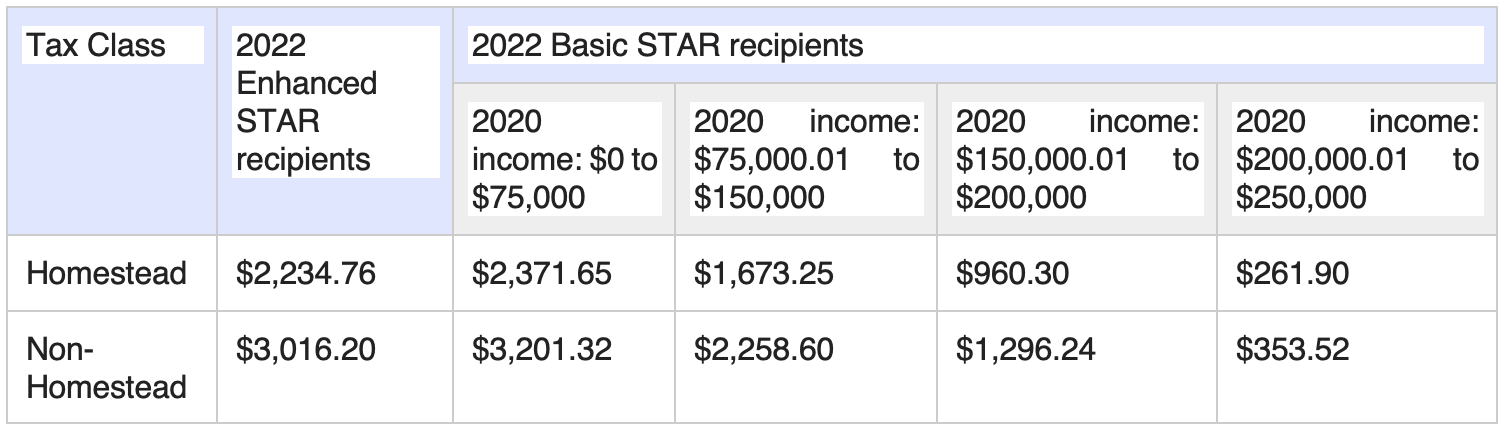

Home Owner Tax Rebate Credit Web To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for

Web 14 mars 2023 nbsp 0183 32 Learn about the homeowner tax rebate credit The homeowner tax rebate credit is a one year program providing direct property tax relief to nearly Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Home Owner Tax Rebate Credit

Home Owner Tax Rebate Credit

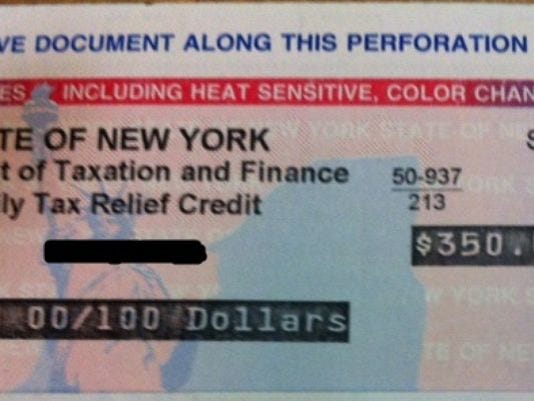

https://www.fingerlakes1.com/wp-content/uploads/2022/07/homeowner-tax-rebate-credit-coming-timeline-for-getting-your-check.jpg

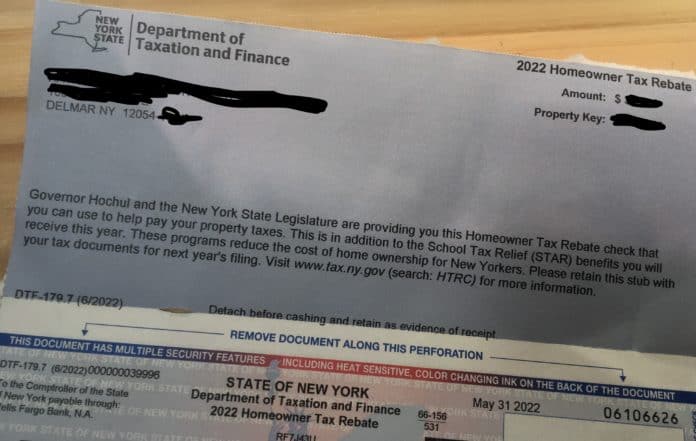

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul

https://yonkerstimes.com/wp-content/uploads/2022/06/FUVtPL9WIAM9l1Zggggg-696x441.jpg

