Housing Loan Interest Deduction Section 2022 23 Web 25 M 228 rz 2016 nbsp 0183 32 Get to know the tax benefits on home loan interest for the F Y 2022 23 Also we have included tax benefits on principal repaid

Web 28 Juli 2023 nbsp 0183 32 What are the Eligibility Criteria for Claiming the Section 80EEA Deduction To be eligible to claim tax deductions under the section 80EEA limit a homebuyer Web 11 Dez 2023 nbsp 0183 32 Under the objective Housing for all the government extended the interest deduction allowed for low cost housing loans taken during the period between 1 April

Housing Loan Interest Deduction Section 2022 23

Housing Loan Interest Deduction Section 2022 23

https://www.legalmantra.net/admin/assets/upload_image/blog/b95.jpg

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

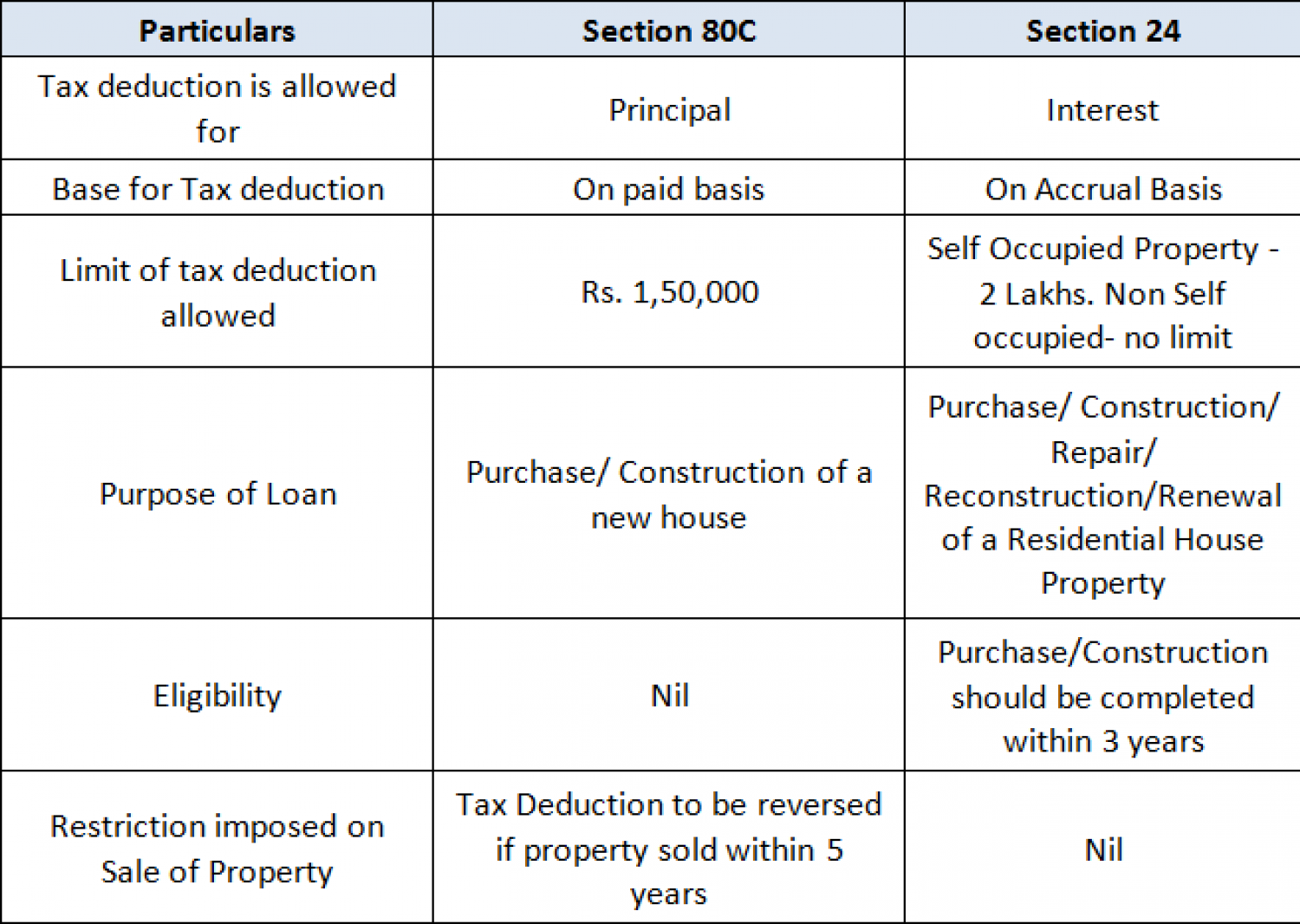

Web 17 Nov 2022 nbsp 0183 32 Interest on home loan Deduction under section 24 b of the Act Self occupied property up to Rs 2 00 000 Let out property Actual interest paid Interest Web 30 M 228 rz 2023 nbsp 0183 32 Deduction of Interest on Home Loan for the property Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his

Web 2 Apr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than Web For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022 This is applicable for

Download Housing Loan Interest Deduction Section 2022 23

More picture related to Housing Loan Interest Deduction Section 2022 23

Home Loan Tax Benefits Learn To Save Income Tax On Home Loan

https://www.aavas.in/uploads/images/blog/tax-benifits-2022-2023-aavasin-min-195380998.jpg

Section 24 Deduction Income From House Property

https://taxguru.in/wp-content/uploads/2021/05/Section-24-Deduction-–-Income-From-House-Property.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Web 7 Feb 2023 nbsp 0183 32 Under Section 80 EEA the government has allowed first time homebuyers to deduct an extra Rs 1 5 lakhs from their taxable income if they pay interest on a house Web 5 Feb 2023 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

Web Tax Benefits on Home Loan FY 2022 23 The home loan tax benefits under the applicable sections of the Income Tax Act of 1961 are listed below Home Loan Principal Web 20 M 228 rz 2023 nbsp 0183 32 How to claim income tax benefits on home loans in FY23 4 min read 20 Mar 2023 06 18 PM IST Join us Vipul Das A Home Loan is a financial source for your

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

How To Get The Interest Deduction On Your Student Loan

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2021/12/0/0/Credible-student-loan-interest-deduction-iStock-thumbnail-1170448087.jpg?ve=1&tl=1

https://blog.saginfotech.com/tax-benefit-on-h…

Web 25 M 228 rz 2016 nbsp 0183 32 Get to know the tax benefits on home loan interest for the F Y 2022 23 Also we have included tax benefits on principal repaid

https://www.piramalrealty.com/blog/post/section-80eea-of-the-income...

Web 28 Juli 2023 nbsp 0183 32 What are the Eligibility Criteria for Claiming the Section 80EEA Deduction To be eligible to claim tax deductions under the section 80EEA limit a homebuyer

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Claiming The Student Loan Interest Deduction

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Housing Loan Interest Additional Deduction On Affordable Housing U s

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Section 24 Home Loan Interest Deduction FinCalC Blog

Housing Loan Interest Deduction Section 2022 23 - Web 2 Apr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than