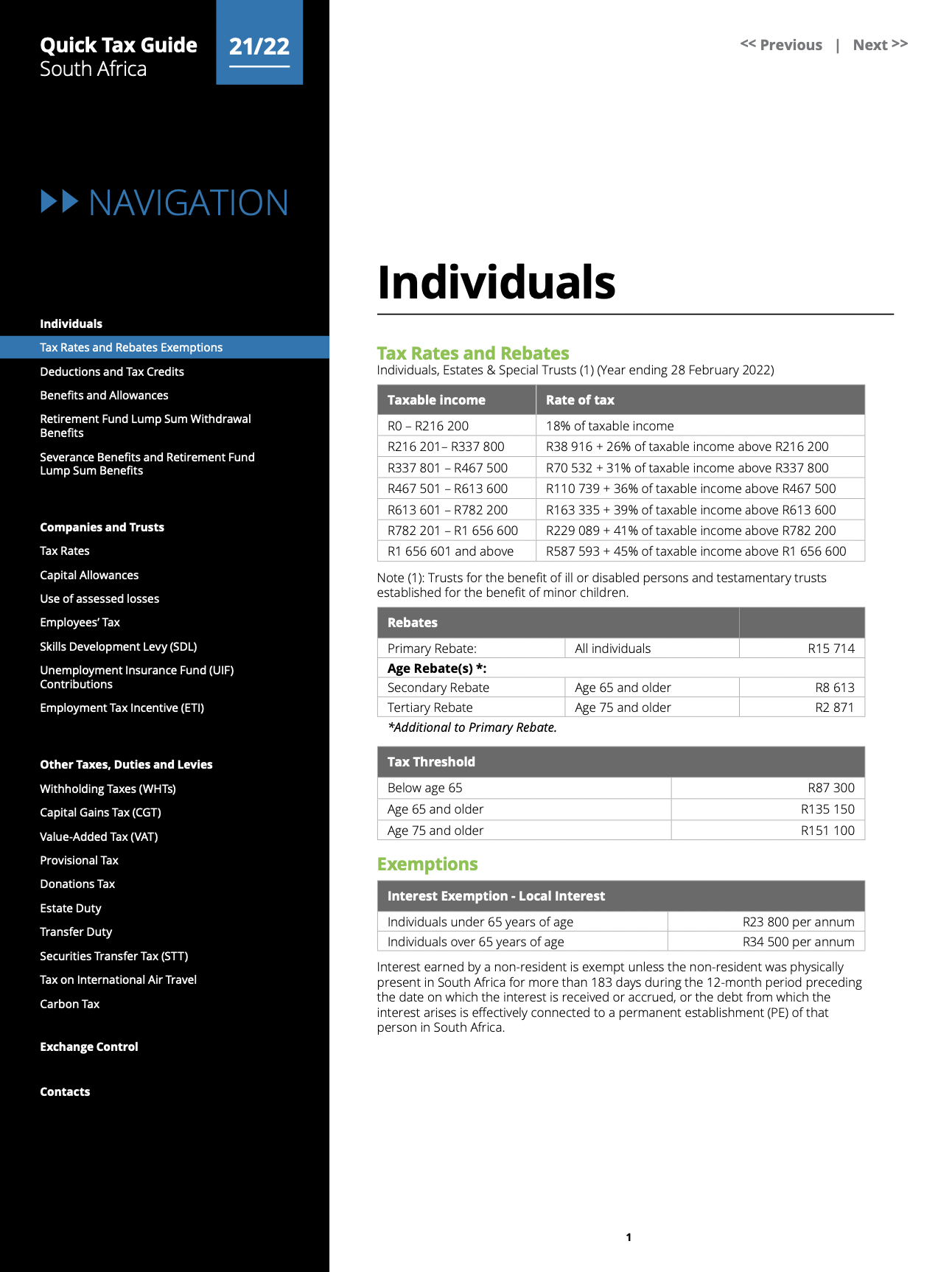

Tax Rebates South Africa Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226 000 18 of taxable income R226 001

Web 27 juin 2023 nbsp 0183 32 The rebates have the effect of establishing tax thresholds below which no tax is payable For the 2024 tax year i e the tax year commencing on 1 March 2023 and Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201