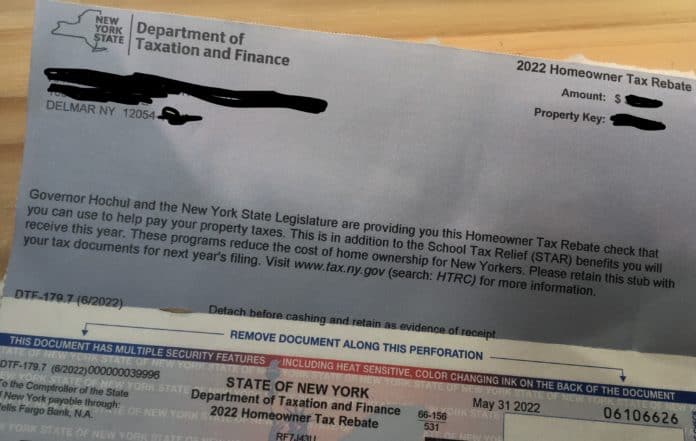

New York State Homeowner Tax Rebate Credit HTRC Sciarabba Walker

https://swcllp.com/wp-content/uploads/2022/06/NYS-Homeowner-Tax-Rebate-Credit-Header-940x675.png

Web 9 sept 2022 nbsp 0183 32 For instance homeowners that make changes that cut their energy usage by at least 35 can get up to 4 000 in rebates That amount is doubled for low and Web 21 sept 2022 nbsp 0183 32 Low income households LMI less than 80 percent of AMI are eligible to receive a rebate equal to 100 percent of the project cost up to the caps listed below Households between 80 percent and 150

Web 22 mai 2023 nbsp 0183 32 The First Time Homebuyer Tax Credit is a 15 000 refundable tax credit for first time home buyers Eligible home buyers must meet the following criteria according to the bill s most recent version Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Download Home Owner Tax Rebate Credit

More picture related to Home Owner Tax Rebate Credit

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

https://media.wgrz.com/assets/WGRZ/images/6bb6d79c-d629-4757-b1e2-c5fefa386c2f/6bb6d79c-d629-4757-b1e2-c5fefa386c2f_750x422.jpg

Mass Tax Rebate Check

https://www.gannett-cdn.com/-mm-/9902e24b3ce22452871a78d74d7f00970fb66eca/c=0-0-533-401/local/-/media/Westchester/None/2014/10/23/635496480107570533-1412267325000-REFUNDCHCKphoto.JPG?width=534&height=401&fit=crop

First time Home Buyer Iowa Tax Credit 2020 Labeerweek

https://blog.constellation.com/wp-content/uploads/2017/01/tax-credits-rebates-homeowners-guide.png

Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of Web 23 janv 2023 nbsp 0183 32 NY Homeowner Tax Rebate Credit HTRC is a one year tax credit program for eligible homeowners The amount of the credit is between 250 and 350

Web 23 juin 2022 nbsp 0183 32 Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or equal to 250 000 for the 2020 income tax Web 17 ao 251 t 2022 nbsp 0183 32 Homeowner tax rebate credit registration If you received a letter Form RP 5303 requesting that you register for the homeowner tax rebate credit please

