Housing Loan Interest Deduction Section Limit Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction from interest paid on housing loan upto Rs 2 00 000

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on a home loan and the loan must be sanctioned between 01 04 2016 to 31 03 2022

Housing Loan Interest Deduction Section Limit

Housing Loan Interest Deduction Section Limit

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Home Loan Tax Benefits Interest On Home Loan Section 24 And

https://i.ytimg.com/vi/M-wUkSDKAfk/maxresdefault.jpg

This provision allows first time homebuyers to avail an extra deduction on the interest paid for home loans taken between April 1 2016 and March 31 2017 amounting to a maximum of INR 50 000 provided they meet specific conditions Under Section 80EE a tax deduction of Rs 50 000 is offered to first time home buyers against the home loan interest payment if they meet certain conditions Click here to read the official text of Section 88EE

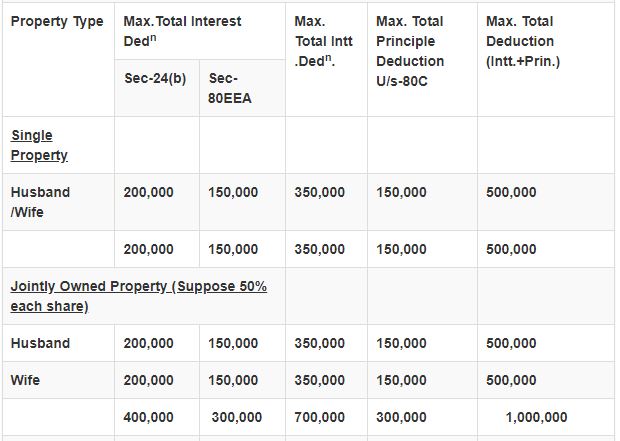

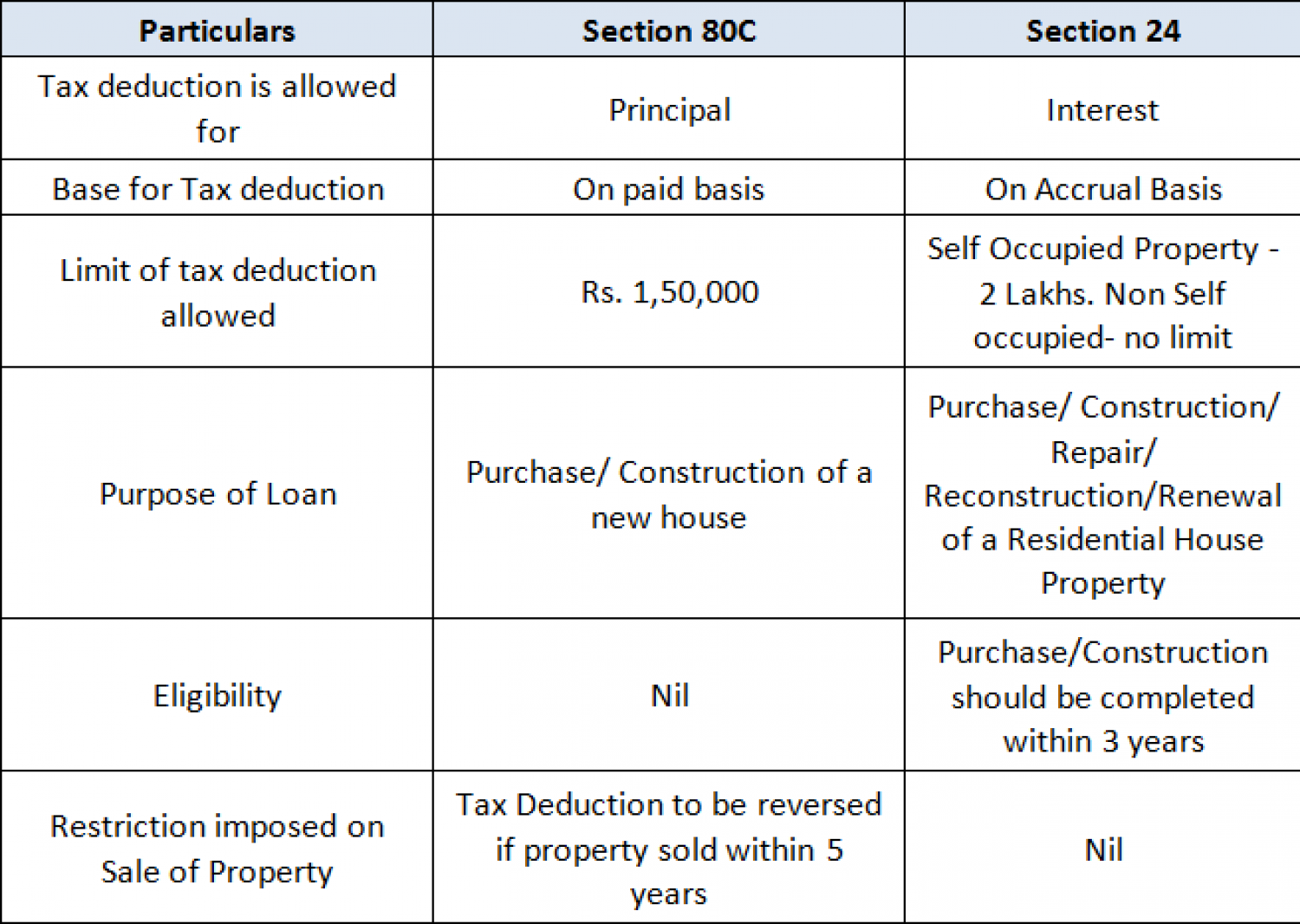

A Deduction U s 24 is available on interest in respect of capital borrowed for acquiring constructing repairing renewing or reconstructing a house For a maximum of two self occupied properties taken together an amount up to two lakh rupees can be claimed In case the house is let full interest can be claimed against the rental income The Indian Income Tax Act provides a tax deduction of up to Rs 1 5 lakhs per financial year for interest paid on home loans taken for purchasing or constructing an affordable house This deduction is available under Section 80EEA of the Income Tax Act and is in addition to the existing tax benefits available under Section 80C and Section 24

Download Housing Loan Interest Deduction Section Limit

More picture related to Housing Loan Interest Deduction Section Limit

Section 24 Deduction Income From House Property

https://taxguru.in/wp-content/uploads/2021/05/Section-24-Deduction-–-Income-From-House-Property.jpg

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