Tax Rebates South Africa

Tax Rebates South Africa

https://www.crs.co.za/wp-content/uploads/2022/02/0224.png

Primary Rebate South Africa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022-1536x651.png

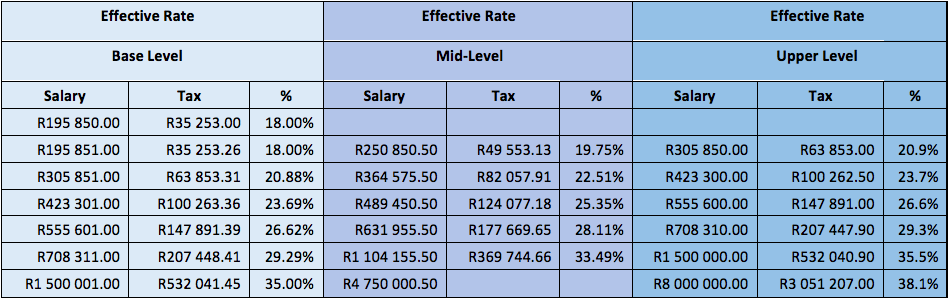

South Africa s Highest Tax Rate Vs The UK Dubai Hong Kong And New York

https://businesstech.co.za/news/wp-content/uploads/2021/03/SA-tax-table-2021-1024x266.png

Web Individuals will be able to receive a tax rebate to the value of 25 of the cost of any new and unused solar PV panels To qualify the solar panels must be purchased and Web 27 juin 2023 nbsp 0183 32 Last reviewed 27 June 2023 Foreign tax credit The South African Income Tax Act makes provision for a rebate against CIT in respect of foreign taxes paid on

Web TaxRebates natural persons Primary rebate R15 714 Secondary rebate age 65 to below 75 R8 613 Tertiary rebate age 75 and older R2871 Individuals who must Web South African TAX GUIDE 2023 2024 INDIVIDUAL TAX RATES INDIVIDUAL REBATES Year of assessment ending 29 February 2024 Taxable Income 0 237 100

Download Tax Rebates South Africa

More picture related to Tax Rebates South Africa

Primary Rebate South Africa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022-Guideline.png

Sars Tax Tables 2017 18 Brokeasshome

https://www.statssa.gov.za/wp-content/uploads/2019/06/pie2.png

Retirement Income Tax Rebate Calculator Greater Good SA

https://gg.myggsa.co.za/how_to_calculate_tax_rebate_for_retirement_annuity_south_africa.pnJFwS5NsgwzDjQtZcjDf9sR_wTndXTKWakA_IzLSfZHvkGnDxIMjTWOn4h_qpnCoymGxeORadFt6dq56FOJNQWinH22TSkj=w1200-h630-pd

Web Rebates Primary Secondary Persons 65 and older Tertiary Persons 75 and older Age Below age 65 Age 65 to below 75 Age 75 and over R15 714 R8 613 R2 871 Web Individual income tax otherwise known as Personal income tax rates in South Africa range from 18 to 45 although the tax threshold of R78 150 for persons below age 65

Web The main tax proposals for 2022 23 are Inflationary relief through a 4 5 per cent adjustment in the personal income tax brackets and rebates An expansion of the employment tax Web 20 juil 2023 nbsp 0183 32 R87 300 if you are younger than 65 years If you are 65 years of age to below 75 years the tax threshold i e the amount above which income tax becomes payable

How The SARS Income Tax Brackets Work

https://image-prod.iol.co.za/resize/610x61000/?source=https://xlibris.public.prod.oc.inl.infomaker.io:8443/opencontent/objects/a43613f6-a44b-557e-b6b3-9afdf3e0c85f&operation=CROP&offset=0x0&resize=1075x472

Income Tax Brackets 2020 South Africa PINCOMEQ

https://www.allangray.co.za/contentassets/ea036c8a5e9c48129b7942288d120e2c/budget-speech-feb-2020-table-1.png

