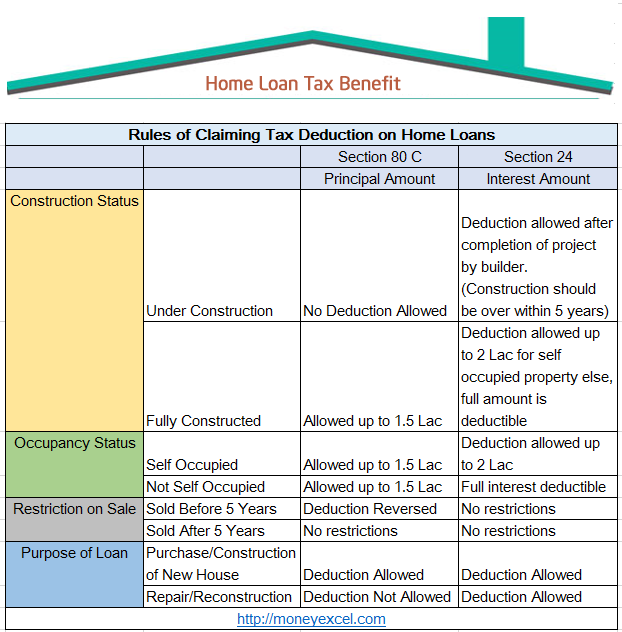

Home Loan Tax Benefit Under 80c First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co borrowers can

Overall the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of INR Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022

Home Loan Tax Benefit Under 80c

Home Loan Tax Benefit Under 80c

https://www.fisdom.com/wp-content/uploads/2021/08/103.png

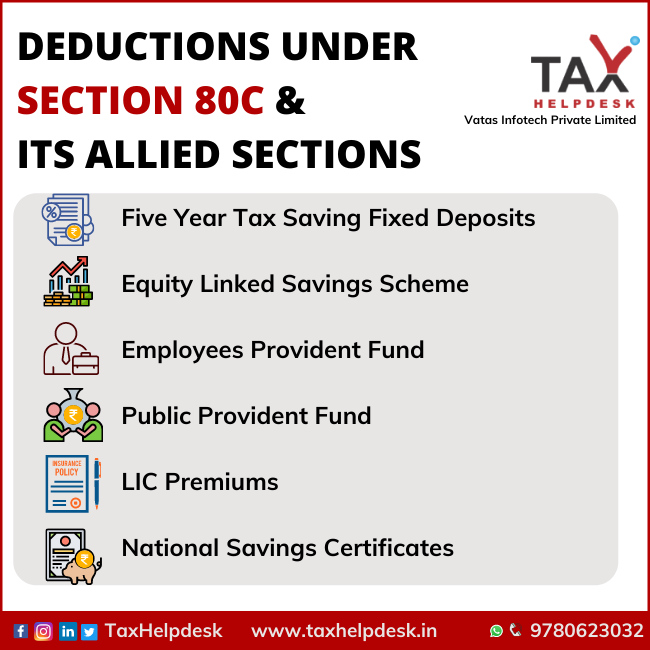

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Deductions-under-Section-80C-its-allied-sections.png

Do You Know How To Get An Annual Housing Loan Tax Benefit Of Rs 5 Lakh

https://blogger.googleusercontent.com/img/a/AVvXsEjEBgXwUxM8gpiEQforulKfUR_9km9BUjn7CBdHLf0KDs6wj2mchTC2y1IfzcbrYC2pvx55p47c81e8ZCsITBZasS2DQ3cJdY7LbUKKKAzfwjQbJHOQ-XlAYAAg26_waKNhnmtQNdqDio3QPh5tttvYjqDfPNpudf5En7ebIFs_YrEo00V-6njDO6EwcQ=s16000

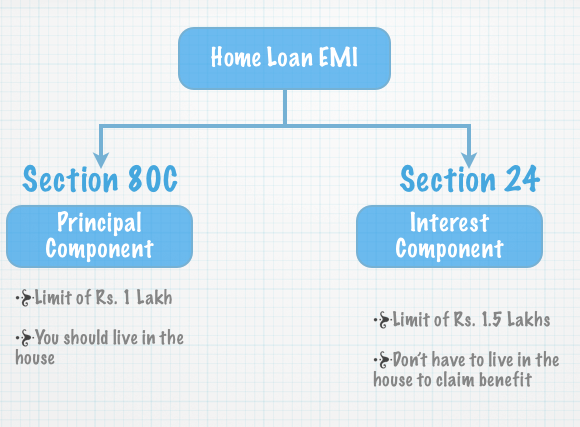

You can claim tax deduction under section 80C on the premium paid for home loan protection insurance plan The deduction is not allowed when you borrow the premium money from your lender and repay via EMIs Individuals who have taken a home loan for purchasing or constructing a residential property can claim tax deductions on the interest paid on the loan under Section 24 of the Income Tax Act

Section 80EEA which provides taxpayers with an extra deduction for paying interest on a house loan Whereas Section 24 exempted interest on home loans up to Rs 2 Section 80C allows the deduction for the amount paid towards the principal repayment of the home loan taken from the specified financial institutions This deduction is allowed under the overall umbrella limit of Rs 1 5

