Homestead Tax Credit Iowa Over 65 In addition to the homestead tax credit eligible claimants who own the home they live in and are 65 years of age or older on or before January 1 of this year are now

Fill out the Homestead Tax Credit 54 028 form Return the form to your city or county assessor This tax credit continues as long as you remain eligible Applications Iowans age 65 or older are eligible for a property tax exemption worth 3 250 for the assessment year beginning Jan 1 2023 In subsequent years the

Homestead Tax Credit Iowa Over 65

Homestead Tax Credit Iowa Over 65

https://i.ytimg.com/vi/Aucw0OHynR8/maxresdefault.jpg

Do You Know About Iowa Homestead Tax Credit YouTube

https://i.ytimg.com/vi/K5hLf7X_hC4/maxresdefault.jpg

Homestead Exemption

https://townandparish.com/wp-content/uploads/2021/07/homestead-home-loan-finance-finances-money-exempted-business-property-economy-credit-financial_t20_RJA1Kk.jpg

DES MOINES IA Iowan s age 65 or older are eligible for a property tax exemption worth 3 250 for the assessment year beginning January 1 2023 In On May 4 2023 Governor Reynolds signed House File 718 establishing a homestead tax exemption for claimants 65 years of age or older This new exemption is in addition to

On May 4 2023 Governor Reynolds signed House File 718 establishing a homestead tax exemption for claimants 65 years of age or older In addition to the Claimants who are 65 years of age or older on or before January 1 of the assessment year are eligible Homeowners should sign up in person at the Scott County Assessor s Office

Download Homestead Tax Credit Iowa Over 65

More picture related to Homestead Tax Credit Iowa Over 65

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Homestead Tax Exemption For Seniors Adams County Iowa

https://adamscounty.iowa.gov/images/news/homestead_tax_exemption_for_seniors_93413.png

Texas Homestead Tax Exemption Cedar Park Texas Living

https://cedarparktxliving.com/wp-content/uploads/2020/12/Homestead-Tax-Exemption-810x810.jpg

The Iowa Department of Revenue has amended the Homestead Tax Credit and Exemption 54 028 form to allow claimants to apply for the new exemption Applications are due For the rollout of this new law property owners who are the age of 65 years or older prior to Jan 1 2023 are eligible for this new additional homestead tax exemption

On May 4 2023 Governor Kim Reynolds signed House File 718 establishing this homestead tax exemption The Iowa Department of Revenue has amended the The Iowa Department of Revenue announced Monday it has amended the homestead tax credit exemption form to allow seniors to apply for the new exemption

Michigan Homestead Tax Credit Have You Applied

https://activerain.com/image_store/uploads/1/9/2/1/5/ar129156998451291.jpg

Iowa Homestead Tax Credit Johnson County

https://imengine.public.prod.cdr.navigacloud.com/?uuid=E8687312-7E82-40D4-8F4E-F7C5FA284BEF&type=preview&q=75&width=1200&height=800

https://www.iowalegalaid.org/resource/homestead...

In addition to the homestead tax credit eligible claimants who own the home they live in and are 65 years of age or older on or before January 1 of this year are now

https://www.iowa.gov/how-do-i-file-homestead-exemption

Fill out the Homestead Tax Credit 54 028 form Return the form to your city or county assessor This tax credit continues as long as you remain eligible Applications

