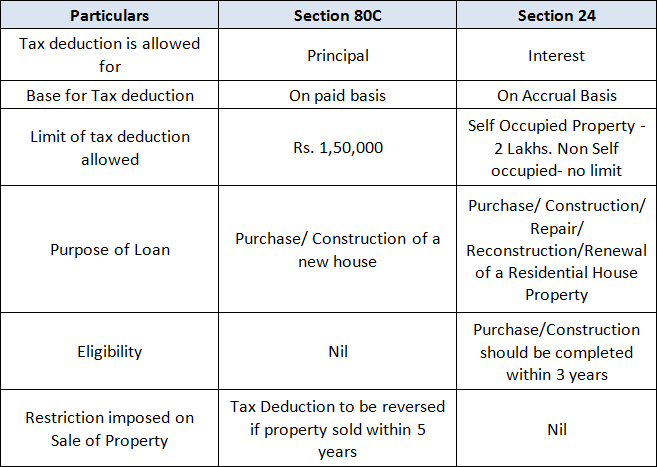

Home Loan Interest Tax Exemption Limit First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March

Home Loan Interest Tax Exemption Limit

Home Loan Interest Tax Exemption Limit

https://i.ytimg.com/vi/_HTrJnRpfN8/maxresdefault.jpg

House Loan Interest Tax Deduction Home Sweet Home Insurance

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

https://4.bp.blogspot.com/-uSsLXFgb7ws/VvkilIzWgnI/AAAAAAAAAR8/kll2wnXfXEcDlh2Tq6MfcAAXdHfQGqwgA/s1600/home-loan-tax-benefits%2B%25283%2529.png

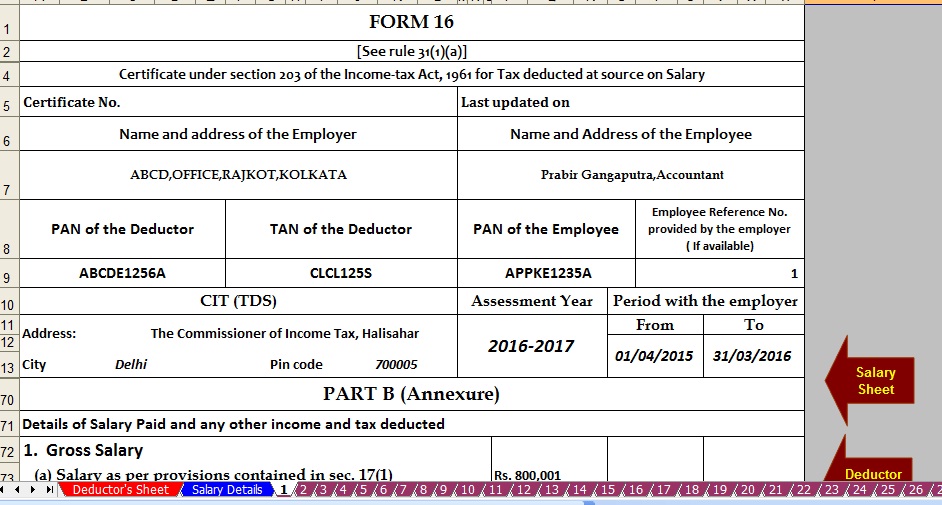

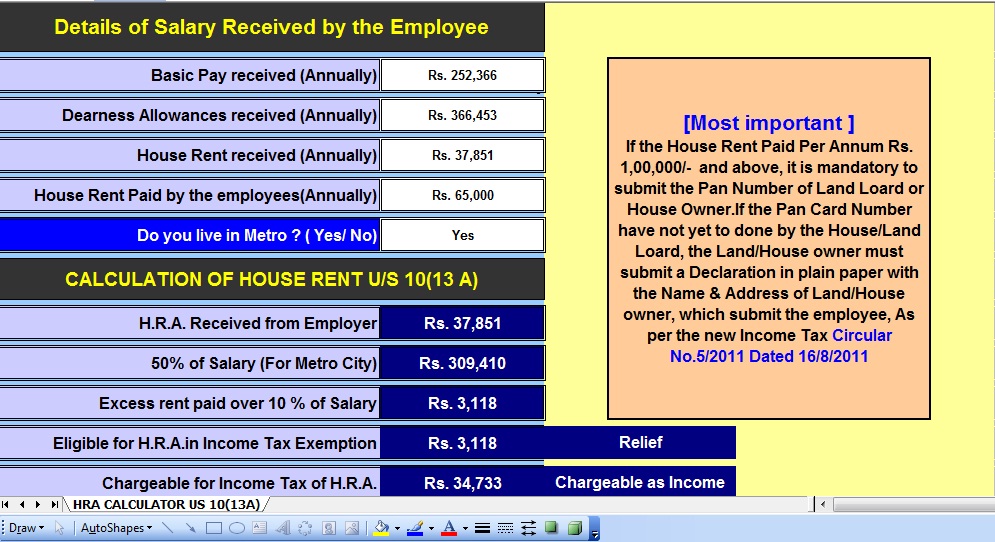

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution or a housing finance company You can claim a deduction of

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross Get income tax benefits on Home Loan under Section 24 80EE and 80C Know how much income tax exemption on a housing loan you can claim in 2024