https://finvestfox.com/wp-content/uploads/2021/07/Section-80EEA-1.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180144/Section-80EE-Income-tax-deduction-for-interest-component-on-home-loan-FB-1200x700-compressed.jpg

Under Section 80EE taxpayers can claim a deduction of up to Rs 50 000 on the interest paid on home loans This is in addition to the deduction available under Section 24 b which allows a maximum deduction of Rs 2 lakh per financial year Individuals are eligible for income tax benefits under Section 80EE of Income Tax Act on the interest component of residential property loans obtained from any financial institution This section s primary goal is to make it possible for people to

Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time home buyers under Section 80EE and Section 24 b of the Income Tax Act 1961 deals with deduction of interest from the GAV in order to arrive at the net asset value NAV Interest deduction treatment is different depending upon whether the house property is self occupied or it is let out

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

Housing Loan Interest Additional Deduction On Affordable Housing U s

https://i.ytimg.com/vi/VdW6k5m3oq0/maxresdefault.jpg

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction from interest paid on housing loan upto Rs 2 00 000

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Claiming The Student Loan Interest Deduction

Student Loan Interest Deduction What You Need To Know

All About Section 80EEA For Deduction On Home Loan Interest

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

How Does The Interest Rate Of Your Housing Loan Works Fortune My

How Does The Interest Rate Of Your Housing Loan Works Fortune My

Income Tax Benefits On Home Loan Loanfasttrack

Home Loan Interest Deduction Procedure To Claim HomeCapital

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Housing Loan Interest Deduction Section Limit - Under Section 80EE a tax deduction of Rs 50 000 is offered to first time home buyers against the home loan interest payment if they meet certain conditions Click here to read the official text of Section 88EE