Home Loan Interest Tax Benefit Before Possession Yes it is possible to claim Home Loan tax benefits before possession However these tax rebates are only applicable to payments made toward principal repayment Suppose you took

The pre construction interest deduction is allowed for interest payments made from the date of borrowing till March 31st before the financial year in which the construction is Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to possession can be claimed over the next 5 years

Home Loan Interest Tax Benefit Before Possession

Home Loan Interest Tax Benefit Before Possession

https://marathikayda.com/wp-content/uploads/2022/12/home-loan-low-interest-rate-compressed.jpg

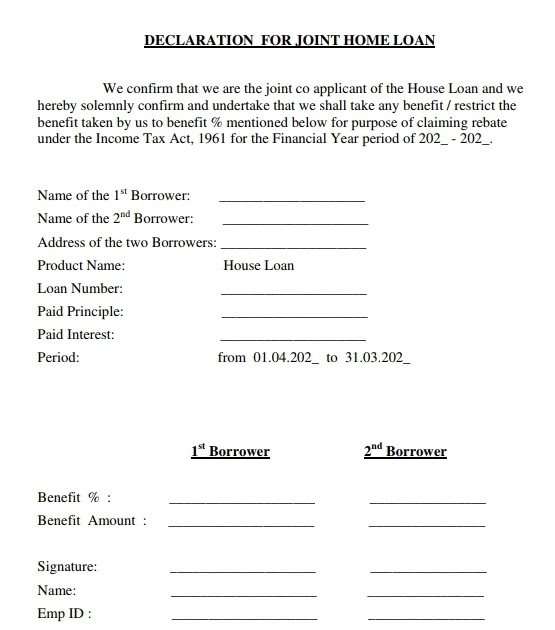

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

Best Home Loan Rates

https://images.livemint.com/img/2021/12/26/original/loan_1640547127620.png

Know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax House property should not be sold within 5 years of possession Interest 24b 2 Lakh The loan must be taken for the purchase construction of a w house and the

Step 1 Determine the date the home loan was repaid Step 2 Determine the date of completion or acquisition possession Step 3 Determine the last day of the fiscal year that ended just before the completion or IT Act 1961 Section 80EEA As per under construction property tax benefits of Section 80EEA the taxpayer can claim an extra tax deduction of Rs 1 50 000 on the home

Download Home Loan Interest Tax Benefit Before Possession

More picture related to Home Loan Interest Tax Benefit Before Possession

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

https://www.idfcfirstbank.com/content/dam/idfcfirstbank/images/blog/finance/income-tax-benefit-on-home-loan-repayment.jpg

How To Get Home Loan Interest Back YouTube

https://i.ytimg.com/vi/CcZVodEGai4/maxresdefault.jpg

Pin On Property Finance

https://i.pinimg.com/originals/5b/9c/f2/5b9cf2873744df5288180e2fd7e7be02.jpg

A home loan borrower can claim only Rs 30 000 as tax deduction against home loan interest payment if the loan has been taken for repairs and renovation work Deduction A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1 5 lakh under Section 80 C towards the principal repayment However you cannot seek these tax benefits

In accordance with Section 24 of the Income Tax Act 1961 hereinafter referred to as the IT Act the taxpayer would not be allowed to claim the benefit of interest deduction For interest paid before possession the financial year in which you got the possession you can add up interest paid before possession and claim as deduction

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

https://img.etimg.com/thumb/height-450,width-800,msid-67320956,imgsize-277725/tax4-getty.jpg

Debt Recovery Interest Calculator HussanRomano

https://i0.wp.com/stableinvestor.com/wp-content/uploads/2020/11/Home-loan-EMI-interest-principal.png?fit=496%2C500&ssl=1

www. bajajhousingfinance.in /claim-tax...

Yes it is possible to claim Home Loan tax benefits before possession However these tax rebates are only applicable to payments made toward principal repayment Suppose you took

cleartax.in /s/case-study-deduction-for-pre-construction-interest

The pre construction interest deduction is allowed for interest payments made from the date of borrowing till March 31st before the financial year in which the construction is

