Home Office Tax Deduction 2023 Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage interest insurance utilities repairs and depreciation for that area

Here s what you should know about the home office tax deduction before you file your 2023 tax return Home office tax deduction Who qualifies You may be eligible for the home office deduction if you had any income from self employment in 2023 but the rules are strict Key Takeaways Under the current law you can qualify for the

Home Office Tax Deduction 2023

![]()

Home Office Tax Deduction 2023

https://db-excel.com/wp-content/uploads/2019/01/real-estate-expense-tracking-spreadsheet-with-regard-to-realtor-expense-tracking-spreadsheet-fresh-tax-deduction-cheat-sheet.png

Printable Tax Deduction Cheat Sheet

https://i.pinimg.com/originals/c6/6c/36/c66c36ac209edd0f430465859899061c.png

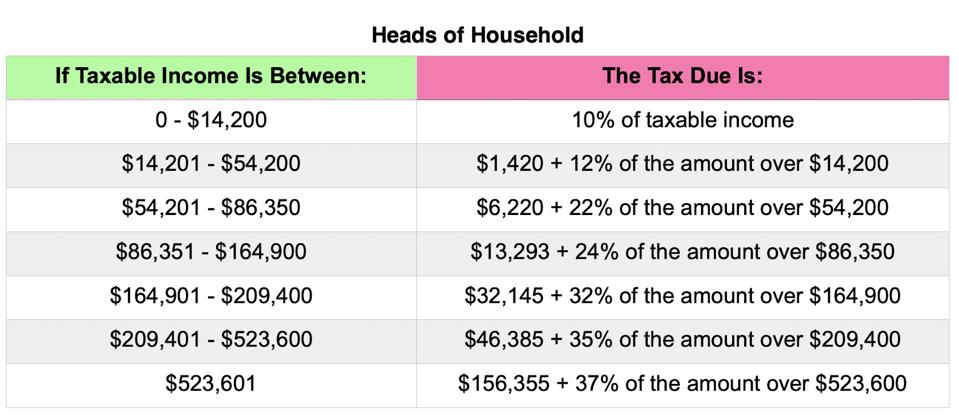

IRS Releases 2021 Tax Rates Standard Deduction Amounts And More

https://specials-images.forbesimg.com/imageserve/5f972ea35188f3014d9232a6/960x0.jpg?fit=scale

If you re a W 2 worker meaning your employer withholds taxes from your paychecks you can t take the home office deduction for 2023 However freelance and contract workers with income The home office deduction calculated on Form 8829 is available to both homeowners and renters There are certain expenses taxpayers can deduct These may include mortgage interest insurance utilities repairs maintenance depreciation and rent

Here s who can claim the home office deduction on this year s taxes Most employees aren t eligible for the home office deduction but you may qualify as a contractor or with a side Regular method Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes Same Allowable square footage of home use for business not to exceed 300 square feet Percentage of home used for business

Download Home Office Tax Deduction 2023

More picture related to Home Office Tax Deduction 2023

Printable List Of Tax Deductions Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/100/302/100302714/large.png

Tax Preparation Worksheet Pdf Completing Form 1040 With A Us Expat

https://www.signnow.com/preview/82/664/82664161/large.png

Fillable Online Apps Irs Standard Deduction Worksheet Line 40 Form Fax

https://www.pdffiller.com/preview/100/101/100101588/large.png

You can t claim the home office deduction as a full time employee with W 2 earnings but it may be possible with 1099 income as a contractor or self employed worker To qualify you must use You may qualify for the home office deduction if you use a portion of your home for your business on a regular basis a home can include a house apartment condominium mobile home boat or similar structure

[desc-10] [desc-11]

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

Home Office Deduction Worksheet Excel Osakiroegner 99

https://i.pinimg.com/originals/5b/f1/1c/5bf11ce4adb7b2d7f007c6ab2ba2a967.png

https://www.irs.gov/credits-deductions/individuals/home-office...

Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage interest insurance utilities repairs and depreciation for that area

https://www.kiplinger.com/taxes/tax-deductions/...

Here s what you should know about the home office tax deduction before you file your 2023 tax return Home office tax deduction Who qualifies

