Home Office Tax Write Off 2023 Self employed people can generally deduct office expenses on Schedule C Form 1040 whether or not they work from home This write off covers office supplies postage computers printers and

Instead of tracking all your home related expenses and writing off a portion based on your business use percentage the simplified method for 5 home office tax deductions to take this tax season From workspace expenses to technology investments uncover the deductions that can contribute to a more financially

Home Office Tax Write Off 2023

Home Office Tax Write Off 2023

https://www.pdffiller.com/preview/391/382/391382225/large.png

Taxes You Can Write Off When You Work From Home INFOGRAPHIC

https://i.pinimg.com/originals/4f/81/0f/4f810f590598d2ffd04be627113bc257.jpg

How To Write Off Home Office Utilities Facebookthesis web fc2

http://www.city-data.com/forum/attachments/real-estate-professionals/163474d1451489223-possible-tax-write-offs-reps-tax-write-offs-real-estate-agents.jpg

One of the most essential tax deductions for freelancers and other self employed individuals is the home office tax deduction Here we will introduce you to what you need to know in order to To qualify for the home office tax write off you must use a space in your home exclusively for your self employed business So not only do you need to work from home but you need to be self employed and your office

For the 2023 tax year the CRA has stated you will be qualified to write off your home office expenses if your home workspace is where you principally meaning more Simplified home office deduction You can deduct 5 per square foot up to 1 500 or 300 square feet a year for your exclusive home office space if it s used for the full