Can I Claim Both Home Loan And HRA Tax Benefits

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

Housing Loan 0363675100002233 Provisional Certificate 2017 18 PDF PDF

With Home Loan Interest Rates Dropping Is It Time To Pull The Cord

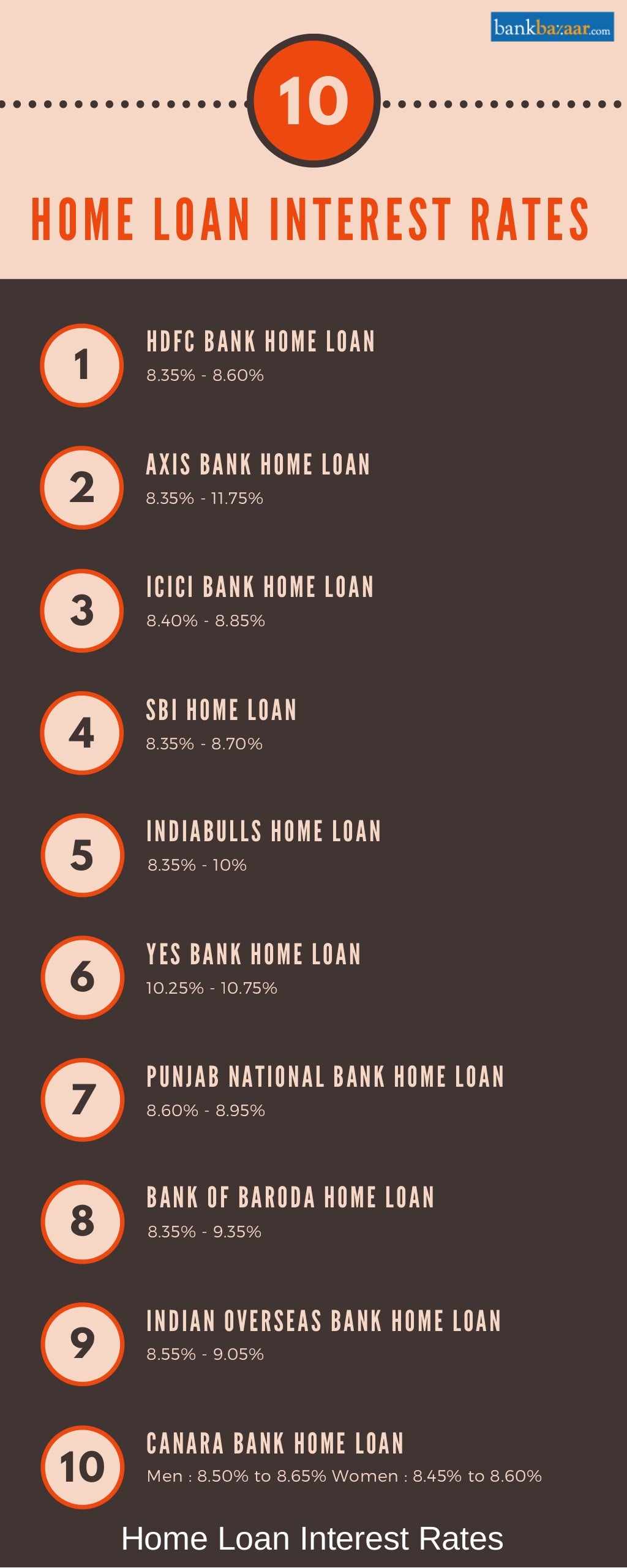

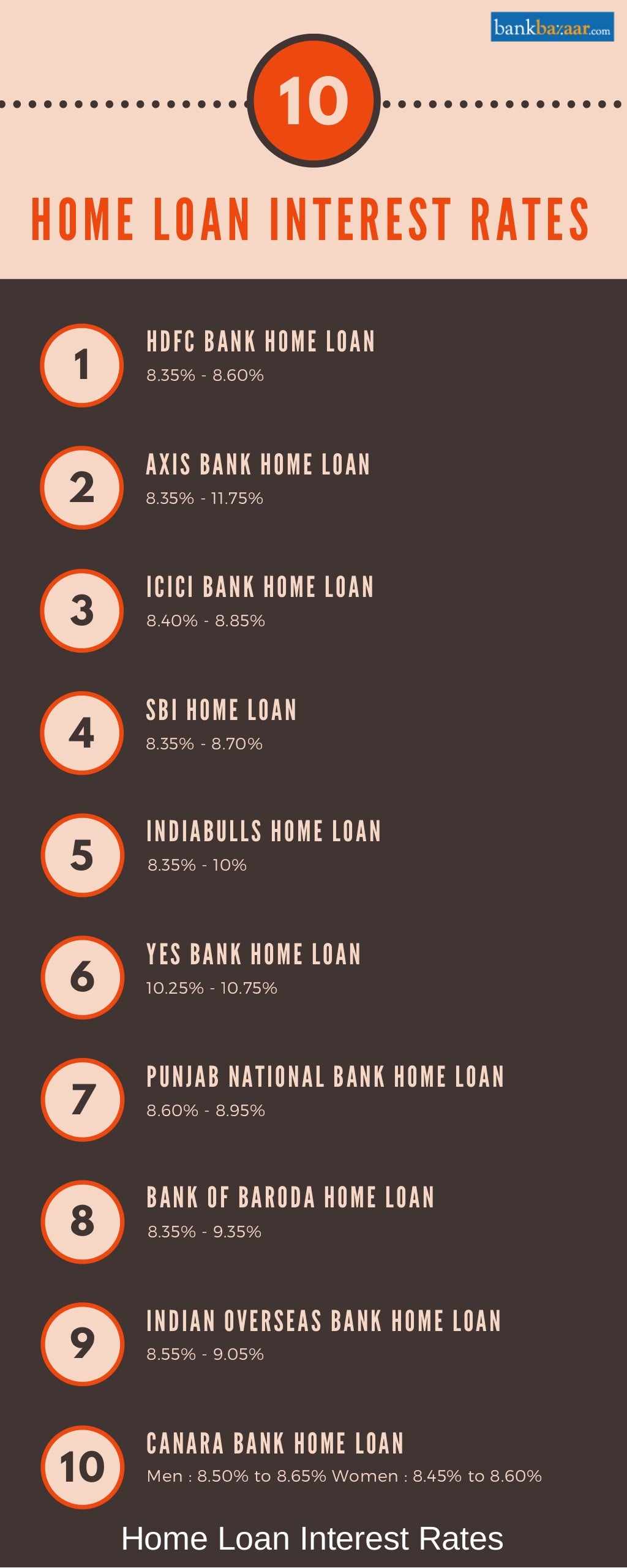

Home Loan Offer Check Best Interest Rates From These Banks

Home Loan Interest Rates

Home Loan Interest Rates

Is Your Interest Tax Deductible ShineWing TY TEOH

Home Loan Interest Rates Updated Interest Rates For All Bank In 2022

Home Loan Interest Rates How To Reduce Home Loan Interest Burden

Home Loan Interest Tax Benefit Before Possession - House property should not be sold within 5 years of possession Interest 24b 2 Lakh The loan must be taken for the purchase construction of a w house and the