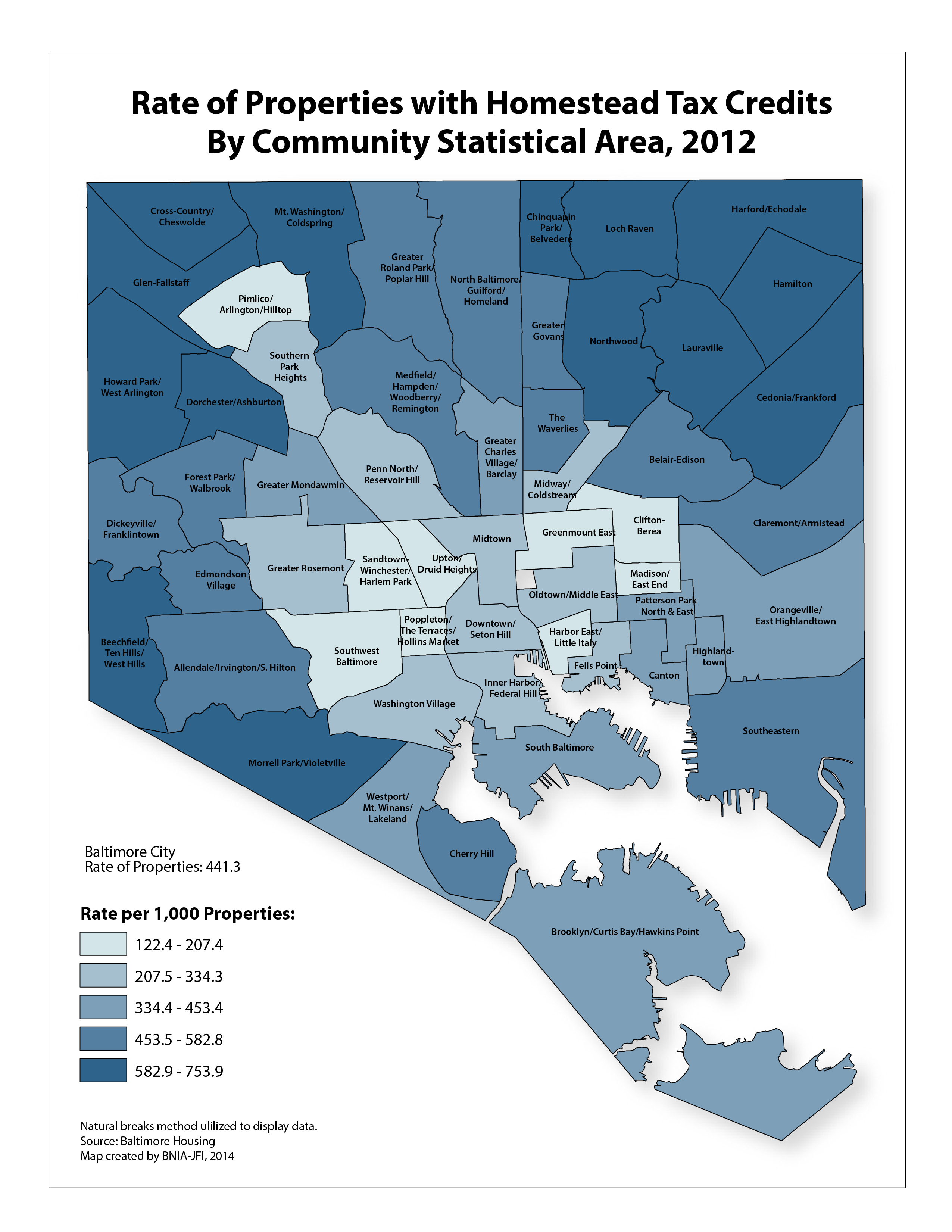

Homestead Tax Credits 2012 BNIA Baltimore Neighborhood Indicators

Michigan Homestead Tax Credit Have You Applied

Homestead Property Tax Credit Increases KNWA YouTube

Property Tax Assessment Homestead Tax Credit Part 3 Of 4 The

Minnesota Homestead

Homestead Tax credit Rise Aired Arkansas Governor Proposes To Reduce

Homestead Tax credit Rise Aired Arkansas Governor Proposes To Reduce

Watch Our Homestead Tax Credit Education Webinar

The Montgomery County Homestead Credit Ozark

Arkansas Homestead Tax Credit W Chrissy Dougherty Executive Broker

Homestead Tax Credit Iowa Over 65 - On May 4 2023 Governor Reynolds signed House File 718 establishing a homestead tax exemption for claimants 65 years of age or older This new exemption is in addition to