Tax Rebate Us87a Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Web 13 mai 2023 nbsp 0183 32 The available tax rebate under Section 87A of the Income Tax Act 1961 offers the benefit of nil taxation if you have a limited income However before claiming Web 6 f 233 vr 2023 nbsp 0183 32 Income Tax Rebate u s 87A By Anjana Dhand Updated on 6 Feb 2023 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we

Tax Rebate Us87a

Tax Rebate Us87a

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

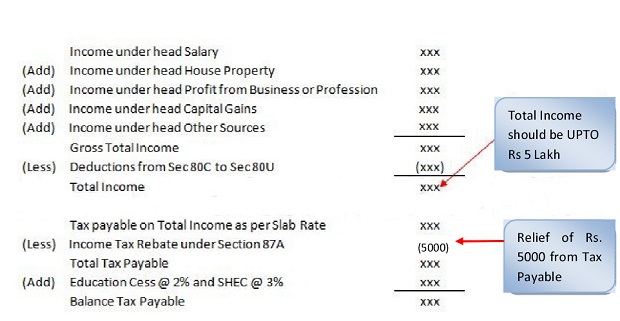

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

https://i.ytimg.com/vi/KqZNdnxM0Bo/maxresdefault.jpg

Web 2 f 233 vr 2023 nbsp 0183 32 In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim Web 21 mai 2016 nbsp 0183 32 Rebate of up to Rs 5 000 for resident individuals having total income of up to Rs 5 00 000 as per Sec 87A of Income Tax Act 1961 for A Y 2017 18 i e F Y 2016 17 The rebate shall be equal to the amount

Web 25 janv 2022 nbsp 0183 32 Taxpayers with income up to Rs 5 lakh can claim a tax rebate of up to Rs 12 500 for AY 2021 22 or as 87A rebate for FY 2020 21 This means that if your annual Web 28 avr 2023 nbsp 0183 32 Section 87A provides a tax credit of Rs 12 500 to people with taxable incomes of up to Rs 5 lakhs for the 2019 2020 fiscal year This is a big rise over the

Download Tax Rebate Us87a

More picture related to Tax Rebate Us87a

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/How-to-calculate-rebate-us-87A.jpg

