House Rent Received Deduction In Income Tax Section What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does By providing the rental agreement or rent receipts to your employer you can claim income tax HRA exemption without excess tax deduction at source In case the annual rent

House Rent Received Deduction In Income Tax Section

House Rent Received Deduction In Income Tax Section

https://blog.tax2win.in/wp-content/uploads/2019/06/Deduction-where-House-rent-is-paid-and-HRA-not-received.jpg

Section 24 Of Income Tax Act House Property Deduction

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03125718/Deduction-us-24b-2-782x1024.jpg

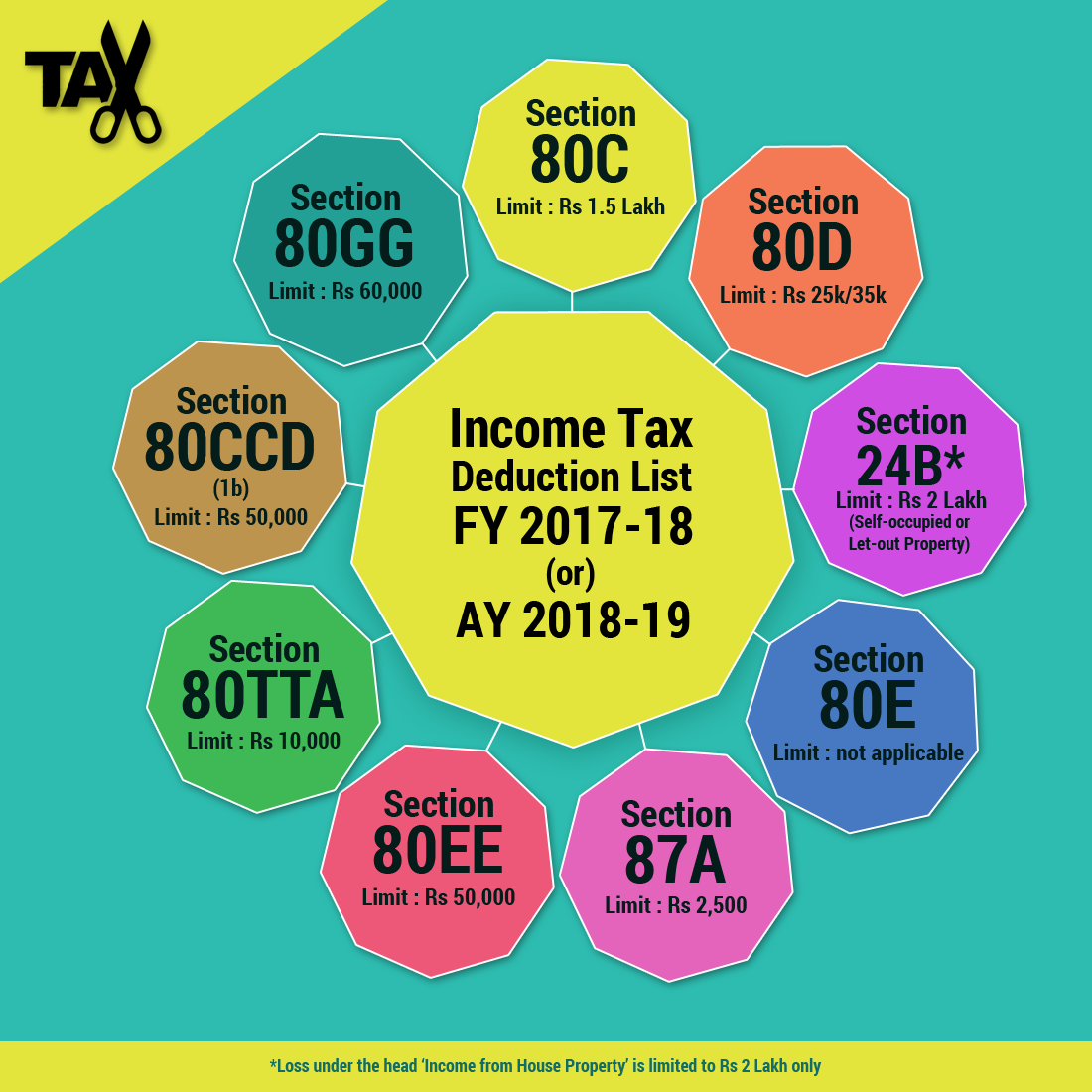

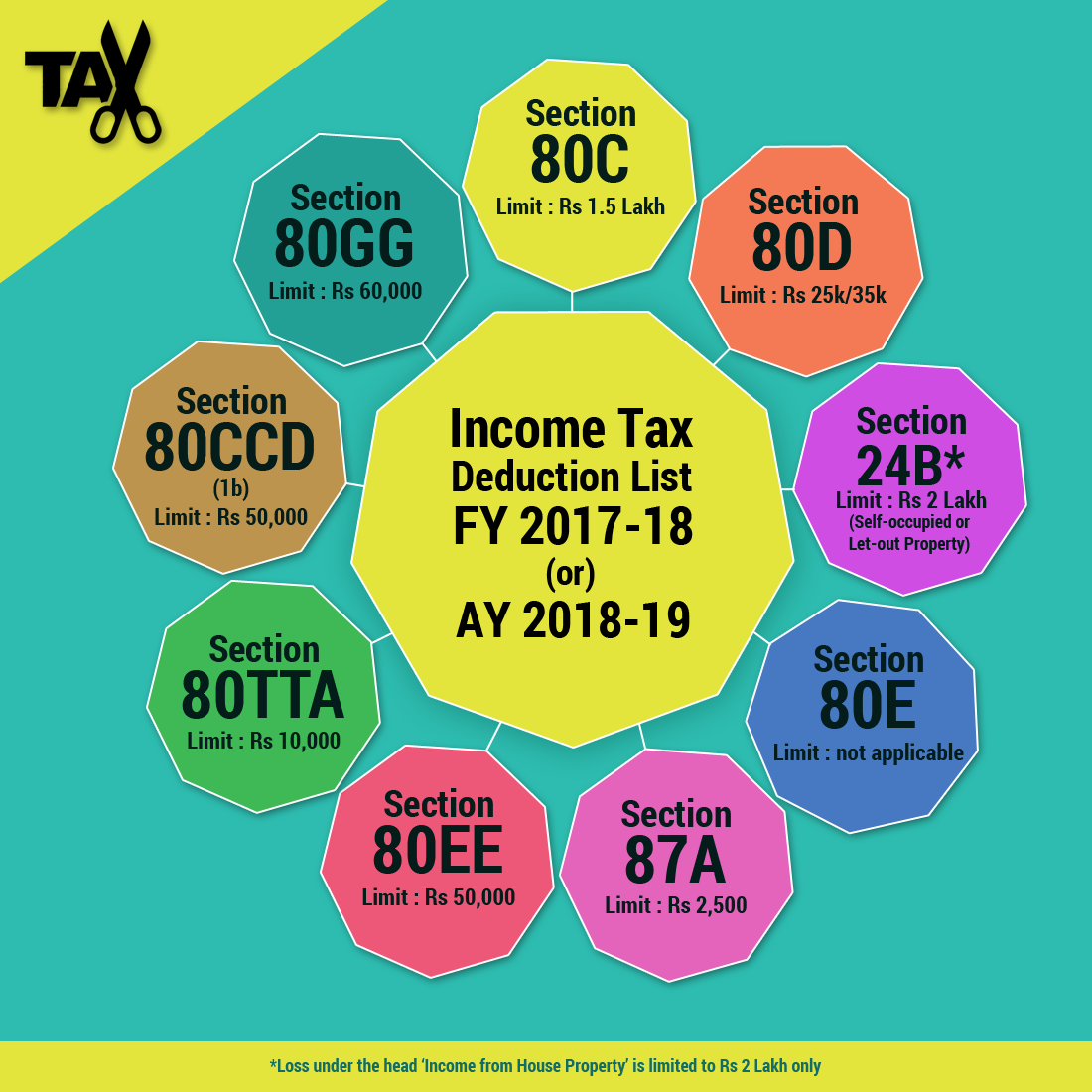

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may Under Section 80GG the deduction is allowed to an individual who pays rent without receiving any House Rent Allowance from an employer Hence check the

You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of If you receive property or services as rent instead of money include the fair market value FMV of the property or services in your rental income If the services are provided at an agreed upon or specified price that price is