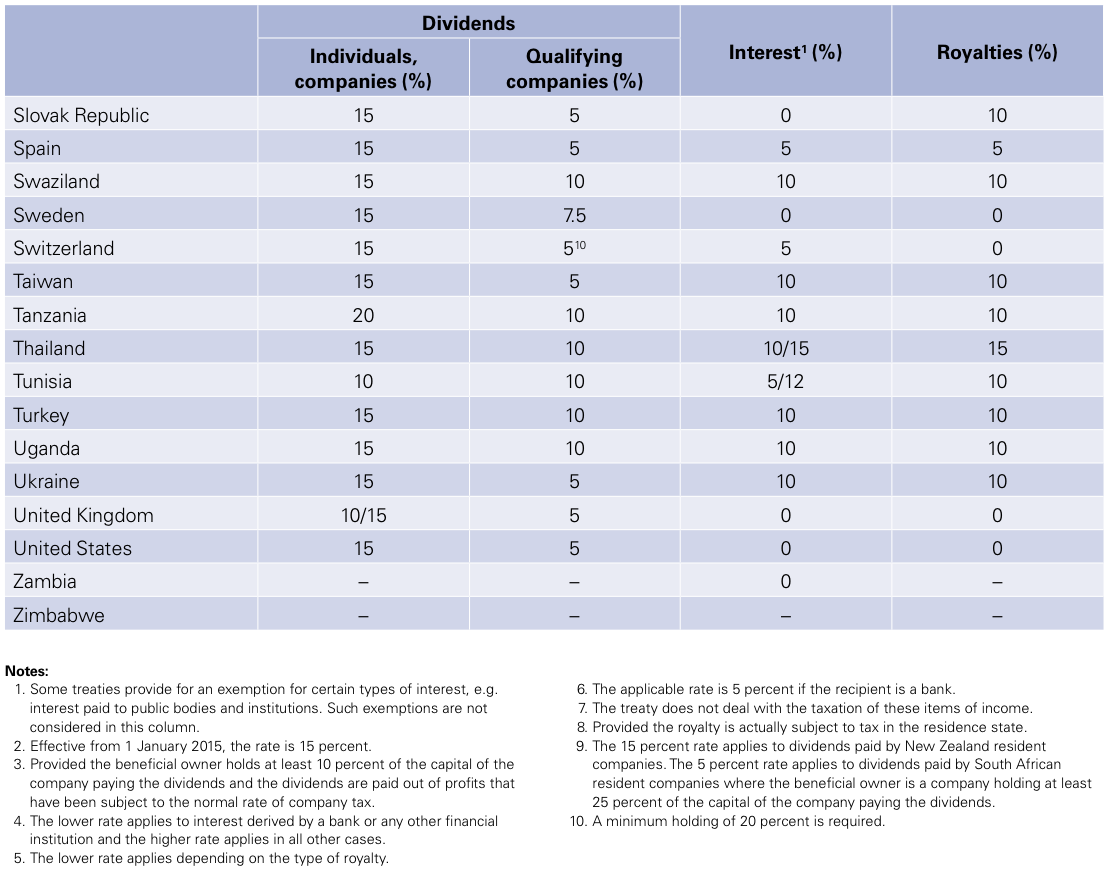

https://www2.deloitte.com/content/dam/Deloitte/za/Documen…

Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226 000 18 of taxable income R226 001

https://taxsummaries.pwc.com/south-africa/individual/other-tax-credits...

Web 27 juin 2023 nbsp 0183 32 The rebates have the effect of establishing tax thresholds below which no tax is payable For the 2024 tax year i e the tax year commencing on 1 March 2023 and