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

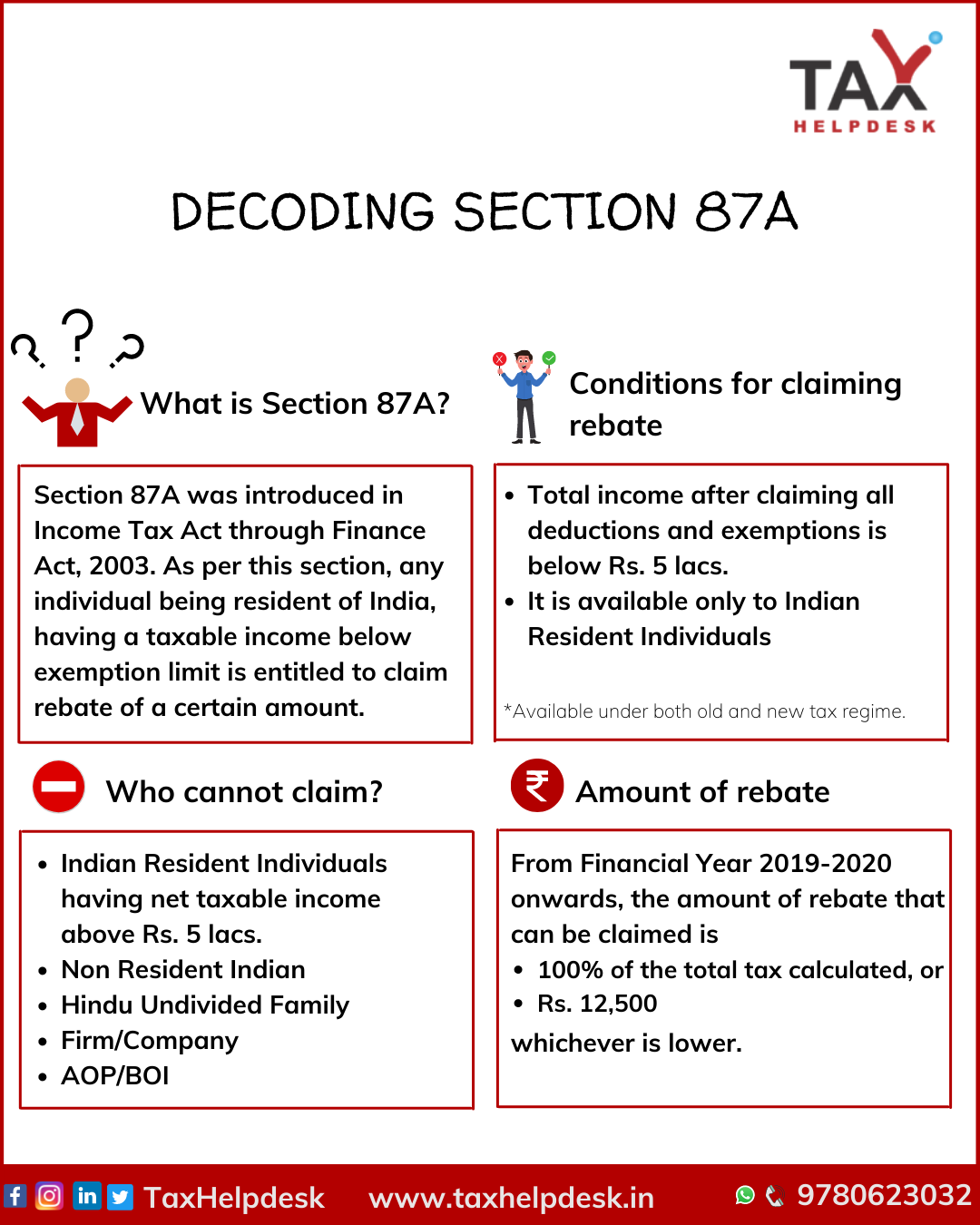

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/DECODING-SECTION-87A.png

Web VDOM DHTML tml gt What is a rebate under Section 87A and who can claim it Quora Something went wrong Wait a moment and try again Web 21 ao 251 t 2023 nbsp 0183 32 Under Section 87A of the Income Tax Act 1961 resident individuals with a taxable income of up to 5 lakhs can claim a tax rebate of 12 500 or the payable tax

Web Tax Rebate Under Section 87A Claim Income Tax Rebate for FY 21 22 AY 22 23 What is Insurance What is Superannuation View All FAQs Section 80CCC Section 80DDB Web The income tax rebate under Section 87A gives some benefit to taxpayers who fall below the 10 tax threshold Any person whose annual net income is not more than Rs 5

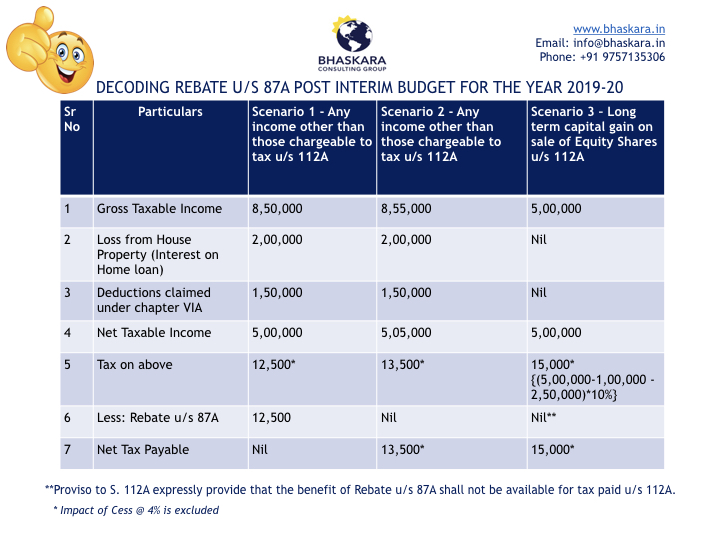

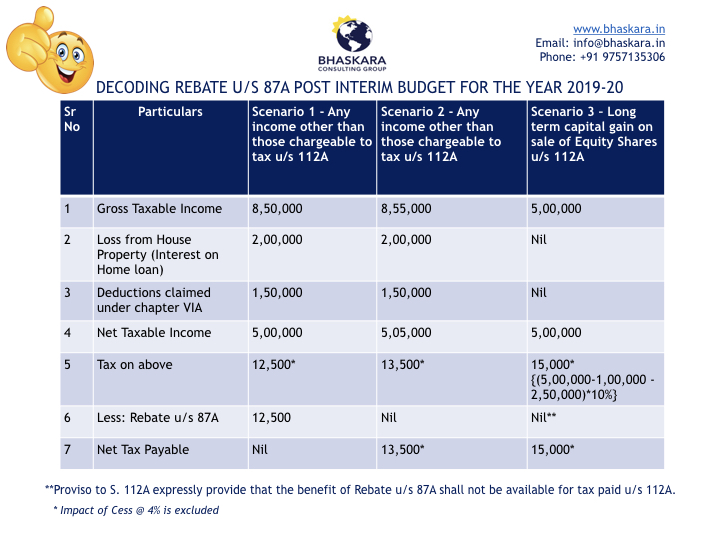

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

http://bhaskara.in/wp-content/uploads/2019/02/87A-Rebate-Provisions.jpeg.001.jpeg

Tax Rebate Under Section 87A All You Need To Know YouTube

https://i.ytimg.com/vi/JM0j9VqDYfI/maxresdefault.jpg

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

https://www.turtlemint.com/tax-rebate-under-87a

Web 13 mai 2023 nbsp 0183 32 The available tax rebate under Section 87A of the Income Tax Act 1961 offers the benefit of nil taxation if you have a limited income However before claiming

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Income Tax Act 87A Rebate Of Resident Individual Income Upto 5 Lakh

Income Tax Act 87A Rebate Of Resident Individual Income Upto 5 Lakh

Rebate U s 87A

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

What Is Rebate U s 87A Standard Deduction Tax Calculation For F Y

Tax Rebate Us87a - Web 2 f 233 vr 2023 nbsp 0183 32 In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim