Home Loan Interest Rebate Limit In Income Tax If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more deductions are available regarding home loans for purchasing a permanent dwelling and loans credits and other borrowing related to home repair

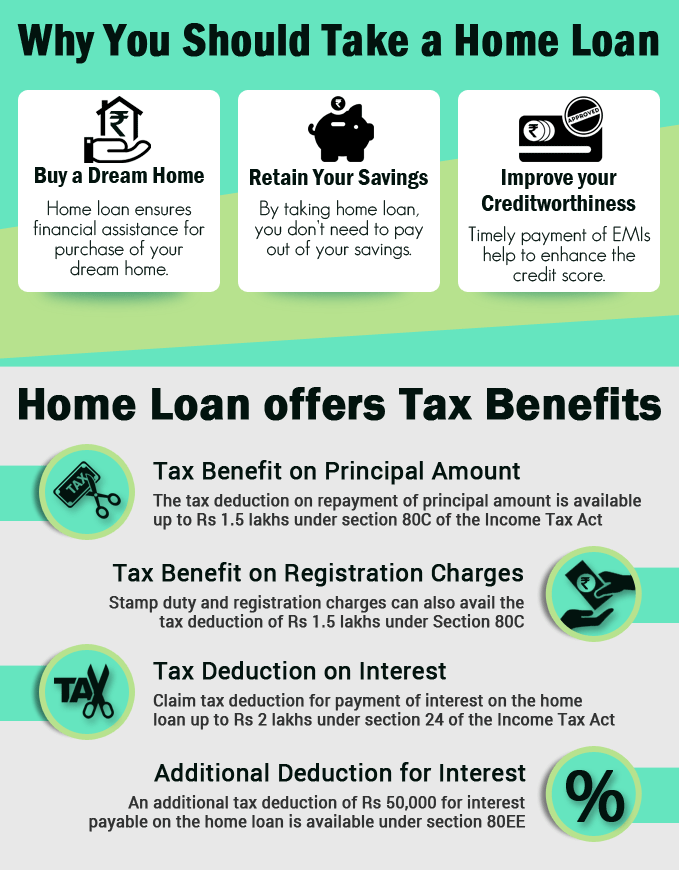

Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law Section 24 Section 80EE Section 80EEA Upper limit on tax rebate Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can claim an additional deduction of Rs 1 5 lakh We have discussed Section 80EEA later in this article

Home Loan Interest Rebate Limit In Income Tax

Home Loan Interest Rebate Limit In Income Tax

https://new-img.patrika.com/upload/2022/03/24/home_loan.jpg

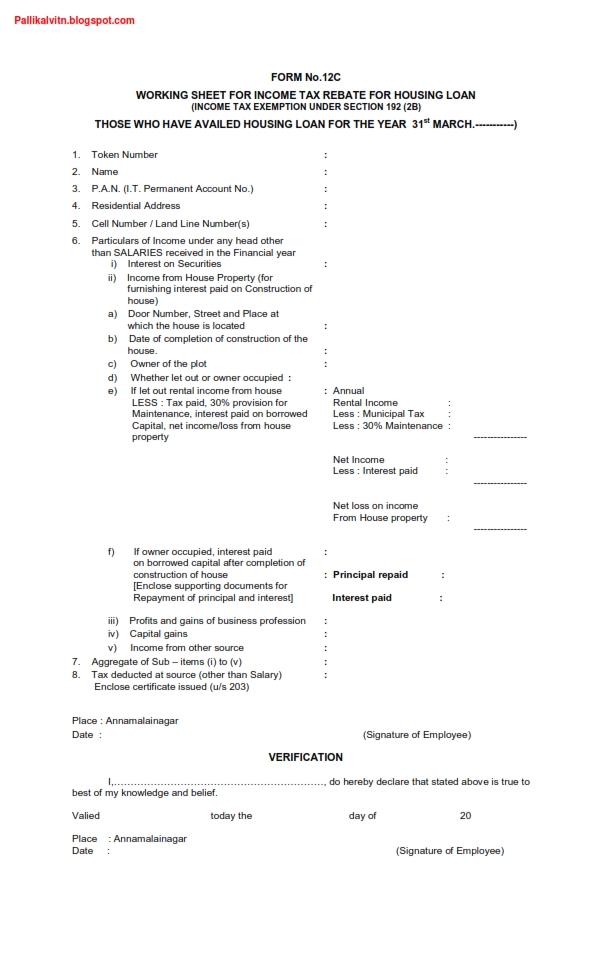

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

https://www.cagmc.com/wp-content/uploads/2020/07/How-to-claim-Tax-rebate-under-Income-Tax-1.png

Interest on Home Loan u s 24b on Let out property In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime Turnover receipts are within these limits Before Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b

You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017 Future developments What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

Download Home Loan Interest Rebate Limit In Income Tax

More picture related to Home Loan Interest Rebate Limit In Income Tax

House Loan Limit In Income Tax Home Sweet Home

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/01/Home-Loan-Benefits.png

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Joint home loan borrowers can claim individual home loan rebates in income tax up to Rs 2 lakh on interest paid and Rs 1 5 lakh on the principal amount Are there any other tax deductions I can claim with respect to interest payment on the home other than the interest under Section 24 b Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can claim this deduction if you complete the building of the house within 5 years otherwise you can claim only Rs 30 000

Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional deduction of 50 000 is Interest on Home Loan Section 24 of the Income Tax Act deals with the deduction of interest on a home loan It allows you to claim a deduction on the interest paid on a home loan for a self occupied property Maximum Deduction Under Section 24 b the maximum deduction allowed is up to Rs 2 lakh per financial year for self

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

Difference Between Income Tax Deductions Exemptions And Rebate Plan

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

https://www.vero.fi/.../deductions/tax_credit_on_interest_payments

If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more deductions are available regarding home loans for purchasing a permanent dwelling and loans credits and other borrowing related to home repair

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law Section 24 Section 80EE Section 80EEA Upper limit on tax rebate

Difference Between Income Tax Rebate Tax Deduction And Exemption Tax

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

How To Claim Interest On Home Loan Deduction While Efiling ITR

Rebate U s 87A Of I Tax Act Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Income Tax Deductions For FY 2018 19 And AY 2019 20 Sid Associates

Income Tax Deductions For FY 2018 19 And AY 2019 20 Sid Associates

Rebate Allowable Under Section 87A Of Income Tax Act TaxGuru

Income Tax Rebate U s 87A Calculate And Claim Tax Rebate FY 20 21

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Home Loan Interest Rebate Limit In Income Tax - Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b