Download Home Office Tax Write Off 2023

More picture related to Home Office Tax Write Off 2023

Brilliant Tax Write Off Template Stores Inventory Excel Format

https://i.pinimg.com/originals/50/36/b5/5036b5533c4f7b4622b69c4de19a3101.jpg

Taxes You Can Write Off When You Work From Home INFOGRAPHIC

https://i.pinimg.com/originals/68/31/b1/6831b1b3ded591f70d81bbb733756dbc.jpg

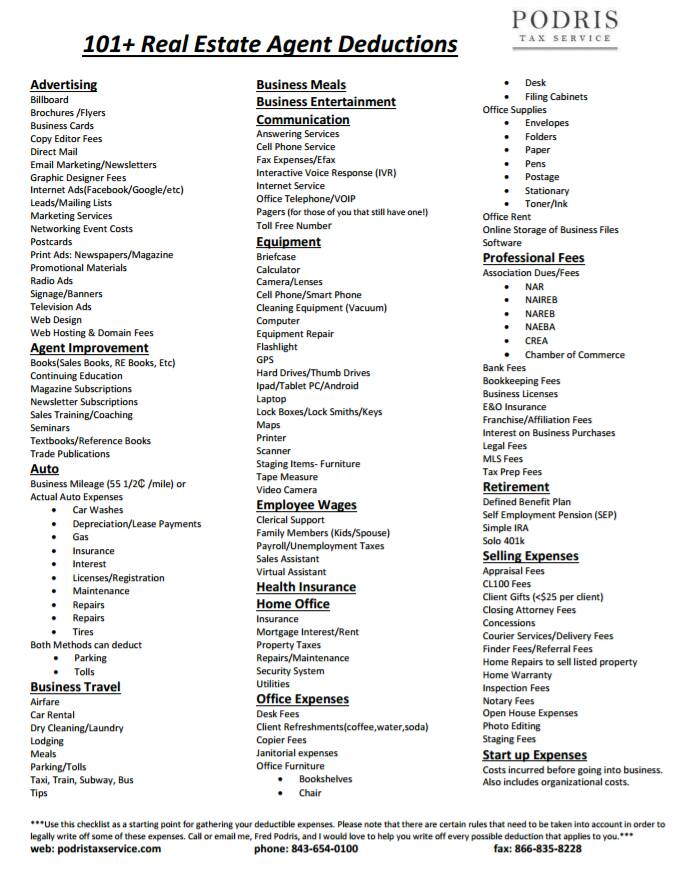

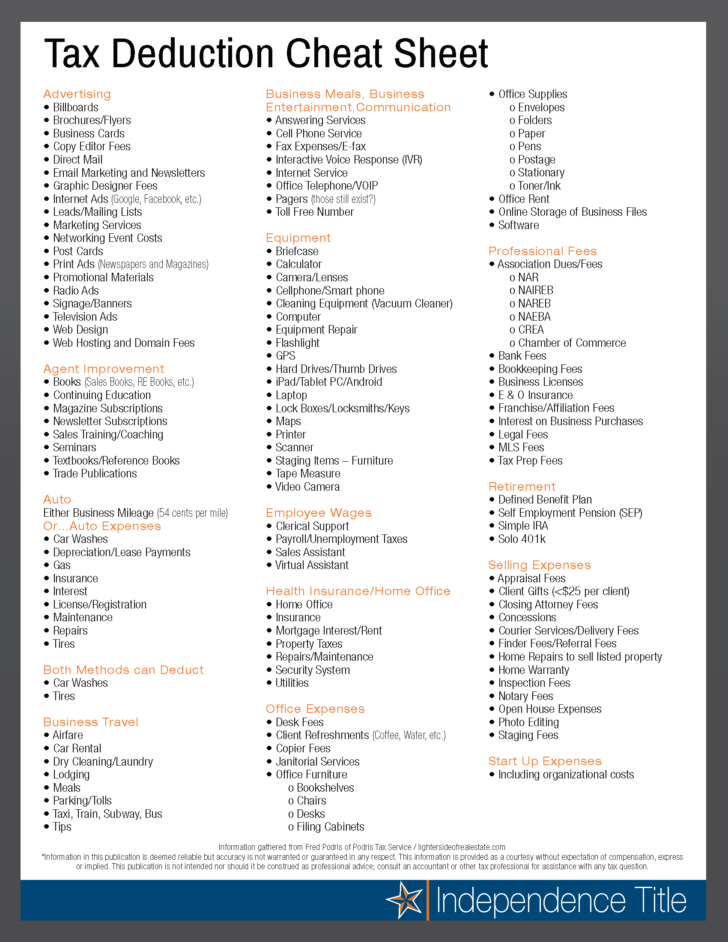

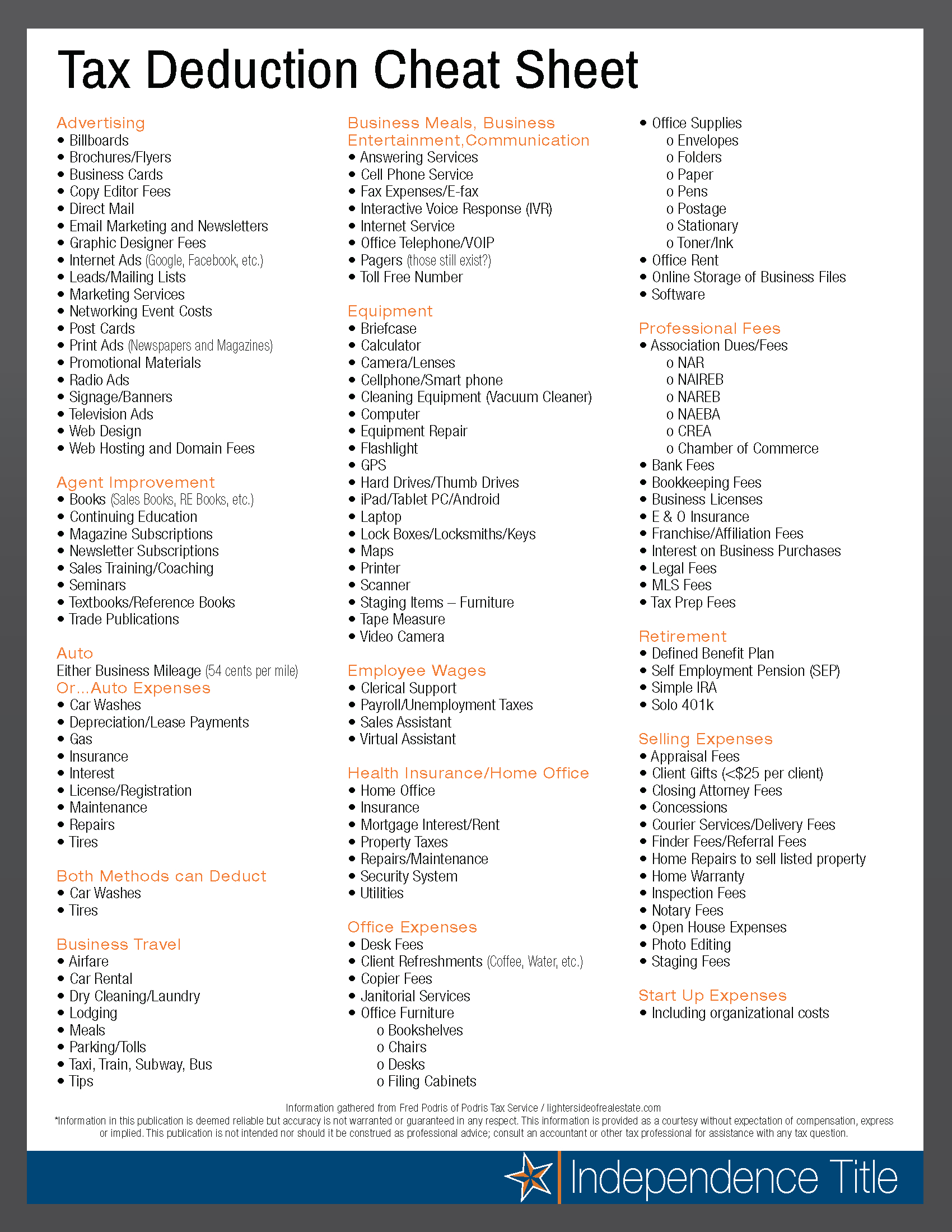

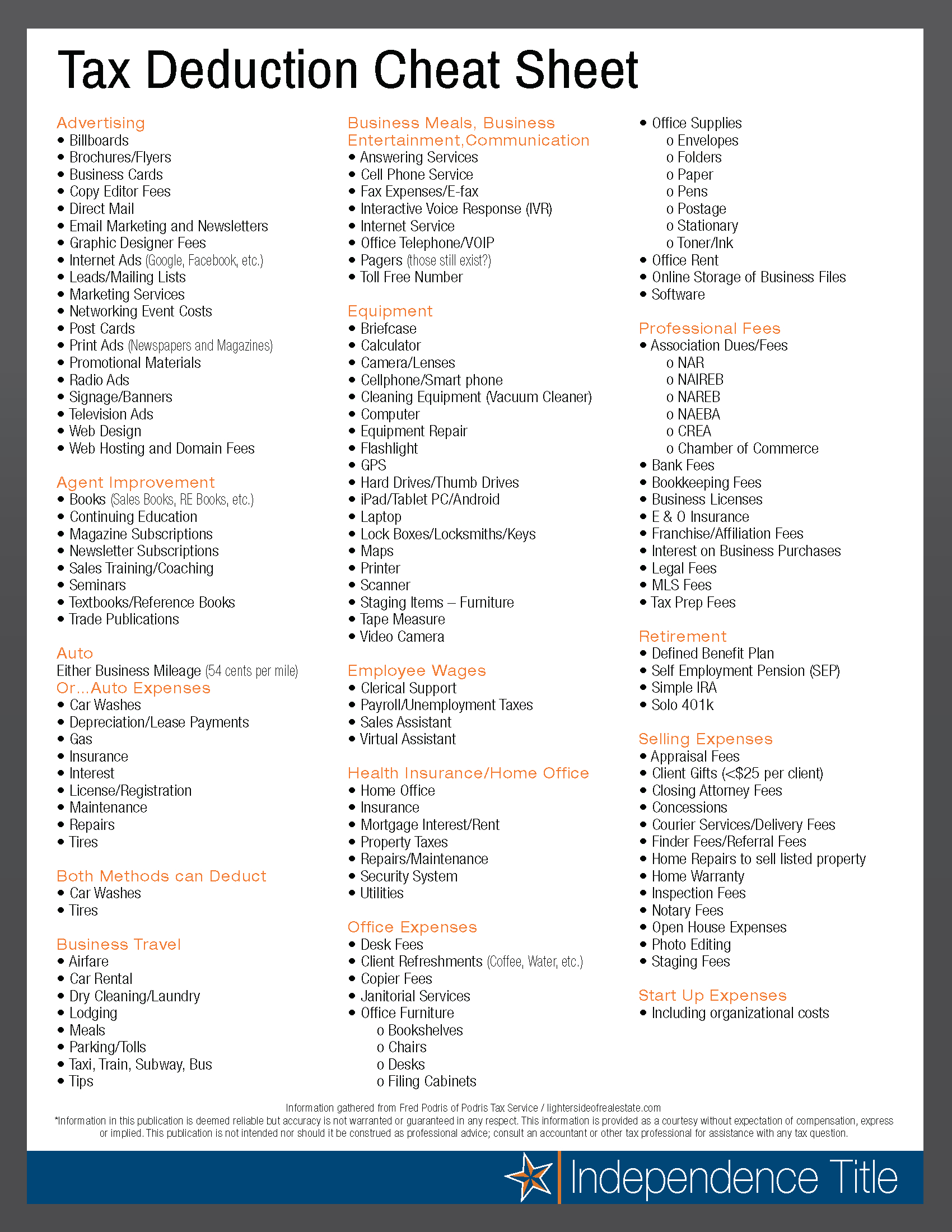

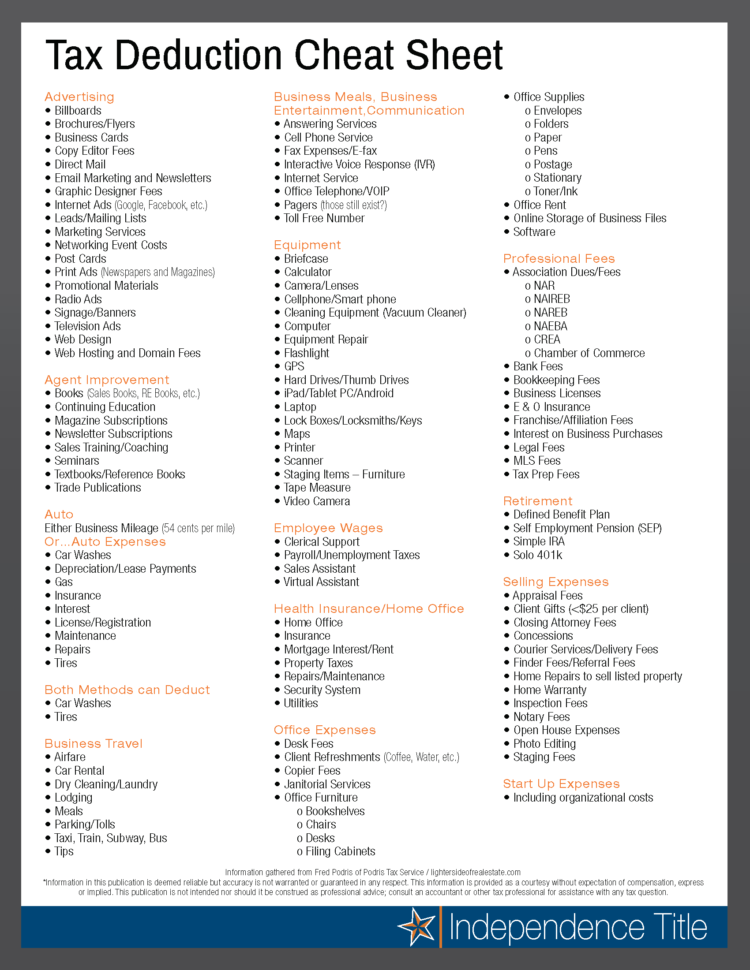

Printable Tax Deduction Cheat Sheet

http://independencetitle.com/wp-content/uploads/RealtorTaxTips2016_Page_2.png

Setting up a home office Discover the important tax implications and learn how to claim the home office deduction if you work from home Maximize your tax benefits by understanding the rules and requirements The