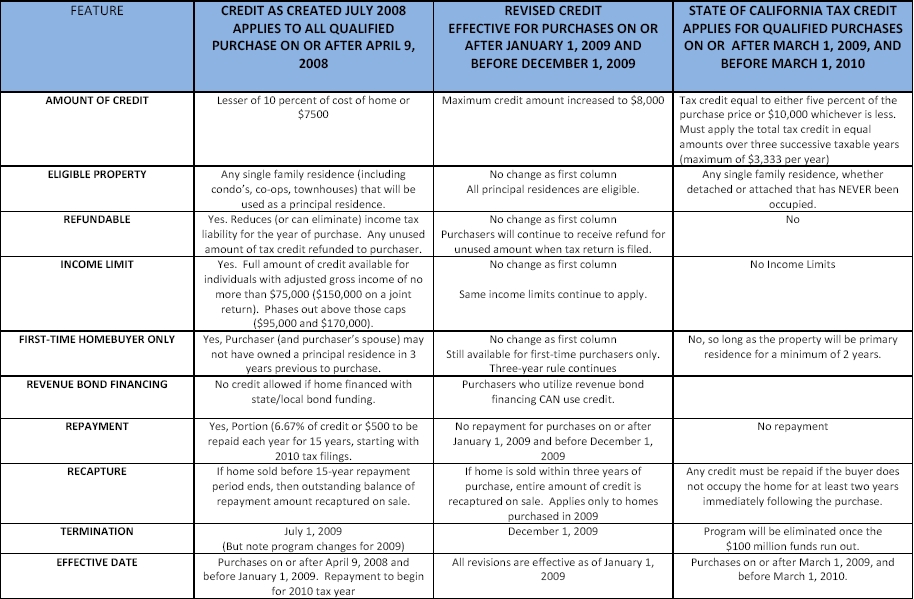

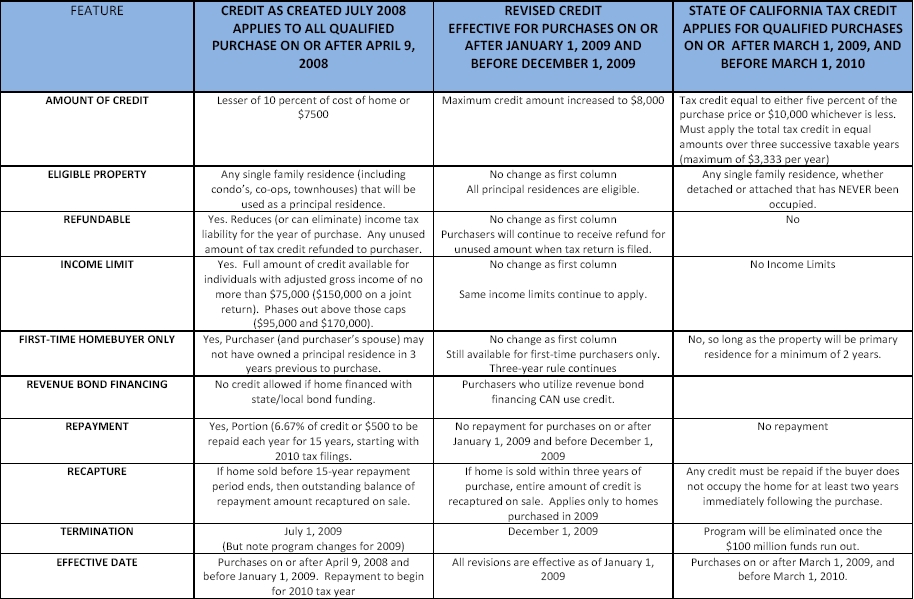

Homeowners Tax Credit Overview Part 2 CA 10k Credit The Basis Point

https://thebasispoint.com/wp-content/uploads/2009/03/fed-and-ca-homeowner-tax-credits.jpg

From Town Assessor State Sending Letter On New Homeowner Tax rebate

https://pelhamexaminer.com/wp-content/uploads/2022/08/Screen-Shot-2022-08-23-at-4.37.55-PM.png

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Web To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for

https://www.tax.ny.gov/pit/property/htrc/lookup.htm

Web 14 mars 2023 nbsp 0183 32 Learn about the homeowner tax rebate credit The homeowner tax rebate credit is a one year program providing direct property tax relief to nearly

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Homeowners Tax Credit Overview Part 2 CA 10k Credit The Basis Point

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/CEH7XCAU3RGZRIFZ3QD7EA46X4.jpg)

Check Yourself Gov Hochul Reminds Voters Who Provided Them A Rebate

New York Property Owners Getting Rebate Checks Months Early

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

Fun With Pre Paid Cards

Fun With Pre Paid Cards

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

What Is The Recovery Rebate Credit CD Tax Financial

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Home Owner Tax Rebate Credit - Web Update on homeowner tax rebate credit checks Great news We ve mailed nearly two million homeowner tax rebate credit checks to eligible New York homeowners and