Homestead Rebate 2024 If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age

New Jersey s ANCHOR tax rebate program was a hallmark of the 2023 budget and the Department of the Treasury is already looking ahead to 2024 As of last month more than 1 638 million The Homestead Refund is a rebate program for the property taxes paid by homeowners The refund is based on a portion of the property tax paid on a Kansas resident s home 2024 to payback the Homestead or SAFESR property tax refund you elected to be advanced or paid to the county by KDOR on your behalf and applied toward the 1st half of

Homestead Rebate 2024

Homestead Rebate 2024

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/property-tax-rebates-check-if-you-are-eligible-for-anchor-program-3.jpg

Nj Homestead Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/homestead-rebate-not-received-this-year-hackettstown-nj.png

Can I File An Appeal For The Homestead Rebate NJMoneyHelp

http://njmoneyhelp.com/wp-content/uploads/2018/07/house-961401_1920-1024x681.jpg

He added These rebates tailored to California s specific needs provide substantial relief to residents Residents are eligible based on their 2023 2024 property taxes as long as their property qualifies as a homestead and they meet the other criteria The amount earned is decided based on several factors but the maximum credit is The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006 The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district Property tax reduction will be through a homestead or farmstead exclusion

Eligibility Requirements You are eligible if you met these requirements You were a New Jersey resident and You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2020 and 2020 property taxes were paid on that home and Your 2020 New Jersey gross income was not more than 250 000 A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older up to a maximum of 6 500 annually Right now senior homeowners making up to 500 000 annually would be eligible for the promised benefits The cost of Stay NJ could eventually rise to

Download Homestead Rebate 2024

More picture related to Homestead Rebate 2024

Is The Homestead Rebate For Homeowners Running Late Nj

https://www.nj.com/resizer/Z-Lasop-fy7Cz2Lo9wlvlTFVzPw=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/RW7W4DUDE5BIHBJBZMV2YOV254.jpg

What s The Maximum For The Homestead Rebate Nj

https://www.nj.com/resizer/FP-9_AOC9tQclFc-fQSuX5aG2Dg=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/WXCOADJAKREWPHN56T4KBMGARY.jpg

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

https://www.nj.com/resizer/mG8HoEC03Z_laQKwr9yycp9fj8o=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OCDIN5URIBBRVLQX5ZOGNBVHZI.jpg

Homestead exemption As part of an 18 billion property tax relief package Texas homeowners will see their homestead exemption on their property tax bill increase from 40 000 to 100 000 of While there are some similarities with Kansas Homestead Refund Program the Topeka rebate is entirely separate and available only to those living within the city The lower COLA for 2024

Politics Murphy talks up NJ s newest property tax program Homeowners who earned more than 150 000 and up to 250 000 annually in 2019 were made eligible to receive Anchor benefits totaling 1 000 Meanwhile renters who earned up to 150 000 annually in 2019 were also made eligible to receive Anchor benefits totaling 450 The next ANCHOR property tax relief benefit will be paid automatically for most New Jersey residents who qualify for the program NJ Advance Media learned Tuesday The state started mailing

Do I Qualify For The Homestead Rebate Or The Senior Freeze NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2020/04/houston-3267075_1920-1024x683.jpg

Do I Have To Report The Homestead Rebate On My Federal Taxes Nj

https://www.nj.com/resizer/qG0TiwqaYedsqil8w-me4KcPNjI=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OMRUQX7ZHBAUZCM7CJOPVJU344.jpg

https://nj.gov/treasury/taxation/anchor/index.shtml

If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age

https://www.msn.com/en-us/money/realestate/this-is-who-can-qualify-for-nj-anchor-rebates-in-2024/ar-AA1emGXe

New Jersey s ANCHOR tax rebate program was a hallmark of the 2023 budget and the Department of the Treasury is already looking ahead to 2024 As of last month more than 1 638 million

When Can I Apply For The Homestead Rebate Nj

Do I Qualify For The Homestead Rebate Or The Senior Freeze NJMoneyHelp

Is This Estate Eligible For The Homestead Rebate NJMoneyHelp

What Happened To My Homestead Rebate Nj

When Will We Get The Homestead Rebate Nj

Can I Submit A Paper Application For The Homestead Rebate Nj

Can I Submit A Paper Application For The Homestead Rebate Nj

The Homestead Rebate Isn t Cutting It Sheneman Nj

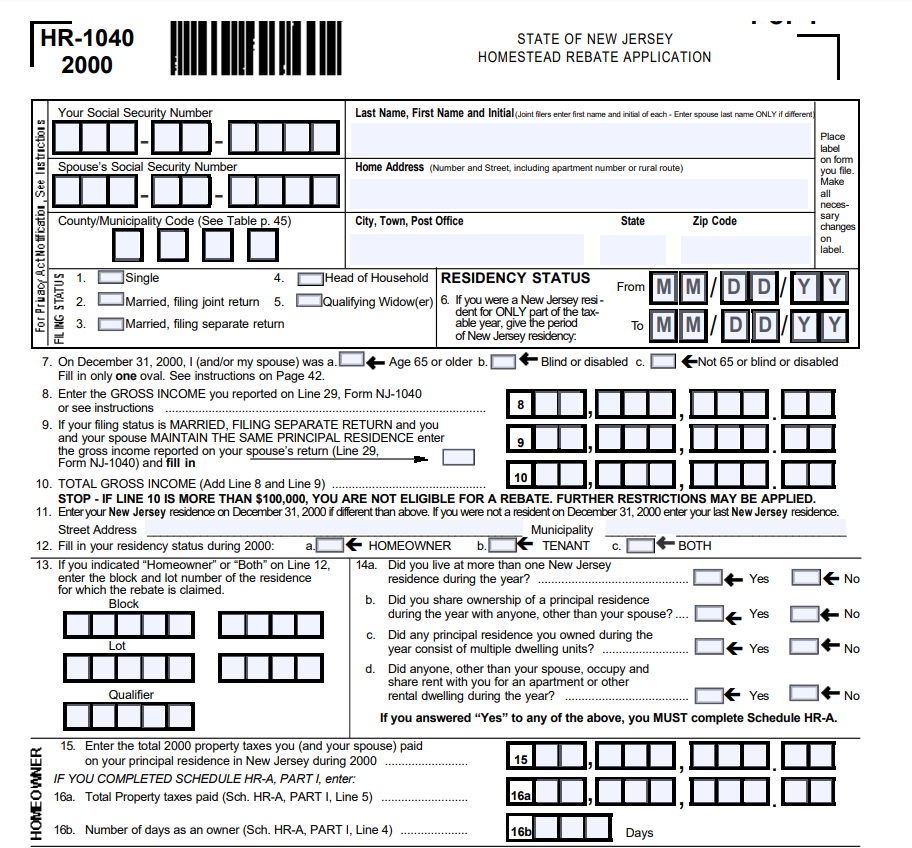

NJ Homestead Printable Rebate Form

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

Homestead Rebate 2024 - A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older up to a maximum of 6 500 annually Right now senior homeowners making up to 500 000 annually would be eligible for the promised benefits The cost of Stay NJ could eventually rise to