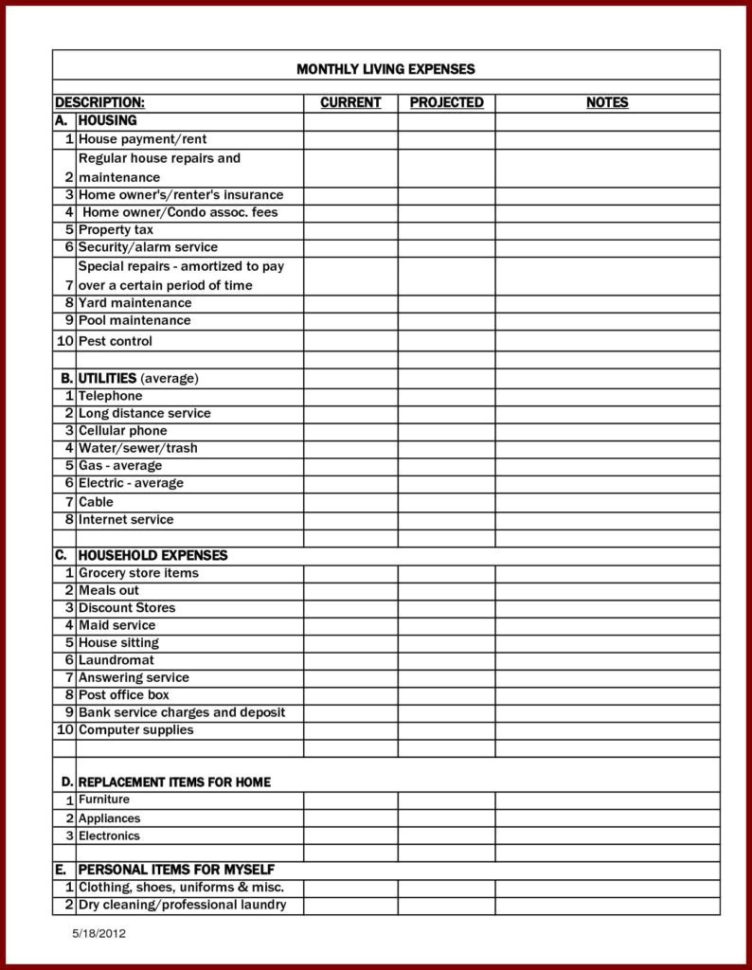

Self Employed Tax Deductions Worksheet Db excel

10 Business Tax Deductions Worksheet Worksheeto

Business Tax List Of Business Tax Deductions

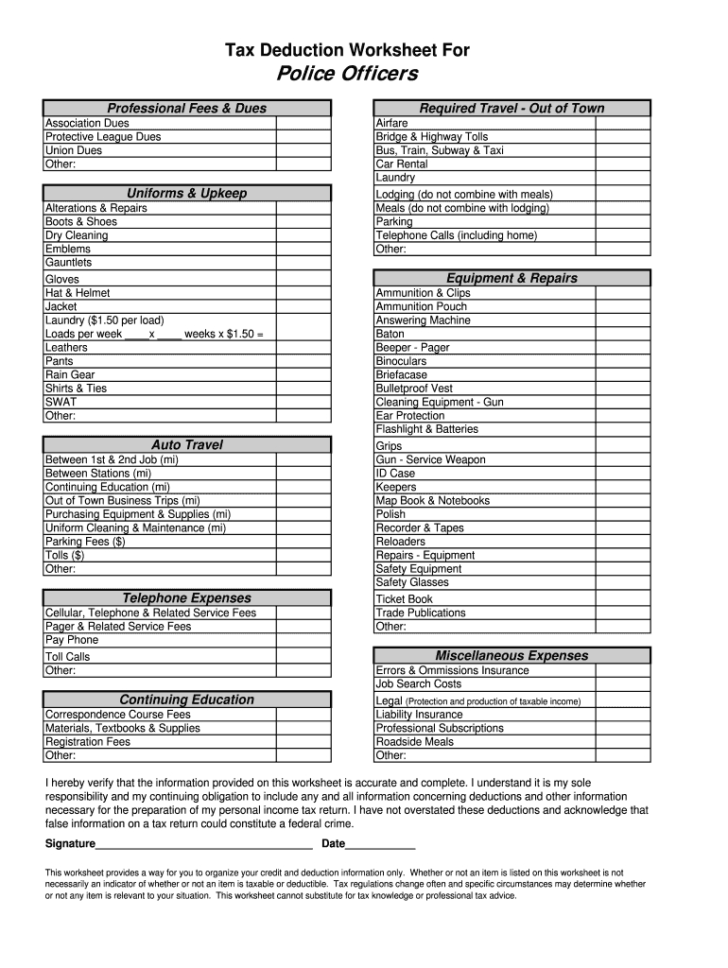

Fillable Online Police Officer Tax Deduction Worksheet Db excel

Tax Preparation Excel Spreadsheet Db excel

Real Estate Agent Commission Spreadsheet With Realtor Expense Tracking

Real Estate Agent Commission Spreadsheet With Realtor Expense Tracking

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

10 Tax Deduction Worksheet Worksheeto

Printable Real Estate Agent Tax Deductions Worksheet

Home Office Tax Deduction 2023 - If you re a W 2 worker meaning your employer withholds taxes from your paychecks you can t take the home office deduction for 2023 However freelance and contract workers with income