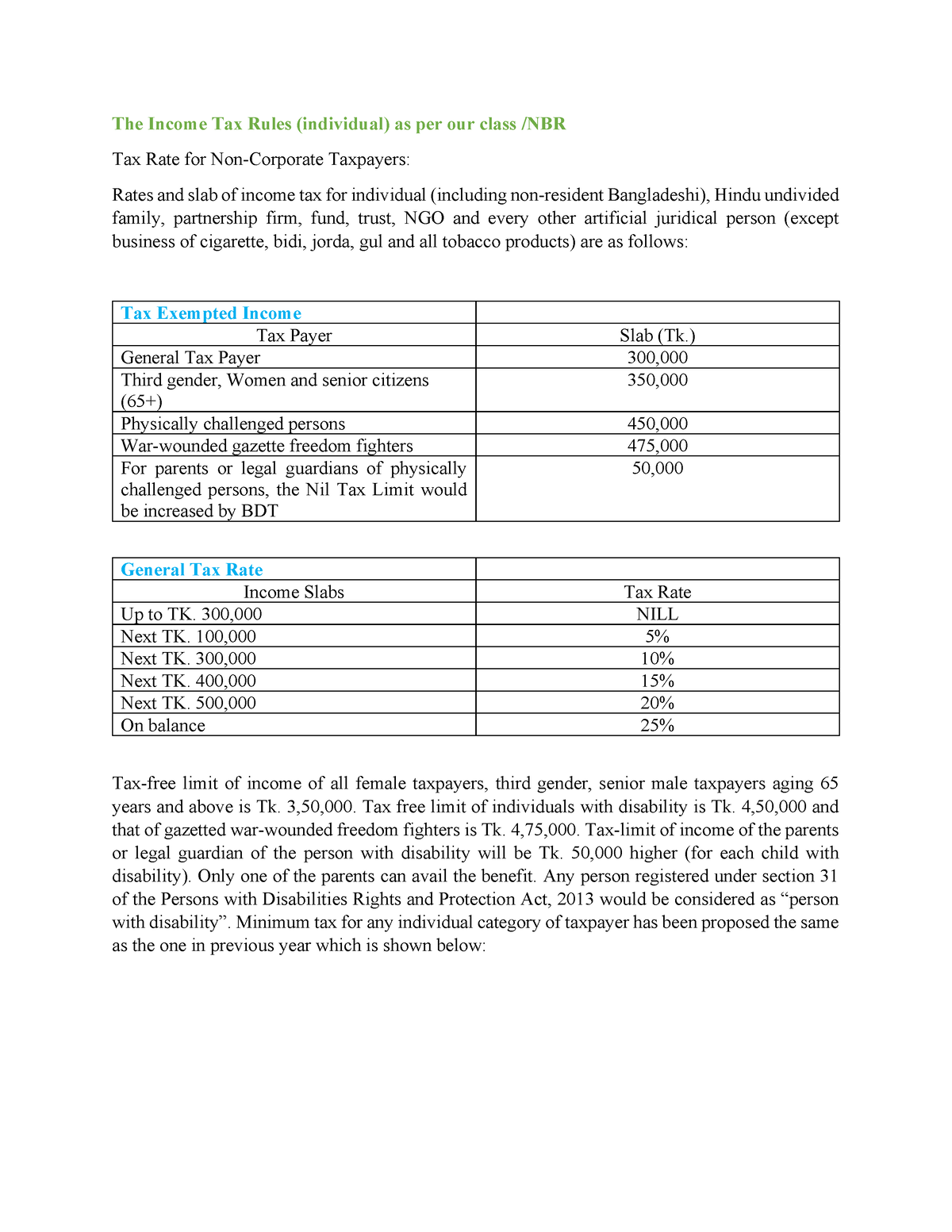

Compensation Assignment The Income Tax Rules individual As Per Our

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Section 24 Of Income Tax Act House Property Deduction

