Homestead Rebate Nj Eligibility Web Affordable New Jersey Communities for Homeowners and Renters ANCHOR This program provides property tax relief to New Jersey residents who own or rent property in

Web 19 ao 251 t 2019 nbsp 0183 32 The 2016 income requirements were that you had to earn less than 150 000 for homeowners who are age 65 or older or blind Web 27 sept 2021 nbsp 0183 32 The current benefit year is for 2018 First let s see if you re eligible You need to be a New Jersey resident and have owned and occupied a home in the state

Homestead Rebate Nj Eligibility

Homestead Rebate Nj Eligibility

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/homestead-rebate-not-received-this-year-hackettstown-nj.png

New Jersey Homestead Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/2018-new-jersey-homestead-rebate-application-fill-out-sign-online.png

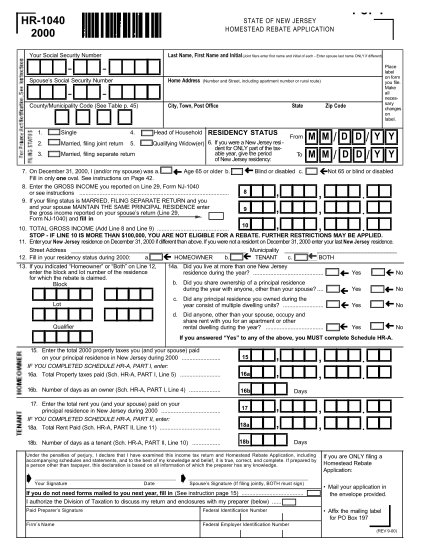

121 P45 Form Page 4 Free To Edit Download Print CocoDoc

https://cdn.cocodoc.com/cocodoc-form/png/64456293--HR-1040-Homestead-Rebate-Application-State-of-New-Jersey-nj--x-01.png

