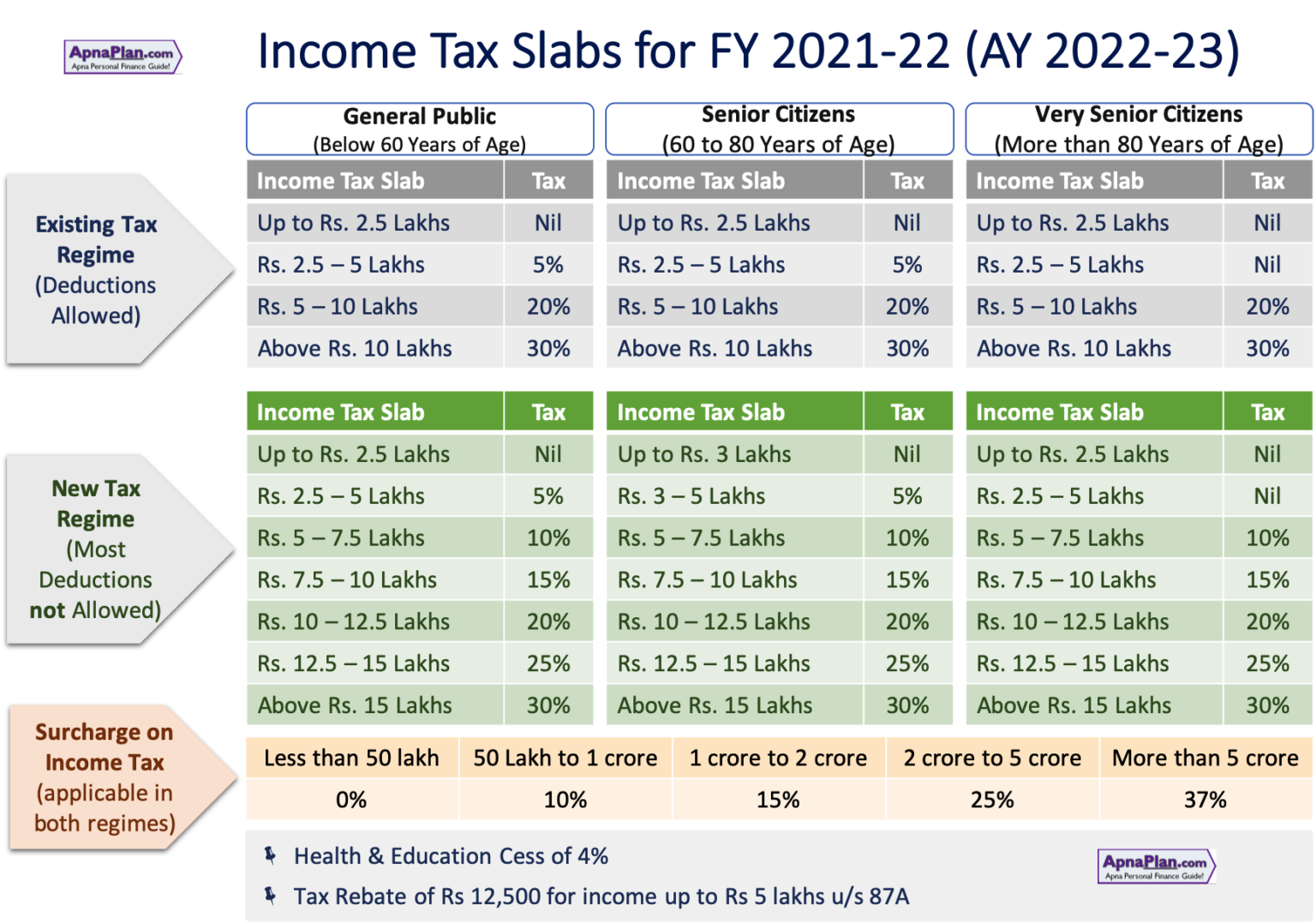

Home Loan Interest Rebate In Income Tax 2022 23 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Income Tax Act

The Union Budget 2019 has introduced a new Section 80EEA to extend the tax benefits of the interest deduction up to Rs 1 50 000 for housing loans taken for As a home loan borrower you can claim tax exemption on principal repayment every year under Section 80C interest payments under Section 24 b and an additional benefit on