Section 24 Of Income Tax Act House Property Deduction

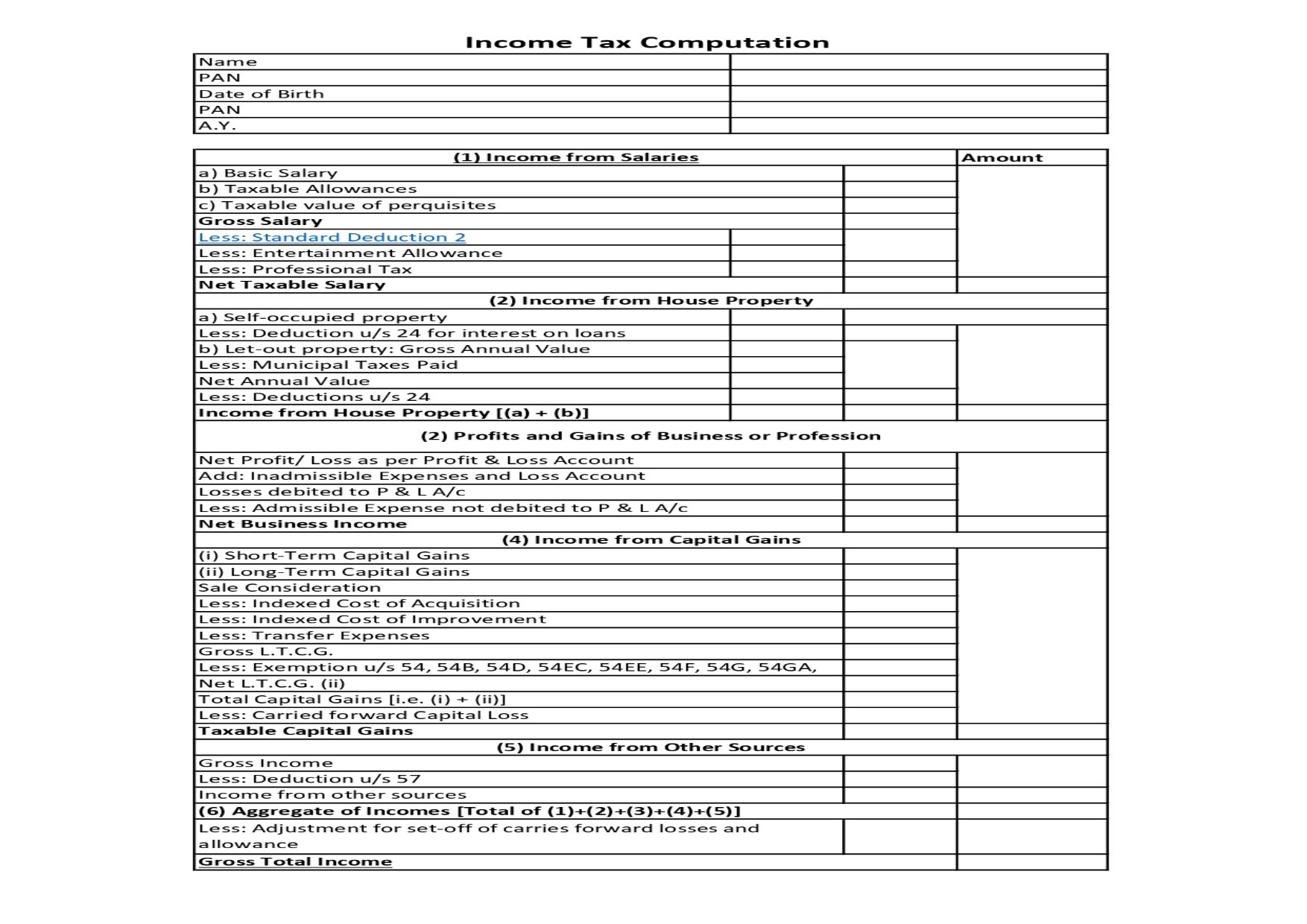

Income Tax Computation Format PDF A Comprehensive Guide

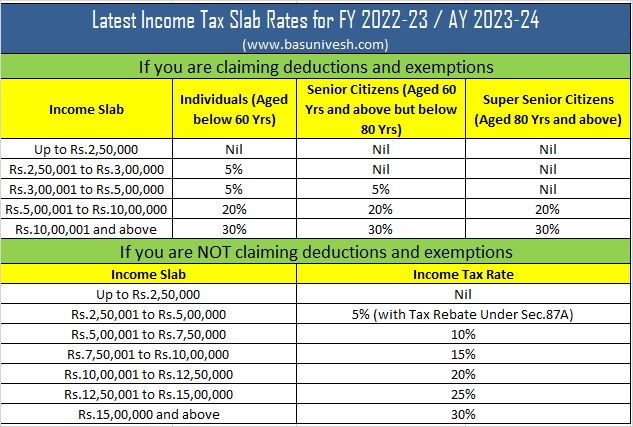

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

CBDT Notifies And Amends Rules Regarding Accumulation Of Unspent Income

Home Loan Deduction In Income Tax Rules - Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross income annually provided the construction acquisition of the house is completed within 5 years Also in case of a self occupied house the