Download House Rent Received Deduction In Income Tax Section

More picture related to House Rent Received Deduction In Income Tax Section

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

What Is Section 24 Of Income Tax Act Save More Worry Less

https://www.nitsotech.com/wp-content/uploads/Understanding-deduction-under-Section-24-of-Income-Tax-Act.jpg

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2019/07/Section-80GG-1.png?fit=1047%2C604&ssl=1

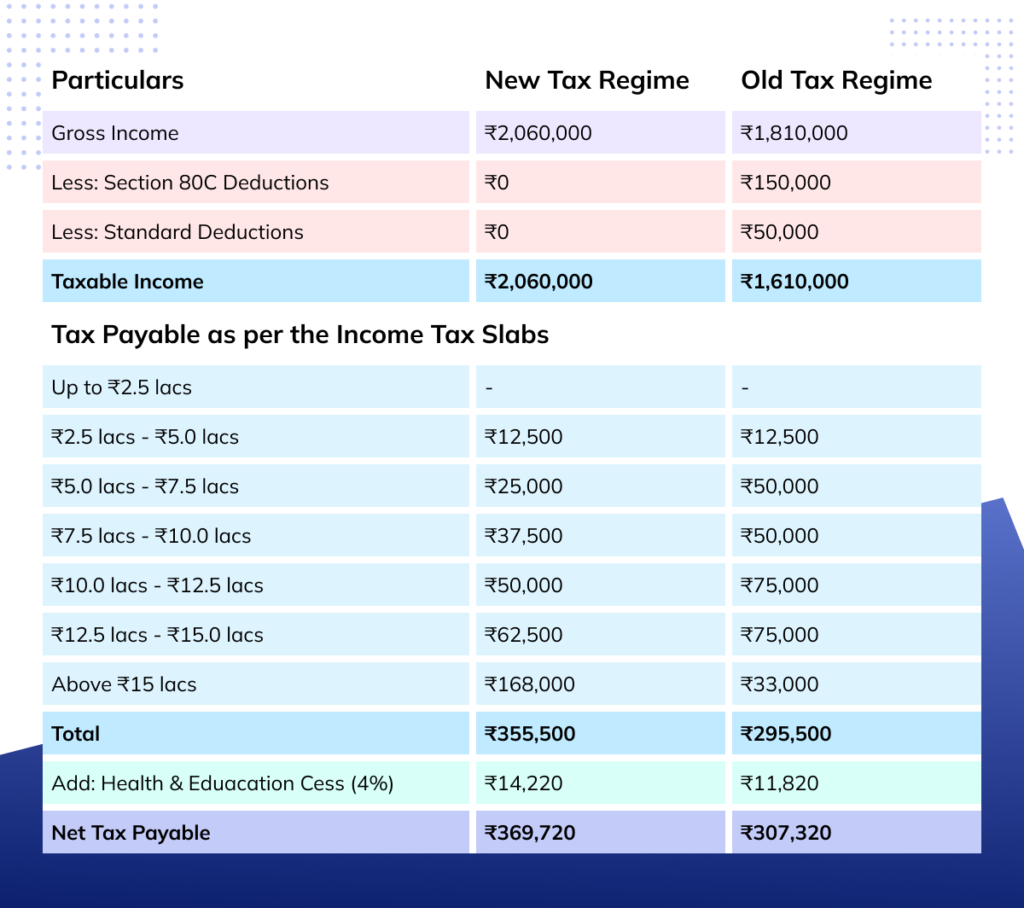

You generally deduct your rental expenses in the year you pay them Publication 527 includes information on the expenses you can deduct if you rent a condominium or This article covers all about the deductions you claim under Section 24 B if you have income from house property and reduce your tax outgo Read on

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting Taxpayers having a rental income can claim the following deductions and benefits in the Income Tax Return ITR Repayment of Loan deduction of principal

Income Tax Deductions For The FY 2019 20 ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2017/12/income-tax-deduction-list-2017-18.png