South Africa Budget 2021 Highlights Activpayroll

How The SARS Income Tax Brackets Work

Monthly Tax Tables 2019 South Africa Brokeasshome

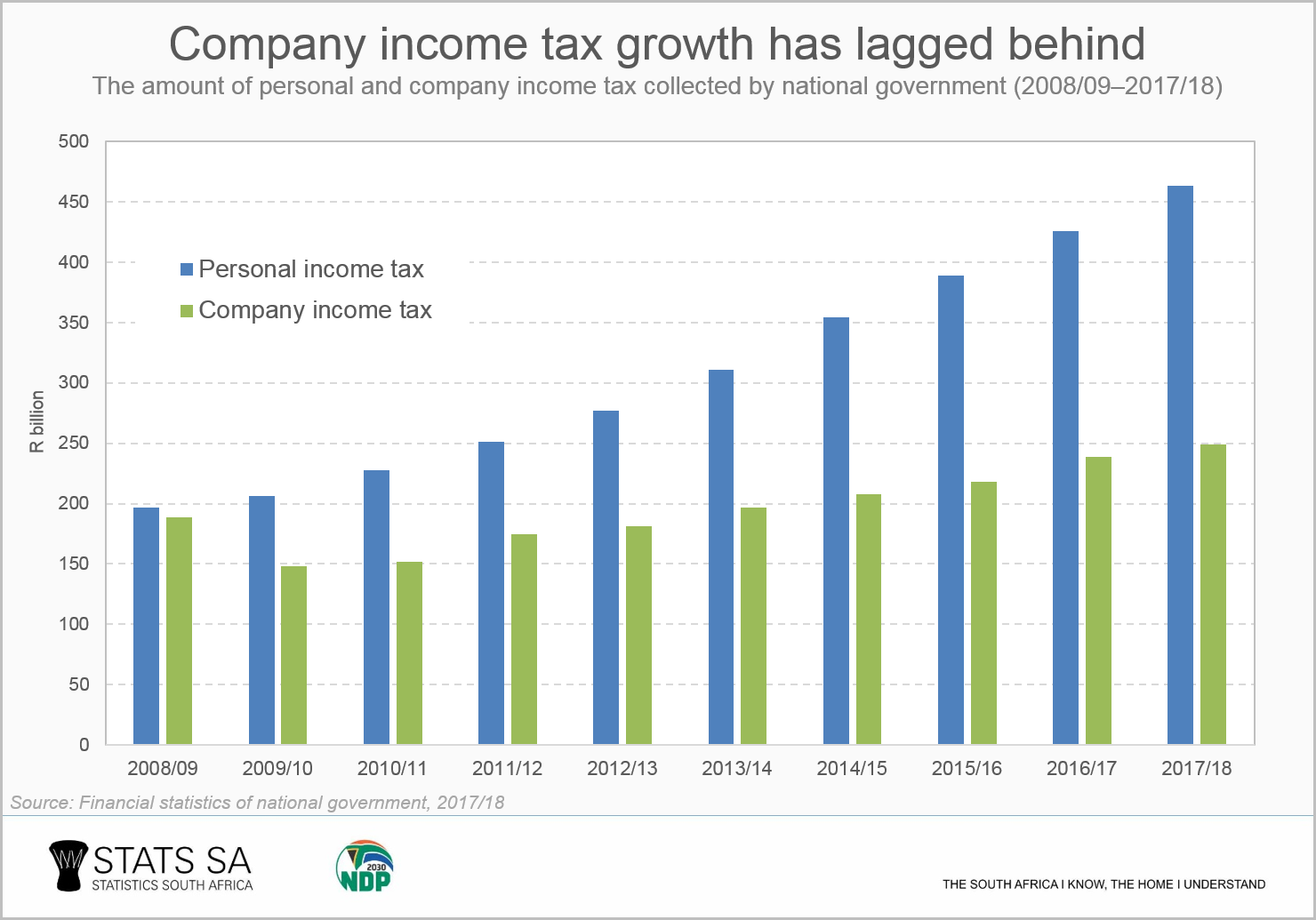

South Africa Corporate Tax Rate 2001 2021 Data 2022 2023 Forecast

South Africa s Tax Vulnerability Moneyweb

Monthly Tax Tables 2019 South Africa Brokeasshome

Monthly Tax Tables 2019 South Africa Brokeasshome

SARS Tax Rates For Individuals South African Tax Consultants

South African Tax Spreadsheet Calculator 2021 2022 AuditExcel co za

Taxation Of Cross Border Mergers And Acquisitions South Africa 2014

Tax Rebates South Africa - Web 27 juin 2023 nbsp 0183 32 Last reviewed 27 June 2023 Foreign tax credit The South African Income Tax Act makes provision for a rebate against CIT in respect of foreign taxes paid on