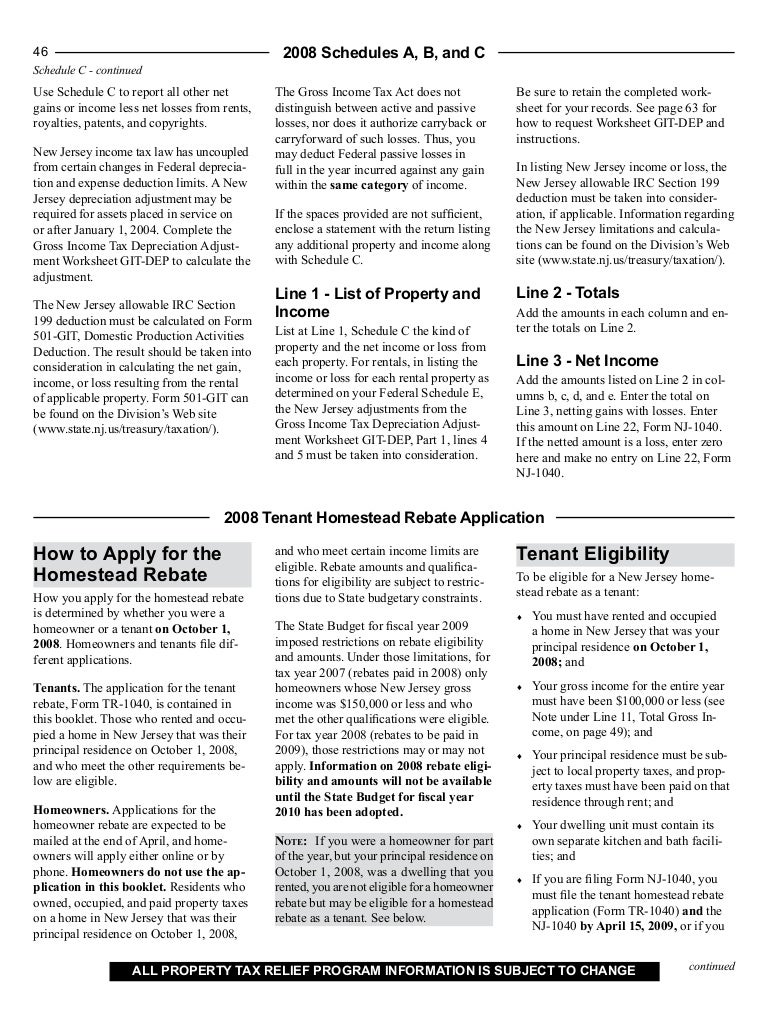

Web 18 juil 2022 nbsp 0183 32 Under the ANCHOR program homeowners would be eligible for an average first year rebate of 700 if income does not exceed 250 000 he said In late June Web 8 avr 2020 nbsp 0183 32 To be eligible you must be a New Jersey resident and owned and occupied a home in New Jersey that was your principal residence on Oct 1 2017 Property taxes must have been paid in full on

Web If you were not a homeowner on October 1 2018 you are not eligible for a Homestead Benefit even if you owned a home for part of the year You are not eligible unless you Web 21 juin 2021 nbsp 0183 32 The update to the Homestead Benefit program is estimated to be worth 130 for seniors and disabled homeowners and 145 for lower income homeowners The estimated cost to the state is nearly 80

Download Homestead Rebate Nj Eligibility

More picture related to Homestead Rebate Nj Eligibility

PPT New Jersey Property Tax Relief Programs PowerPoint Presentation

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/ppt-new-jersey-property-tax-relief-programs-powerpoint-presentation-1.jpg?w=1024&ssl=1

Save The Homestead Rebate Program New Jersey Republican Party

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/nj-homestead-rebate-due-11-30-2018-youtube.jpg?w=975&h=549&ssl=1

New Jersey Scraps Homestead Rebate Implements ANCHOR Program TaxBuzz

https://img.particlenews.com/img/id/3govbI_0iJuAleB00?type=thumbnail_1600x1200

Web 10 juin 2020 nbsp 0183 32 Who s eligible for the program To get the credit you need to be a New Jersey resident and meet other eligibility requirements including You owned a house in New Jersey and lived in it as your primary Web receiving Homestead Benefits and or Property Tax Credits or Deductions also can receive the Senior Freeze if they meet the eligibility require ments However the total of all

Web 1 A resident who is 65 years of age or older at the close of the tax year or who is allowed to claim a personal deduction as a blind or disabled taxpayer pursuant to subsection b of Web 25 oct 2021 nbsp 0183 32 To qualify you must have been a New Jersey resident who has owned as well as occupied a home in the state as your primary residence on Oct 1 2018 she

Nj Homestead Rebate 2022 Renters RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/property-tax-rebates-check-if-you-are-eligible-for-anchor-program-3.jpg

Can I Qualify For The Homestead Rebate If A Trust Owns My Condo Nj

https://www.nj.com/resizer/CSsRqnnhfZgKnX0qCL2rTateEpg=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/WLTTETQJCZEB3KZCLMQOR775T4.jpg

https://nj.gov/treasury/taxation/anchor/index.shtml

Web Affordable New Jersey Communities for Homeowners and Renters ANCHOR This program provides property tax relief to New Jersey residents who own or rent property in

https://www.nj.com/advice/2019/08/when-will-i-b…

Web 19 ao 251 t 2019 nbsp 0183 32 The 2016 income requirements were that you had to earn less than 150 000 for homeowners who are age 65 or older or blind

Download Free State Of New Jersey Homestead Rebate Program Software

Nj Homestead Rebate 2022 Renters RentersRebate

How Do I Apply For Nj Homestead Rebate Important Facts

What Happens To My Homestead Rebate If I Move NJMoneyHelp

I Missed The Homestead Rebate Deadline What Now Nj PropertyRebate

Can I Appeal My Homestead Rebate Application NJMoneyHelp

Can I Appeal My Homestead Rebate Application NJMoneyHelp

Fortune Salaire Mensuel De Nj Budget 2022 Homestead Rebate Combien

New Jersey Rent Rebate Printable Rebate Form

Homestead Rebate Application For Tenants Only

Homestead Rebate Nj Eligibility - Web 21 juin 2021 nbsp 0183 32 The update to the Homestead Benefit program is estimated to be worth 130 for seniors and disabled homeowners and 145 for lower income homeowners The estimated cost to the state is nearly 80