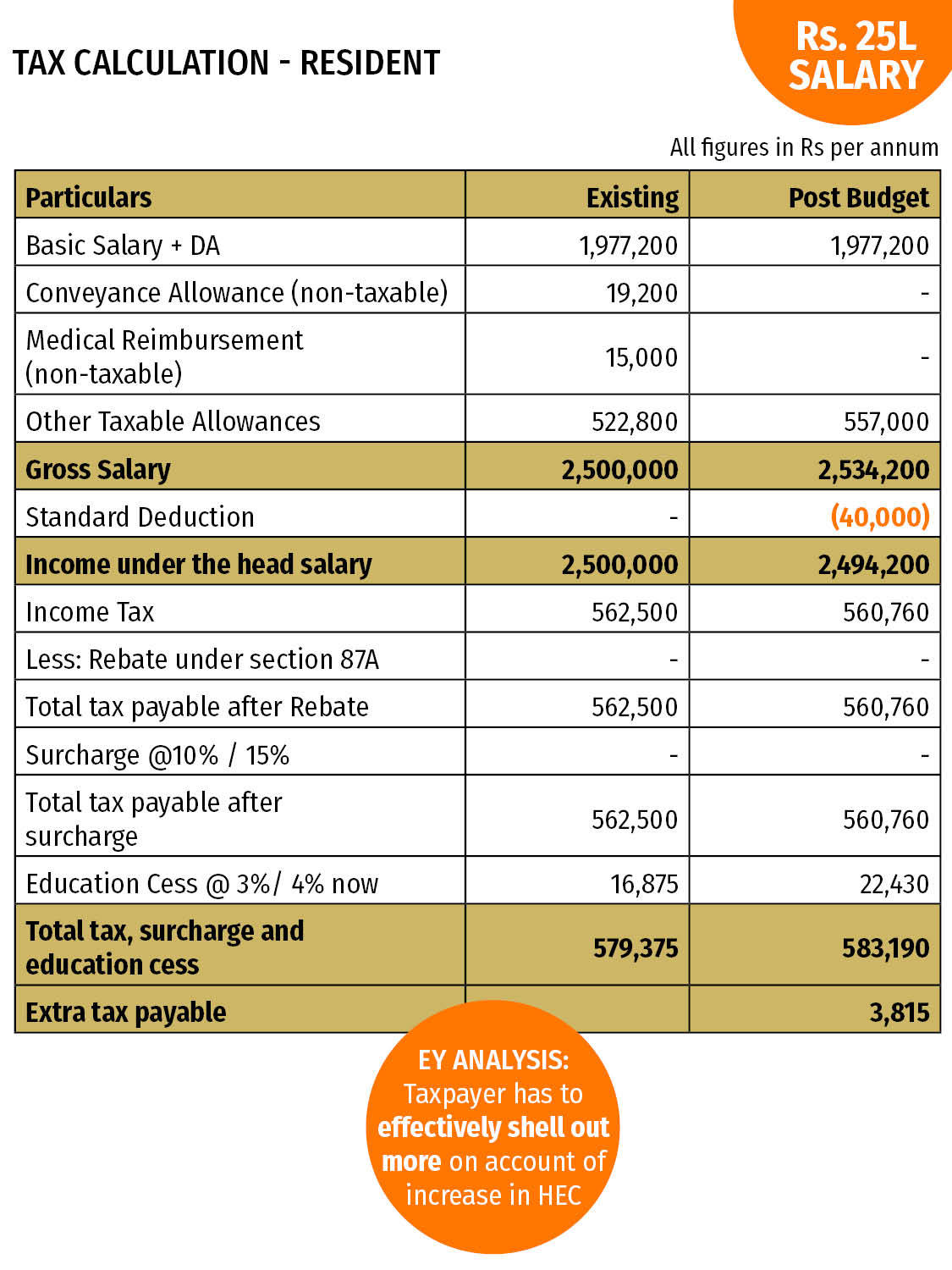

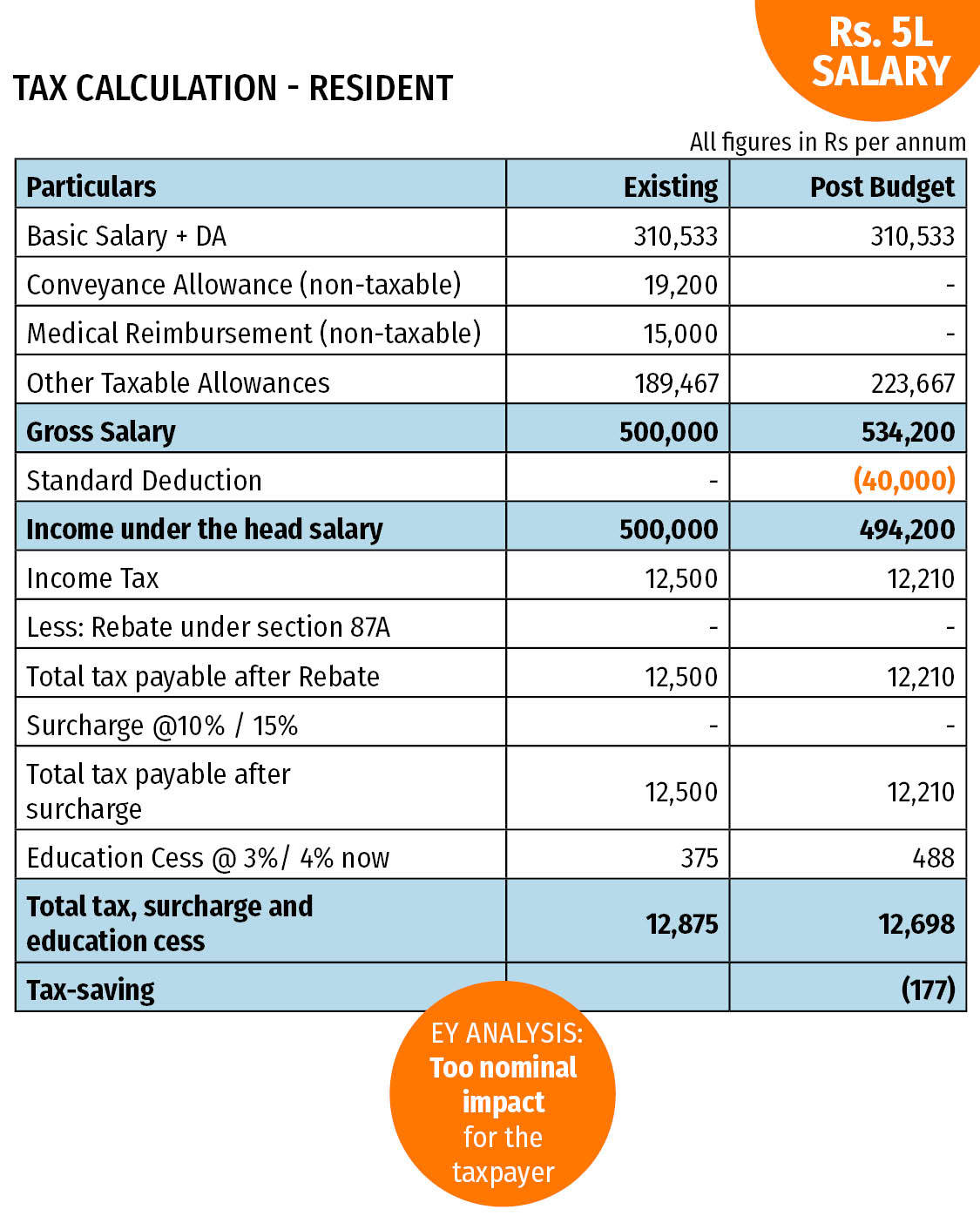

How To Calculate Income Tax On Salary With Example

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied

https://cleartax.in/s/hra-house-rent-allo…

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

Income Tax Deductions For The FY 2019 20 ComparePolicy