Home Loan Interest Rebate In Income Tax 2022 23

Home Loan Interest Rebate In Income Tax 2022 23

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2020/06/Income-Tax-Deductions-List-FY-2020-21-Latest-Tax-exemptions-for-AY-2021-2022-tax-saving-options-chart-tax-rebate.jpg

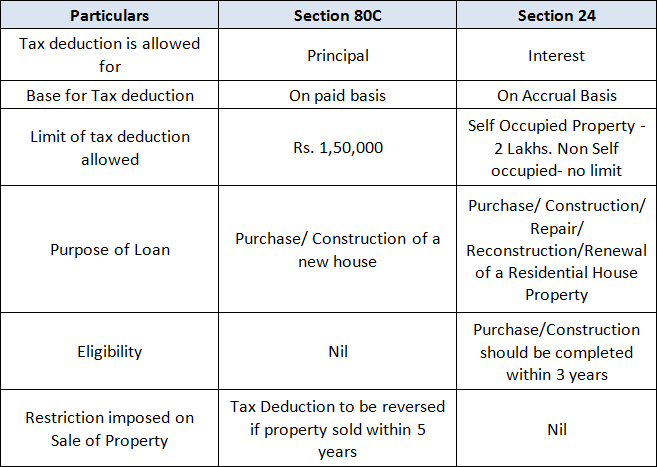

Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March A home loan provides a number of benefits upon repayment through tax deductions under the Income Tax Act of 1961 A home loan repayment consists of two

Home loan tax benefits include deductions on principal interest payments under sections 80C 24 b of Income Tax Act reducing overall tax liability for owners Yes the home loan comes with many tax saving deductions such as a deduction under section 24 for interest payments a deduction under 80C for repayment

Download Home Loan Interest Rebate In Income Tax 2022 23

More picture related to Home Loan Interest Rebate In Income Tax 2022 23

How To Use TAX REBATE In Income Tax TAX REBATE Tips Tricks

https://i.ytimg.com/vi/2Bx_7lRoC78/maxresdefault.jpg

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

https://www.cagmc.com/wp-content/uploads/2020/07/How-to-claim-Tax-rebate-under-Income-Tax-1.png

Loan Rebate 2022 Credit Union News Loans News Harp And Crown

https://harpandcrown.co.uk/download/images/loan-rebate-2022-news.jpg

Budget 2023 should hike the tax rebate on housing loan interest under Section 24 b to Rs 5 lakh said experts The government should seriously consider A home loan can help you claim an 80C deduction of up to 1 5 lakh a 80EE deduction of 50 000 and a 24 b deduction of 2 lakh making a total taxable value deduction of up

If your home loan is disbursed in the next financial year but if you manage to take the sanction letter by 31st March 2022 you can still deduct the interest paid up Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Difference Between Income Tax Rebate Tax Deduction And Exemption Tax

https://gkmtax.in/wp-content/uploads/2020/03/Income-tax-rebate-tax-deduction-and-exemption.jpg

Budget 2020 Expectations Home Loan Interest Payment Rebate Could

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2020/01/28/110184-money-guru.jpg?itok=CoV4iyRi&c=c5af8c0f92ccc8e249257bf0f1cb18e8

https://www.livemint.com/money/personal-finance/...

So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Income Tax Act

https://cleartax.in/s/section-80ee-income-tax...

The Union Budget 2019 has introduced a new Section 80EEA to extend the tax benefits of the interest deduction up to Rs 1 50 000 for housing loans taken for

Income Tax Calculator India FY 2021 22 AY 2022 23 ApnaPlan

Difference Between Income Tax Rebate Tax Deduction And Exemption Tax

What Is Income Tax Rebate Under Section 87A HDFC Life

How To Claim Interest On Home Loan Deduction While Efiling ITR

Rebate U s 87A Of I Tax Act Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Bonus Dividend Loan Interest Rebate Windthorst Federal Credit Union

2022 Deductions List Name List 2022

Income Tax Rebate Under Section 87A Rebate For Financial Year GST

Home Loan Interest Rebate In Income Tax 2022 23 - Home loan tax benefits include deductions on principal interest payments under sections 80C 24 b of Income Tax Act reducing overall tax liability for owners