home office tax deduction is used to write off your home office and office related expenses Claim it using the standard or simplified method LEARN MORE

The home office deduction could provide a tax break on your 2024 return Here s who qualifies and how to claim it For 2023 2024 both homeowners and renters can claim the deduction for any type of home you reside in including a house apartment mobile home houseboat or condo However your

Realtor Tax Deductions Worksheet

https://db-excel.com/wp-content/uploads/2018/11/business-itemized-deductions-worksheet-beautiful-business-itemized-for-business-expense-deductions-spreadsheet-750x970.jpg

Deductions Worksheet Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/354/967/354967762/large.png

https://www.kiplinger.com › taxes › tax-de…

Self employed people can generally deduct office expenses on Schedule C Form 1040 whether or not they work from home This write off covers office supplies postage computers printers and

https://www.keepertax.com › posts › home …

Instead of tracking all your home related expenses and writing off a portion based on your business use percentage the simplified method for

Owner Operator Tax Deductions Worksheets

Realtor Tax Deductions Worksheet

Self Employed Tax Deductions Worksheet

Small Business Tax Small Business Tax Deductions Business Tax Deductions

Tax Preparation Fees 2020 Deduction Stormy Olmstead

Tax Deduction List 2024 Rena Krista

Tax Deduction List 2024 Rena Krista

Real Estate Agent Tax Deductions Worksheet

Home Office Tax Expenses

Printable Tax Deduction Cheat Sheet Web Use The Following Tax Deduction

Home Office Tax Write Off 2023 - Writing off home office purchases in 2023 is still possible under the same rules as in previous years Keep detailed records of your expenses and consult with a tax professional