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

How Does Tax Deduction Work In India Tax Walls

How Does Tax Deduction Work In India Tax Walls

What Is Section 10AA Of Income Tax Act Ebizfiling

What Is Section 10AA Of Income Tax Act Ebizfiling

How To Save Tax On Rental Income In India Tax Deductions On Rent

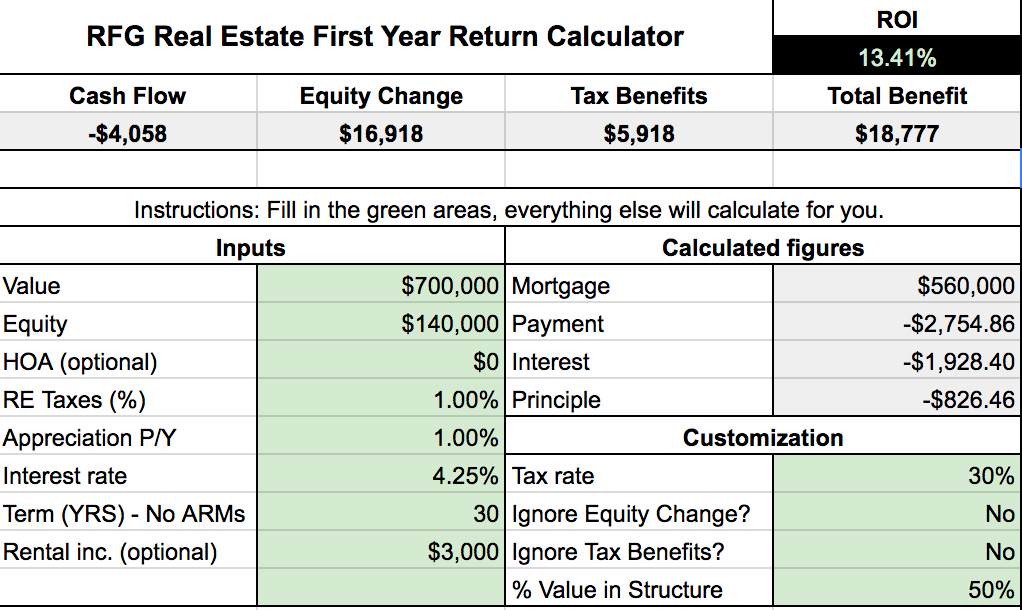

Real Estate Tax Deductions For Condos Real Finance Guy

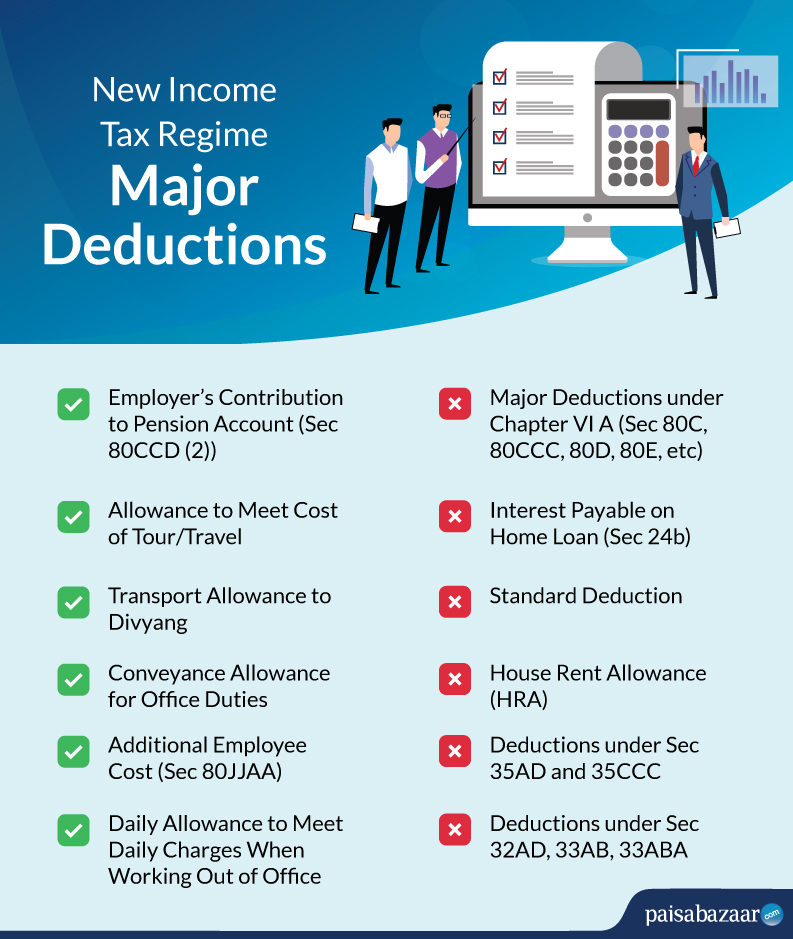

Deductions Allowed Under The New Income Tax Regime Paisabazaar

House Rent Received Deduction In Income Tax Section - If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may