Download Home Loan Tax Benefit Under 80c

More picture related to Home Loan Tax Benefit Under 80c

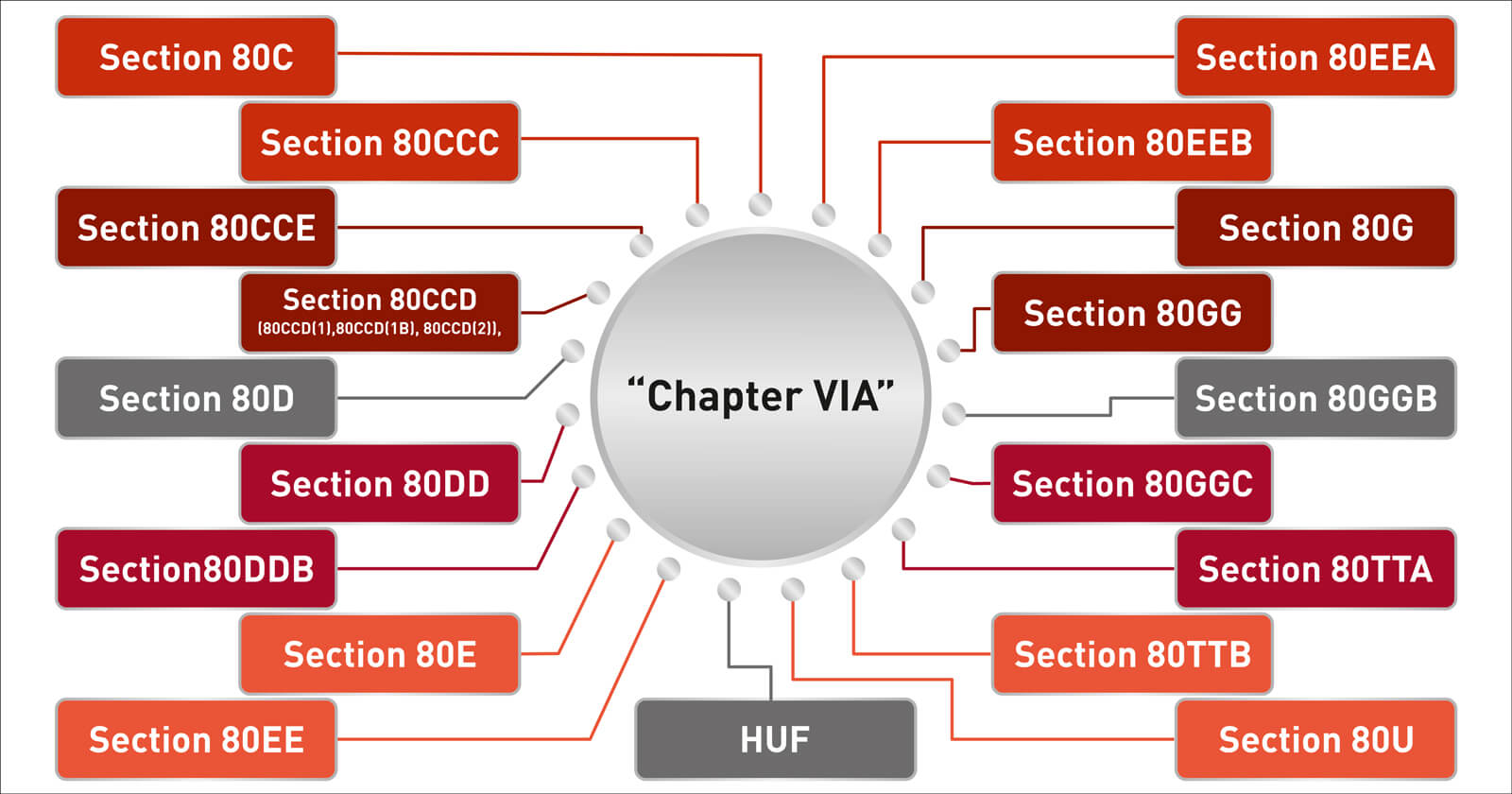

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Home Loan Tax Benefit Under Section 80EE

https://cdn.staticmb.com/homeloanstatic/images/magicbricks-home-loans.jpg

Home Loan Tax Benefit Calculator Housing Loan Tax Saving Calculator

https://www.indiabullshomeloans.com/images/tax-benefit-calculator-img.jpg

Things you must know about tax benefits on home loan 1 Home loan borrowers are entitled to tax benefits under Section 80C and Section 24 of the Income Tax Act These Discover the tax advantages of home loans under the Income Tax Act 1961 Explore Sections 24B 80C 80EE and 80EEA which offer deductions for interest on loan

Get income tax benefits on Home Loan under Section 24 80EE and 80C Know how much income tax exemption on a housing loan you can claim in 2024 Under section 80C a deduction of Rs 1 5 lakh can be claimed for the repayment of the home loan s principal amount where loan is taken for the construction or purchase of a new house

Will All Kinds Of Tuition Fees Qualify For Tax Benefit Under Section

https://www.financialexpress.com/wp-content/uploads/2022/07/1-438.jpg?resize=650

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

https://housing.com/news/home-loans-guide …

First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co borrowers can

https://taxguru.in/income-tax/tax-benefits-home...

Overall the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of INR

Home Loan Tax Benefits As Per Union Budget 2020

Will All Kinds Of Tuition Fees Qualify For Tax Benefit Under Section

How Housing Loan Tax Benefit

Section 80C Deductions List To Save Income Tax FinCalC Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80C Deduction Under Section 80C In India Paisabazaar

Home Loan Tax Benefits Section 24 80EE 80C 10 Less Known Facts

Pin P Home Improvement And Construction Blogs

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium

Home Loan Tax Benefit Under 80c - Individuals who have taken a home loan for purchasing or constructing a residential property can claim tax deductions on the interest paid on the loan under Section 24 of the Income Tax Act