Homeowner Tax Rebate Credit Ct Connecticut laws require municipalities to provide property tax relief for specific groups of homeowners such as those who are seniors veterans or have a disability Additionally some homeowners are eligible for an exemption for using certain renewable energy sources and an income tax credit for paying property taxes

Connecticut provides state reimburse circuit breaker property tax credits to homeowners who are at least 65 years old or totally disabled and whose annual incomes do not exceed certain limits The widow or widower of someone who received benefits at time of death also qualifies for this relief Enter below the property tax paid in 2021 to a Connecticut city or town on your primary residence or privately owned or leased automobile Press the Calculate Your Credit button when complete QUALIFYING

Homeowner Tax Rebate Credit Ct

Homeowner Tax Rebate Credit Ct

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

What You Need To Know About A State Child Tax Credit CT Voices

https://ctvoices.org/wp-content/uploads/2021/03/What-you-need-to-know-about-a-state-Child-Tax-Credit-819x2048.jpg

The Homeowners Elderly Disabled Tax Relief Program also known as Circuit Breaker provides a property tax credit to eligible individuals in need of relief It does so through a credit against local property tax for homeowners State law provides a property tax credit program for Connecticut homeowners who are elderly or totally disabled and whose incomes do not exceed certain limits Property tax credit can be up to 1 250 for married couples and 1 000 for single people

The application period for 2024 Senior Disabled Homeowners Tax Relief is open from Thursday February 1 2024 The deadline to apply by mail is Monday April 15th 2024 and the deadline to apply in person is Wednesday May 15 th 2024 Under City of Stamford Ordinance s 1282 Supplemental the City of Stamford offers biennial tax credit programs for totally disabled homeowners with proof of disability from Social Security office or seniors who have been 65

Download Homeowner Tax Rebate Credit Ct

More picture related to Homeowner Tax Rebate Credit Ct

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

https://media.wgrz.com/assets/WGRZ/images/1045202f-604f-4386-8a31-35efff450899/1045202f-604f-4386-8a31-35efff450899_1920x1080.jpg

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-IMAGE-1024x587.jpg

Homeowner Tax Rebate Credit Coming Timeline For Getting Your Check

https://www.fingerlakes1.com/wp-content/uploads/2022/07/homeowner-tax-rebate-credit-coming-timeline-for-getting-your-check.jpg

Tax relief for certain elderly or totally disabled homeowners Reductions in real property taxes Sec 12 170cc Formerly Sec 12 170c Appeals from Secretary of the Office of Policy and Management or assessors Sec 12 170f State law provides a property tax credit program for Connecticut homeowners who are elderly or totally disabled and whose incomes do not exceed certain limits

Renter s Rebate Program For The Elderly and Totally Disabled Filing period is between April 1st and October 1st Renter s Rebate will follow the same income guidelines as the State Homeowner s Benefit program Tax relief credits range from 150 00 to 1250 00 depending on qualifying income for 100 owners For the City of Norwalk program the maximum qualifying income level counting all taxable and non taxable income for 2021 for both single and married applicants will be set by February 1 2022

New Child Tax Rebate Available Applications Being Accepted Now

https://www.cthousegop.com/mccarty/wp-content/uploads/sites/44/2022/05/Baz-child-tax-credit.png

NYS Tax Department Tax Tips For Property Owners Homeowner Tax Rebate

https://content.govdelivery.com/attachments/fancy_images/NYTAX/2022/06/6008609/htrc-3_original.jpg

https://www.cga.ct.gov/2021/rpt/pdf/2021-R-0172.pdf

Connecticut laws require municipalities to provide property tax relief for specific groups of homeowners such as those who are seniors veterans or have a disability Additionally some homeowners are eligible for an exemption for using certain renewable energy sources and an income tax credit for paying property taxes

https://www.cga.ct.gov/2012/rpt/2012-R-0104.htm

Connecticut provides state reimburse circuit breaker property tax credits to homeowners who are at least 65 years old or totally disabled and whose annual incomes do not exceed certain limits The widow or widower of someone who received benefits at time of death also qualifies for this relief

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate

New Child Tax Rebate Available Applications Being Accepted Now

From Town Assessor State Sending Letter On New Homeowner Tax rebate

NY Homeowner Tax Rebate Checks Arriving Early WHEC

Inflation Relief Checks Up To 1 700 To Be Released In 18 States Who

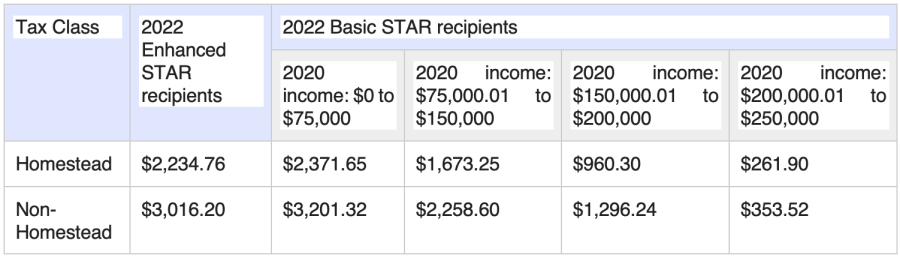

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

NYS Homeowner Tax Rebate Credit EFPR Group

NYC Homeowners To Start Receiving New Property Tax Rebate This Week

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Homeowner Tax Rebate Credit Ct - Homeowners Elderly Disabled Circuit Breaker Tax Relief Program State law provides a property tax credit program for Connecticut owners in residence of real property who are elderly 65 and over or totally disabled and whose annual incomes do not exceed certain limits