Download Home Loan Interest Tax Exemption Limit

More picture related to Home Loan Interest Tax Exemption Limit

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

The maximum limit for 80EEA exemption in a single financial year has been capped at 1 5 lakhs A homebuyer can claim this deduction of 1 5 lakhs over and Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy build or substantially improve the taxpayer s home that secures the loan

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified

What Is The Wealth Tax Exemption Limit All About Wealth Tax Sqrrl

https://wp.sqrrl.in/wp-content/uploads/2021/03/Wealth-Tax-Exemption-Limit-1.png

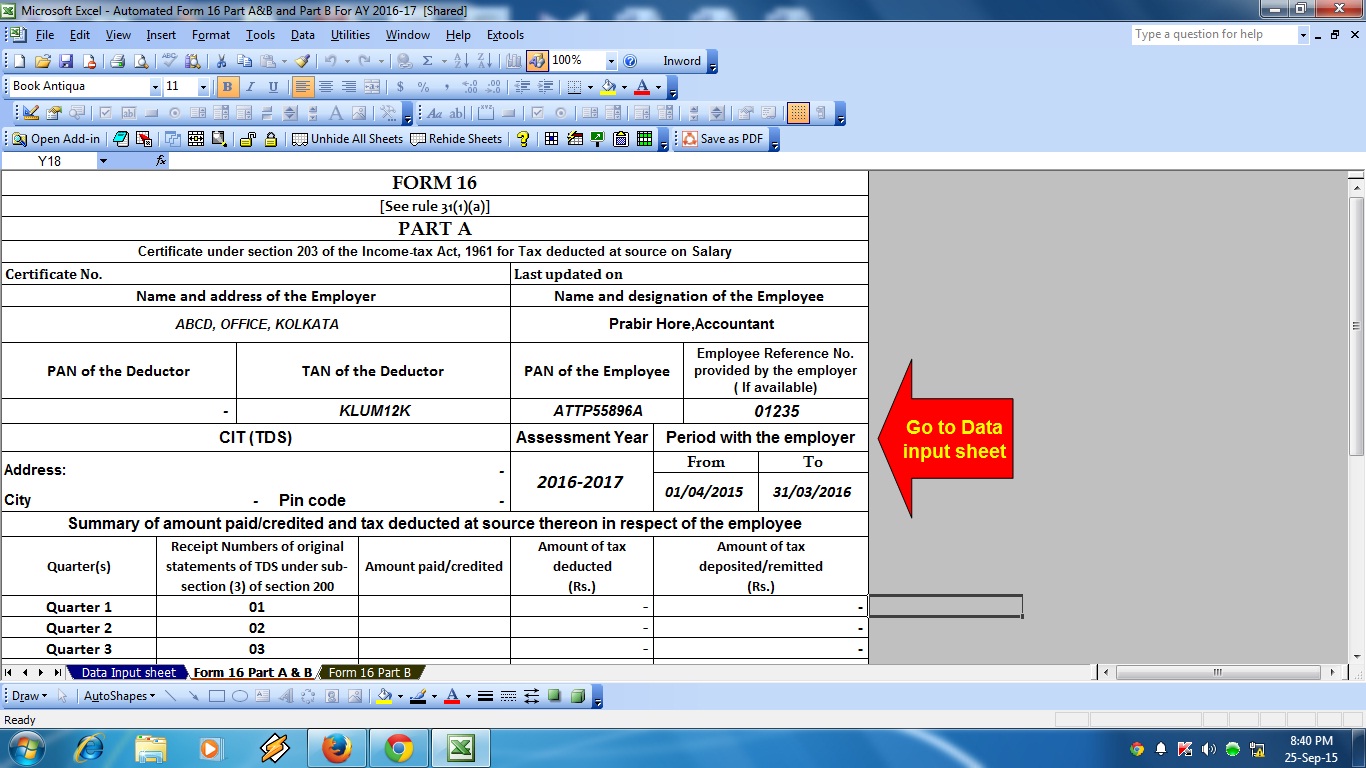

Home Loan Interest Home Loan Interest Exemption In Income Tax Fy 2016 17

https://2.bp.blogspot.com/-cN32m4O9mcM/WDcN-xG4G9I/AAAAAAAADis/1bAfLE9_WKEJyqfxftzoMXVByKmc1YhcACLcB/s1600/Form%2B16%2B3.jpg

https://housing.com/news/home-loans-guide …

First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto

Home Loan Tax Benefit Calculator FrankiSoumya

What Is The Wealth Tax Exemption Limit All About Wealth Tax Sqrrl

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

Home Loan Interest Home Loan Interest For Tax Exemption

Home Loan Interest Home Loan Interest For Tax Exemption

House Loan Limit In Income Tax Home Sweet Home

House Loan Limit In Income Tax Home Sweet Home

Tax Benefits How To Use Home Loan Interest To Benefit Of Tax

Housing Loans Joint Housing Loan Interest Tax Exemption

Tax Exemption On Home Loan Interest

Home Loan Interest Tax Exemption Limit - Get income tax benefits on Home Loan under Section 24 80EE and 80C Know how much income tax exemption on a housing loan you can claim in 2024